Chicago industrial - Rockford Area Economic Development Council

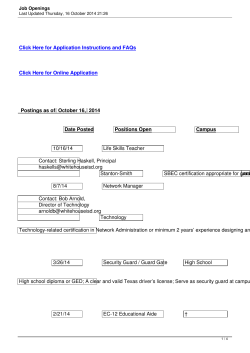

Q4 2014 | INDUSTRIAL CHICAGO INDUSTRIAL MARKET OVERVIEW CONSTRUCTION DELIVERIES RISE A key indicator of the health of the metropolitan Chicago industrial market is the notable increase in new construction deliveries witnessed in 2014. Industrial construction deliveries totaled 11.5 million square feet in 2014, a 30.2 percent increase from total 2013 volume. Other statistical indicators followed suit, as the vacancy rate fell by almost one whole percentage point, leasing volume increased 2.0 million square feet, and sale volume surpassed 20.0 million square feet for just the third time since 2000. In addition, net absorption improved by more than 5.5 million square feet in 2014 versus 2013 results. VACANCY AND SUPPLY MARKET INDICATORS Chicago’s industrial vacancy rate fell by 97 basis points from the year-end 2013 rate of 8.70 percent to 7.73 percent at year-end 2014. This was caused primarily by strong user demand and a small amount of second generation space returning to the market. Chicago Metro 2013 2014 VACANCY 8.70% The Chicago area industrial vacancy rate has not fallen below 8.0 percent since 2001 when it dipped to ironically 7.73 percent. 7.73% ABSORPTION 12,760,948 18,301,811 RENTAL RATE $4.11 $4.41 The I-290 North and O’Hare industrial submarkets witnessed a year-over-year vacancy rate decline of more than 200 basis points from 2013, while vacancy in the Northwest Suburbs and I-55 Corridor rose more than 100 basis points. Vacant supply in the metropolitan Chicago industrial market totaled 102.2 million square feet at the end of 2014, an impressive 12.2-million-square-foot improvement from year-end 2013. Spaces larger than 300,000 square feet saw a 13.7 percent decline in vacancy supply from totals reported at year-end 2013. Market indicators benefited from the fact that only 48.0 million square feet of space returned to the Chicago industrial market in 2014, the lowest total of the past decade. The 48.0 million square feet were composed of 5.1 million square feet of speculative development and 42.9 million square feet of second generation space. HISTORICAL TRENDS 14% 25.0 20.0 12% 15.0 10.0 10% 5.0 8% 0.0 -5.0 6% -10.0 4% -15.0 2% -20.0 -25.0 2008 2009 2010 2011 2012 2013 2014 0% Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates LEASING AND SALE ACTIVITY Total 2014 industrial leasing volume edged up from the prior year’s volume of 35.7 million square feet to 37.7 million square feet in 2014. The 5.6 percent increase was realized primarily from smaller users in the 10,000- to 25,000-square-foot range. Big box transactions greater than 300,000 square feet were not as prevalent in 2014 as 14 such leases were signed compared to 19 transactions consummated in 2013. However, the total volume of those leases was higher with 8.5 million square feet versus 8.3 million square feet. Leasing activity in the I-80/Joliet Corridor totaled 4.9 million square feet in 2014, surpassing the www.colliers.com/chicago RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL 2013 total by an impressive 1.7 million square feet. This was followed closely by the Elgin I-90 Corridor, which saw an increase of 1.2 million square feet in 2014. The weakest markets in terms of year-over-year leasing activity include Central DuPage, which fell 1.3 million square feet, and the I-55 Corridor which fell 927,700 square feet from 2013 results. Year-end 2014 sale volume escalated to 20.6 million square feet which represents an impressive 15.5 percent increase from the 17.8 million square feet sold in 2013. All size ranges realized higher transaction volume, with the big box user sales achieving the highest gain with 8.7 percent over the prior year’s total. The 20.6 million square feet sold in 2014 represents the highest volume sold in the past ten years. User sale volume was strongest in the South Suburbs as 2.8 million square feet of sale transactions were completed, accounting for 13.5 percent of all 2014 sale activity in metropolitan Chicago. However, the I-290 North market sale volume of 2.1 million square feet represented the largest gain of any Chicago market from one year ago. ABSORPTION Heightened user demand drove cumulative 2014 net absorption to 18.3 million square feet. This was a remarkable 43.4 percent increase from the 12.8 million square feet posted in the prior year, and the highest net absorption volume achieved since 2005 when 20.0 million square feet were recorded. Eight Chicago-area industrial submarkets realized a positive swing in net absorption of more than 1.0 million square feet from one year ago, with O’Hare market leading the results with 1.9 million square feet. Conversely, net absorption in the Central DuPage and the Northwest Suburbs dropped more than 1.0 million square feet from the 2013 total. CONSTRUCTION ACTIVITY Construction deliveries in 2014 topped out at 11.5 million square feet, a sharp increase from the 8.8 million square feet completed in 2013. More than 6.4 million square feet of all new 2014 deliveries resulted from build-to-suit projects. Although new construction is on the rise it is still considerably below the height of the market which reached 21.0 million square feet in 2009. The Chicago Metropolitan area witnessed 45 new projects started in 2014, with a collective inventory of 12.6 million square feet. Thirteen construction projects were started in the fourth quarter alone, which will add 1.5 million square feet to Chicago’s inventory base when completed. The largest fourth quarter development was started for Niagra Bottling, LLC which commenced construction on a 377,300-square-foot warehouse/distribution facility at Lakeview Corporate Park in Pleasant Prairie. The I-55 Corridor reclaimed the top spot for most construction activity in 2014, as 3.1 million square feet of new projects were constructed. This marks 27.2 percent of all 2014 construction activity in the metropolitan Chicago area. No new construction completions occurred in DeKalb County, Far South Suburbs, McHenry County, and Northwest Indiana. WHAT TO EXPECT IN 2015 Speculative development will remain strong in 2015. Developers will remain focused on building multi-tenant product in sizes from 100,000 square feet to 500,000 square feet. We could see big box development in 2015 if the current pipeline of deals comes to fruition. Rent growth will continue to rise modestly in Class A. Class B product will also see a slight uptick in rents in core markets due to limited supply, while Class C product will still see limited interest. Low interest rates will continue to draw buyers to the market, however, limited supply will push up pricing. P. 2 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL Central DuPage VACANCY AND SUPPLY After reaching 8.60 percent in the first quarter of 2014, the vacancy rate in the Central DuPage submarket receded dramatically throughout the year to a fourth quarter total of 7.35 percent. This was also a 21-basis-point decline from the fourth quarter 2013 total of 7.56 percent. At the end of the fourth quarter Central DuPage’s available industrial supply measured 6.2 million square feet, a modest decrease from the 6.4 million square feet reported vacant at year-end 2013. Spaces between 30,000 square feet and 60,000 square feet proved to be the most sought-after, as the available options in that size range dropped from 41 in 2013 to 28 in 2014. Declining supply has caused a complete absence of available space greater than 350,000 square feet. MARKET INDICATORS Central DuPage 2013 CONSTRUCTION Three build-to-suit developments were completed in 2014 adding 188,000 square feet to Central DuPage’s inventory base. All three projects represented company expansions, and the largest was a 80,000-square-foot food warehouse for Portillo’s at 350 Rohlwing Road in Addison. 