A GUIDE AND UTILITIES TO ASSIST YOUR CLIENTS IN

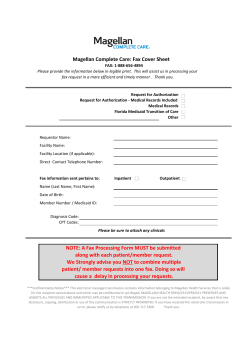

C PR Comprehensive PLUS Financial Network Policy Review A GUIDE AND UTILITIES TO ASSIST YOUR CLIENTS IN MAINTAINING LIFE INSURANCE COVERAGE TO MEET THEIR EVOLVING NEEDS INNOVATIVE SOLUTIONS DEDICATED RELATIONSHIPS COMMITMENT TO EXCELLENCE 800.887.7587 . fax 248.603.3595 . 2155 Butterfield, Suite 102 South, Troy, MI 48084 C PR Comprehensive PLUS Financial Network Policy Review A GUIDE TO REVIEWING YOUR CLIENTS’ UNIQUE INSURANCE NEEDS WHAT IS C PR ? As an advisor, you can provide a valuable service for your clients by making sure that their life insurance coverage is adequate to help them meet their current financial goals. Although clients regularly review financial goals and investments, they often forget to review their life insurance coverage to meet their changing needs and concerns. When you perform a Comprehensive PLUS Financial Network Policy Review, you provide a service that demonstrates a commitment to your client’s interests. Basically, you will be reviewing your client’s current coverage, and assessing any life changes that have taken place since the policy or policies were issued. PLUS Financial Network helps you illustrate the value of periodic life insurance reviews for your clients. Done periodically, a Comprehensive PLUS Financial Network Policy Review can help your clients develop savings, insurance and estate planning strategies. WHY PERFORM C PR ? Many clients may not realize their life insurance needs may have changed since they first purchased this important asset. Life insurance policies are often left unattended, they don’t perform as expected, or they may be in danger of lapsing due to loans, excessive withdrawals or non-payment of premiums. As a part of financial goal setting, it is critical to revive your clients’ life insurance coverage to keep pace with their changing lives. The following list of life changes and events can signal the need to perform a Comprehensive PLUS Financial Network Policy Review. • Marriage or Divorce • Childbirth or Adoption • New Job or Career Change • Significant Salary Increase • Home Purchase • Starting or Owning a Business • Nearing Retirement • Financial Support of Elderly Parents HOW DOES IT WORK? When administeringC PR, you will review your client’s current needs and purposes for life insurance. • Gather as much documentation as possible on their current life insurance policies. • Complete a Comprehensive PLUS Financial Network Policy Review Underwriting Fact Finder* to assess your client’s objective and medical history. • Have your client sign an In-Force Policy Illustration Form* so that we may obtain policy information from their current carrier, and PLUS Financial Network will ensure that your client’s life insurance coverage meets their current protection needs. PLUS Financial Network does all the work and provides an unbiased 3rd party analysis. * Forms are available at www.plusfinancialnetwork.com or by contacting our Marketing Team at 800-887-7587 or [email protected]. INNOVATIVE SOLUTIONS DEDICATED RELATIONSHIPS COMMITMENT TO EXCELLENCE 800.887.7587 . fax 248.603.3595 . 2155 Butterfield, Suite 102 South, Troy, MI 48084 C PR Comprehensive PLUS Financial Network Policy Review HOW TO GET STARTED You can give your clients assurance and grow your business by offering a complimentary Comprehensive PLUS Financial Network Policy Review. Contact the PLUS Financial Network team today to get started. We support you with knowledgeable service and timely information. Our goal is to make it easier for you to help your client protect what matters most. Our C PR kit offers ideas about identifying prospects and starting the life insurance checkup conversation. IDENTIFY OPPORTUNITIES Use the information below to help target and track clients who are good prospects for a Comprehensive PLUS Financial Network Policy Review. The following criteria are some of the signs that a client is a good candidate: • 40-65 Years Old • Owns a Policy That is at Least 3 Years Old • In Good Health • Has Estate Planning Issues or Concerns • Owns a Small Business • Has Experienced a Recent Life or Financial Change In addition, your prospects may