Th` Dyn`m~` and In",g~

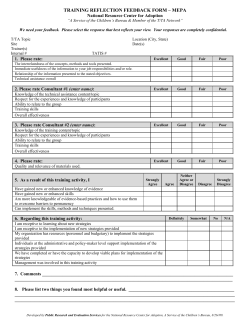

318 IV f Genepating Inequality Th' Dyn'm~' In",g~ and permanently poor to P~ agendas, both group~ downplayed the eX1~ poverty at one point or . Two factors have co .. vatives' emphasis at tim~ nature of poverty. The ~ the openness of society. ~ that markets lead to a. l among social and econonW argued that there is. COl acrosS the income dlstr~ that for many families ~ nent status. Second is the measures of yearly.pover1 ate the amount of pover\:1 defects of annual income distribution of well-beil offsetting changes in inCl Milton Friedman makes fully by asking us to C( that have the same disa: come: "In one there it change so that the pos~ti lies in the income hie from year to year. In tb rigidity, each family sta1 year after year. Clear! sense, the second one 'I equal society" (1962, this view, we should b the distribution of lifeti of the poor in one year lowing year, then the poor, are a small subse year. 2 Liberals have also a existence of permane two somewhat diffen belief that income is factors outside the c< such as the health of I to stress the transitor welfare reci piency. 1 times. During these b tunate fall into povel ticipate in governrn conditions may chal exits from both pove Ii1 PETER GOTTSCHALK, SARA AND GARY D. SANDEFUR MCLANAHAN, The Dynamics and Intergenerational Transmission ofPoverty and Welfare Parlicipation The traditional approach to the measurement of poverty has been to examine the size and composition of the poverty population by an alyzing cross-sectional data <:'1) yearly income. Yet a good part of the poverty policy debate focuses on issues that cannot be addressed with data on yearly income. There is substan tial interest, for example, in long-term poverty or the welfare dependence of a single generation and the links between the out comes of parents and their children. Statistics on who is poor (or who receives welfare) dur ing a single year provide no information on the total number of years that individuals and families are poor (or receiving welfare). Nor do they tell us if today's poor (or' welfare re cipients) grew up in households that were poor or received public assistance. Here we examine the recent empirical research on poverty and welfare dynamics and the emerg ing research on the links between generations. The vision of a permanently dependent un derclass, mired in poverty and dependency, gained considerable attention during the 1980s. Conservative analysts such as Charles Murray (1984) argued that a "welfare trap" robbed recipients of the will to better their Originally published in 1994. Please see complete source information beginning on page 891. lot. Welfare offered the opportunity to drop out of the labor market and to abandon the traditional family model by making it possible to raise children while unemployed and un married. Furthermore, the resulting debilitat ing effects of welfare were asserted to be passed on to successive generations. Accord ing to this view, welfare programs were a cause of the problem, rather than part of the solution to poverty. The way to save people from long-term poverty and dependence was to scale back the welfare system. Ironically, the notion that people were trapped in long-term poverty was one of the motivations for the War on Poverty. Drawing on the work of Oscar Lewis (1961) and Michael Harrington (1962), liberals used the idea of an intergenerational poverty to galva nize public support for the creation of work and training programs for youth. These pro grams promised to reunite the poor with the rest of society. In effect, the War on Poverty was waged on behalf of the children of the poor, who were assumed to be trapped by poverty rather than by welfare. According to this view, welfare provided the transitional fi nancial support necessary to allow the poor to gain the skills to become self-sufficient. That the specter of a permanently poor class has been used to justify both the creation and the dismantling of social programs is in dicative of the controversy surrounding these issues. Moreover, just as both liberals and conservatives have used the existence of the IV I Gelleratlll Inelluallty opportunity to drop and to abandon the by making it possible memployed and un Ie resulting debilitat ",ere asserted to be senerations. Accord 'e programs were a ther than part of the way to save people llld dependence was system. I that people were 'erty was one of the :m Poverty. Drawing Lewis (1961) and ;2), liberals used the lal poverty to galva he creation of work 'r youth. These pro e the poor with the the War on Povertv the children of th~ 1 to be trapped by elfare. According to d the transitional fi T to allow the poor .e self-sufficient. permanently poor .fy both the creation cial programs is in r surrounding these both liberals and he existence of the The Dyn,lmics and Intergenerational Transmission of Poverty and Welfare Participation permanently poor to promote their policy agendas, both groups have also denied or downplayed the existence of permanent poverty at one point or another. Two factors have contributed to the conser vatives' emphasis at times on the transitory nature of poverty. The first is their belief in the openness of society. Sensitive to criticisms that markets lead to a rigid class division among social and economic classes, they have argued that there is considerable mobility across the income distribution and, hence, that for many families poverty is not a perma nent status. Second is their belief that official measures of yearly poverty seriously exagger ate the amount of poverty. One of the primary defects of anImal income as a measure of the distribution of well-being is that it ignores .offsetting changes in incomes in other years. 