2014 VACANCY 7.56% 7.35% ABSORPTION 2,165,011 170,709 RENTAL RATE $5.04 $5.21 In 2013 just one speculative development was completed, a 139,000-square-foot property at 201 Gary Avenue at Turnberry Lakes International Business Park in Roselle. LEASE AND SALE ACTIVITY Occupier demand was weaker in 2014 as just 2.7 million square feet of lease transactions were completed. This represents a decline of 1.3 million square feet 4.0 million square feet leased in 2013. Market conditions in 2013 benefited from two large lease transactions in spaces over 350,000 square feet. However, the largest lease signed in the Central DuPage market in 2014 was Com2 Computer Recycling Solutions’ 207,800-square-foot commitment at 500 Kehoe Boulevard in Carol Stream. HISTORICAL TRENDS On a positive note, leasing activity witnessed an increase in signed leases in the 60,000 to 100,000-square-foot range, as seven such transactions were completed in 2014 versus just five in 2013. 2.5 14% 2.0 12% 1.5 10% 1.0 0.5 8% 0.0 6% -0.5 4% -1.0 2% -1.5 -2.0 2008 2009 2010 2011 2012 2013 2014 Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates Massive fourth quarter sale activity of 781,600 square feet drove the year-end sale volume to 1.5 million square feet. This was a dramatic 47.1 percent gain from 2013’s results. User demand was most prevalent in building sales between 10,000 and 60,000 square feet, as 26 of the 29 sales recorded in 2014 were in this size range. 0% NET ABSORPTION Despite strong fourth quarter sale volume the cumulative 2014 net absorption measured just 170,700 square feet, far below the 2.2 million square feet of net absorption reported one year ago. Central DuPage’s net absorption was negatively impacted by a higher level of space returning to the market. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Com2 Computer Recycling Solutions 207,758 500 Kehoe Blvd, Carol Stream Lease Diamond Marketing Solutions 184,574 900 Kimberly Drive, Carol Stream Lease Semblex Corporation 139,720 900 N. Church Road, Elmhurst Sale WHAT TO EXPECT IN 2015 Big box users will be driven to the Fox Valley and I-55 Corridor markets due to limited supply in Central DuPage. Rents will continue to improve in big box space, however, spaces from 40,000 square feet to 100,000 square feet will remain flat due to abundant supply. Low interest rates will keep buyers active, but limited supply will drive up pricing which will ultimately slow down 2015 sales. P. 3 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL Chicago VACANCY AND SUPPLY The Chicago South vacancy rate experienced a sharp decline of 77 basis points from the 2013 level of 11.17 percent to 10.40 percent in 2014, while Chicago North 2014 vacancy rate of 6.86 percent closely matched the 6.87 percent posted one year prior. Heightened tenant demand in the Chicago South market contributed greatly to its declining vacancy rate, while increased buyer activity kept the Chicago North vacancy from rising. Chicago North’s vacant supply has fallen steadily from the all-time high of 7.4 million square feet in 2009 to 6.1 million square feet in 2014. Chicago South’s available supply also improved considerably, dropping more than 600,000 square feet from 2013’s volume to 8.7 million square feet. This market’s all-time high of 11.8 million square feet occurred in 2011. MARKET INDICATORS Chicago North ABSORPTION -243,653 -449,188 RENTAL RATE $5.49 $8.37 CONSTRUCTION ACTIVITY Both Chicago markets were witness to new construction completions in 2014 for the first time since 2011. In Chicago North, New World Van Lines moved into a 30,000-square-foot facility at 5875 N. Rogers, while two build-to-suit projects were completed in Chicago South that added 136,600 square feet to its inventory base. The largest development was University of Chicago’s 86,600-square-foot warehouse at 5225 S. Cottage Grove, a McShane Construction development. 2014 Method Products started construction on a 150,000-square-foot build-to-suit at 720 E. 111th Street and Vienna Beef is adding a 12,000-square-foot addition on its plant at 1000 W. Pershing Road in the historic Stockyard Business Park. 2013 2014 VACANCY 6.87% - 6.86% Chicago South 2013 VACANCY 11.17% In Chicago North, four obsolete buildings were demolished, eliminating 552,000 square feet of inventory while in Chicago South four buildings totaling 215,000 square feet were razed. Seven of these tear-downs will be redeveloped for alternative uses. 10.40% ABSORPTION 1,127,180 359,395 RENTAL RATE $3.82 $4.33 LEASING AND SALE ACTIVITY Chicago North leasing activity measured 481,200 square feet, up 49 percent 2013’s total of 322,800 square feet. Chicago South’s volume of 1.7 million square feet marked a significant increase from the 1.4 million square feet leased in 2013. 2014 tenant demand in Chicago North was driven by smaller users, whereas the increase in Chicago South’s volume was balanced in all size ranges. HISTORICAL TRENDS Strong user demand for both Chicago markets during 2014 resulted in sale volume that exceeded 1.0 million square feet for the second consecutive year. Sale activity measured 1.9 million square feet in Chicago North market, which surpassed 2013 level by 48.9 percent. The Chicago South 2014 volume reached 1.7 million square feet, slightly lower than the 1.8 million square feet sold in the prior year. Absorption and Vacancy Rates 1.5 10% 1.0 9% 8% 0.5 7% 0.0 6% -0.5 5% -1.0 4% 3% -1.5 2% -2.0 -2.5 Vacancy Rate Square Feet Absorbed (Millions) Chicago North 1% 2008 2009 2010 2011 2012 2013 2014 0% TOP 2014 TRANSACTIONS 4.0 16% 3.0 14% 2.0 12% 1.0 10% 0.0 8% -1.0 6% -2.0 4% -3.0 2% P. 4 2008 2009 2010 2011 2012 2013 2014 | COLLIERS INTERNATIONAL 0% Vacancy Rate Square Feet Absorbed (Millions) Chicago South -4.0 NET ABSORPTION Net absorption in Chicago South measured only 359,400 square feet, down from 1.1 million square feet in 2013. Absorption was negative in Chicago North for the fourth consecutive year, reaching negative 449,200 square feet in 2014, down from negative 243,700 square feet in 2013. TENANT/BUYER SIZE (SF) ADDRESS TYPE Affordable Moving Company 377,378 4500 W. Armitage Avenue Sale CLA Comm Major, LLC 359,374 1819 N. Major Avenue Sale QTS Realty Trust 327,000 2800 S. Ashland Avenue Sale WHAT TO EXPECT IN 2015 Buyers will be active in the market but should expect to pay more in 2015 due to limited supply. Tremendous demand for land in prime areas of Chicago will push land values to historically high levels in 2015. Strong occupier demand in the Chicago South market has generated developer interest that could result in speculative construction in 2015. RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL Elgin/I-90 Corridor VACANCY AND SUPPLY An increase in tenant activity pushed the Elgin/I-90 Corridor vacancy rate down a remarkable 148 basis points from the year-end 2013 rate of 13.23 percent to the year-end 2014 rate of 11.75 percent. The vacant industrial supply in the Elgin/I-90 Corridor measured 3.5 million square feet at the end of 2014, which was a 10.9 percent decrease from the 2013 year-end total of 3.8 million square feet. Strong user demand throughout the