US rate hike and political vote in HK clouding the market

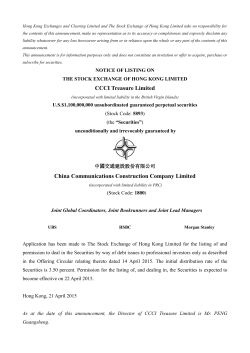

股票报告网整理http://www.nxny.com EAST ASIA SECURITIES COMPANY LIMITED 9/F, 10 Des Voeux Road Central, Hong Kong. Dealing: 2308 8200 Research: 3608 8098 Facsimile: 3608 6113 HONG KONG RESEARCH Weekly Report th 12 June 2015 Restricted circulation Analyst: Carmen Wong US rate hike and political vote in HK clouding the market HSI Weekly Movement 500 29,000 450 28,500 27,281 27,260 27,316 26,990 26,688 26,908 +21 +0.1% 27,500 HS Red Chip Index 5,050 5,101 -51 -1.0% 27,000 HS China Enterprises Index 13,984 13,915 +69 +0.5% HS Hong Kong 35 Index 2,986 3,016 -30 -1.0% HS Mainland 100 Index 8,499 8,504 -5 -0.1% Growth Enterprise Index 804 813 -9 -1.1% Avg Daily Turnover (HK$ bn ) 143.6 163.1 -20 -12.0% 39,947 53,648 36,060 15,101 39,613 55,163 36,413 15,148 +334 -1,515 -353 -47 +0.8% -2.7% -1.0% -0.3% 250 26,000 158.46 151.09 25,500 144.13 124.30 131.53 25,000 24,500 100 24,000 50 23,500 0 23,000 5-Jun Mon Tue Turnover Wed Thu % 27,260 26,500 150 05/6/2015 Change 27,281 300 166.90 12/6/2015 Hang Seng Index 28,000 350 200 Week ended Fri Hang Seng Index Hang Seng Index 400 Turnover (HK$ bn) Weekly Market Statistics Sectoral Indices Finance Utilities Properties Comm & Ind Review & Outlook of Market Performance Although Hong Kong stock market started the week with a positive tone, shares plunged on Tuesday and Wednesday, amid concerns over possible US interest rate hike in the coming months as well as fears of MERS (Middle East Respiratory Syndrome) spreading in Hong Kong. Besides, investor appetite was curbed by a political vote in Hong Kong on next Wednesday for the Chief Executive election in 2017. Shares rebounded later this week, as the Centre for Health Protection of Hong Kong clarified no confirmed case of MERS was found in Hong Kong. Over the week, the HSI edged up by 0.1% w-o-w to 27,281, while the HSCEI climbed 0.5% w-o-w. The daily average Mainboard turnover reduced to HK$143.6 billion, down from HK$163.1 billion in the previous week. The Chinese banking sector broadly outperformed the market, led by Bank of Communications (3328.HK; +5.5% w-o-w). Shares were cheered, as news reported the mixed-ownership reform plan of BoCom would be approved within two weeks at the earliest. Also BoCom was said to be having talks to introduce Fosun Group and Tencent as investors. Meanwhile, the primary market started to heat up, as a number of companies are set to be listed in the local bourse by end of this month, including Legend Holdings, the parent of Lenovo Group (0992) as well as Red Star Macalline Group , the largest home improvement and furnishings mall in China. On the economic front, China’s consumer inflation unexpectedly eased from 1.5% y-o-y in April to 1.2% y-o-y in May (vs. consensus of +1.3% y-o-y), whereas the producer price index stayed unchanged at a negative 4.6% yo-y. Fixed asset investment for the first 5 months this year merely grew 11.4% y-o-y (April: +12.0% y-o-y), its slowest pace in nearly 15 years, although growth in retail sales (+10.1% y-o-y, same as consensus) and factory output (+6.1% y-o-y vs. consensus of +6.0% y-o-y) steadied in May. For the coming week, Hong Kong stocks are expected to remain volatile, ahead of the Legislative Council vote on the political reform package in Hong Kong and the Federal Open Market Committee meeting in the US. Shares may see further downside, in the event of more signs of MERS spreading in the territory. The HSI may find its near-term support level at around 26,800 points. This report has been prepared solely for information purposes and we, East Asia Securities Company Limited are not soliciting any action based upon it. Neither this document nor its contents shall be construed as an offer, invitation, advertisement, inducement or representation of any kind or form whatsoever. This document is based upon information, which we consider reliable, but accuracy and completeness are not guaranteed. Opinions expressed herein are subject to change without notice. At the time of preparing this report, we have no position in securities of the company or companies mentioned herein, while other Bank of East Asia Group companies may from time to time have interests in securities of the company or companies mentioned herein. 股票报告网整理http://www.nxny.com EAST ASIA SECURITIES COMPANY LIMITED US & Regional Markets Weekly Update Date US Dow Jones US NASDAQ JAPAN Nikkei Avg SINGAPORE STI MALAYSIA KLSE Index BANGKOK SET Index TAIPEI Weighted Index 12th June 5th June 18,039.37* 17,849.46 5,082.51* 5,068.46 20,407.08 20,460.90 3,351.97^ 3,333.67 1,734.37^ 1,745.33 1,507.89^ 1,507.37 9,301.93 9,340.13 +0.52 +0.0% -38.20 -0.4% Change +189.91 +14.05 -53.82 +18.30 -10.96 % +1.1% +0.3% -0.3% +0.5% -0.6% th th Remark: (*) closing as of 11 June 2015; (^) closing as at 17:00 of 12 June 2015 Major Changes in Index Constituent Stocks (Week ended 12th June 2015) Hang Seng Index (HSI) Stock Stock Closing Price Code @12/6/2015 W-O-W Change Galaxy Entertainment 00027 HK$33.75 Absolute -HK$2.05 % -5.7% Cathay Pacific 00293 HK$18.48 -HK$1.06 -5.4% Remarks / Comments Deutsche bank maintained its “Underweight” rating on Macau gaming sector, as the opening of Galaxy Macau Phase 2 failed to boost the performance of the sector. For the first seven days of June, the average daily gross gaming revenue was down 50% y-o-y to MOP520 million per day. The Security Bureau of Hong Kong has issued a Red Outbound Travel Alert to Korea in view of the outbreak of the MERS. Shares of Cathay Pacific tumbled, amid fears