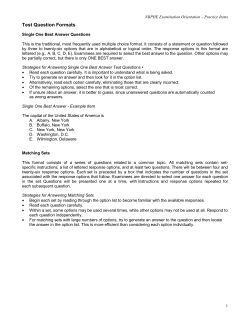

BCP H Business Continuity Planning