year was the primary factor in the improvement. CONSTRUCTION ACTIVITY Four buildings were completed in 2014 adding 440,064 square feet to Elgin/I-90 Corridor’s inventory base. Bridge Development Partners completed a 225,200-square-foot speculative warehouse distribution facility at 2750 Alft Lane in Elgin’s Randall Crossings Business Park in the first quarter. Three constructions projects were completed in the third quarter. World Richman Corporation built a 108,307-square-foot multi-tenant speculative facility at 2725 Alft Lane at the Randall Crossings Business Park in Elgin, Cargo Equipment Corporation took occupancy of a 40,052-square-foot buildto-suit sale building at 13700 George Bush Court in Huntley and Newhaven Display International moved into a 26,500-square-foot build-to-suit sale at 2661 Galvin Drive in Elgin. MARKET INDICATORS Elgin/I-90 Corridor 2013 2014 VACANCY 13.23% 11.75% ABSORPTION -331,444 753,238 RENTAL RATE $4.86 $5.14 Duke Realty Corporation broke ground on a 757,100-sqaure-foot build-to-suit lease warehouse/ distribution facility for Weber Stephens Products Company. Once completed this will be the secondlargest facility completed in the Elgin/I-90 Corridor. LEASING AND SALE ACTIVITY Tenant demand was strongest in the third quarter as 1.3 million square feet of lease transactions were completed, largely due to the Weber Stephens Products Company build-to-suit lease. This catapulted the 2014 year-end leasing total to 2.3 million square feet, which more than doubled the 2013 volume of 1.0 million square feet. HISTORICAL TRENDS 1.0 14% 0.8 12% 0.6 0.4 10% 0.2 8% 0.0 -0.2 6% -0.4 4% -0.6 2% -0.8 -1.0 2008 2009 2010 2011 2012 2013 2014 0% Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates Sale volume measured an impressive 741,000 square feet in 2014, eclipsing the 2013 volume of 416,809 square feet. One transaction greatly contributed to heightened 2014 sale volume. JIT Packaging recently moved into a 407,400-square-foot manufacturing plant at 1717 Gifford Road in Elgin. NET ABSORPTION Tremendous user demand in the Elgin/I-90 Corridor during 2014 resulted in the year-end net absorption of 753,238 square feet, a vast improvement from the negative 331,444 square feet reported in 2013. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Weber-Stephen Products 757,120 Oak Creek Parkway, Huntley Lease JIT Packaging 407,400 1717 Gifford Road, Elgin Sale Weber-Stephen Products 250,828 2500 Northwest Parkway, Elgin Lease WHAT TO EXPECT IN 2015 There will continue to be high demand from developers seeking industrial land for future development. Prices and lease rates will stay consistent to 2014 levels. Elgin will continue to attract users in the home improvement industry. P. 5 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL Fox Valley VACANCY AND SUPPLY Fox Valley’s vacancy rate measured 6.83 percent at the end of 2014 which was down 43 percentage points from the level recorded one year ago. Strong buyer demand was a key contributor to Fox Valley’s improved vacancy rate. Fox Valley’s vacancy rate has not fallen below 7.0 percent since the first quarter of 2000 when a vacancy rate of 6.92 percent was reported. The recent completion of two speculative developments added 754,100 square feet to Fox Valley’s available supply, bringing the year-end available supply to 6.3 million square feet. Fox Valley’s yearover-year vacant supply has fallen dramatically from the all-time high of 13.5 million square feet reported in 2009. MARKET INDICATORS Fox Valley 2013 CONSTRUCTION ACTIVITY 2014 construction activity in Fox Valley consisted of two build-to-suits totaling 403,300 square feet and two speculative projects totaling 754,100 square feet. These projects pushed 2014 construction volume to 1.2 million square feet, easily surpassing the 421,100 square feet built in 2013. 2014 VACANCY 7.26% 6.83% ABSORPTION 1,553,644 1,336,341 RENTAL RATE $4.20 $4.40 Fox Valley’s construction activity has not experienced volume in excess of 1.0 million square feet since 2009. The largest speculative development completed in 2014 was a joint venture The Opus Group and USAA, resulting in a new 604,600-square-foot property at 1200 Orchard Gateway Boulevard in North Aurora. Additionally, O’Reilly Auto Parts moved into a 363,700-square-foot build-to-suit sale property at 543 Frontenac Court in Naperville. Four projects totaling 656,100 square feet are currently underway. The largest project is Liberty Property Trust’s 429,800-square-foot bulk warehouse/distribution facility at 300 Mitchell Road. HISTORICAL TRENDS 5.0 16% 4.0 14% 3.0 12% 2.0 10% 1.0 8% 0.0 6% -1.0 4% -2.0 2% -3.0 2008 2009 2010 2011 2012 2013 2014 0% Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates LEASING AND SALE ACTIVITY Leasing volume in Fox Valley fell from the 2013 year-end volume of 2.8 million square feet to 2.1 million square feet in 2014, the second lowest total in this submarket in the past 10 years. 2013 volume was driven by larger users while 2014 tenant demand was strongest in spaces between 10,000 to 30,000 square feet. Heightened demand in the first and fourth quarters of 2014 drove Fox Valley’s sale activity to 1.4 million square feet. This doubled the 2013 year-end volume of 716,100 square feet. NET ABSORPTION Escalating sale volume resulted in a positive 1.3 million square feet of net absorption for Fox Valley this year. However, this marked a 14.0-percent decline from the 2013 total of 1.6 million square feet. Fox Valley has witnessed positive year-end net absorption for five consecutive years. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE O’Reilly Auto Parts 363,711 543 Frontenac Court, Naperville Sale Infinity Logistics 202,991 1111 W. Harvester Road, West Chicago Lease Tri-Ring American Corporation 152,859 820 Frontenac Drive, Naperville Sale WHAT TO EXPECT IN 2015 Big Box users from neighboring Central DuPage will be drawn to Fox Valley due to lack of product. Speculative developers will be drawn to Fox Valley, however limited development opportunities will force them west of the Orchard Road. A diverging diamond interchange has commenced construction on I-88 at Route 59 which should alleviate traffic congestion that surpasses 50,000 vehicles each day. The project is scheduled to be completed by the fall of 2015. P. 6 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL I-290 North VACANCY AND SUPPLY I-290 North’s vacancy rate achieved a remarkable reduction of 244 basis points from the year-end 2013 level of 10.51 percent to 8.07 percent in 2014. This decline also represents the largest yearover-year improvement of any Chicago market. The vacant industrial supply at the end of the fourth quarter measured 6.1 million square feet, down an impressive 1.8 million square feet from the 8.0 million square feet reported vacant in 2013. The reduction in available space was encountered in all size ranges with the 100,000 to 200,000-squarefoot range experiencing the largest reduction. Available options of that size dropped from 13 in 2013 to just six in 2014. MARKET INDICATORS The I-290 North market currently has five vacancies above 350,000 square feet. However, there were only five total sale or lease transactions completed in that size range since 2000. I-290 North 2013 2014 VACANCY 10.51% CONSTRUCTION ACTIVITY The I-290 North market realized its first construction delivery in five years in 2014. Duke Realty Corporation completed a 51,900-square-foot addition to a building at 599 Northwest Avenue in Northlake as a result of the tenant’s expansion needs. 