fall into all or none of these categories: • Do existing policies coincide with current goals? • Have financial objectives changed since the client bought the life insurance policy(ies)? • Are term policy premiums about to increase? • Do the client’s long-term goals require a permanent policy? PLUS FINANCIAL NETWORK WANTS TO HELP YOU, THE ADVISOR, TO HELP YOUR CLIENTS ACHIEVE FINANCIAL SECURITY. Managing client relationships goes beyond the initial sale, a Comprehensive PLUS Financial Network Policy Review is a great way to demonstrate your commitment to personalized service, and show concern for the financial well-being of your clients and their families. INNOVATIVE SOLUTIONS DEDICATED RELATIONSHIPS COMMITMENT TO EXCELLENCE 800.887.7587 . fax 248.603.3595 . 2155 Butterfield, Suite 102 South, Troy, MI 48084 ADVISOR’S GUIDE TO LEARNING C PR Comprehensive PLUS Financial Network Policy Review IDENTIFY PROSPECTS The first step in conducting C+PR is to identify the right prospects, and the easiest place to start is your list of existing clients. CONTACT PROSPECTS Contact your clients and prospects to offer a complimentary PLUS Financial Network Policy Review. We can even provide sample letters to get you started. IDENTIFY YOUR CLIENT’S NEEDS AND OBJECTIVES Collect copies of current policy (ies). Complete the Underwriting Fact Finder and a Request for In-Force Policy Information. Define your client’s life changes, goals and needs. IDENTIFY SOLUTIONS Product and planning tactics are reviewed by PLUS Financial Network professionals to determine if they are aligned with the client’s goals and objectives. Recommendations are either to maintain the current policy (ies) or consider other options that could optimize coverage. PLUS Financial Network will develop a proposal that fits your client’s needs. PRESENT CLIENT SOLUTIONS Present your analysis, proposals and marketing materials to your client. CLOSE THE SALE Identify the forms needed to complete the transaction and provide your client the necessary assistance in completing them. Walk through what your client will need to do next to complete the application. Be sure to ask for referrals once the sale is completed. INNOVATIVE SOLUTIONS DEDICATED RELATIONSHIPS COMMITMENT TO EXCELLENCE 800.887.7587 . fax 248.603.3595 . 2155 Butterfield, Suite 102 South, Troy, MI 48084 POLICY REVIEW UNDERWRITING FACT FINDER DATE:___________________________ ADVISOR NAME: _________________________________________________________ PHONE:____________________________ FAX:_____________________________ EMAIL:______________________________ RETURN QUOTE BY: o EMAIL o FAX o MAIL o AGENT PICK UP NEEDED BY:____/____/____ CLIENT INFORMATION: CLIENT NAME:_________________________________________________ DATE OF BIRTH:____/____/____ o MALE STATE OF SALE:_________________________ o FEMALE HEIGHT:__________ NICOTINE USE: o YES FORM: o CIGARETTES o NO o CIGARS WEIGHT:__________lbs. o QUIT WHEN_________________________________________________ o CHEWING TOBACCO o OTHER:___________________________ POLICY GOALS & PRODUCT DESIGN (PLEASE RANK 1-5 IN ORDER OF IMPORTANCE): _____DEATH BENEFIT _____REDUCE PREMIUM _____INCREASE BENEFIT _____EXTENDED COVERAGE DURATION — HOW LONG:________YEARS _____CASH VALUE ACCUMULATION _____OTHER_____________________ MEDICAL HISTORY: GENERAL HEALTH DETAILS: __________________________________________________________________________________ __________________________________________________________________________________________________________ __________________________________________________________________________________________________________ TREATMENTS (WITHIN LAST 5 YEARS): _________________________________________________________________________ __________________________________________________________________________________________________________ __________________________________________________________________________________________________________ MEDICATION(S) (NAME AND DOSAGE):________________________________________________________________________ __________________________________________________________________________________________________________ HAS THE CLIENT BEEN TREATED FOR ANY OF THE FOLLOWING? o ALCOHOL/DRUGS