REI May Newsletter 5.18.15

MONTHLY NEWS

MAY 2015 Client Newsletter

Employee Dress Codes + Heat!

What’s in This Issue:

HR

✦

Workplace Wellness

✦

I-9 Noncompliance Fines

✦

Pop Quiz: Managing Leave

✦

Minimum Wage Increases

Balancing the image of the company with the individual rights of employees gets difficult as

the weather heats up. Employers are increasingly confronted with dress code issues, such as

attire that covers tattoos, and claims by employees for harassment and discrimination arise

within various businesses. Employers have to balance the need to have a regulated employee

appearance with the individual rights of each employee which are protected under the law.

Here are a few best practices regarding workplace dress code polices:!

•

Dress code policies should be clear, well-written, and up

to date.!

•

A dress code policy should be job or safety related

(meaning it impacts the business) and not simply based

on the employer's preferences.!

•

Dress codes should be explained to managers and

employees.!

•

The consequences for violation of the dress code should

be explained to managers and employees.!

•

Managers should be trained to consistently and evenly

apply the dress code policies to both men and women,

and amongst other members of protected classes.!

•

Managers should understand that accommodations or

exemptions from the dress code policy may be legally

required and that they should to seek guidance from

Human Resources or legal counsel when making or considering an accommodation.!

Benefits

✦

Urgent Care vs. ER

✦

May Wellness Tip

✦

Cal Perks with CalChoice

✦

401k Webinar

✦

ACA Forms 1094 & 1095

✦

Certificates of Coverage

✦

UHC Members

Compliance

✦

Federal Updates

✦

State-by-State Compliance

✦

Massachusetts,

Washington, Tennessee,

Utah, Pennsylvania

Risk Management

✦

Occupational Heat

Exposure

✦

Online Safety

✦

State of Workers’ Comp

Events & More

✦

Upcoming Webinars

Resourcing Edge Newsletter

Currently, the United States Supreme Court is considering a case which will further define

what is required by an employer with regard to making a reasonable accommodation for its

dress code policy. In EEOC vs. Abercrombie & Fitch

Stores, Inc., Samantha Elauf claimed that she was not

hired at Abercrombie & Fitch, because she wore a

hijab (a Muslim headscarf) at her interview. Abercrombie & Fitch has strict requirements for the

appearance of its employees, including the

prohibition of headscarves. In finding for

Abercrombie & Fitch, the Tenth Circuit found that

Elauf did not tell the Company that she wore her

headscarf for religious purposes, and she did not

request any accommodation for it. Therefore,

Abercrombie & Fitch had no duty to provide her

with an accommodation. The Supreme Court is

reviewing that decision, and a central question

before it is what burdens employers and employees

have with regard to reasonable accommodations to a

company's dress code policy.

1

HUMAN RESOURCES

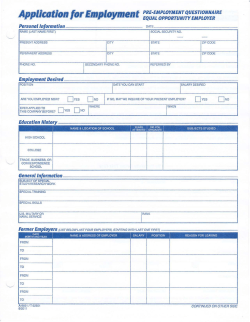

Severe Fines for I-9 Noncompliance

During the first quarter of 2015, The Office of Chief Administrative Hearing Officer (OCAHO) issued five decisions involving

employer violations related to Form I-9. In its latest decision (United States v. Liberty Packaging, Inc., 2/24/15), OCAHO found that the

employer committed “systematic and deliberate falsification” in Section 2 of Form I-9, after a U.S. Immigration and Customs

Enforcement (ICE) audit revealed that the company’s HR Manager backdated numerous forms between two and 20 years from the

actual date of hire. OCAHO stated in its decision that the company “cannot be said to indicate good faith” in handling its I-9

program and subsequent ICE inspection. ICE proposed a penalty of $19,354, which OCAHO lowered to $11,700 due to the company’s

resources (or lack thereof).!

!