1 Milton Friedman makes the case most force fully by asking us to consider two societies that have the same distribution of annual in come: "In one there is great mobility and change so that the position of particular fami lies in the income hierarchy varies widely from year to year. In the other, there is great rigidity, each family stays in the same position year after year. Clearly, in any meaningful sense, the second one would be the more un equal society" (1962, p. 171). According to this view, we should be most concerned with the distribution of lifetime well-being. If many of the poor in one year are not poor in the fol lowing year, then the truly needy, or truly poor, are a small subset of the poor in a single year. 2 Liberals have also at times downplayed the existence of permanent poverty, though for two somewhat different reasons. First, their belief that income is largely determined by factors outside the control of the individual, such as the health of the economy, leads them to stress the transitory nature of poverty and welfare recipiency. Families fall upon hard times. During these bleak periods the less for tunate fall into poverty and may need to par ticipate in government programs. Outside conditions may change, however, leading to exits from both poverty and welfare. 878 Second, liberals are also reluctant to em brace the notion of an underclass because of their experience with the debate over the "culture of poverty" in the late 1960s. Al though the concept of a dysfunctional cul ture was originally proposed as a critique of capitalism, the culture of poverty argument soon came to be viewed as "blaming the vic tims" for conditions bevond their control. According to this view, it was not "the sys tern" but rather the poor's lack of will to avoid the "welfare trap" that caused long term poverty) As black clients became an in creasing proportion of the welfare caseload, this argument became open to charges of racial bias. As a result, liberals backed off from any discussion of long-term or inter generational poverty during the 1970s for fear of being labeled racist or unsympathetic to the poor. That liberals and conservatives have such different views on intragenerational and inter generational dynamics is due, in part, to their very different models of the causes of long term poverty and the role of welfare in reduc ing or exacerbating poverty_ The causal expla nation, put forward by conservatives, is that welfare programs create dependency and, therefore, perpetuate poverty (Murray, 1984; Mead, 1986). The availability of welfare en courages women to bear children out of wed lock, encourages families to break up, and eliminates the need for absentee fathers to contribute to the economic and social require ments of their children, thereby encouraging long-term dependency. Furthermore, long term dependency is assumed to be passed from one generation to the next. For liberals, long-term poverty and welfare participation have generally been explained in terms of the lack of employment opportuni ties or the existence of jobs that do not pro vide earnings sufficient for a family to have a minimally adequate standard of living (Har rington, 1962; Wilson and Neckerman, 1986). If employment opportunities continue to be inadequate, then parents will not be able to earn enough to support their children. Poverty will continue, and in some cases, de 380 pendency on welfare will also result from the inadequate economic environment. William Julius Wilson and Kathryn Necker man (1986) have further broadened the focus to the connections between inadequate em ployment opportunities, family structure, and poverty. They argue that the lack of employ ment opportunities, especially for black men, has led to a lower rate of marriage and a higher rate of out-of-wedlock childbearing among black women. Inadequate employ ment opportunities thus produce poverty and welfare dependence indirectly through effects on family structure as well as directly through reduced income. From this brief review, we can see that con servatives are likely to view long-term poverty as evidence of the dangers of welfare. At the same time they stress that Amerjs:an society is fairly open, so that many of the poor are only temporarily poor. Liberals are likely to point to the problems faced by the long-term poor as a way of marshaling sympathy for the poor and garnering support for government inter ventions to combat poverty, including policies to improve market opportunities and to ex pand programs. At the same time, liberals downplay any negative behavioral effects of long-term welfare participation. Who is correct in this debate is still a highly contested issue. Part of the debate'rests on logical arguments. Liberals argue that because welfare is freely chosen by recipients, it can hardly be called a "trap." Recipients obvi ously believe that welfare is the best of the bad options they face. There is no logical ba sis for arguing that the mother herself would freely choose welfare if it formed a "trap" that she wished to avoid. Welfare provides a steady, if meager, source of income, which must be preferred to the option of working and raising a family as a single parent or the option of marrying the father, who may not be able to support his children financially. Al though it is possible to argue that the children or taxpayers are worse off when the mother accepts assistance, it is not