o CANCER o CARDIAC o DIABETES o HYPERTENSION o DEPRESSION o LUNG DISORDERS o SLEEP APNEA o OTHER_______________________________________________________ BLOOD PRESSURE AND CHOLESTEROL (IF NOT NORMAL): LATEST TOTAL CHOLESTEROL________mg RATIO:________ LATEST BP READING:________/________ HDL:________ LDL:________ FAMILY HISTORY: (PARENTS AND SIBLINGS) DIAGNOSIS OF HEART DISEASE OR CANCER PRIOR TO AGE 60? o YES o NO IF YES, DETAILS:_____________________________________________________________________ IF DECEASED, INDICATE CAUSE AND AGE:____________________________________________________________________ AVIATION/AVOCATION: IN THE PAST 5 YEARS HAS THE CLIENT PARTICIPATED IN, OR DOES THE CLIENT INTEND TO PARTICIPATE IN ANY OF THE FOLLOWING? o AVIATION o RACING o SKY DIVING o SCUBA DIVING o OTHER o NONE DETAILS:___________________________________________________________________________________________________ CITIZENSHIP/RESIDENCY/TRAVEL: U.S. CITIZEN: o YES o NO GREEN CARD: o YES o NO PLANS TO LIVE OR TRAVEL OUTSIDE THE U.S.? DETAILS:__________________________________________________________ DRIVING HISTORY: IN THE PAST 10 YEARS, HAS THE CLIENT HAD ANY OF THE FOLLOWING MOTOR VEHICLE RELATED INCIDENTS? o MOVING VIOLATION o RECKLESS DRIVING o DUI o LICENSE SUSPENDED OR REVOKED DETAILS:___________________________________________________________________________________________________ Visit our website at www.plusfinancialnetwork.com for additional sales tools. INNOVATIVE SOLUTIONS DEDICATED RELATIONSHIPS COMMITMENT TO EXCELLENCE 800.887.7587 . fax 248.603.3595 . 2155 Butterfield, Suite 102 South, Troy, MI 48084 POLICY INFORMATION AUTHORIZATION AND REQUEST CARRIER NAME:________________________________________________________________________________________________ INSURED’S NAME:_________________________________________POLICY #: __________________________________________ PRODUCT:_______________________________________________FACE AMOUNT: $____________________________________ PLEASE SUPPLY THE FOLLOWING INFORMATION: Policy Type: ____Term ____UL ____WL ____VUL Issue Class:_______________________________________ Length of Term (if applicable):______________________ Riders—Type:_____________________________________ Issue Date:______________________________________ State of Issue:______________________________________ Current Premium:________________________________ Maturity Date:____________________________________ Mode:_________________________________________ Owner (if Trust, full name and date):___________________ Paid To Date:____________________________________ Beneficiary:________________________________________ Gross Death Benefit:______________________________ Assignee:_________________________________________ Products Available for Conversion:__________________ _______________________________________________ Conversion Expiration Date:_______________________ (Applicable for Term Policies) To Whom It May Concern: I hereby authorize you to release any information on the above captioned policy with your company, to PLUS Financial Network. A photocopy or faxed copy of this authorization shall be as valid as the original. Thank you for your attention to this request. Sincerely, Owner/Trustee Signature:_________________________________________ Date:____/____/____ Owner/Trustee Name (Printed):_____________________________________ Owner/Trustee SSN:_____-_____-_____ Owner/Trustee Signature:_________________________________________ Date:____/____/____ Owner/Trustee Name (Printed):_____________________________________ Owner/Trustee SSN:_____-_____-_____ Insured’s Name (Please Print):______________________________________ Date of Birth:____/____/____ I AUTHORIZE YOU TO FORWARD THIS INFORMATION TO: o PLUS Financial Network 2155 Butterfield, Suite 102 South Troy, MI 48084 fax: 248.603.3595 email: [email protected] PREFERRED METHOD OF DELIVERY: o Other:___________________________________ ___________________________________ ___________________________________ ___________________________________ ___________________________________ _____EMAIL _____FAX _____MAIL IN-FORCE POLICY ILLUSTRATION AUTHORIZATION AND REQUEST CARRIER NAME:_______________________________________________________________________________________________ INSURED’S NAME:_________________________________________POLICY #: __________________________________________ PRODUCT:_______________________________________________FACE AMOUNT: $____________________________________ PLEASE PROVIDE A SEPARATE IN-FORCE ILLUSTRATION ON EACH OF THE FOLLOWING PARAMETERS: PREMIUM REQUEST (check one or more) o Pay current scheduled premium o Solve for level premium o Pay no further premium o Specified premium of $__________ o Solve for premium to age 100 TARGETING (if solving for premium or distributions)* o Endow at Maturity o Target Cash Value $_________ Target Year/Age_____ *No-Lapse UL products will default to solving for Lapse Protection Guarantee. SPECIAL INSTRUCTIONS:______________________ _______________________________________________ _______________________________________________ PREMIUM DURATION (check one or more) o Pay all years o Pay until policy year_____OR to age_____ SPECIFIED AMOUNT (optional, check one or more) o Change Death Benefit to $__________ o Change Death Benefit option to Option 1 RATE OF RETURN (IF VUL) _____% POLICY LOAN/WITHDRAWLS (check one or more)** o Solve for distribution o Specified distribution of $ __________ o From Year/Age_____Through Year/Age_____ **Specify if withdrawal, loan, or combination of both in the special instructions section. Certain restrictions may apply. PLEASE SUPPLY THE FOLLOWING INFORMATION: Paid To Date/Next Due Date:___________________________ Total Premiums Paid:__________________________________ Policy Loan:__________________________________________ Loan Interest Rate:____________________________________ Cash Value:__________________________________________ Surrender Value:____________________________________ Cost Basis:________________________________________ Owner:___________________________________________ Beneficiary:________________________________________ Issue Class:________________________________________ To Whom It May Concern: I hereby authorize you to release any information on the above captioned policy with your company, to PLUS Financial Network. This includes, but is not exclusive to, any cash value information as well as in-force ledgers. A photocopy or faxed copy of this authorization shall be as valid as the original. Thank you for your attention to this request. Sincerely, Owner/Trustee Signature:_________________________________________ Date:____/____/____ Owner/Trustee Name (Printed):_____________________________________ Owner/Trustee SSN:_____-_____-_____ Owner/Trustee Signature:_________________________________________ Date:____/____/____ Owner/Trustee Name (Printed):_____________________________________ Owner/Trustee SSN:_____-_____-_____ Insured’s Name (Please Print):______________________________________ Date of Birth:____/____/____ I AUTHORIZE YOU TO FORWARD THIS INFORMATION TO: o PLUS Financial Network 2155 Butterfield, Suite 102 South Troy, MI 48084 fax: 248.603.3595 email: [email protected] PREFERRED METHOD OF DELIVERY: o Other:___________________________________ ___________________________________ ___________________________________ ___________________________________ ___________________________________ _____EMAIL _____FAX _____MAIL AUTHORIZATION TO OBTAIN AND DISCLOSE INFORMATION HIPAA COMPLIANT Mailing Address: 2155 Butterfield Dr., Ste. 102 South Troy, MI 48084 Phone: (248) 356-7587 Fax: (248) 603-3595 www.plusfinancialnetwork.com I understand that PLUS Financial Network, and its staff, the insurers PLUS Financial Network represents and their reinsurers, any insurance support organization and their authorized representatives may need to collect information about me in regard to obtaining insurance coverage. Therefore, I authorize any physician, medical practitioner, medical examination company, hospital, clinic or other medical facility or medical-related facility, insurance or reinsuring company, the Medical Information Bureau, Inc. (MIB), Motor Vehicle Report (MVR), Prescription Drug Report (PDR), consumer reporting agency (CRA), or employer having information available as to the diagnosis, treatment or prognosis with respect to any physical or mental condition and/or treatment of me to give the insurers