8.07% ABSORPTION 56,746 1,521,890 RENTAL RATE $3.24 $4.21 There are no new developments underway in the I-290 North but there are rumors of a new speculative project south of O’Hare International Airport. The only active development in I-290 North is the elimination of buildings from the market. In 2014, two buildings totaling 63,400 square feet were razed with the intent of replacing them with nonindustrial development – a trend that will continue in this mature market. LEASING AND SALE ACTIVITY I-290 North 2014 leasing volume totaled 1.3 million square feet, consistent with the five-year average in the market, but far below the all-time high of 2.1 million square feet leased in 2013. HISTORICAL TRENDS 2.0 14% 1.0 12% 0.0 10% -1.0 8% -2.0 6% -3.0 4% -4.0 2% -5.0 2008 2009 2010 2011 2012 2013 2014 0% Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates I-290 North’s sale volume escalated to 2.1 million square feet in 2014, more that tripling the 665,700 square feet sold in 2013 and marking the highest sale volume in this market in the past 10 years. The increase in user demand was due to increased activity from large users. Four sales were recorded in buildings over 100,000 square feet while there was only one such sale in 2013. NET ABSORPTION After registering positive net absorption of only 56,700 square feet in 2013, historic sale volume elevated net absorption to 1.5 million square feet in 2014. This represents the third consecutive year of positive net absorption, erasing four prior years of negative marks. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Honey-Can-Do 468,734 5300 St. Charles Road, Berkeley Sale Coregistics 262,000 3501 County Line Road, Franklin Park Lease Edsal Manufacturing 218,749 5600 Proviso Drive, Berkeley Sale WHAT TO EXPECT IN 2015 Developer interest to develop speculative product will be heightened in 2015, however, pricing could prove an impediment. Demand for buildings for sale will remain strong but will buyers be eager to buy less functional product at current pricing levels. Newer product will continue to be the desired choice, yet pricing will draw some users to Class B product. P. 7 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL I-290 South VACANCY AND SUPPLY I-290 South’s vacancy rate fluctuated greatly in 2014, from a high of 7.0 percent in the first quarter to a low of 5.10 percent in the third quarter, and ending the year at 6.78 percent. This was attributed to the large gains from user demand in the second and third quarters. Although I-290 South’s vacancy rate jumped to 6.78 percent in the fourth quarter, it was still 43 basis points lower than the 2013 year-end total of 7.26 percent. Available space measured 3.1 million square feet at the end of the fourth quarter, down slightly from the 3.3 million square feet reported in the year prior. The largest improvement in I-290 South’s vacancy supply was in the 100,000- to 200,000-square-foot rage, dropping from 10 options in 2013 to 5 options in 2014. MARKET INDICATORS I-290 South 2013 CONSTRUCTION ACTIVITY Four buildings totaling 1.2 million square feet were completed in the I-290 South market in 2014, the highest construction volume of the past 10 years. No new developments were reported in 2013. 2014 VACANCY 7.26% 6.78% ABSORPTION -506,929 1,285,280 RENTAL RATE $3.78 $4.50 All four new construction projects took place in McCook. The largest build-to-suit project was completed by Freeman Decorating which built a 365,400-square-foot property at 8201 W. 47th Street, while the largest speculative project was DP Partners’ 351,900-square-foot project at 8601 W, 47th Street. Bridge Development Partners, LLC commenced construction on a 226,200-square-foot speculative development at 8401 Riverside Drive, also in McCook. The building is scheduled for completion in the spring of 2015. LEASING AND SALE ACTIVITY Leasing volume ended 2014 at 882,200 square feet, down slightly from the 920,700 square feet leased for in 2013. Although lower than 2013 volume, the 882,200 square feet leased surpassed the historical average of 796,900 square feet. HISTORICAL TRENDS 2.0 12% 1.5 10% 1.0 8% 0.5 6% 0.0 4% -0.5 2% -1.0 -1.5 2008 2009 2010 2011 2012 2013 2014 0% Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates Tenant demand in 2014 witnessed increased activity from users in the 30,000- to 60,000-squarefoot range, which posted six lease transactions in 2014 versus just one in 2013. The I-290 South market posted a 92.8 percent gain in its cumulative sale volume, reaching an impressive 1.7 million square feet in 2014 after just 423,600 square feet of sale transactions in 2013. The increase in activity was due to heightened transaction volume rather than one large sale. NET ABSORPTION Heightened sale activity greatly influenced the year-end net absorption of 1.3 million square feet. This represents an astonishing swing of more than 1.8 million square feet from the negative 506,900 square feet posted in 2013. This is only the second time since 2000 that I-290 South’s year-end, cumulative net absorption surpassed 1.0 million square feet. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Star Plastics & Rubber 293,750 2801 S. 25th Avenue, Broadview Sale Undisclosed 200,000 5622 W. 51st Street, Forest View Lease Golden State Foods 152,670 8901 W. 47th Street, McCook Sold WHAT TO EXPECT IN 2015 Redevelopment will continue but will be limited due to pricing constraints. The recent completion of 662,700 square feet of speculative product will have a impact on second generation space as tenants will be driven to modern, efficient space. The limited supply of buildings for sale will put upward pressure on pricing in 2015. P. 8 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL I-55 Corridor VACANCY AND SUPPLY The vacancy rate in the I-55 Corridor escalated more than one whole percentage point from the yearend 2013 rate of 9.83 percent to 10.86 percent in 2014. An excessive amount of second generation space coupled with 1.8 million square feet of recently completed speculative projects was too much for user demand to overcome. I-55 Corridor’s vacant industrial supply reached 8.4 million square feet. This was a 1.1-millionsquare-foot increase from one year prior. However, this is far from the market’s all-time high of 12.9 million square feet registered in the third quarter of 2010. Big box users have six options over 350,000 square feet, double the options offered in 2013. MARKET INDICATORS CONSTRUCTION ACTIVITY After registering only 410,400 square feet of new construction in 2013, the I-55 Corridor experienced an explosion of new construction deliveries in 2014, as 3.1 million square feet of projects were completed. This total is competing with the peak of the market, which occurred in 2004 when 6.6 million square feet of new construction occurred. I-55 Corridor 2013 2014 VACANCY 9.83% 10.86% ABSORPTION 275,617 1,736,307 RENTAL RATE $5.08 $5.07 - Two large speculative developments totaling 1.8 million square feet were completed in the I-55 Corridor in 2014, which surpassed the 1.3 million square feet of build-to-suit completions. Pizzuti Company built 672,100 square feet at Pinnacle Business Center in Romeoville and IDI Gazeley finished 602,800 square feet at Bolingbrook Corporate Center West. Industrial development will continue as there are 10 new projects totaling 2.2 million square feet currently underway in various stages of development (three build-to-suit and seven speculative). The