GUIDE TO PREPARING A RETAIL BUSINESS PLAN

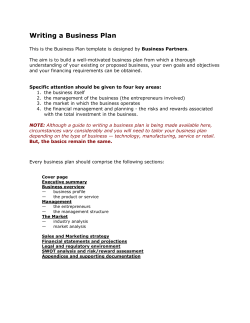

GUIDE TO PREPARING A RETAIL BUSINESS PLAN GUIDE TO PREPARING A RETAIL BUSINESS PLAN INTRODUCTION Why should you go to the trouble of creating a written business plan? There are three major reasons: 1. The process of putting a business plan together, including the thought you put in before beginning to write it, forces you to take an objective, critical, unemotional look at your business project in its entirety. 2. The finished product – your business plan – is an operating tool which, properly used will help you to manage your business and work toward its success. 3. The complete business plan is the means for communicating your ideas to others and provides necessary information to your landlord, among others. The importance of planning cannot be overemphasized. By taking an objective look at your business, you can identify areas of weakness and strength, pinpoint needs you might otherwise overlook, spot problems before they arise, and begin planning how you can best achieve your business goals. As an operating tool, your business plan helps you to establish reasonable objectives and figure out how to best accomplish them. It also helps you to red-flag problems as they arise and aids you in identifying their source, thus suggesting ways to solve them. It may even help you to avoid some problems altogether. No business plan, no matter how carefully constructed and no matter how thoroughly understood will be of any use at all unless you use it. Going into business is rough – over half of all new businesses fail within the first two years of operation; over 90 percent fail within the first 10 years. A major reason for failure is lack of planning. The best way to enhance your chances of success is to plan and follow through on your planning. Use your plan. Don’t put it in the bottom drawer of your desk and forget it. -Page 2- STATEMENT OF PURPOSE The first page of your plan should state the objectives of the plan as simply as possible. The statements should be a brief description of how you intend to support the investment you are making in the business. Keep the statement short and businesslike. It will usually be no longer than half a page, but it may be longer if necessary. Use your own judgment. TABLE OF CONTENTS The Table of Contents should follow your Statement of Purpose. The remainder of the plan is devoted to elaborating and supporting the Statement of Purpose. There are three main sections of your plan: I. The Business II. Financial Data III. Supporting Demographics These sections may be broken down further if it seems necessary to do so. It helps the reader find his or her way through a lengthy proposal if you break the Table of Contents down into subcategories. The Statement of Purpose states what your deal is. Your reader may want to turn immediately to specifics. A SAMPLE FORMAT I. II. III. THE BUSINESS……………………………………………………………………...1 A. Executive Summary…..……………………………..……………………..1 B. Description of Business……………………………………………..….….1 C. Market…….….………..………………………………………………….…1 D. Competition….………………………………………………………...……2 E. Management …….………………………………………………………….3 F. Personnel …….……………………………………………………………...3 G. Financing …….……………………………………………………………...4 FINANCIAL DATA………………………………………………………………....6 A. Sources and Applications of Funding …..…………………………….….6 B. Capital Equipment List………………..…………………………………...7 C. Pro-Forma Balance Sheet……..…………………………………………....8 D. Breakeven Analysis….……………………………………………………..9 E. Income Projections…….………………………………………………….10 1. Five Year Summary………………………………………………..10 2. Detail by Month, First Year……………………………………….11 3. Detail by Year, Second Through Fifth Years……….………..….12 4. Notes of Explanation…...…………………………………….……13 F. Pro-Forma Cash Flow…..………………………………………………..15 1. Detail by Month, First Year………………………………………15 2. Detail by Year, Second Through Fifth Years…………………...16 3. Notes of Explanation……………………………………………...17 SUPPORTING DOCUMENTS -Page 3- PART I. THE BUSINESS This is the most important part of your business plan. The objective of this section is to make a clear statement of: 1. What the business is (or will be); 2. What market do you intend to service, the size of the market and your expected share; 3. Why you can service that market better than your competition; 4. What management and other personnel are available and required for the operation; and The Executive Summary should answer these and other questions as outlined below. Remember that technical support for your business idea will be found primarily in the FINANCIAL DATA section and the SUPPORT DOCUMENTS. In this section (THE BUSINESS), reference the supporting data as needed. -Page 4- A. GUIDELINES FOR EXECUTIVE SUMMARY SECTION The following checklist is an outline you can use to make sure that important points are covered in your Executive Summary and your entire plan. These Guidelines are a suggestion. Your business may need to stress different points. If so, make sure that they are included. Description of Business 1. Business form: proprietorship, partnership, corporation? 2. Merchandising, manufacturing or service? 3. What is the product? 4. Is it a new business? A take-over? An Expansion? 5. Why will your business be profitable? 6. When is your business open? 7. Is it a seasonal business? 