Knowing Hire and

Continuing to

Employ Violations

0% – 9%

First Tier

$375 - $3,200

Second Tier

$3,200 - $6,500

Third Tier

$4,300 - $16,000

$375

$3,200

$4,300

10% – 19%

$845

$3,750

$6,250

20% – 29%

$1,315

$4,300

$8,200

30% – 39%

$1,785

$4,850

$10,150

40% – 49%

$2,255

$5,400

$12,100

50% or more

$2,725

$5,950

$14,050

Substantive

Verification

Violations

0% – 9%

1st Offense

$110 – $1100

2nd Offense

$110 – $1100

3rd Offense +

$110 – $1100

$110

$550

$1,100

You have an employee that twists her ankle on the

job:

10% – 19%

$275

$650

$1,100

20% – 29%

$440

$750

$1,100

Your employee has worked for you for two years

as a server. She has worked a total of 1,485 hours

in the last year.You have 35 employees at one

location and 25 miles away you have 40 employees

at another location. She is pregnant and is planning

to take time off to bond with her baby. She just

slipped in the kitchen and twisted her ankle. She

needs to be off of her feet for 6 weeks for her

ankle to heal.

30% – 39%

$605

$850

$1,100

40% – 49%

$770

$950

$1,100

50% or more

$935

$1,100

$1,100

The penalties for I-9 noncompliance can be

severe and jeopardize a company’s viability. It is

important to retain adequate counsel to

conduct regular I-9 audits, to mitigate or

eliminate any liability to the employer. Here is

the fine schedule released by ICE:!

Managing leaves can be complex, especially when

multiple leave laws may apply to a situation.

!

!

!

!

!

!

How do you handle this time off?

A) Family Medical Leave Act – She has a serious

medical condition that prevents her from working.

B) State Pregnancy Disability Leave – She’s

pregnant and disabled so this leave must apply.

C) Workers’ Compensation Leave – She was hurt

on the job, so it has to be designated as workers’

comp.

!

D) Americans with Disabilities Act – Since she is

disabled, she would have protections under this

law.

!

Resourcing Edge Newsletter

Minimum Wage Increases

San Francisco - The San Francisco minimum wage increased to $12.25

on May 1st. !

!

Chicago - Effective July 1st, 2015 the minimum wage will increase to

$10.00 per hour. This is the first of a series of annual tiered minimum

wage increases that will extend through 2019. Any employer who (1)

maintains a business facility in Chicago or (2) is subject to Chicago

licensing requirements is subject to Chicago’s minimum wage

ordinance.!

!

2

BENEFITS

Urgent Care Center vs. Emergency Room

If the situation requires prompt medical attention but is not life threatening, you

will usually receive faster and more affordable care at an urgent care clinic.

These treatment centers are staffed with professionals equipped to handle

situations that a primary care doctor could, are often open extended hours

including evenings, weekends, and holidays, and are able to see walk-in

patients with minimal wait, saving you time and money.!

Common conditions treated at urgent care clinics include:!

!

!

!

!

!

!

!

!

!

•!

•!

•!

•!

•!

•!

•!

Respiratory infections colds, cough, sore throat, or flu!

Urinary tract infections!

Sprains, strains, or broken bones!

Moderate fevers!

Bruises, abrasions, and minor cuts or burns!

Eye, ear, or skin infections!

Vomiting, diarrhea, or stomach pain!

Reminder:

Special 401k

Webinar

Save the ER visit for a true medical emergency. Symptoms that generally indicate a

medical emergency include:!

!

!

!

!

!

!

!

!

!

•!

•!

•!

•!

•!

•!

•!

Uncontrollable bleeding or deep cuts!

Inability to breathe or severe shortness of breath!

Seizure or loss of consciousness!

Persistent chest or abdominal pain or pressure!

Numbness or paralysis in the face, arm, or leg!

Sudden slurred speech, visual changes (blurred vision), or weakness!

Major burns!

California Corner

CalChoice has rolled out a new feature called “Cal Perks.” If you are currently a

CalChoice member, you can log onto www.calchoice.com, click on the “Cal Perks”

button and see their current discounts on the following:!

· Movie Tickets (AMC & Regal Cinemas)!

· Tickets to pro football, soccer, basketball, hockey,

baseball teams!

· Theme Park tickets!

· Car Rentals!

· Costco & Sam’s Club memberships!

!

!

!

!

!

Resourcing Edge Newsletter

Watch for an invite for our July

webinar about 401k. Tax breaks for

employers is one of the topics we will

discuss. You don’t want to miss it!!

