CONSTRUCTIVE THINKING 25 lucrative property trends

CONSTRUCTIVE THINKING 25 lucrative property trends Issue 02 April 2015 Demographic trends that investors can get behind You could call this a “cheat sheet” for what you should be doing with your money. A full blown list of the New Zealand property trends that are poised to make people billions. To us, this is a compilation of what we talk about around RCG. It’s both inspiration and robust statistics two things that play a big part in what we do best. You can’t create a commercially successful environment without a bit of both. Whittled down from 45 down to 25, this list spotlights the most lucrative trends that property people can get behind. Most of all, this list shows where things are going. “Research, with its interplay of data, theory and prediction, is the most powerful resource.” 1 2 3 Constructive thinking Issue 02, 2015 Locality and convenience key Locality and convenience will be major influences as time becomes increasingly valuable to us. This will cut across all property sectors, particularly in retail, residential and office. We will look for locations that are within easy reach of end users – close to road links and public transport. In Auckland, sites close to train stations will be particularly lucrative. Carparks will continue to be critical. International investment growing Growth in international investment will push property prices up. New Zealand’s property returns are high and less risky by overseas standards. This will support property prices in areas that are internationally attractive. In 2014 the Singapore Government invested $1.2 billion into the Westfield shopping centres and Wynyard Quarter developments. Expect to see more of this happening and property prices increasing as a result. Education better using land resources Schools and tertiary providers will innovate to get more out of their land resource. With booming land prices and flat education budgets, a sound property strategy and master plan are crucial for future academic success. Good retail stores can make a commercial contribution and improve vitality on campus. The University of Auckland and Unitec are facing different pressures and making bold development moves. 4 5 6 Specialty precincts gain traction Specialty precincts will increase their pulling power. The value of branded precincts is becoming recognised across entertainment and specialty retail sectors as convenience and accessibility further determine consumers choices. Clustering of like retailers and businesses is a long standing practice that has been used by banks, healthcare and discount retailers since the 1990’s. The success of this trend hinges on a developers’ ability to create the right mix and identity, one that taps into a lifestyle. Auckland’s “Third Ring” to develop Auckland’s ‘Third Ring’ will be a hot zone for new mixed use development. Brownfield sites filled with industrial services (warehousing, manufacturing and distribution centres) form a ‘Third Ring’ around Auckland’s central suburbs. Many areas in this zone, like Onehunga, and New Lynn, are ready to be developed. Where brownfield sites have become surrounded by medium density housing and offices, and where industry is quiet and low emission, these are lucrative spots for new mixed use. New flexible master planning approach The value of a flexible master plan will increase. As property and land prices continue to grow, so will the need for master planners. Most importantly, we will see a trend for planners to create both short and long term strategies for land development. i.e. a 10 year plan that makes good use of strong local demographics along the way and provides a holding income for later, more intensive development. Constructive thinking Issue 02, 2015 7 City schools to intensify Inner city schools will intensify, and brownfield sites will be redeveloped. Schools in growth areas are figuring out how to accommodate increasing student numbers. Looking at Auckland city, the pressure is most intense in Devonport, Waitemata, Albert-Eden and Orakei. These areas will benefit from a sound master plan and development strategy. Top Auckland “Inner City” growth areas Top Auckland “Inner City” growth areas for schools 25,000 Albert-Eden Devonport-Takapuna 15,000 Orakei Student Roll students 20,000 Waitemata 10,000 5,000 0 1996 1999 2002 Devonport-Takapuna Constructive thinking Issue 02, 2015 2005 Year year Waitemata 2008 2011 Albert-Eden 2014 Orakei “In these areas it’s not as simple as buying land for a school in a new subdivision. Existing schools will need to intensify, or the Ministry of Education needs to look out for brownfield redevelopment sites.” John Long, director Read about our work with St Mary’s. We’ve created a compact master plan and prioritised new builds to match the schools roll expansion and mission. 