of MERS spreading with suspected cases found in Hong Kong this week. Hang Seng China Enterprises Index (HSCEI) Stock CGN Power Stock Closing Price Code @12/6/2015 01816 HK$4.70 W-O-W Change Absolute -HK$0.72 % -13.3% Remarks / Comments Its key competitor, China National Nuclear Power, the second largest nuclear power operator, was listed in th the Shanghai A-share market on 10 June. Nomura and Credit Suisse recommended "Reduce" and "Underperform" rating on CGN respectively on its stretched valuations. Hang Seng China-Affiliated Corporations Index (HSCCI) Stock Lenovo Group Stock Closing Price Code @12/6/2015 00992 HK$11.42 W-O-W Change Absolute -HK$0.60 2 % -5.0% Remarks / Comments Legend Group, the parent company of Lenovo Group, is set to be listed in the Hong Kong Stock Exchange later this month, raising proceeds of US$2 billion to US$ 3 billion. 股票报告网整理http://www.nxny.com EAST ASIA SECURITIES COMPANY LIMITED Summary of US Economic News Indicator Initial jobless claims – week ended 6 June 2015 Change/Index th +0.7% w-o-w Retail sales – May 2015 +1.2% m-o-m Comments Initial jobless claims increased slightly more than expected by 2,000 to a seasonally adjusted 279,000 (vs. consensus of 275,000) for the week th ended 6 June 2015. Yet, the level remained near its 15-year low. The 4-week average rose 3,750 to 278,750. Retail sales growth rebounded from a 0.2% monthly gain in April to 1.2% m-o-m in May, mainly boosted by increased sales of automobiles and stronger consumption of gasoline. Excluding these 2 components, retail sales rose 0.7% from the previous month. Forthcoming Important Announcements / Events th 15 June 2015 (Monday) th 16 June 2015 (Tuesday) th 17 June 2015 (Wednesday) th 18 June 2015 (Thursday) th 19 June 2015 (Friday) Gross National Income and External Primary Income Flows for 1Q15 Industrial Production – May 2015 Adobe Systems Inc – 2Q15 results No important announcements/ events Housing Starts – May 2015 FedEx Corp – 4Q15 results Oracle Corp – 4Q15 results No important announcements/ events HK : US : HK : US : HK : US : HK : US : HK : FOMC Meeting Announcement China Greenfresh Group Co., Ltd. (06183) – trading debut Trade Involving Outward Processing in China for 1Q15 Volume and Price Statistics of External Merchandise Trade for April 2015 Unemployment and Underemployment for March – May 2015 Consumer Price Index – May 2015 th Initial jobless claims – week ended 13 June 2015 Pa Shun Pharmaceutical International (00574) – trading debut US : No important announcements/ events 3 股票报告网整理http://www.nxny.com EAST ASIA SECURITIES COMPANY LIMITED Important Disclosure / Analyst Declaration / Disclaimer This report is published by East Asia Securities Company Limited, a wholly-owned subsidiary of The Bank of East Asia, Limited (“BEA”). Each research analyst primarily responsible for the content of this report (whether in part or in whole) certifies that (i) the views on the companies and securities mentioned in this report accurately reflect his/her personal views; and (ii) no part of his/her compensation was, is, or will be, directly, or indirectly, related to specific recommendations or views expressed in this report. This report has been prepared solely for information purposes and has no intention whatsoever to solicit any action based upon it. Neither this report nor its contents shall be construed as an offer, invitation, advertisement, inducement or representation of any kind or form whatsoever. This report is based upon information, which East Asia Securities Company Limited considers reliable, but accuracy or completeness is not guaranteed. The analysis or opinions expressed in this report only reflect the views of the relevant analyst as at the date of the release of this report which are subject to change without notice. Any recommendation contained in this report does not have regard to the specific investment objectives, financial situation and the particular needs of any specific recipient. This report should not be regarded by recipients as a substitute for the exercise of their own judgment. Investments involve risks and investors should exercise prudence in making their investment decisions and obtain separate legal or financial advice, if necessary. East Asia Securities Company Limited and / or The Bank of East Asia Group accepts no liability whatsoever for any direct or consequential loss arising from any use of or reliance on this report or further communication given in relation to this report. At the time of preparing this report, East Asia Securities Company Limited has no position in securities of the company or companies mentioned herein, while BEA along with its affiliates/associates and/or persons associated with any of them may from time to time have interests in the securities mentioned in this report. BEA and its affiliates/associates, their directors, and/or employees may have positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking services for these companies. BEA and/or any of its affiliates/associates may beneficially own a total of 1% or more of any class of common equity securities of the company or companies mentioned in this report and may, within the past 12 months, have received compensation and/or within the next 3 months seek to obtain compensation for investment banking services from the company or companies mentioned in the report. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of, or located in, any locality, state, country or other jurisdiction, publication, availability or use would be contrary to law and regulation. 4

© Copyright 2026