8. What have your learned about your kind of business from outside sources (trade suppliers, banks, other business people, publications)? The Market 1. Who is your market? DEFINE YOUR MARKET. 2. How are you going to satisfy your market’s wants? 3. How will you attract and hold your share of the market? 4. How are you going to price your product? Competition 1. Plan to keep an eye on the competition. 2. Who are your nearest competitors? 3. How is their business? 4. What have you learned from their operations? -Page 5- Location of Business 1. Plan to keep an eye on any demographic shifts in your area. 2. Why is this a desirable area? A desirable building? Management 1. How does your background/business experience help you in this business? Also, for your own benefit, what weaknesses do you have and how will you compensate for them, i.e. what related work experience have you had? 2. Who is on the management team? 3. What are the duties of each individual on the management team? 4. Are these duties clearly defined? How? 5. What additional resources have you arranged to have available to help you and your business? Personnel 1. Plan for training personnel for both operations and management. 2. Wages: Salary or hourly? Overtime? Fringe benefits? Taxes? 3. What are your personnel needs now? 4. What will your needs be in five years? Application and Expected Effect of Investment 1. How will the investment (loan or injection of other new funds) make your business more profitable? 2. Should you buy or lease equipment? 3. Do you need this money? Establish a procedure for making borrowing decisions. Plan your borrowing. -Page 6- B. DESCRIPTION OF BUSINESS The objective of this section is to explain o what your business is; o how you are going to run it; o and why you think your business will be successful. Deciding what your business is – and what it will be in five years – is the most important decision you will have to make. A small business may be involved in more than one activity: If so, the judgment of what the central activity is (or what the central activities are) is crucial. Your entire planning effort is based on your perception of what business you are in. The Description of Business includes: 1. The type of business: Is your business primarily merchandising or service? 2. The status of business: Is your business a star-up? An expansion of a going concern? A take-over of an existing business? 3. The business form: Sole proprietorship, partnership, corporation? 4. Why is your business going to be profitable? 5. When will your business open? 6. What hours of the day and days of the week will you be (are you) in operation? 7. If yours is a seasonal business, or if the hours will be adjusted seasonally, make sure that the seasonality is reflected in your replies to 5 & 6. For A New Business Your description of the business should contain responses to the following (as well as the seven items previously listed): 1. Why will you be successful in this business? 2. What is your experience in this business? 3. Have you spoken with other people in this kind of business? 4. What will be special about your business? -Page 7- Many businesses fail to take advantage of the insights and experience of possible competitors. They are your best single source of information and will often give you much valuable advice for nothing more than a chance to show their expertise. Talking with them (and observing their business practices) will also help you define what the special advantages of your own business will be. 5. Have you spoken with prospective trade suppliers to find out what managerial and/or technical help they will provide? 6. Have you asked about trade credit? -Page 8- C. THE MARKET In order to generate a consistent and increasing sales flow, you must become knowledgeable about your market – the people who will be buying your service, product, or merchandise. The basic marketing considerations are: 1. Who is your market? 2. What is the present size of the market? 3. What percent of the market will you have? 4. What is the market’s growth potential? 5. As the market grows, does your share increase or decrease? 6. How are you going to satisfy your market? 7. How are you going to price your service, product, or merchandise to make a fair profit and, at the same time, be competitive? DEFINE YOUR MARKET In marketing terminology, define your target market. Defining the target market is done in a logical fashion by considering: o who needs your service? o who needs your product? o who buys the kind of merchandise you stock? It may be necessary to change your service, product, or merchandise mix to meet the needs of the market you have targeted (Item 6) or make rational price adjustments (Item 7). Your target market, the market you have selected to serve, must be measured. Having too few customers puts you out of business. Although your business will receive cash from four sources – (1) sales, (2) loan proceeds, (3) sale of fixed assets, and (4) proceeds of new investment – it will ultimately rely on SALES as the main source of money. If there are no sales, there is no business. You can obtain information about the size of your market from the Chamber of Commerce, trade publications, marketing consultants, other business persons, schools, and colleges. An excellent source of information is the Federal Census Report which includes your area. It is best to get help in assessing the market from such sources rather than trying to guess by watching passing traffic and hoping for the best. Good marketing strategy must be planned, and it must be based on good information. -Page 9- When you have a feeling for your market, the following questions can be raised: 8. How will you attract and keep this market? 