!

On July 23, 2015, at 2:00 CST our 401k

specialists, Transamerica, LPL

Financial and Lone Star TPA will

feature a webinar to offer insight on

how having a 401k can earn employers

tax credits! We will send out

reminders and invitations in the

coming months! !

3

BENEFITS

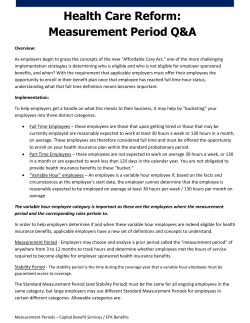

Affordable Care Act Update

We know that the 1094 and 1095 tax forms are on everyone’s mind right now. We will be

sending out a communication within the next few weeks on what REI’s role will be and

how we can assist you with this ACA requirement. In the meantime, if you have questions,

please do not hesitate to reach out to your HRC or the Benefits Department.!

Reminder About Certificates of Creditable Coverage for Groups

Blue Cross Blue Shield has released the following regarding Certificates of Credible

Coverage: As a reminder, the federal government has eliminated any requirement to

provide certificates of creditable coverage (CoCCs) after Dec. 31, 2014. However, Texas law

still requires carriers to provide CoCCs upon request. BCBS will provide these on a

request basis only and members can simply call the customer service number on their ID

card to request a certificate.!

!

UHC Members

If you are currently enrolled in a United Healthcare plan, you may want to listen to their

prerecorded presentation about new pharmacy benefits effective July 1st. To view the

video, go to www.uhc.com/pharmacy. Updates include tier changes for certain

prescriptions at your next renewal. !

MAY WELLNESS TIP:

Childhood Obesity & Employers

Employers are constantly challenged by competitive pressures to attract and retain employees and to control cost components

that exhibit high rates of growth. The challenge often requires meeting increasing work-life needs of employees with

dependent children. For example, between 1975 and 2008 the proportion of employed women with children under age 18

grew from 47% to 71%. Employers have responded with services and benefits including flexible work arrangements, lactation

programs and added benefits for children with special care needs to ensure higher levels of employee commitment and

satisfaction. !

!

To help control labor costs, employers should actively address health benefits,

which are now the largest component of overall benefit costs. Here are a few

things you can do to help:!

• Organize family oriented fitness events.!

• Consider starting a Family Fun Run or Family Bowl-a-Thon, and hold the

event after hours or on the weekend so that children can come with their

parents. Or sponsor a company team in a local family fun run or

challenge. !

• Offer discounts to local gyms for employees and their families.!

• Post calendars from your local YMCA to let your employees know about

upcoming family friendly events and activities.!

!

For more ideas and assistance in developing, please contact us for help!!

!

Resourcing Edge Newsletter

!

4

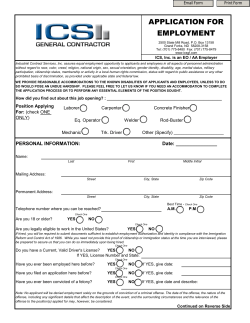

LEGAL COMPLIANCE

Federal and State Updates

EEOC - Inability To “Work With Others” Is A Major Life

Activity

The EEOC has defined the “ability to work with others” as a major life activity under

the American’s with Disabilities Act (ADA). Practically, this means that an employee

or applicant can claim that they are disabled under the ADA if they are unable to

work with others. It is unclear how broadly this definition will be interpreted.!

!

The plaintiff in the case at issue, suffered from a social anxiety disorder. As an

accommodation, she had requested to be transferred to a department with “less social

interaction.” The employer refused to accommodate her, claiming that she was not

disabled. The EEOC, and eventually the Fourth District Court of Appeal, disagreed with the employer and found that the inability to

“work with others” is a major life activity. Plaintiff’s social anxiety disorder effected her ability to work with others, thus qualifying

her as disabled.!

!

EEOC Issues Guidance on Company Wellness Programs

The EEOC published proposed rules on the application of the Americans with Disabilities Act (ADA) and wellness programs.

Highlights of the proposed rules include:!

!

•

•

•

•

!

!