8 9 10 Hotel investment growing Investment in hotels will grow again. New Zealand hotels are running at near-full capacity. Auckland, Queenstown, Rotorua and Wellington are all experiencing strong growth in occupancy, some at record levels. In Hamilton and Auckland Tainui is already making strong moves in this market. There’s a significant gap in New Zealand for resort and up market hotels. Serviced apartments are also likely to expand aggressively. Interest rates lower for longer Interest rates will remain lower for longer. Interest rates are low around the world, as is inflation and it is increasingly clear that this is the new normal. In New Zealand lenders are offering long-term finance at low rates, most interestingly TSB has come out offering 10 year mortgages at 5.9%. Similarly, office owner Precinct Properties has locked in funding from US institutions for 4.2%. Retailers meet global standards New Zealand retailers will meet global standards. New Zealand consumers are increasingly aware of experiences and products available around the world. This is shaped by the gradual push of overseas retailers into Australasia, and increased access to overseas retailers online. Retailers here will lift their brand experience on par to their global counterparts, but with a local twist. Constructive thinking Issue 02, 2015 11 Residential to adjoin shopping centres Hotels and apartments will adjoin shopping centres. It’s an idea that has been considered before but is gaining traction as demand for higher density accommodation increases. By adding residential, shopping centres can get more value out of their land, and add to their catchment. “This will turn shopping centres into real town centres and add round-the-clock activity” This will turn shopping centres into real town centres and add round-the-clock activity to places which become passive after 6 o’clock. Bear in mind, this opportunity will be very centre-specific. We’ve heard Milford, Pakaranga and The Warehouse Group are considering this tactic. Constructive thinking Issue 02, 2015 “Milford Mall could have around 200 apartments and generate $30 million in profit for its owner. We could see hundreds of millions of dollars’ worth of residential development above shopping centres in the next 10-20 years.” Des Wai, director Read about our work with Pukeroa Oruwhata. Rotorua Central was once an abandoned railway yard. Now it’s a powerful, regional shopping destination. 12 13 14 Constructive thinking Issue 02, 2015 Civic, the growing anchor Anchor institutions will activate the prosperity of lacklustre centres. Government and developers alike will invest in community revitalisation. Civic institutions, like schools and medical centres, generate high levels of activity and build more connected communities. “Eds, meds and feds” as they say in the USA. They participate in local and national markets, employ hundreds of workers, and purchase from other businesses. Auckland to outperform in tourism Auckland will continue to outperform in tourism. Auckland has long been the pace setter in many categories, but tourism is a new one. Helped along by public investment in international awareness of the city, and places like Wynyard Quarter and Queen St. In the last five years “guest nights” stayed by visitors to Auckland have risen 28% from 5.4 million to 7.0 million. Apartment and terrace housing boom Apartment and terrace housing developments will be increasingly popular. Even though the trade-off is having less space, when there’s high demand for land these homes become incredibly popular for their location and price. The demographics support it – baby boomers are looking to downsize, and young adults are having fewer children. Now is the time to build. 15 16 Constructive thinking Issue 02, 2015 17 Shared and serviced offices taking off More businesses will move into shared or serviced offices. 1.3 billion people are working mobilely around the world, and that number is expected to double by 2018. But human contact is as crucial as ever to good business. Shared spaces offer a flexible working capability but also create opportunities to connect and network. Serviced offices provide companies with everything they might need, including IT maintenance and mail collection, to allow them to focus on growth. What they need to work on now is sociability. Retail emerging along transport hubs Retail opportunities will emerge wherever there are plenty of people. “Travel retail” is a common term overseas – retailing in airports or transport hubs – and New Zealand is just starting to catch up. Our airports are on top of the trend, but look for more retail interest in train and bus stations, motorway service centres and so on. This is also a growing opportunity for hospitals, universities and other sectors. Mixed use guides will be defined Mixed use developments will only succeed if controls are put in place. This begins with the creation of a demographically sound mix and the design of a brand identity that attracts it. Then the body corporate rules need to be written to match, striking a balance between the needs of residents and retail tenants, and controlling things like noise, parking, maintenance and signage. 