consistent to argue that recipients make choices and that these choices make them worse off. IV I Genel'allnglnequalllJ Similarly, conservatives argue that liberals deny the inevitable work and marriage disin centives inherent in the welfare system. By paying a mother more if she doesn't work and doesn't marry, the welfare system discourages mothers from following either of these so cially desirable activities. Because both mar riage and work lead to higher income, the welfare system creates long-term poverty and dependency. Therefore, according to conser vatives, the logical outcome of a more gener ous welfare system is to form a trap that locks recipients into long-term poverty. The relevant question, however, is not whether a trap exists or whether there are dis incentives, for it is certainly true that some families receive welfare for protracted periods and that there are disincentives. The question is the quantitative magnitude of these factors. We approach this highly ideological debate by examining two central issues: the prevalence of long-term poverty and welfare participa tion and the disincentives caused by public as sistance; and the relationship between poverty, income, and welfare use in one gen eration and the next. The Dynamics and Intergener4 (Author'S tabulation of Pan!J a. All races proportion 0.70 0.60 0.50 0040 0.30 0.20 II I 1 year Evidence on Intragenerational Mobility b. By race Dynamic issues have received less attention than the static measures of poverty, in part be cause longitudinal data sets such as the Panel Study of Income Dynamics (PSID) and the National Longitudinal Survey of Youth (NLSY) have been widely available only since the late 1960s. These data sets only now have enough years of data to study both long-term poverty and welfare recipiency and to observe the outcomes over multiple generations. 0.70 Income and Poverty Dynamics We begin by documenting the extent to which poverty is a permanent or transitory condi tion. Figure 1 presents data on the length of poverty spells. This figure, based on data from the Panel Study of Income Dynamics, I. I Proportion 0.60 0.50 0040 0.30 0.20 0.10 0.00 1 year 2y~ IV I Generating Inequality The Dynamics and Intergenerational Transmission of l'overty and Welfare Participation argue that liberals and marriage dis in welfare system. By Ie doesn't work and system discourages either of these so Because both mar ligher income, the ?;-term poverty and cording to conser e of a more gener 'ill a trap that locks )verty. however, is not ether there are dis tly true that Some protracted periods :ives. The question Je of these factors. ~ological debate by es: the prevalence welfare participa LUsed by public as lonshi p between re use in one gen FIGURE 1 Annual poverty spell distribution. (Author's tabulation of Panel Study of Income Dynamics, 1968-1987, distribution of first observed spell.) 981 a. All races Proportion 0.70 0.594 0.60 0.50 0.40 0.30 0.20 0.10 0.030 0.049 0.015 0.022 0.00 1 year 2 years 3 years 4 years 5 years 6 years 7 years over 7 years Spell length b. By race ry Proportion 'ed less attention overty, in part be such as the Panel ; (PSID) and the lrvey of Youth ailable only since ts only now have y both long-term :y and to observe enerations. 0.70 0.60 Nonblack • 0.40 0.30 0.20 0.10 mics ~ extent to which ransitory condi :m the length of based on da ta orne Dynamics, Black 0,50 ,1 0.00 1 year 2 years 3 years 4 years 5 years Spell length 6 years 7 years over 7 years 382 counts the number of consecutive years that a person lived in a family with an annual in come below the family's annual poverty line. It asks the question, "If you follow a group of people who have just started new poverty spells, how long will these poverty spells last?" Figure 1a shows data for persons of all races. It shows that 59.4 percent of poverty spells last only one year. 4 An additional 16.6 percent last only two years. Thus nearly three-quarters of all poverty spells are shorter than two years. At the other extreme only 7.1 percent of the spells last seven or more years. Figure 1 b shows the corresponding data for persons disaggregated by race. From this fig ure it is clear that blacks stay in poveny longer than nonblacks. Of the poverty spells of nonblacks, 63.1 percent last )~ss than one year; the corresponding figure for blacks is only 48.4. Blacks also have considerably more long spells. Almost 15 percent of their poverty spells last seven or more years, while only 4.3 percent of the spells for non blacks are this long.... Welfare Dynamics The public debate during the 1980s over wel fare reform was largely driven by the percep tion that a large number of welfare recipients were incapable of becoming self-sufficient without either a large carrot to persuade them off the program or a large stick to force them off. Conservatives charged that welfare recipi ents stayed on welfare for long periods, soak ing up tax dollars and living in perpetual de pendency. Liberals downplayed long-term dependency, acknowledging that a small pro portion of the welfare population had long welfare spells but emphasizing that most re cipients used welfare on a temporary basis. Duration of single AFDC spells. We begin by answering the following question: If all the Aid to Families with Dependent Children cases that opened in a given year were fol lowed for their duration, how long would each spell last?5 Figure 2 shows that most The Dynamics and Intergenet IV I Generating Inequality AFDC spells are short. For blacks, 33.7 per cent of spells last only a year, and an addi tional 16.2 percent end in the second year.6 For nonblacks, the corresponding figures are 44.0 and 22.8 percent.? By the end of two years, half of the welfare spells for blacks and two-thirds of the spells for nonblacks have ended. These data provide evidence that most wel fare entrants are not trapped in perpetual de pendency. 