If an employee voluntary agrees to an inquiry about their

health or a medical examination, it is permissible for an

employer to require such actions as part of their employee

health program.!

Employer health programs are permissible under the ADA, but

the employer may not use the health program to discriminate

against disabled employees!

Participation in a health or wellness program cannot be

required!

Employers may not discriminate, retaliate against or harass

employees who choose to not participate in a health or

wellness program!

We will publish the finalized version of the rules as soon as they are made public.!

Second Circuit - Expands Protections Under the FLSA

The Fair Labor Standards Act (FLSA) prohibits discrimination and retaliation against employees who have “filed any complaint”

under the FLSA. The Second Circuit Court of Appeal recently held that an oral complaint

is considered “filed” under the statute, thus protecting these employees from retaliation

and discrimination.!

!

WASHINGTON: Supreme Court Rules on Employee Privacy

The Washington Supreme Court held that an employee does not have a privacy interest in

the investigation records, provided that the nature of the allegations are not in the file. Accordingly, the Court found that the employer did not violate the employee’s privacy

rights when the employer disclosed the name of an employee involved in a workplace

investigation. The mere existence of an investigation is not a “private” matter.

Resourcing Edge Newsletter

5

LEGAL COMPLIANCE

Federal and State Updates Cont.

PHILADELPHIA: Issued Sick Leave Notice

The City of Philadelphia Managing Director's Office ("the Agency") recently issued its official notice

of employee rights under the Philadelphia sick leave ordinance. This will take effect on May 13,

2015, and require employers to provide employees with notice of their right to sick leave by either

distributing the notice to each employee or posting the notice in a conspicuous and accessible

location in the workplace. Employers are required to provide the notice in any language that is the

1st language spoken by at least 5% of the employer's work force. Additionally, the following

information must be included in any employee handbook that is distributed to employees:

employees' entitlement to sick time, amount of sick time, the terms of use guaranteed under the law,

right to file a complaint, and protection from retaliation. Employers who fail to comply with the sick leave law's notice requirements

shall be subject to a civil fine in an amount not to exceed $100 for each separate offense. We can help you update your handbook with

this change.!

!

UTAH: Bans Discrimination Against Nursing Mothers

As mentioned in last months newsletter, employers are prohibited from discriminating

against employees who choose to breastfeed at work. The new law, signed on March 23,

2015, takes effect on May 12, 2015.!

UTAH: Payment on Termination

Employers can satisfy the requirement to make final wage-payments to discharged employees within

24 hours by mailing wages in envelopes postmarked no later than one day after employees'

discharge, issuing direct deposits into employees' bank account or hand delivering wages to

employees.!

Maryland: Bill Protecting Interns From Employment Discrimination

As of October 1, 2015, employers are prohibited from discriminating against interns with

respect to their internships on the basis of race, color, religion, sex, age, national origin,

marital status, sexual orientation, gender identity or disability. Employers also will be

required to provide accommodations for interns with disabilities and prohibits retaliation

against them for pursuing their rights under the law. Interns will have access to the

employer’s internal procedures for investigating discrimination. If the employer does not

have a procedure, interns may file a compliant with the Maryland Commission of Civil

Rights for non-monetary administrative

remedies.!

!

Nebraska: Reasonable Accommodations for Pregnant

Workers

A new law signed on April 13, 2015, will take effect this September and provide

reasonable accommodations for Nebraska's’ ‘mothers to be.’ Employers are required to

accommodate pregnant individuals with a “known physical limitation,” limited only

by the employer’s ability to demonstrate that a requested accommodation would

“require great difficulty or expense.” In summary, for the first time in Nebraska,

covered employers will be required to provide assistance with manual labor, light-duty

assignments and temporary transfers to less strenuous or hazardous work. !

Resourcing Edge Newsletter

6

HUMAN RESOURCES

!

Montana: New Law Protects Employee Social

Media Accounts

Starting in April, Employers are unable to require or request that a

current or prospective employee: disclose a username or password to

his or her personal social media account, access a personal social media

account in the presence of the employer; or divulge any information

contained on personal social media. Employers may not take adverse

action against a current or prospective employee for refusing to engage

in such activity. Montana joins AK, CA, CO, IL, LA, MA, MI, NV, NH,

NJ, NJ, OK, OR, RI, TN, UT, VA, WA, and WI, which have passed

similar measures. If you have any questions or issues, we can help.!