listed below, their reinsurers and authorized representatives all such information. This information may include, but is not limited to, documents relating to my mental and physical health, office notes, laboratory studies, pathology reports, test results, mental health records, psychotherapy notes, drug/alcohol abuse, treatment records, pharmacy prescriptions, HIV testing and treatment, STD testing and treatment, any other communicable disease records, genetic testing, general reputation, mode of living, finances, occupation, driving records and other personal traits (“information”). To facilitate rapid submission of such information, I authorize all said sources to give information and records to PLUS Financial Network, its staff and its authorized representatives. I understand and agree that the information obtained by use of this Authorization will be used by PLUS Financial Network and/or insurers listed below and their authorized representatives to determine eligibility for insurance, and eligibility for benefits under existing policies. Any information obtained will not be released by PLUS Financial Network EXCEPT to one or more of the insurers listed below, their reinsurers, the MIB, my insurance agent or other persons or organizations performing business or legal services in connection with my application, or as may be otherwise lawfully required or as I may further authorize. I understand that the recipient of information disclosed pursuant to this Authorization may re-disclose the information and that, once disclosed, the information may no longer be protected by state or federal law. I agree this Authorization shall be valid for two (2) years from the date shown below, unless I revoke it sooner, or in the event of a claim for benefits, for the duration of such claim. I understand that I have the right to revoke this Authorization in writing, mailed via certified mail, return receipt requested, to PLUS Financial Network at the mailing address provided above. I understand that a revocation is not effective to the extent that PLUS Financial Network or others have relied on the protected health information disclosed pursuant to this Authorization prior to its revocation. I understand the execution of this Authorization is voluntary and that I can refuse to sign this Authorization. I understand that my refusal to sign this Authorization will not affect my ability to obtain treatment or payment or my eligibility for health care benefits. However, I understand that my refusal to sign this Authorization may prevent me from obtaining insurance products or services from one or more of the insurers listed below. I acknowledge that I have read and understand the above and agree that this Authorization was completed prior to my signature. I further agree that a copy of this Authorization, whether a photocopy, carbon copy, or otherwise, shall have equal standing as if it were the original and can be relied upon by PLUS Financial Network and/or any third party designated herein. PLUS Financial Network represents the following insurers: American General/AIG Companies, American National, Ameritas, Assurity Life Insurance, AVIVA, AXA/Equitable, Banner Life, Chesapeake Life, Cincinnati Life, Employee Pooling, LLC, Fidelity Life, Fidelity Security Life, Genworth Life Insurance Company, Genworth Life & Annuity, Great American Life, Guarantee Trust Life, Hartford, ING Companies, John Hancock Life, LifeSecure, Lincoln Benefit Life, Lincoln National Life, Mass Mutual, MetLife Investors, Metropolitan Life, Minnesota Life, Mutual of Omaha, National Life Group, National Western Life Insurance, Nationwide, North American Company for Life and Health, Presidential, Principal, Principal National Life Insurance, Principal Life Insurance Company, Protective Life, Prudential Life, SBLI, State Life, Sun Life of Canada, Transamerica Occidental Life, Union Central Life, United of Omaha, and Zurich. Signed this_______________________________ day of ______________________________________, 20______ Signature of Proposed Insured/Parent or Guardian Proposed Insured/Parent or Guardian (Please Print) Agent/Witness PLUS FINANCIAL NETWORK HIPAA AUTHORIZATION 09/03/14 Date of Birth

© Copyright 2026