8 But Figure 2 also shows that al though most cases are not long, a substantial minority of cases remain open for protracted periods. At the end of seven years, 5.8 percent of the AFDC spells of non blacks were still in progress and 25.4 percent of the AFDC spells of blacks were still in progress. Dis! (Author'S tabulation of Pa:! Proportion 0.50 0045 0040 0.35 0.30 0.25 0.20 0.15 Recidivism and duration of multiple spells. Roughly half of the families leaving AFDC or Food Stamps will return to these programs at some future date. The duration of a single spell thus gives only a partial picture. To know whether recipients use AFDC for exten sive parts of their child-rearing years, one must take account of recidivism and the com bined length of multiple spells. Data on multi ple spells, however, are limited. An alternative measure of participation across multiple spells is to estimate the num ber of years a family receives AFDC, without regard to breaks in spells. Figure 3 (see page 384) shows our estimates of the number of years a woman who received welfare would receive AFDC in the first nine years after the birth of her first child. 9 These distributions are shown separately by race for all women who received AFDC (Figure 3a for blacks and 3b for nonblacks).lO As expected, the number of total years on welfare is substantially higher than the num ber of years on welfare in the first spelL Al though roughly half the initial spells of blacks last two years or less, just 27.7 percent of black recipients received AFDC for only two of the ten years when multiple spells are taken into account. l l For nonblacks the proportion of spells of two years or less drops from 66.8 to 41.3 when multiple spells are included. The 0.10 0.05 0.00 1 year 2: short spells are partial1 three to four years as I exit and return for sl multiple spells, howe proportion of long sp initial spells that taste 21.1 percent for blacl nonblacks. When roul these figures increas€ cent... , Evidence on Intergeneratlonal t ~! • We noW extend our welfare dynamicS a· this issue has a polit to focus on the inter IV I GenaratillllneqUality :or blacks, 33.7 per I year, and an addi in the second year.6 sponding figures are By the end of two spells for blacks and for nonblacks have The Dynamics and Intergenerational Transmission of Poverty and Welfare ParticilJation FIGURE 2 Distribution of AFDC spell length by race, 1974-1987. (Author's tabulation of Panel Study of Income Dynamics, 1974-1987, distribution of first observed spell.) Proportion 0.50 0.45 ience that most wel ped in perpetual de also shows that al t long, a substantial open for protracted ;n years, 5.8 percent nblacks were still in . of the AFDC spells ~ress. of multiple spells. es leaving AFDC or o these programs at uration of a single partial picture. To se AFDC for exten rearing years, one iivism and the com dIs. Data on multi .ited. e of participation , estimate the num ves AFDC, without Figure 3 (see page of the number of ved welfare would line years after the 'hese distributions ace for all women ; 3a for blacks and . of total years on her than the num the first spell. Al ial spells of blacks t 27.7 percent of :;'DC for only two )Ie spells are taken ks the proportion , drops from 66.8 are included. The 383 0.440 0.40 Nonblack • Black 0.35 0.30 0.25 0.20 0.15 0.10 0.05 0.00 1 year 2 years 3 years 4 years .5 years 6 years 7 years over 7 years Spell length short spells are partially replaced by spells of three to four years as people with short spells exit and return for short periods. Including multi pIe spells, however, also increases the proportion of long spells. The proportion of initial spells that lasted seven to ten years is 21.1 percent for blacks and 11.7 percent for nonblacks. When multiple spells are included, these figures increase to 34.4 and 18.0 per cent.... Evidence on Intergenerational Dynamics We now extend our analysis to poverty and welfare dynamics across generations. Again this issue has a political context. Liberals tend to focus on the intergenerational transmission of family background, income, and poverty, If low-income families have few resources to pass on to their children or to use to finance their children's education, then their children will be more likely to become poor adults themselves. Inasmuch as poverty leads to wel fare participation, this will also lead to inter generational welfare participation. According to this view, the intergenerational transmis sion of poverty causes the intergenerational correlation in welfare participation. Conser vatives tend to argue the opposite. Welfare perpetuates poverty and dependence across generations by promoting out-of-wedlock childbearing, by breaking up families, and by eroding the work ethic. These early childhood experiences lower children's achievement and lead to poverty and welfare participation in the next generation. The Dynamics and Interge IV I GeReratlng inequality 884 come of .58 and 040 rel intergenerational corre plies relatively little across generations. What do these correl one who is born in j Solon (1992) estimates erational correlation i the probability that a s the bottom quintile (2( distribution will remat of the income distribu Growing up at the bo tribution poses a sign American society,l4 Si and her colleagues (1 