Challenges, Capital and Building Independents in Africa

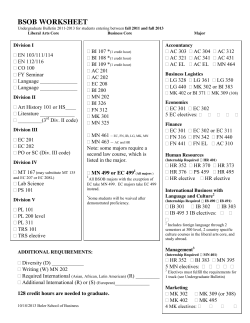

Challenges, Capital and Building Independents in Africa www.raglancapital.ie The Role of Independents in African E&P - Actually what is the role of Independents? There will always be a role for Independents in the upstream Oil & Gas industry Independents are Nimble and Entrepreneurial – act like R&D departments for Big Oil as with other sectors such as Technology and Pharmaceuticals whereby larger players will make an acquisition once an asset is technically and commercially derisked Independents have a much higher risk tolerance than the Industry Majors – prepared to invest time and resources in areas that are underexplored and carry high geological risk Majority of large frontier discoveries in Africa in last decade were made by Independents Majors cannot and should not be entrepreneurial or risk takers – business model is process driven i.e. buy assets or farm in to acreage that has been technically de-risked by Independents - Entrepreneurs would rip major organisations apart www.raglancapital.ie 2 Successful Independent E&P companies in Africa in the past decade Major discoveries in Sub-Saharan Africa over the last ten years Gas discoveries Oil discoveries www.raglancapital.ie “A rising tide lifts all boats” – a decade of ‘Eazy’ living for the industry Major events and real world oil prices (inflation adjusted for USA CPI) www.raglancapital.ie 4 During the ‘Eazy’ Decade the Oil & Gas Majors had access to almost unlimited funds - and this in turn trickled down to Independents For this Decade the Majors have been paying 3% - 5% dividend annually • Big draw for worldwide institutional investors – must have for most pension funds • For example the BP dividend comprises 10% of all dividends paid on the London stock market Majors paid for dividends by increasing borrowings tied to increasing oil prices Increasing oil prices also generated substantial free cash flow for the Majors which was used to fund expensive CAPEX programmes Lower oil prices make borrowing difficult so dividends now being funded by asset sales and from free cash flow, resulting in significant CAPEX reductions Existing independents now vulnerable: • Independents traditionally farmed out assets or were taken over by majors • For the next 5 years this model will be increasingly difficult due to a lack of majors’ currency for such transactions • Excess funding has dried up and this ‘trickle down’ from majors has ceased www.raglancapital.ie 5 Challenges being faced by Independents in Africa Decline in exploration success Development difficulties Lack of infrastructure Political risks increasing Shale oil “revolution” in North America − Hoovering up capital away from African developments Africa now out of favour www.raglancapital.ie 6 High oil prices attracted significant capital to Africa E&P leading to sharp decline in Exploration success rate • World class discoveries in Ghana, Angola, Mozambique, Kenya attracted significant capital to Independents operating in the region Early exploration success has not been sustained and from 2009 to 2013 the commercial discovery success rate fell from 24% to 5% Commercial Discoveries Success Rate SubSaharan Africa 100 25% 90 80 20% 70 60 15% 50 40 10% 30 20 5% 10 0 0% 2008 www.raglancapital.ie 2009 2010 2011 2012 2013 2014 7 Commercial Discoveries (%) • High oil prices during the ‘Eazy’ Decade has been catalyst for expensive deepwater drilling campaigns in sub-Saharan Africa in the last decade Number of Exploration Wells • Sub-Saharan Africa development difficulties Volumes produced from same discoveries Volumes discovered, 2004-2014 18,000 Rest of Sub Sahara Africa 16000 Ghana 14,000 Ghana Tanzania 14000 Angola Mozambique 10,000 8,000 12000 Production, mmboe Volumes discovered (mmboe) Nigeria 12,000 Rest of Sub Sahara Africa Tanzania Nigeria Angola 10000 8000 6,000 6000 4,000 4000 2,000 2000 Production, mmboe 16,000 18000 250 200 150 100 50 2010 2011 2012 2013 2014 0 - 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 www.raglancapital.ie 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 8 North American Shale Revolution hoovering up capital from Africa Shale Oil “Revolution” North America • Driven by advances in technology and higher oil prices • US Oil Production in 2015 forecast to reach 10 million bopd (77% increase since 2011) • Capital is becoming scarce for African exploration as available resources are reallocated to onshore America Onshore American Shale African Exploration U.S. Crude Oil Production million barrels per day (MMbbl/d) No Exploration Risk Exploration Risk 12 10.001 10 No Logistics Risk Logistics Risk 8 6 No Political Risk Political Instability Abundance of Quality Infrastructure already in place Lack of Quality Infrastructure 5.65 4 2 0 2011 2012 2013 Production www.raglancapital.ie 2014 2015 Forecast 9 OIl Production (Barrels per Day) Well 5 Well 4 Well 3 Well 2 500 Well 1 Long tail of US Shale Oil could be a paradigm shift Typical Decline Curve for Shale Wells 400 300 Potential paradigm shift 200 100 Long tails coming from shale oil?? Are these wells recharging?? 0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Years • High rate of initial production allows investors to recoup the cost of well drilling in initial 1-2 years of production • This is followed by a potential 20 year long tail of production supported by enhanced recovery offering investors an attractive annuity • Could US shale wells be re-charging in the long tail of production? We only have 8 years’ performance history for new high tech shale wells but observers are amazed at how tail productivity is so far exceeding all expectations Current generation of thousands of shale wells in North America have potential to deliver long tail production and income streams above expectations in next 10 – 20 years www.raglancapital.ie 10 Opportunities for Independents in Africa There will always be opportunities for entrepreneurial and nimble Independents who can adjust to the new industry landscape If funding can be secured it is a great time to buy assets as the Asians and Majors are no longer chasing assets Opportunities for Independents in Africa: - Production orientated and / or low cost onshore projects New private equity backed Independents with capacity to buy onshore and offshore production attractive prices (e.g. Nigeria) Opportunities for Independents outside Africa: - P/E backed acquisitions of North Sea production assets being sold by Majors South American production assets (e.g. Columbia) RTO- Reverse Takeover Transactions - - Huge opportunities in today’s market for those successful management teams in the 1990’s who developed E&P’s in a tough environment to now reverse their Newco vehicles into many sleeping and underperforming Independents in the $500m - $3bn market cap range e.g. T5 Oil & Gas Limited - led by 5 former Tullow Oil directors now actively looking at RTO’s www.raglancapital.ie 11 Future for Independents in Africa – Tied to Oil Price Fundraising capabilities of Independents in the coming years will be tied to direction of oil price Difficult to predict oil price movements in next couple of years but one should keep in mind the oil price collapsed by 60% in 1986 after Saudi Arabia held production and chased prices down • Could history be repeating itself? In 2014 Saudi’s are holding production and competing on price in response to declining demand – we believe Saudi agenda is to influence Iran USA has become second global swing producer to rival Saudi with daily output on target to surpass 10m bopd – we believe USA agenda is to influence Russia USA economy benefits from lower oil prices and Saudi’s can withstand lower prices due to massive reserve account We believe that until political tensions in Russia and Iran are resolved it will be difficult for oil prices to recover There will always be exciting opportunities for Independent Oil and Gas companies who remain nimble and entrepreneurial www.raglancapital.ie 12

© Copyright 2026