!

Georgia’s Medical Marijuana Law - No Discrimination Protection

Medical marijuana is now legal in Georgia for low-potency forms of cannabis oil for medicinal uses, however, the law

contains no language protecting medical marijuana users from employment discrimination. The law provides

protections for employers from employees reporting to work or remaining on duty after consuming the drug.

Employers are still under obligation to reasonably accommodate an employee’s underlying medical condition and

should consult with counsel to determine how their particular circumstances are affected by the new law.!

!

New York City: New Law Limiting

the Use of Credit Checks in

Employment

It will now be unlawful discriminatory practice for

Employers or Employer Agents to request or use for

hiring or other employment purposes the “consumer

credit history” of an employee or applicant. There are a

few exceptions, but Employers should carefully review

the exceptions to the law to determine which positions

may still be subject to credit checks. For more details,

please email [email protected]. !

!

!

!

!

!

New York City: Human Rights ‘Tester’ Law Set

To Uncover Discrimination In Hiring

!

!

Resourcing Edge Newsletter

City anti-discrimination agents will be sending out ‘testers’ (2 applicants

who are different in age, race, gender, etc., to see if they can locate any

hiring Employers who are being discriminatory in an effort to enforce the

Human Rights Law. Employers must ensure job advertisements are nondiscriminatory and that individuals who review applications and conduct

interviews focus on job-related skills and abilities, not protected

characteristics. Job applicant screeners may follow a precautionary

approach of assuming every applicant is an official tester. !

7

RISK MANAGEMENT

Occupational Heat Exposure

Many people are exposed to heat on some jobs, outdoors or in hot indoor

environments. Operations involving high air temperatures, radiant heat

sources, high humidity, direct physical contact with hot objects, or strenuous

physical activities have a high potential for causing heat-related illness.

Outdoor operations conducted in hot weather and direct sun, such as farm

work, construction, oil and gas well operations, asbestos removal,

landscaping, emergency response operations and hazardous waste site

activities, also increase the risk of heat-related illness in exposed workers. !

!

Heat Index

Risk Level

Protective Measures

Less than

91°

Lower

(caution)

Basic heat safety and

planning

91° to 103°

Moderate

Implement precautions

and heighten awareness

103° to 115°

High

Additional precautions

to protect workers

Greater than

115°

Very High to

Extreme

Triggers even more

aggressive protective

measures

To assist your employees in knowing the various factors that put workers at a

greater risk (limited air movement, physical exertion, protective clothing,

humidity, etc.) it is important to know that the best way to measure conditions is through the Heat Index, which takes both

temperature and humidity into account. The chart above can assist with precautionary steps for various companies.!

!

New Trend in Online Safety!

Google recently made a huge change in its log-in procedure. In an effort to “work towards

introducing new authentication solutions that complement traditional passwords” they have

split the log-in page into 2 separate pages, with the intent to eliminate passwords entirely.

Most computer breaches involve password theft. Hackers steal them by invading corporate

systems. No matter how much companies invest in security, there is always vulnerability.

Facial recognition and “trusted location” information will be part of the wave of the future. !

!

State of Workers’ Compensation Industry

How did the workers’ comp market do in 2014? What challenges will the National Council

on Compensation Insurance (NCCI) be watching? What are the market indicators? The

NCCI recently released their ‘State of the Line Workers’ Compensation Market Analysis’ in

which the state of the industry is calm now, but turbulence ahead. Here are the highlights of the report:!

• 2014 underwriting results combined with investment gains on insurance transactions produced a workers compensation pretax

operating gain of 14%.!

• Overall reserve position for private carriers further improved in 2014. NCCI estimates the year-end 2014 reserve position to be a

$10 billion deficiency for private carriers—down from $11 billion in 2013.!

• Lost-time claim frequency maintained a path of decline in 2014—down 2%, on average, in NCCI states.!