growing up in familic term poverty have sil tion, wages, and inco] FIGURE 3 Estimated distribution of years a mother receives AFDC in the first ten years after conception of her first child. (Authors' calculations based on the Panel Study of Income Dynamics, 1974-1987.) a. All black recipients % 35 30 25 20 15 10 5 o 1.31.3 1 year 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years Spell length • First spell D The Role of Family alld Family StrICbI All spells b. All non black recipients % 45 40 35 40.2 30 25 20 15 10 5 o 2.2 2.7 1 year 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 0.5 0.5 10 years Spell length Intergenerational Correlations in Poverty and Income If successive generations have similar in comes, then parents and their children are likely to have similar probabilities of falling into poverty.12 Although early studies of inter generational income mobility tended to find relatively low correlations, recent evidence suggests the correlation is substantial. 13 For example, Donald Treiman and Robert Hauser (1977) estimated that the intergenerational correlation of income was between .24 and .36 for men aged 25 to 34; Jere Behrman and Paul Taubman (1990) and Gary Solon (1992) found correlations of father's and son's in- .. The research on tht tionships in the expt viewed as part of a 1~ research on the effe( on social and econOl hood. The research! income and father's ground characteristi cation, whether or n ried, and number affect children's ac 1972; Featherman a The effects of fan well as of family other variables, am which is an indivic words, background ucation, which in t income. Although family a child grew up iI long been included els, interest in fam mechanism for e: tional transmissioI IV I SIReratlRI r 1Re~ .£3 fC in the first ten years after conception of her :1 Study of Income Dynamics, 1974-1987.) , Dynamics and Intergenerational Transmission of Poverty and Welfare ParticitN.Jtion of .58 and .40 respectively. Such a high correlation in income im r¥'l"~"~'~ relatively little mobility in incomes generations. do these correlations imply for some - - - - - - - - - - - - - - - - l e who is born in a low-income family? (1992) estimates (assuming an intergen correlation in income of .40) that probability that a son whose father was in bottom quintile (20 percent) of the income . will remain in the bottom quintile the income distribution as an adult is .42. up at the bottom of the income dis poses a significant disadvantage in tneJrICl'lln society)4 Similarly, Mary Corcoran her colleagues (1987) find that children up in families that experience long poverty have significantly lower educa length wages, and incomes .... [ ] All spells Role of Family Background Family Structure - - - - - - - - - - - - - - - - - - i l . , . research on the intergenerational rela J.,Im)!u.x. in the experience of poverty can be as part of a larger body of sociological on the effects of family background social and economic achievement in adult The research shows that, in addition to and father's occupation, family back characteristics, such as parents' edu whether or not parents remained mar and number of siblings, significantly children's achievement (Jencks et aI., Featherman and Hauser, 1978). The effects of family background factors as ength as of family income are mediated by variables, among the most important of is an individual's education. In other background has a strong effect on ed elatively low correlations, recent eVlderJ;:atlOll, which in turn has a strong effect on Jggests the correlation is substantial.l3 x:ample, Donald Treiman and Robert Although family structure-whether or not 1977) estimated that the intergenerati child grew up in a "broken family"-has )rrelation of income was between .24 been included in status attainment mod :6 for men aged 25 to 34; Jere Behrman in family instability as a possible lUI Taubman (1990) and Gary Solon (1 ","',HalH",l>! for explaining the intergenera lUnd correlations of father's and son's transmission of poverty increased in the 385 19808. 15 Today most of the background characteristics known to affect children's well-being have changed in ways that would be expected to benefit children. Parents are more educated than they were several decades ago; fathers' occupational status has risen; and the number of siblings in the fam ily has declined. In contrast, family instabil ity, which is believed to reduce children's well-being, has become increasingly common since 1950. Hence researchers have focused on the role of family structure in reproducing poverty across generations. Does family instability harm children? If we ask whether growing up in a nonintact family is associated with being poor in adulthood, the answer is yes. Figure 4 shows the likeli hood of experiencing several "high-risk" events-dropping out of school, having a child out of wedlock before age twenty, and being idle in late adolescence-for children who grow up in intact and nonintact families. Each of these events increases the risk of poverty and welfare dependence in adult hood, and each is a fairly good proxy for chil dren's lifetime income. Children from non intact families are more than twice as likely to drop out of high school as children from intact families. Young women from nonintact families are between two and four times as likely to give birth out of wedlock as young women from intact fami lies, and young men from nonintact families are about 1.5 times as likely to become idle as their peers from intact families. About half of the association between family instability and child well-being is due to