Shaping The Future Of Insurance In The Middle East By Driving

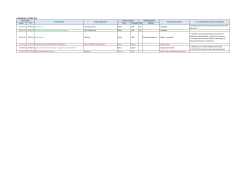

Shaping The Future Of Insurance In The Middle East By Driving Efficiencies, Increasing Penetration and Sustaining Growth Conference Day One: Tuesday, 12 May 2015 08:30 Registration and morning refreshments 09:00 Chairman’s opening remarks Michael Faulkner, Editor, Insurance Day, UK KEY STAKEHOLDER CONGRESS 09:15 Tapping Potential: Discussing how the insurance industry can work together to build trust and awareness in the region to increase market growth and penetration Moderated by: Mohammed Ali Riyazuddin Londe, Analyst, Moody's Dr. Sven Rohte, Chief Commercial Officer, DAMAN, UAE Mark Cooper, Country Manager, Lloyd’s, UAE Ghassan Marrouche, Chief Executive Officer, Noor Takaful, UAE Franck Heimburger, Country Manager UAE, AXA Insurance (Gulf), UAE 10:15 MENA Insurance Review: Taking stock of recent market developments and lessons learnt, to develop strategy going forward Sanjay Jain, Director, MENA Insurance Advisory, EY, UAE 11:00 Speed-Networking: Expand your business network and create a competitive edge A quick and effective way to expand your business network, generate key contacts and win new deals. 11:20 Morning refreshments and networking break INTERNATIONAL KEYNOTE 11:50 Global Insurance Review: Tracking global insurance market trends to develop robust strategies for business growth in the Middle East Cameron Murray, Head of UK, Ireland, Middle East & Africa, Lloyd's, UK 12:30 The Global Risk Makeover: Cutting edge information on new regulatory compliance and how risk management is transforming business decisions today Scott Lim, Senior Manager, Dubai Financial Services Authority, UAE 13:10 Lunch and networking break INSURANCE LEADERS ROUNDTABLE 14:10 Where Is The Sector Headed: Expert insight on which geographies, product lines and distribution channels will drive volumes and profitability in 2015 Moderated by: Kevin Willis, Director - Financial Institution Rating Services, Middle East & Africa Sector Specialist, Standard & Poor's, UAE George Kabban, Chief Executive Officer, UIB (DIFC) Ltd, UAE Prem Sagar, Chief Executive Officer, ACR ReTakaful MEA, Bahrain Jabran Noor, Executive Director - Actuarial & Risk Management, Tajweez Advisory Co., Bahrain MULTI-STAKEHOLDER CONGRESS 14:50 Shariah Compliant Products: Converting potential into real growth and sustaining momentum for takaful products in the Middle East Amer Daya, Chief Executive Officer, Al Hilal Takaful, UAE Mohamed El Dishish, Chief Executive Officer, EmiratesRE, UAE Rached Diab, Executive Director Operations - General, Aman Insurance 15:30 Afternoon refreshments and networking 16:00 ROUNDTABLE DISCUSSIONS Through interactive discussions, these roundtables give you the opportunity to open up strategies for taking advantage of increasing volumes and driving profitability; driving market penetration and reach and for increasing premium income and margins. After 30 minutes, a spokesperson from each roundtable will present a summary. Choose one of the two roundtables: Health Insurance: David T. Youssef, Managing Director, NowHealth International, UAE Life Insurance: Xavier Arputharaj, EVP, Life & Medical, Orient Insurance, UAE 16h45 Closing remarks and end of day one Michael Faulkner, Editor, Insurance Day, UK Conference Day Two: Wednesday, 13 May 2015 09:00 Chairman’s opening remarks Michael Faulkner, Editor, Insurance Day, UK INDUSTRY LEADERS KEYNOTE ROUNDTABLE 09:10 Opportunity Or Threat: Industry perspectives on recent regulatory changes with a focus on increased capital requirements and market consolidation Moderator: Hatim Maskawala, Managing Director, Badri Management Consultancy, UAE Raed Haddadin, Chief Legal & Compliance Officer, ADNIC, UAE Dr. Saif Al Jaibeji, Regional General Manager, Middle East & Africa, Optum, UAE Gautam Datta, Chief Executive Officer, Al Madina Insurance Company, Oman Prem Sagar, Chief Executive Officer, ACR ReTakaful MEA, Bahrain KEY STAKEHOLDER CONGRESS 09:55 Driving Customer Centricity: Developing a customer centric ethos to increase competitiveness, market share and penetration in retail lines Moderator: Dr. Saif Al Jaibeji, Regional General Manager, Middle East & Africa, Optum, UAE Tamer Saher, Director – Business Development, RGA Reinsurance Company Middle East Limited, UAE Ramzi Ghurani, General Manager, Petra Insurance Brokers, UAE Hatim Maskawala, Managing Director, Badri Management Consultancy, UAE 10:40 Morning refreshments and networking break 11:10 Product Innovation: Developing and underwriting innovative products specifically designed for the region to maintain competitiveness, attract new customers and build loyalty Jabran Noor, Executive Director - Actuarial & Risk Management, Tajweez Advisory Co., Bahrain 11:55 Global Risks: Understanding how to identify, manage, mitigate & transfer risk in a changing risk landscape in Middle East & North Africa Neil B Irwin, Managing Director, Marsh, UAE 12:40 Lunch and networking break 13:40 Claims: Understanding the key policy requirements and avoiding the pitfalls in the claim making process to maximize the settlement potential Ian Peters, Risk Consulting & Claims Practice Leader, MENA Region, Marsh, UAE RETAIL LINES 14:25 Building Partnerships: Tools for developing mutually beneficial relationships with key affinity partners Dr. Dennis Sebastian, Regional Health Director, RGA Reinsurance Company Middle East Limited, UAE 15h10 Afternoon refreshments and networking COMMERCIAL LINES 15:40 The Human Factor: Building competency and effectively managing your internal talent pool to deliver customer satisfaction and growth Richard Schofield, Executive Director, TON Training & Business Consultancy, UAE 16:25 Chairman’s closing remarks and end of Insurance Leaders Forum 2014 Michael Faulkner, Editor, Insurance Day, UK Post-Conference Seminar: Thursday, 14 May 2015 Practical tools for building competencies in insurance underwriting and sales to increase market penetration and growth Due to the lack of regulations on required qualifications for insurance staff, there is a dearth of high-calibre underwriters and sales people with adequate training in the MENA region. This shortage inevitably leads to the sale of unsuitable products, which has a significant long-term impact on both the reputation and revenue streams for the industry. To ensure an adequately skilled sales staff and safeguard long-term customer loyalty, insurers must deliver structured development programmes for their own staff and partners in order to empower employees and reward professional development. This half day workshop designed specifically for insurers will provide proven strategies and programmes for developing exceptional underwriting staff including: Setting expectations: Accurately communicating culture, reporting lines, relationship with insurers and allocation of responsibility. Communicating Checks: Developing an understanding of compliance frameworks, checks, priorities and claims handling. Developing sales skills: Training on technical topics, product specific knowledge, segmentation, sales management and sales techniques. Developing underwriting skills: Technical training on underwriting fundamentals, policy coverage of various product lines and how they differ, techniques for developing individual underwriting knowledge and skills as well as integrated risk management. Richard Schofield, Executive Director, TON Training & Business Consultancy, UAE Vikas Shukla, Executive Director, TON Training & Business Consultancy, UAE Workshop runs 9am – 2pm, with breaks for refreshments and lunch

© Copyright 2026