• In NCCI states, the average indemnity cost per lost-time claim increased by 4% in 2014,

following increases of less than 2% each year from 2011–2013. Similarly, the average

medical cost per lost-time claim increased by 4% in 2014—following increases of 2–3%

This Page Brought To

in each of the prior three years.!

You By:

• Last year marked the 4th consecutive year of workers compensation residual market

premium growth. Premiums grew by approximately 7% in 2014, while the average

market share in the residual market held steady at 8%. NCCI’s latest data shows that

total residual market premium declined in the first quarter of 2015 compared to the first

quarter of 2014.!

• Despite the growth in premium volume, the residual market policy year combined

ratio held steady at 106 in 2014. The total underwriting loss in the residual market

pools serviced by NCCI grew to $74 million, up slightly from $64 million in 2013.!

The Leading Edge Group is REI’s

!

For more information on these statistics and future details, please contact

[email protected]. Resourcing Edge Newsletter

internal insurance broker partner.

Learn more via

www.theleadingedgegroup.com.!

8

EVENTS AND MORE

UPCOMING WEBINARS!

HR POP QUIZ ANSWER: A

Employers: Find Out What The NLRB Is

Looking For - Union and Non-Union

Because she has worked for 12 months and at least 1,250

hours in the past year and you employ over 50 employees

within a 75 mile radius, she would qualify for 12 weeks of

leave under the Family Medical Leave Act (FMLA). It is

important to inform employees of their rights and

responsibilities and to designate this time properly.

Employees are provided not only job protected leave under

FMLA, but continuation of benefits as well.!

May 28, 2015 @ 10:30 AM PT / 11:30 AM MT / 12:30 PM

CT / 1:30 PM ET!

Union and Non-Union Employers – This is your chance to hear

directly from an NLRB Supervising Attorney about the Board’s 2015

agenda. Learn about the new "quickie" election rules and the General

Counsel’s position on your

handbook policies. Don’t miss

this rare opportunity. !

!

Who should attend:!

In-house counsel, managers,

supervisors, and HR

professionals!

!

Speaker: Sean Marshall, Esq.,

Supervising Field Attorney,

National Labor Relations

Board, Region Five!

Webinars are pre-approved for 1 hour of

HRCI credit.!

Register at http://resourcingedge.com/humanresources/webinar-schedule.html !

Event ID: 1013 Event Passcode: 9870!

Navigating Social Media in the Workplace

June 18, 2015!

In this webinar Resourcing Edge will highlight challenges and risks

employers face with respect to social media including harassment,

confidential information and the application of the National Labor

Relations Act’s protections to employees. Attendees will understand

the different types of social media, know what they can prohibit

employees from doing during work hours and understand the

importance of having social media policies and how they impact

terminations.!

!

Register for all webinars and view previously recording webinars on

the HR page of our website or email [email protected] for

more information.

Resourcing Edge Newsletter

!

!

Pregnancy Disability Leave would not apply at this time

since her injury had nothing to do with pregnancy. In

addition, not all states provide leave for pregnancy.

Employers must check their state and local laws to see if

these laws exist. If so, she may qualify for this type of leave

if later she has pregnancy related disabilities. At that time,

you could run pregnancy disability leave concurrently with

any remaining time under FMLA that had not been used for

the work-related injury.!

!

There is no such thing as Workers’ Compensation Leave.

Workers’ Compensation Insurance provides replacement for

lost wages and medical benefits for injuries that occur on the

job, however there is no leave that is provided. Leave is

usually provided by FMLA, ADA or other state/local laws.!

!

Americans with Disabilities Act (ADA) could apply if the

employee did not qualify for FMLA and may apply later if

the employee exhausts all of her leave granted under FMLA

and becomes disabled due to pregnancy. Since she does

qualify for FMLA, there would be no need to apply ADA at

this time. There is no continuation of benefits under ADA,

so this leave should not be offered before FMLA.!

!

Contact Info

Main Office: 214-771-4411

General Inquiries [email protected]!

Payroll [email protected]!

Human Resources/Background & Drug

Screens - [email protected]!

Benefits Questions

[email protected]!

Workers' Comp and Certificates

[email protected] !

Accounting Issues

[email protected] !

Tax Questions [email protected]!

Colorado Office: 719-260-7570

9

© Copyright 2026