difference in family income. Most of the rest is due to differences in parenting behavior (such as helping with school work and supervising social activities) and residential mobility. Although family structure has a sizable im pact, family disruption does not automati cally relegate children to long-term poverty or welfare dependence. Most children finish high school, delay childbearing, and become at tached to the labor force regardless of whether they live with one or both parents while growing up .... The Dynamics and Intergi IV f aene..ating Inequality 888 Intergeneratlonll CI in Wellare Partie" FIGURE 4 Family stability and children's attainment. (Estimates are based on four nationally representative surveys: the National Longitudinal Survey-Youth Cohort (NLSY), the Panel Study of Income Dynamics (PSID), the High School and Beyond Study (HSB), and the National Survey of Families and Households (NSFH). The bars represent "predicted values" based on models that control for race, parents' education, number of siblings, and region of residence at age sixteen.) a. High school dropout (males and females) Proportion 0.30.---------------------------, • Intact Nonintact 0.20 I-------l 0.10 0.00 NLSY PSID HSB NSFHl b. Teen premarital birth (females) Proportion 0.30 r-------------------------, 0.20 I - - - - - - - - - - - - - - - - - - - - - - - - - - - - - l t t t 0.10 I----...,........- r - - - - - - - - - - j ~ t 0.00 NLSY PSID HSB NSFHl t c. Idleness (males) t Proportion 0.30 r---------------------- t 0.201----------------------- • ., 0.10 t . 0.00 NLSY PSID HSB • . • The research on inte participation suggest across generations. Pe finds that although a of the daughters of we receive welfare themsel is substantially greater ters whose mothers d The probability that a a child and receives mother received welt: .066 if the mother nev comparable figures f( .136. 16 McLanahan (1 from a family that I more of its annual inC! the daughter was betl and sixteen has the i welfare indicators on whites, while a simplt ceipt during the ages t strongest effect for bl~ Because of the lack histories of both gem tempt to construct me fare use in both genl Martha Hill, and Sau ure welfare dependen as receiving welfare ( year period. They fin women whose familic during their adolesce teen to fifteen) did n< between the ages of three. Only 20 perc users themselves. W justed for differences individuals (income ~ relationship betweel fare use and childre but remains positive. Moffitt (1992) r studies and concludl evidence of stroni parental welfare rec fare receipt, even tb , I S.....atlng !nUlluallty The Dynamics and Intergenerational Transmission of Poverty and Welfare Participation Intergenerational Correlations In Welfare Participation presentative surveys: E Dynamics (PSID), -Iouseholds (NSFH). , education, number ntact • • • The research on intergenerational welfare participation suggests common patterns across generations. Peter Gottschalk (1992) finds that although a substantial proportion of the daughters of welfare recipients do not receive welfare themselves as adults, their risk is substantially greater than the risk of daugh ters whose mothers did not receive welfare. The probability that a nonblack daughter has a child and receives welfare is .261 if the mother received welfare, whereas it is only .066 if the mother never received AFDe. The comparable figures for blacks are .486 and .136. 16 McLanahan (1988) finds that coming from a fa~ily that received 50 percent or more. of its annual income from welfare while the daughter was between the ages of twelve and sixteen has the strongest effect among welfare indicators on AFDC participation for whites, while a simple measure of welfare re ceipt during the ages twelve to sixteen has the strongest effect for blacks. Because of the lack of data on full welfare histories of both generations, few studies at tempt to construct measures of long-term wel fare use in both generations. Greg Duncan, Martha Hill, and Saul Hoffman (1988) meas ure welfare dependence as heavy use, defined as receiving welfare continuously for a three year period. They find that 64 percent of the women whose families were highly dependent during their adolescence (defined as ages thir teen to fifteen) did not use welfare themselves between the ages of twenty-one and twenty three. Only 20 percent were heavy welfare users themselves. When the analyses are ad justed for differences in the background of the individuals (income and family structure), the relationship between family of origin's wel fare use and children's welfare use declines but remains positive. Moffitt (1992) reviews these and other studies and concludes that there is consistent evidence of strong correlations between parental welfare receipt and daughter's wel fare receipt, even though this preliminary re- 887 search has not yet explained the causes of the strong intergenerational correlation. Because families receiving welfare are poor-indeed, poverty is a condition of welfare receipt-we would expect children from welfare families to have higher rates of poverty and welfare use as adults than children from nonpoor, nonwelfare families. Intergenerational corre lation, therefore, does not necessarily indicate a causal relationship. Daughters and their mothers may simply share characteristics that increase the probability of their both receiving assistance.l7 For example, if both the mother and the daughter grow up in neighborhoods with poor-quality schools, both will be more likely to have lower earnings and, hence, a greater need for income assistance. In this