I-55 Corridor witnessed the rare demolition of two buildings in 2014. Duke Realty Corporation razed a 101,700-square-foot facility at 1350 Lakeside in Romeoville and immediately started construction on 324,100-square-foot speculative project. Also, MacNeil Automotive tore down a 119,000-square-foot property at 501 S. Woodcreek in Bolingbrook for a new planned facility. HISTORICAL TRENDS 3.0 18% 16% 2.5 14% 2.0 12% 10% 1.5 8% 1.0 6% 4% 0.5 0.0 2% 2008 2009 2010 2011 2012 2013 2014 0% Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates LEASING AND SALE ACTIVITY I-55 Corridor year-end leasing volume measured 4.7 million square feet in 2014, which was down 16.4 percent from one year prior. Less big box users in the market were the primary culprit as five users signed leases in space over 200,000 square feet in 2014 versus seven in 2013. The sale of a 642,900-square-foot facility at 1300 Naperville Road in Romeoville captured 46 percent of all 2014 sale volume which measured 1.4 million square feet. The buyer, Magid Glove and Safety, relocated from Chicago. This transaction alone exceeded 2013 sale volume of 522,800 square feet. NET ABSORPTION I-55 Corridor’s 2014 net absorption of 1.7 million square feet was a significant improvement from 2013’s year-end volume of 275,600 square feet. This was the result of heightened user demand during the first half of 2014. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Lease Ferrara Pan Candy 747,152 901 Carlow Drive, Bolingbrook Midwest Warehouse & Distribution System, Inc. 650,494 1450 Remington Boulevard, Bolingbrook Lease Magid Glove and Safety, LLC 642,852 1300 Naperville Road, Romeoville Sale WHAT TO EXPECT IN 2015 Tenants will continue to be driven to new product, which is not good news for owners of second generation vacancies. Landlords will look to secure long-term leases and will be less likely to sign short term deals in 2015. Class A product in spaces under 50,000 square feet will see a spike in rents as supply is limited, while rents for big box product will be flat due to ample supply. P. 9 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL I-80/Joliet Corridor VACANCY AND SUPPLY The I-80/Joliet Corridor’s vacancy rate continued to improve, dropping 141 basis points from the 2013 total of 10.68 to 9.27 percent in 2014. An increase in activity from big box users was the primary cause of this sizable decline. This marks the first time that the I-80/Joliet Corridor’s year-end vacancy rate has fallen below 10.0 percent in the last ten years. Available supply declined by almost 1.0 million square feet from the 2013 level of 7.6 million square feet to 6.8 million square feet in the fourth quarter of 2014. This is less than half the 14.1 million square feet reported available during the height of the recession in 2009. MARKET INDICATORS CONSTRUCTION ACTIVITY Construction completions in 2014 measured 1.9 million square feet, a sharp decline from the 4.3 million square feet reported one year ago. Build-to-suit deliveries captured 54.9 percent of all completions in 2014. I-80/Joliet Corridor 2013 2014 VACANCY 10.68% 9.27% ABSORPTION 3,708,904 2,738,204 RENTAL RATE $3.47 $3.47 - The pipeline for new projects remains strong in the I-80/Joliet Corridor. Four buildings broke ground in 2014 which will add 2.3 million square feet to I-80/Joliet Corridor’s inventory base. The most notable project is Michelin Tire’s 1.7 million-square-foot, three-building build-to-suit project to be constructed by Ridge Property Trust at RidgePort Logistics Center in Wilmington. Additionally ML Realty Partners commenced construction on a 512,000-square-foot speculative project at Heritage Commerce Center in Lockport. HISTORICAL TRENDS 25% 4.0 3.5 20% 3.0 2.5 15% 2.0 10% 1.5 1.0 5% 0.5 2008 2009 2010 2011 2012 2013 2014 0% Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates 0.0 Although build-to-suit developments posted the majority of all 2014 deliveries, the largest building completed was a 752,000-square-foot speculative warehouse/distribution facility at 21215 SW Frontage Road in Shorewood. The developer, Clarion Partners successfully secured a tenant for the whole building. LEASING AND SALE ACTIVITY The Michelin Tire lease of 1.7 million square feet drove 2014 leasing volume to 4.9 million square feet, which was a remarkable increase from year-end 2013 volume of 3.2 million square feet. Although 2014 leasing volume increased over 2013 totals, it was achieved through 10 less transactions. I-80/Joliet Corridor’s sale volume totaled 763,400 square feet, far below the 1.7 million square feet sold in 2013. Activity was primarily driven by smaller sales while 2013 volume was heavily weighted from users buying facilities over 100,000 square feet. NET ABSORPTION Net absorption declined 26.2 percent in 2014 but still registered an impressive 2.7 million square feet – the second-highest year end total of all market - due to brisk leasing activity. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Michelin Tire 1,700,000 RidgePort Logistics Center, Wilmington Lease IKEA 849,691 501 Internationale Parkway, Minooka Lease Bob’s Discount Furniture 751,966 21215 SW. Frontage Road, Shorewood Lease WHAT TO EXPECT IN 2015 The recent absorption of large blocks of space in the I-80/Joliet Corridor could draw new speculative development in 2015. The I-80/Joliet Corridor market will continue to draw large scale development projects as it has the most options of shovel-ready sites of any Chicago area market. P. 10 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL Lake County VACANCY AND SUPPLY The vacancy rate in Lake County witnessed a sizeable improvement in 2014, falling 54 basis points from 10.54 percent in 2013 to the 2014 year-end rate of 10.00 percent. This represents the lowest year-over-year vacancy rate reported in Lake County market since 2007 when it dropped to 8.53 percent. Lake County’s vacant supply measured 7.0 million square feet, a healthy decline from the 7.5 million square feet reported one year ago. This was largely the result of robust leasing activity. Lake County has significant vacancy in the 200,000- to 350,000-square-foot range with seven vacant options. Based on current absorption trends, this equates to a 2.5-year supply. MARKET INDICATORS CONSTRUCTION ACTIVITY Just one build-to-suit project was completed in 2014 totaling 22,000 square feet. Schneider Graphics, Inc. took possession of a manufacturing plant at 885 Telser Road in Lake Zurich. Construction projects totaling 520,800 square feet were built in 2013. Lake County 2013 2014 VACANCY 10.54% 10.00% ABSORPTION 609,201 -72,140 RENTAL RATE $5.17 $5.19 Three new speculative projects are currently underway. IDI Gazeley is building a 454,300-squarefoot facility at ACC Logistics Center in Antioch while Bridge Development Partners, LLC broke ground on a 406,220-square-foot two-building development at Bridgepoint 94 Corporate Park in Libertyville. Speculative development in Lake County hasn’t experienced this level of new construction activity since 2008 when four big box facilities 740,500 square feet were built. LEASING AND SALE ACTIVITY The Lake County’s 2014 leasing volume reached 2.3 million square feet, an impressive 30 percent rise in leasing activity from the 1.7 million square feet leased in 2013. Two leases were inked in spaces over 200,000 square feet, while no transactions were recorded in that size range in 2013. HISTORICAL TRENDS 2.0 16% 1.5 14% 1.0 12% 0.5 10% 0.0 8% -0.5 6% -1.0 4% -1.5 2% -2.0 2008 2009 2010 2011 2012 2013 2014 0% Tenant demand in 2014 was strongest in spaces between 10,000 square feet and 60,000 square feet as 47 such transactions were recorded in 2014 just 27 in 2013. Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates Despite an increase in the number of sale transactions, Lake County’s total sale volume of 699,000 square feet represented a 20.3 percent decline from the 838,900 square feet sold in 2013. The largest sale transaction in 2013 was a 304,600-square-foot building while the largest sale in 2014 was an 85,400-square-foot facility at 27944 N. Bradley Road in Libertyville purchased by Croda, LLC. NET ABSORPTION Despite heightened tenant demand, Lake County net absorption fell to negative 72,100 square feet in 2014 partially due to the elimination of a 450,000-square-foot manufacturing plant in Libertyville. In 2013, net absorption measured 609,200 square feet. The last time Lake County’s year-over-year volume reported negative results was in 2010 when negative 847,100 square feet were reported. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Flextronics 362,969 700 Corporate Grove Drive, Buffalo Grove Lease Hearthware Home Products 253,141 1755 Butterfield Road, Libertyville Lease Woodland Foods 161,816 3818 W. Grandville Avenue, Gurnee Lease WHAT TO EXPECT IN 2015 Recent land plays in neighboring Southeast Wisconsin could drive more tenants out of Illinois. The three speculative projects under construction will attract the current deals in the market making second generation space less desirable in 2015. High-end manufacturing growth will spur build-to-suit activity in Lake County next year. P. 11 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL North Suburbs VACANCY AND SUPPLY North Suburb’s vacancy rate dropped to an extremely tight 5.36 percent in 2014, down from the yearend 2013 mark of 6.48 percent. An uptick in leasing and sale activity contributed to the decline in in North Suburbs’ vacancy rate. The last time North Suburbs vacancy rate fell below 6.0 percent was in the third quarter of 2001 when a rate of 4.87 percent was reported. The available supply at the end of 2014 measured 3.0 million square feet, an 18.4-percent decrease from the 3.7 million square feet registered vacant in 2013. MARKET INDICATORS There are no vacant options above 200,000 square feet in the North Suburbs, which has been the case for the past 24 months. North Suburbs 2013 2014 VACANCY 6.48% CONSTRUCTION ACTIVITY Speculative development was reintroduced to the North Suburbs market in 2014. Panattoni Development Company completed a 150,100-square-foot warehouse/distribution project at North Shore Industrial Center at 7711 Gross Point Road, Skokie. This represents the first speculative development to occur in the North Suburbs since the fourth quarter of 2007 when a 234,700-squarefoot facility was constructed at 6300 W. Howard Street in Niles. 5.36% ABSORPTION -182,913 -202,347 RENTAL RATE $4.71 $5.18 One large scale build-to-suit is underway in Niles. FedEx is building a 306,400-square-foot distribution center on a 34-acre site formerly home to WW Grainger. The building is scheduled for completion in the summer of 2015. Three buildings were demolished in 2014, eliminating 906,600 square feet from North Suburbs’ occupied supply. One of these sites is being developed for the FedEx build-to-suit project. HISTORICAL TRENDS 1.5 12% 1.0 10% 0.5 0.0 8% -0.5 6% -1.0 -1.5 4% -2.0 2% -2.5 -3.0 2008 2009 2010 2011 2012 2013 2014 0% Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates LEASING AND SALE ACTIVITY The North Suburbs’ leasing activity reached 1.1 million square feet in 2014, surpassing 2013 results by 70.8 percent. The last time North Suburbs year-end leasing volume exceeded 1.0 million square feet was in 2011 when 1.1 million square feet of lease transactions were reported. The bulk of 2014 leasing transactions occurred in spaces between 10,000 square feet and 30,000 square feet, as 28 transactions totaling 453,900 square feet or 42 percent of all 2014 leasing volume occurred in that size range. Four sale transactions over 100,000 square feet drove total year-end 2014 sale volume to 1.2 million square feet, marking the third consecutive year that sale activity has surpassed leasing activity. However, this is an 11.2-percent decline from the 2013 cumulative total of 1.9 million square feet. NET ABSORPTION Despite heighted leasing activity in the North Suburbs, net absorption measured a disappointing negative 202,300 square feet. The elimination of 906,600 square feet of industrial inventory negatively impacted the results. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Fresh Farms 302,379 5990 W. Touhy Avenue, Niles Sale Con-Tech Lighting 188,901 725 Landwehr Road, Northbrook Lease Scannell Properties 149,995 1234 Peterson Drive, Wheeling Sale WHAT TO EXPECT IN 2015 The limited supply of Class B product should drive additional speculative development in 2015, however pricing could be an issue. Rents for Class B product will rise due to reduced supply. Buyers will be active but should expect to see price increases in 2015 due to very limited supply. P. 12 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL Northwest Suburbs VACANCY AND SUPPLY The Northwest Suburbs’ vacancy rate was negatively influenced by an elevated amount of space returning to the market. The year-end vacancy rate jumped to 8.44 percent, up 106 basis points from the 2013 year-end result of 7.38 percent. Vacant supply rose in each quarter in the Northwest Suburbs in 2014, ending the year at 2.8 million square feet. This represents a 353,000-square-foot increase from the 2.5 million square feet that were available one year ago. CONSTRUCTION ACTIVITY Two new construction projects were completed in the first quarter at the Brewster Creek Business Park in Bartlett. A 90,203-square-foot speculative multi-tenant facility was completed on Hecht Drive while RhinoDox completed a 66,600-square-foot manufacturing plant at 1200 Humbract Circle. However, a 260,000-square-foot manufacturing facility at 1309 E. Algonquin Road in Schaumburg was demolished in the third quarter. MARKET INDICATORS Northwest Suburbs 2013 2014 VACANCY 7.38% 8.44% ABSORPTION 721,900 -466,869 RENTAL RATE $4.55 $5.13 Sunstar Americas is close to finishing its 302,000-square-foot manufacturing plant on an 80.0-acre site in Schaumburg. LEASING AND SALE ACTIVITY Leasing activity in the Northwest Suburbs fell by 10.6 percent in 2014. After witnessing total volume of 836,300 square feet in 2013, transaction volume in 2014 totaled 747,400 square feet. Creative Works’ 400,000-square-foot lease in Bartlett represented 53.6 percent of all 2014 leasing volume in the Northwest Suburbs. The Northwest Suburbs witnessed a marginal increase in sale activity in 2014 with 274,400 square feet of transactions were completed. Transaction volume in 2013 totaled 253,100 square feet. HISTORICAL TRENDS 12% 0.9 0.6 9% 0.3 0.0 6% -0.3 -0.6 3% -0.9 -1.2 -1.5 2008 2009 2010 2011 2012 2013 2014 0% Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates NET ABSORPTION Weaker user demand resulted in year-end net absorption in Northwest Suburbs of negative 466,900 square feet, a dramatic decline from the positive 721,900 square feet of net absorption registered in 2013. