FACS FileS inSurAnCe GroSS ProFit vS. ACCountinG GroSS ProFit The Policy

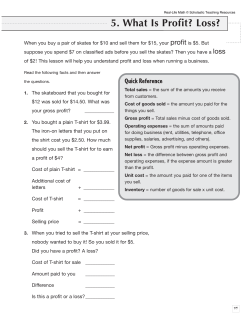

FACS files Insurance Gross Profit vs. Accounting Gross Profit The Policy Accounting Gross Profit By way of introduction, we begin with the typical language from a Business Interruption policy: “Gross Profit - Accounting gross profit is calculated as ‘turnover’ less ‘cost of sales’, where turnover represents sales revenue and cost of sales includes costs such as materials purchased. However, cost of sales can also include factory costs, or direct costs, which include production labour and utilities, as explained further below. This results in Accounting Gross Profit. A gross profit rate is expressed as a percentage, and represents gross profit as a percentage of turnover. •• (i) the sum of the amount of the turnover and the amounts of the closing stock and work in progress shall exceed •• (ii) the sum of the amounts of the opening stock and work in progress (WIP) and the amount of the Uninsured Working Expenses” In the event of a loss, a claim under the business interruption policy would be limited to: •• “The loss of gross profit due to (a) reduction in turnover and (b) increase in cost of working and the amount payable as an indemnity shall be :•• (a) in respect of reduction in turnover : the sum produced by applying the rate of gross profit to the amount by which the turnover during the indemnity period shall fall short of the standard turnover in consequence of the Incident •• (b) in respect of Increase in cost of working; the additional expenditure necessarily and reasonably incurred for the sole purpose of avoiding or diminishing the reduction in turnover which but for that expenditure would have taken place during the indemnity period in consequence of the incident but not exceeding the sum produced by applying the rate of gross profit to the amount of the reduction thereby avoided.” We therefore need to understand how Insurance Gross Profit is calculated, what the Gross Profit Rate is and what the Uninsured Working Expenses should be. The starting point is often the Gross Profit from the profit and loss account of the company or the Accounting Gross Profit. Direct or indirect costs Direct costs include those costs which directly relate to the cost of production of goods for sale, and therefore represent a cost of sale. These are distinct from indirect costs, which cannot be directly related back to the production of goods for sale. Indirect costs, or overheads, include expenses such as administration, nonproduction payroll, rent and insurance also referred to as ‘standing charges’ or ‘continuing costs’. Variable or fixed costs Costs are generally considered to be variable or fixed in nature. Variable costs are considered variable if they vary in direct proportion to sales volume. But some costs can be stepped (varying with steps in capacity, such as additional equipment/ site expansion) or semi-variable (incorporating a fixed and variable element, such as electricity). The mix Direct costs are mix of variable and fixed costs, whereas indirect costs are mainly fixed in nature. Deducting all costs (both direct and indirect, or variable and fixed) from all revenue gives a company’s net profit. Insurance Gross Profit Comparison/Differences Gross Profit Accounting gross profit is therefore not equal to insurance gross profit and the cost of sales figure according to normal accounting principles is not equal to uninsured working expenses. The purpose of business interruption insurance is to pay for the loss of cash flow resulting from an interruption (caused by an insured peril under the property damage policy) which would ordinarily: The above simplified practical example shows the differences between the two approaches and how, using the wrong methodology, it can have a significant impact on the quantum of a gross profit calculation. •• Turnover/Sales are the same under both methods •• Costs of sales in accounting gross profit can include direct costs – that include both fixed and variable expenses •• Net profit is the same under both methods •• Have been generated by the gross profit, i.e. turnover (sales/ revenue) less variable costs (top down approach), or in other words; •• Be used by the business to cover the net profit and fixed costs (bottom up/additions approach). Essentially a business must ensure that it receives cash to compensate for the net profit it can no longer earn, plus cover the costs that will continue to be incurred during the interruption. •• Costs of sales from an accounting perspective does not equal uninsured working expenses (variable/ non-continuing costs) resulting in a different gross profit and rates of gross profit In the event of a business interruption loss claim, the gross profit rate should be 65% (650 gross profit / 1000 sales). Inappropriately identifying fixed costs as uninsured working expenses can result in a gross profit declaration that is too low (350) and consequently a rate of gross profit that is not sufficient (35%). Both the bottom up and top down approaches effectively produce the same end result. (sees FACS file Issue 1). Insurance Gross Profit relies on the calculation of gross profit as defined in the policy wording. This can lead to a number of problems: Uninsured Working Expenses •• Under insurance or average being applied to the claim depending upon the policy wording. In the above scenario – a £65m claim could well be reduced to £35m; The policy specifies the deduction of uninsured working expenses which are those costs that are 100% variable in nature (i.e. variable costs, as identified above, that vary in direct proportion to turnover). These are costs that the business will no longer incur if the business is unable to make the sale. This is therefore fundamentally different to accounting gross profit. There should be no deduction of fixed costs, such as production labour or fixed factory overheads. •• Inaccurate declared values; •• A reduced calculation of the economic limit (the allowable level of increased costs) as the gross profit being ‘protected’ is lower and therefore any allowed increased costs will also be lower, further reducing the claim. Another common mistake in establishing insurance gross profit is to only consider complete loss scenarios. So even if it has been identified that fixed costs are included in cost of sales, some of the fixed costs are still deducted in the calculation of gross profit because it is assumed those costs will not continue if a complete site is lost. We must ensure that the business is covered in the event of a partial loss situation as well. A partial loss will result in the majority of costs continuing, and only the truly variable costs being saved. Conclusions It is important for all parties involved in both the placement of business interruption insurance and the calculation of claims to be aware of the differences between accounting gross profit and insurance gross profit. From a placement perspective, not only will it ensure that the policyholder is adequately insured, but the policyholder will also have a better understanding of what they are insured for. All businesses are different and as such there is no ‘one size fits all’ approach for calculating insurance gross profit. Only a detailed review of a business can ensure that the gross profit calculation is appropriate. This forms part of the Business Interruption Insurance Review Service offered by the Forensic Accounting & Claims Services (FACS) team. The policy should specifically name those variable costs which an insured has elected not to insure i.e. the specified or uninsured working expenses. It is recommended that a thorough review of the business and policy wording be undertaken to ensure the detail is fully understood, and the correct uninsured working expenses are identified. Given that the quantum of any loss depends on the calculation of the rate of gross profit, the identification of uninsured working expenses becomes critical. However, an understanding of the calculation of insurance gross profit is not only important in the event of a loss. There must also be a detailed understanding of the business and the nature of its costs if the correct gross profit sum insured is to be established. 2 • FACS files Marsh • 3 Contact us Neil Greaves Leader of FACS, UK +44 (0)207 357 3887 [email protected] The information contained herein is based on sources we believe reliable and should be understood to be general risk management and insurance information only. The information is not intended to be taken as advice with respect to any individual situation and cannot be relied upon as such. In the United Kingdom, Marsh Ltd. is authorised and regulated by the Financial Services Authority for insurance mediation activities only. © Copyright 2012 Marsh Ltd All rights reserved GRAPHICS NO. 11-0172

© Copyright 2026