18 Our food culture is growing in sophistication New Zealand’s food culture is booming and growing in sophistication. Its effect is felt most in the hospitality sector, where leading operators are responding to the market and transforming their offer to be fresh, fast, tasty, stylish and innovative. Channels and formats are being re-imagined and taking off as a result. Think farmers markets, specialty grocers, food trucks and the lucrative My Food Bag. Our research suggests the market is far from oversaturated, but as competition continues to ramp-up, the weaker operators will be pushed further out of the city to the fringe. Read about our work with Farro. This beloved and commercially successful grocer has won a global retail award. Constructive thinking Issue 02, 2015 19 20 21 Development process more efficient Government and councils are making development easier. National has signed Housing Accords with several councils as a stop-gap measure, giving a streamlined consenting process in some areas. Once refined, this process should be applied elsewhere. There are still hurdles when developing all types of property in New Zealand, but now there is active recognition that it needs to be made more efficient to meet demand. Joint ventures and partnerships evolving The traditional boundaries of joint ventures and partnerships are evolving. Joint ventures let business partners share the risks and rewards of a new enterprise. A smart partnership means both skills and resources are pooled. Great examples are The Mind Lab by Unitec, and Barworks by DB Breweries and JAG Hospitality. Expect to see some unexpected and lucrative relationships forming across sectors and scales. Design will reshape the quarter acre dream Good design will give multi-unit developments the right appeal. The dream of owning a family home on a quarter acre property is hard-wired into the Kiwi psyche. Developments that have a mix of activity and human centred design will rewire the market. Designers must break a few traditions and create higher density living that has the right amount of light, space, village like communities, green edges and pocket parks. Constructive thinking Issue 02, 2015 22 ‘Grey dollar’ is most influential The ‘grey dollar’ will determine the shape of all sectors. The baby boomers are now empty nesters. Most are seeking leisure time, new experiences, or retirement - but on their own terms - and they’re creating a strong market demand along the way. Baby boomers control a big share of national income and wealth. Their effect will be most influential to travel, leisure, healthcare, retirement, hospitality, fashion, and residential facilities. “Baby boomers make up around 25% of New Zealand’s population, but have a much larger influence on the economy.” They earn a total of $40 billion - 35% of the country’s income and they control close to 45% of national wealth. Constructive thinking Issue 02, 2015 “71% of baby boomers own their home, compared to 41% of other New Zealanders. On top of this, they’re major property investors and landlords.” John Lenihan, director Click here to experience an interactive map of Auckland. And find out where our Baby Boomer generation are living. Constructive thinking Issue 02, 2015 23 24 25 Constructive thinking Issue 02, 2015 Surrounding amenities gain importance Proximity and amenity are the key to attracting staff, residents, shoppers, or the stakeholders that make places hum. Prime CBD locations will continue to do well in the next decade. Office parks and edge-of-town subdivisions will need to have their own selling points. It’ll take more than just a great internal environment; externally users expect a strong level of nature and parks (peace and quiet), nearby hospitality and service shops, and transport access. A smarter way to retail Shopping centres will lead the way to a smarter retail experience. New Zealand shopping centres will use mobile devices as a means to analyse physical shopping habits. Expect smarter shopping and parking, with features such as guided navigation and personalised recommendations. This tracking data will then be used to optimise and experiment with store layouts and retail experience. Growing international visitor numbers Tourism operators need to invest more in their facilities and have an eye to their next one. International visitor numbers to New Zealand grown 5% to 2.86 million in 2014, and are expected to reach 3 million this year. But tourists are increasingly time poor and they want new, unique experiences during their brief stays in the country. Tourism operators can capture more spending by redefining their offer, clustering activities together and making more intensive use of their sites. “International visitor numbers grew 5% in 2014 and are expected to reach 3 million this year. Capture more spending by redefining your offer, clustering activities together and making more intensive use of your sites.” John Polkinghorne, associate director The Bottom Line? It’s all about peoples experience This publication contains some bold and diverse predictions, but if we really think about it, every single one of them boils down to one thing: understanding your market and improving their experience. Keep this in mind whenever you’re pondering which direction to take your property. Always ask yourself if your efforts are truly making life convenient, safer, and more enjoyable for your end user. Stick with that strategy, and you’ll be just fine in the future. And if you’re looking for insights about these trends, give us a call, read our in depth articles on the RCG blog, or check us out on Twitter and LinkedIn. We’re property, architecture, design and research experts and we create commercially successful environments. rcg.co.nz Subscribe to CONSTRUCTIVE THINKING

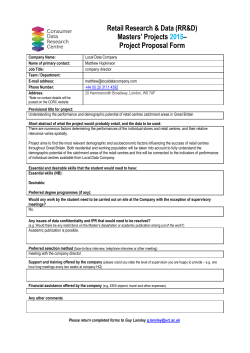

© Copyright 2026