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Creative Works 400,000 1350 Munger Road, Bartlett Lease Stonemont Financial Group 260,000 1309 E Algonquin Road, Schaumburg Sale Hi-Grade Welding 76,867 140 Commerce Drive, Schaumburg Lease WHAT TO EXPECT IN 2015 Lease rates will stay flat in the Northwest market in 2015. Sale prices will increase based on limited availability. Alternative uses like health care and special education are anticipated to drive absorption in 2015. P. 13 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL O’Hare VACANCY AND SUPPLY The O’Hare vacancy rate fell 240 basis points in 2014 to 5.98 percent, down from the 2013 rate of 8.38 percent. This represents the largest year-over-year decline of any Chicago-area market in 2014. The last time that the O’Hare market’s vacancy rate fell below 6.0 percent was in the first quarter of 2001, when a rate of 5.32 percent was reported. O’Hare’s available supply declined sharply in 2014. After reaching 11.7 million square feet at the end of 2013, available supply measured 8.4 million square feet at year-end 2014. Users looking for big box space in the O’Hare market will have just two options above 200,000 square feet and zero above 250,000 square feet. MARKET INDICATORS CONSTRUCTION ACTIVITY Two buildings were delivered to the O’Hare market in 2014 measuring 630,500 square feet which was 21.3 percent lower than the 800,800 square feet completed in 2013. The largest development was for DHL, which moved into a 491,000-square-foot build-to-suit lease at 895 Upper Express Drive in Chicago. Additionally, Brennan Investment Group, LLC built a 139,400-square-foot speculative warehouse/distribution facility at 1780 Birchwood Avenue in Des Plaines. O’Hare 2013 2014 VACANCY 8.38% 5.98% ABSORPTION 1,343,464 3,253,708 RENTAL RATE $4.74 $5.14 Two construction projects totaling 65,800 square feet commenced construction in Des Plaines. Liberty Property Trust broke ground on a 235,800-square-foot speculative warehouse/distribution facility at 333 Howard Avenue while LSG Sky Chefs contracted IAC to build a 130,000-square-foot food processing facility at 200 Touhy Avenue. The O’Hare market’s inventory base was reduced by 289,900 square feet as 333 Howard Avenue in Des Plaines, formerly occupied by Ciba Vision, was demolished. Liberty Property Trust is expected to begin construction immediately on its planned speculative development. HISTORICAL TRENDS 4.0 14% 3.0 12% 2.0 10% 1.0 8% 0.0 6% -1.0 4% -2.0 2% -3.0 -4.0 2008 2009 2010 2011 2012 2013 2014 0% Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates LEASING AND SALE ACTIVITY Leasing activity in the O’Hare market measured 5.7 million square feet, a 13.3-percent increase over the 5.1 million square feet leased in 2013 and the metropolitan Chicago area’s highest year-over-year volume increase in 2014. Tenant demand in 2014 was driven by users in the 100,000- to 200,000-square-foot size range as nine such transactions totaling 1.3 million square feet were recorded, compared to just four transactions totaling 437,000 square feet in 2013. O’Hare’s sale volume totaled 1.0 million square feet, a 48.3-percent decrease from the 2013 total sale activity of 1.9 million square feet. The largest sale occurred when House of Spices purchased a 128,600-square-foot facility at 2121 Touhy Avenue in Elk Grove Village. NET ABSORPTION Strong tenant demand resulted in O’Hare market’s year-end net absorption of positive 3.3 million square feet, far eclipsing the 2013 outcome of 1.3 million square feet and the highest in the O’hare market it the past 10 years. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Wholesale Interiors 306,590 1010 Foster Avenue, Bensenville Lease BMAK Auctions, LLC 234,000 777 Mark Street, Wood Dale Lease Ceva Logistics 208,406 1925 Busse Road, Elk Grove Village Lease WHAT TO EXPECT IN 2015 Sales will be less prevalent in 2015 due to the limited supply. Developer interest for redevelopment opportunities will remain strong, however the current supply of projects already in process will draw developer caution. Big box users will have to look elsewhere for blocks of space greater than 250,000 square feet. P. 14 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL South Suburbs VACANCY AND SUPPLY The South Suburbs’ vacancy rate significantly improved from the 2013 rate of 9.66 percent to the year-end 2014 rate of 7.86 percent. This represents a drop of 180 basis points. Vacant space at the end of 2014 totaled 7.9 million square feet, falling an astounding 1.9 million square feet from the 9.8 million square feet vacant reported at the end of 2013. This was primarily attributed to the fact that only 2.8 million square feet of space returned to the market in 2014 versus 4.5 million square feet in 2013. CONSTRUCTION ACTIVITY Two build-to-suit construction projects were completed in 2014 adding 76,000 square feet to the South Suburbs’ inventory base. Plastics Color Corporation built a 40,000-square-foot manufacturing facility at 14201 Paxton in Calumet City and Intermodal Maintenance Group built a 36,000-squarefoot garage building at 5444 W. 73rd Street in Bedford Park. MARKET INDICATORS South Suburbs 2013 2014 9.66% 7.86% ABSORPTION 817,623 1,967,585 RENTAL RATE $4.20 $3.73 VACANCY 7035 W. 65th Street, a 437,900-square-foot manufacturing facility in Bedford Park, was demolished in the third quarter. Three buildings commenced construction in the South Suburbs that will eventually add 255,000 square feet to South Suburbs’ inventory. The largest development was a 150,000-square-foot freezer/cooler facility at 7035 W. 65th Street in Bedford Park for Professional Freezer Services. LEASING AND SALE ACTIVITY 2014 leasing volume totaled 2.9 million square feet, a 25.8-percent increase from the 2013 total of 2.3 million square feet. This represents a new all-time high for the South Suburbs. Sale activity in the South Suburbs measured 2.8 million square feet in 2014, an amazing 38.3-percent rise from the 2013 year-end total of 2.0 million square feet. The largest sale occurred when Professional Freezing Services purchased a 437,910-square-foot manufacturing facility at 7035 W. 65th Street in Bedford Park. HISTORICAL TRENDS 2.5 2.0 1.5 1.0 0.5 0.0 -0.5 -1.0 -1.5 -2.0 -2.5 -3.0 14% 12% 10% 8% 6% 4% 2% 2008 2009 2010 2011 2012 2013 2014 0% Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates ABSORPTION The South Suburbs achieved positive net absorption for the third consecutive year, reaching 2.0 million square feet in 2014. This was more than double the year-end 2013 volume of 817,623 square feet. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Professional Freezing Services 437,910 7035 W. 65th Street, Bedford Park Sale The Crown Group 330,000 6901-39 W. 65th Street, Bedford Park Sale Permasteelisa 161,740 7400-20 W. Richards Road, Bridgeview Lease WHAT TO EXPECT IN 2015 Tenant demand will be steady but not to the levels witnessed in 2014. Sale prices will increase in 2015 caused by limited supply. Rent growth is possible if tenant demand is sustained. P. 15 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL Southeast Wisconsin VACANCY AND SUPPLY Southeast Wisconsin’s vacant industrial supply measured 1.7 million square feet, falling below 2.0 million square feet for the first time since the third quarter 2006. In comparison, 2013 year-end volume totaled 2.4 million square feet – a remarkable 700,000-square-foot decline. The industrial vacancy rate in the Southeast Wisconsin market measured 3.46 percent at year-end 2014, a substantial 144-basis-point drop from the 4.9 percent vacant recorded in 2013. CONSTRUCTION ACTIVITY Southeast Wisconsin witnessed two completed build-to-suit projects and two building expansions in 2014 which added 1.6 million square feet to the total inventory base. MARKET INDICATORS Southeast Wisconsin 2013 In the second quarter, a 432,000-square-foot build-to-suit project in Sturtevant was completed for United Natural Foods and in the third quarter one build-to-suit and two building expansions were completed. KTR Capital Partners completed a 500,000-square-foot warehouse/distribution facility for Amazon.com in Kenosha; Rust-Oleum built a 250,000-square-foot warehouse addition also in Kenosha, while Kerry Ingredients & Flavours added 76,320 square feet to its manufacturing plant in Sturtevant. 