case, taking the mother off of welfare will not lower the probability that the daughter will receive assistance. Changing the quality of the school the daughter attends, however, will raise her income and, in turn, lower the prob ability that she receives public assistance. * ., We have focused on two broad issues: (1) the extent to which individuals and families are poor for long periods of time or use welfare for extended periods; and (2) the extent to which the experiences of individuals as chil dren are associated with their economic situa tion as adults or, more specifically, the extent to which poverty and welfare use are passed on across generations. The results regarding the first issue sug gest that a majority of the poor remain poor for short periods of time, and that a major ity of welfare recipients receive welfare for only a few years. There is, however, a mi nority who experience long-term poverty or welfare dependence. By most accounts, nev ertheless, temporary dips into poverty and short-term participation in welfare are much more common than long-term spells of poverty and dependence. The results regarding the second issue whether poverty and welfare dependence are passed along from generation to generation also suggest that the media and some scholars 388 have overstated the extent to which poverty and welfare are traps in which individuals and families are caught. The large majority of families and individuals who are poor or who use welfare are not trapped, and neither are their children. It is true that individuals who lived in poor families as children are more likely to experience poverty as adults, and it is true that individuals whose families partici pated in welfare programs when they were children are more likely to receive welfare as adults. But it is also true that as many as two thirds of the children from these families man age to escape poverty and dependence when they grow up. Notes . 1. Annual income would be the proper measure If people could only save or borrow to smooth in come within each year. 2. Note that this argument implicitly assumes that people can smooth their consumption by ei ther saving Of borrowing against future income. The argument for extending the accounting period beyond a year becomes much weaker if many poverty spells occur early in life when income smoothing through saving may not be possible. 3. This view is still often reflected in public state ments. For example, in his famous "Murphy Brown" speech, Vice President Dan Quayle stated that "the intergenerational poverty that troubles us so much today is predominately a poverty of val ues." Boston Globe, May 21,1992. 4. We find more one-year spells than reported in Bane and Ellwood (1986). This reflects our use of the official poverty line rather than 125 percent of the official thresholds, our inclusion of post-1982 data, our inclusion of persons over sixty-five, and their excluSion of some one-year spells. Using their procedure reduces the frequency of one-year spells by.084. 5. This question differs from the question that asks how long spells currently in progress will last. 6. Our results differ from those of Ellwood (1986) who used fewer years of data and who looked only at spells of both receiving AFDC and being a female head of household. 7. Blank (1989) finds somewhat shorter dura tions because she uses monthly data. 8. Although AFDC receives by far the most at tention, the Food Stamp program provides assis tance to a much larger caseload. Burstein and The Dynamics and Int IV I Generating Inequality Visher (1989) show that there is even more turnover in the Food Stamp caseload than in the AFDC caseload. At the end of one year roughly two-thirds of all Food Stamp cases h~ve been closed. If long-term recipiency is defined as a Food Stamp spell that lasts for three years or more, then only 15 percent of all Food Stamp cases could be classified as long term. 9. Because AFDC is available to pregnant women, we mclude the year prior to birth and the following nine years in the ten-year window. 10. These data are generated by estimating dis crete time duration models for spells on and off of welfare and simulating the predicted spell dura tions over the ten-year period. The data on the first spell differ from the data in Figure 2, which sam ples all spells. 11. Duncan, Laren, and Yeung (1991) examined families in the PSID that received AFDC at least once during the first eighteen years of their child's life. Although their conclusions are based on smaller samples that do not allow for disaggrega tion, they find similar overall patterns. 12. Furthermore, a focus on the association in income across generations may be more informa tive, as individuals who experience childhood poverty may experience near-poverty as adults. They would not be counted as poor, but analyzing lllcome, rather than poverty status, overcomes the problem of living standards above the poverty line. 13. Becker and Tomes (1986) concluded that the intergenerational correlation in income was some where around .17, based on their review of some early studies. This finding suggests a fairly small ef fect of parental income on the income of children later as adults. 14. If the intergenerational correlation in income were zero, the probability that the child of a poor family would fall into poverty would be the same as the probability for the child of a rich family namely .20. ' 15. For a review of this literature, see McLana han and Booth (1989). 16. These patterns are attenuated but not elimi nated after controlling for a large number of factors that may also affect the daughter's participation. 