2014 VACANCY 4.90% 3.46% ABSORPTION 1,112,595 2,018,320 RENTAL RATE $4.05 $3.53 An additional six new construction projects with a combined inventory of 3.0 million square feet have broken ground in the Southeast Wisconsin market. The largest of these developments is by Amazon. com who has hired KTR Capital Partners to build a 1.1 million-square-foot build-to-suit property at Kenosha Enterprise Park that the e-retailer will lease. The building is set for completion first quarter of 2015. LEASING AND SALE ACTIVITY Southeast Wisconsin leasing activity totaled 1.1 million square feet in 2014, a 15.4-percent drop from the 2013 year-end total of 1.3 million square feet. HISTORICAL TRENDS 3.0 14% 2.5 12% 2.0 10% 1.5 8% 1.0 6% 0.5 4% 0.0 2% -0.5 0% 2008 2009 2010 2011 2012 2013 2014 Amazon.com’s 500,000-square-foot build-to-suit lease at Kenosha Enterprise Park represented almost 50 percent of all 2014 leasing volume in the Southeast Wisconsin. Vacancy Rate Square Feet Absorbed (Millions) Absorption and Vacancy Rates Sale activity was impressive in the Southeast Wisconsin market in 2014 as 764,000 square feet of transactions were completed. This more than tripled the 166,995 square feet sold in 2013. ABSORPTION Swift user demand resulted in 2014 resulted in year-end net absorption of 2.0 million square feet, an impressive 900,000-square-foot improvement from the 1.1 million square feet posted in 2013. TOP 2014 TRANSACTIONS TENANT/BUYER SIZE (SF) ADDRESS TYPE Amazon.Com 500,000 SWC Highway 142 and I-94, Kenosha Lease United Natural Foods 432,000 Highway H and Hwy 11, Sturtevant Sale FNA IP Holdings 176,433 7152 72nd Ave, Pleasant Prairie Lease WHAT TO EXPECT IN 2015 Developers will continue to exercise caution in regards to building speculative product which will hold down vacancies in 2015. Rental growth will continue for well-located modern functional space. P. 16 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL FOURTH QUARTER 2014 MARKET STATISTICS Total Inventory Sq. Ft Sub-Market New Supply Came on Market Vacancy Rate Current Qtr Vacancy Rate Prior Qtr Net Absorption Current Qtr-SF Net Absorption YTD-SF Leased SF Current Qtr. Sold SF Current Qtr. Under Construction Current Qtr. Ave Annual Asking Rate/SF Ave Asking Sales Price/SF Central DuPage County 84,503,494 0 793,235 7.35% 8.36% 845,944 170,709 703,418 781,604 - $5.21 $62.55 Chicago North 89,493,780 -350,000 801,225 6.86% 6.80% (412,443) (449,188) 166,429 307,351 0 $8.37 $49.10 Chicago South 84,013,865 -5,109 1,092,313 10.40% 9.89% (499,080) 359,395 363,133 253,394 162,000 $4.33 $26.30 DeKalb County 19,981,307 0 146,325 3.79% 4.40% (39,937) (259,733) - 15,988 0 $3.29 $39.28 Elgin I-90 Corridor 29,606,392 40,000 505,739 11.75% 13.08% 421,757 753,238 451,786 447,400 1,077,278 $5.14 $54.65 Far South Suburbs 45,378,632 0 0 4.81% 5.33% 209,000 386,455 209,000 0 46,500 $3.59 $36.71 Fox Valley 90,988,100 552,775 608,519 6.83% 7.21% 834,169 1,336,341 672,530 530,214 656,078 $4.40 $48.23 I-290 North 75,829,512 -63,384 882,629 8.07% 8.68% 118,070 1,521,890 555,897 433,527 0 $4.21 $32.64 I-290 South 46,116,575 662,700 1,159,151 6.78% 5.10% (155,022) 1,285,280 315,049 16,380 226,196 $4.50 $28.69 I-39 Corridor 17,919,915 0 0 2.91% 3.08% 30,960 162,026 - 30,960 0 $2.29 $18.03 I-55 Corridor 77,624,123 991,726 2,126,314 10.86% 9.04% (569,703) 1,736,307 432,641 112,244 2,219,383 $5.07 $69.17 I-80/Joliet Corridor 73,328,562 788,526 1,035,170 9.27% 9.44% 838,621 2,738,204 971,417 101,260 2,343,915 $3.47 $54.58 Lake County 70,355,305 0 427,275 10.00% 9.96% (43,657) (72,140) 213,250 24,247 860,488 $5.19 $52.53 McHenry County 30,099,848 0 187,552 14.52% 15.00% 143,368 463,627 197,286 12,360 20,000 $4.04 $38.02 North Suburbs 56,226,169 150,070 574,943 5.36% 5.43% 149,402 (202,347) 256,496 302,379 306,448 $5.18 $56.49 Northwest Suburbs 34,058,583 0 559,040 8.44% 8.45% (9,803) (466,869) 485,111 48,220 302,000 $5.13 $60.87 O’Hare 139,589,258 340,532 965,034 5.98% 7.00% 1,726,975 3,253,708 1,944,379 376,430 365,781 $5.14 $56.43 South Suburbs 101,532,085 -691,910 279,516 7.86% 8.50% 1,160,760 1,967,585 1,603,647 1,674,672 255,000 $3.73 $30.17 Metro Chicago Total 1,166,645,505 2,415,926 12,143,980 7.91% 8.10% 4,749,381 14,684,488 9,541,469 5,468,630 8,841,067 $4.59 $46.13 Northwest Indiana 54,500,906 0 29,556 6.16% 7.16% 547,194 664,981 232,395 134,355 318,120 $3.52 $32.40 Rockford Area 52,095,970 80,000 25,000 9.22% 9.89% 422,010 934,022 268,921 26,213 435,000 $2.76 $17.81 Southeastern Wisconsin 49,977,613 308,433 488,569 3.46% 3.74% 423,321 2,018,320 197,195 73,500 3,014,738 $3.53 $31.46 GRAND TOTAL 1,323,219,994 2,804,359 12,687,105 7.73% 7.97% 6,141,906 18,301,811 10,239,980 5,702,698 12,608,925 $4.41 $43.56 QUARTERLY COMPARISON AND TOTALS Q4-14 1,323,219,994 2,804,359 12,687,105 7.73% 7.97% 6,141,906 18,301,811 10,239,980 5,702,698 12,608,925 $4.41 $43.56 Q3-14 1,320,053,725 2,102,509 9,699,511 7.97% 8.43% 7,802,102 12,159,905 9,913,838 5,530,040 15,613,944 $4.31 $43.24 Q2-14 1,317,951,216 1,393,343 11,847,098 8.43% 8.53% 1,922,549 4,357,803 9,021,292 5,194,399 12,955,527 $4.19 $44.41 Q1-14 1,316,557,873 808,987 13,752,791 8.53% 8.70% 2,435,254 2,435,254 8,510,129 4,163,516 9,867,130 $4.18 $44.04 Q4-13 1,315,748,886 2,698,924 14,261,931 8.70% 8.80% 3,153,323 12,760,948 6,867,660 6,719,920 9,800,982 $4.11 $43.14 The information contained in this report was provided by sources deemed to be reliable, however, no guarantee is made as to the accuracy or reliability. As new, corrected or updated information is obtained, it is incorporated into both current and historical data, which may invalidate comparison to previously issued reports. P. 17 | COLLIERS INTERNATIONAL RESEARCH & FORECAST REPORT | Q4 2014 | CHICAGO | INDUSTRIAL CHICAGO INDUSTRIAL SUBMARKET MAP 485 offices in 63 countries on 6 continents SOUTHEAST WISCONSIN United States: 146 Canada: 44 Asia: 38 Australia/New Zealand: 148 Latin Ameria: 25 EMEA: 84 LAKE COUNTY McHENRY COUNTY 83 45 Lake Michigan 68 12 14 41 21 62 94 59 53 90 O'HARE 294 58 www.twitter.com/ColliersChicago O'Hare Expy. inElg 20 31 20 41 90 190 CHICAGO NORTH 290 CENTRAL DuPAGE 64 DeKALB COUNTY 15,800 professionals NORTH SUBURBS/COOK Lake Cook Rd. 72 billion square feet under management 94 22 NORTHWEST SUBURBS > 1.46 60 83 ELGIN I-90 billion in annual revenue > Over 45 12 > $2.1 290 94 I-290 NORTH 53 355 90 I-88 / FOX VALLEY I-290 SOUTH 83 59 290 CHICAGO SOUTH 43 45 88 ay East-West Tollw 88 www.colliers.com/chicago 64 90 34 294 94 55 34 50 43 53 355 I-55 CORRIDOR 94 90 55 12 20 SOUTH SUBURBS 57 94 53 171 7 50 45 I-80 / JOLIET CORRIDOR 294 80 80 FAR SOUTH SUBURBS NORTH 0 1 5 10 miles NORTHWEST INDIANA RESEARCHER: George A. Cutro Vice President Research Services Colliers International Chicago 6250 N. River Road, Suite 11-100 Rosemont, IL 60018 TEL +1 847 698 8295 [email protected] 55 Accelerating success. www.colliers.com/marketname

© Copyright 2026