17. Gottschalk (1992) finds some evidence that the relationship is not just spurious. t ~ I, .. References Bane, Mary jo, and David T. Ellwood. 1986. :'Slipping into and out of Poverty: The Dynam ICS of Spells." Journal of Human Resources 21 (Winter): 1-23. Becker, Gary 5., and Nigel Tomes. 1986. "Human Capital and the Rise and Fall of Families." • .. Journal of Labor 51-539. Behrman, Jere R., and P lntergenerational dren's Adult Earnin come: Results from of Income Dynamics." i Wealth 36: 115-127. i, Blank, Rebecca M. 1989·1 of Welfare Spells." J~ nomics 39: 245-273. . Burstein, Nancy R., and 1 "The Dynamics ofF~ ipation." U.S. Dep~ Food, and Nutrition Sd March. Mimeo. Corcoran, Mary, Roger I Laren, and Gary SolOi tional Transmission of I Earnings." University d Public Policy Studies, M Duncan, Greg J., Martbi Hoffman. 1988. "Wei' and acrosS Generat 467-471. Duncan, Greg J., DebOl Yeung. 1991. "How J) Children on Welfare? R PSID." Institute for Soc of Michigan, Ann ArOO Ellwood, David T. 1986, Long- Term Recipients NJ.: Mathematica Polie Featherman, David 1., a 1978. Opportunity art Academic Press. Freidman, Milton. 1962 dom. Chicago: Universi Gottschalk, Peter. 1992. Welfare Participation a ous? Department of I lege. Mimeo. IV / SlnlratlDg Inequality The Dynamics and Intergenerational Transmission of Poverty and Welfare Participation there is even more caseload than in the of one year, roughly :mp cases have been :y is defined as a Food ee years or more, then Stamp cases could be Journal of Labor Economics 4 (2, pt. 2): Sl-S39. Behrman, Jere R., and Paul Taubman. 1990. "The Intergenerational Correlation between Chil dren's Adult Earnings and Their Parents' In come: Results from the Michigan Panel Study of Income Dynamics." Review of Income and Wealth 36: 115-127. Blank, Rebecca M. 1989. "Analyzing the Length of Welfare Spells." Journal of Public Eco nomics 39: 245-273. Burstein, Nancy R., and Mary G. Visher. 1989. "The Dynamics of Food Stamp Program Partic ipation." U.S. Department of Agriculture, Food, and Nutrition Service, Washington, D.C. March. Mimeo. Corcoran, Mary, Roger H. Gordon, Deborah Laren, and Gary Solon. 1987. "Intergenera tiona I Transmission of Education, Income, and Earnings." University of Michigan, Institute of Public Policy Studies, Mimeo. Duncan, Greg J., Martha S. Hill, and Saul D. Hoffman. 1988. "Welfare Dependence within . - and across Generations." Science 239: 467-471. Duncan, Greg J., Deborah Laren, and W.J.J. Yeung. 1991. "How Dependent Are America's Children on Welfare? Recent Findings from the PSID." Institute for Social Research, University of Michigan, Ann Arbor. Mimeo. Ellwood, David T. 1986. Targeting "Would-Be" Long-Term Recipients of AFDC. Princeton, NJ.: Mathematica Policy Research. Featherman, David L., and Robert M. Hauser. 1978. Opportunity and Change. New York: Academic Press. Freidman, Milton. 1962. Capitalism and Free dom. Chicago: University of Chicago Press. Gottschalk, Peter. 1992. "Is the Correlation in Welfare Participation across Generations Spuri ous? Department of Economics, Boston Col lege. Mimeo. I 'ailable to pregnant prior to birth and the n-year window. ted by estimating dis )r spells on and off of predicted spell dura . The data on the first Figure 2, which sam :ung (1991) examined :eived AFDC at least years of their child's sions are based on allow for disaggrega patterns. :m the association in ay be more informa ICperience childhood lr-poverty as adults. s poor, but analyzing ;tatus, overcomes the Jove the poverty line. 6) concluded that the in income was some their review of some ~ests a fairly small ef e income of children :orrelation in income t the child of a poor r would be the same ild of a rich family, rature, see McLana uated but not dimi ge number of factors er's participation. some evidence that IOUS. '. Ellwood. 1986. rerty: The Dynam· man Resources 21 ~S. 1986. "Human ;all of Families." • • • • • • 888 Harrington, Michael. 1962. The Other America: Poverty in the United States. New York; Macmillan. Jencks, Christopher, Marshall Smith, Henry Acland, Mary Jo Bane, David Cohen, Herbert Gintis, Barbara Heyns, and Stephan Michelson. 1972. Inequality. New York: Basic Books. Lewis, Oscar. 1961. The Children of Sanchez. New York; Random House. McLanahan, Sara S. 1988. "Family Structure and Dependency; Early Transitions to Female Household Headship." Demography 25: 1-16. McLanahan, Sara S., and Karen Booth. 1989. "Mother-Only Families: Problems, Prospects, and Politics." Journal of Marriage and the Family 51: 557-580. Mead, Lawrence M. 1986. Beyond Entitlement: The Social Obligations of Citizenship. New York: Free Press. Moffitt, Robert. 1992. "The Effect of the Medi caid Program on Welfare Participation and La bor Supply." Review of Economics and Statis tics 74 (4): 615-626. Murray, Charles. 1984. Losing Ground: Ameri can Social Policy, 1950-1980. New York; Basic Books. Solon, Gary. 1992. "Intergenerational Income Mobility in the United States." American Eco nomic Review 82 (3); 393-408. Treiman, DonaldJ., and Robert M. Hauser. 1977. "Intergenerational Transmission of Income: An Exercise in Theory Construction." In The Pro cess of Stratification: Trends and Analyses, ed. Robert M. Hauser and David L. Featherman. New York: Academic Press. Wilson, William Julius, and Kathryn M. Necker man. 1986. "Poverty and Family Structure: The Widening Gap Between Evidence and Public Policy Issues." In Fighting Poverty: What Works and What Doesn't, ed. Sheldon H. Danziger and Daniel H. Weinberg. Cambridge, Mass.: Harvard University Press.

© Copyright 2026