9. How can you expand your market? Items 8 and 9 are elaborations of Item 6. Item 6 should be part of your basic company policy. Items 8 and 9 bring in such ideas as how and where to advertise, the suitability of your location, and the attractiveness and comfort of your store for the clientele you hope to acquire. The second aspect of your marketing strategy (Item 7, above) concerns price: 10. What price do you anticipate getting for your product? 11. Is the price competitive? 12. Why will someone pay your price? 13. How did you arrive at the price? 14. What special advantages do you offer that may justify a higher price (you don’t necessarily have to engage in direct price competition)? In order to make a profit, a business must make more on sales than it spends (both directly, as in cost of goods sold, and indirectly, as in overhead and selling costs). Many businesses flounder because they lose sight of this simple truth. -Page 10- D. COMPETITION If you have decided on your target market and it is large enough to be profitable and contains reasonable expansion possibilities, the next step is to check out your competition, both direct (similar operations) and indirect. Consider these questions: 1. Who are your three nearest competitors? 2. How will your operation be better than theirs? 3. How is their business: steady? increasing? decreasing? Why? 4. How are their options similar and dissimilar to yours? 5. What are their strengths and/or weaknesses? 6. What have you learned from watching their operations? The objective of this section is to enable you to make your business more profitable by picking up the good competitive practices and avoiding the errors of your competitors. Carefully viewing the competition will sometimes lead you to alter your basic business strategy or change existing operations to compete more effectively. This should be an ongoing practice since markets shift and success attracts competition. In Item 1, the number of competitors (three) is a minimum. There may be more, both direct and indirect. Make sure you keep abreast of the competition on a regular basis – at least quarterly, preferably more often. -Page 11- E. MANAGEMENT According to various studies of failures of small business, roughly 98% of businesses fail because of managerial weakness; less than 2% of the failures are due to factors beyond control of the persons involved. Your business plan must take this into account. You should make sure that your landlord is aware of what steps you have taken or are taking to correct any weaknesses in your managerial staff (yourself and any other managerial persons involved); if you are to use your business plan to it’s fullest extent, you should use this segment to highlight both strengths and weaknesses of management for your own sake. In preparing the MANAGEMENT section, there are five areas to be covered: 1. Personal History of Principles 2. Related Work Experience 3. Duties and Responsibilities 4. Salaries 5. Resources Available to the business The aim is to spot areas of potential weakness before problems caused by them arise and put you out of business. 1. Personal History of Principles This segment should include responses to the following questions: 1. What is your business background? 2. What management experience have you had? 3. What education have you had (including both formal and informal learning experiences) which have bearing on your managerial abilities. 4. Personal data: age; where you live and have lived; special abilities and interests; reasons for going into business. The personal data needn’t be a confession, but it should reflect where your motivation comes from. Without a lot of motivation, your chances of success are slight. It pays to be ruthlessly honest with yourself – even if you don’t put the results on paper. 5. Are you physically up to the job? Stamina counts. 6. Why are you going to be successful at this venture? -Page 12- Keep in mind that your family will be affected by your decision to go into business for yourself and try to assess the potential fallout; while they may be supportive now, will they continue to be? 7. 2. A personal financial statement must be included as a supporting document in your Business plan. Related Work Experience This segment is a detailed response to the experience factors mentioned earlier. It includes (but is not limited to) responses to the following: 1. Direct operational experience in this type of business; 2. Managerial experience in this type of business; 3. Managerial experience acquired elsewhere – whether in totally different kinds of businesses or as an offshoot of club or team membership, civic activities, church work, or some other. 3. Duties and Responsibilities Once you have written down the experience and skills (and have a feel for the weaknesses) of the proposed management, this segment becomes much simpler. Follow the rule: ALWAYS BUILD ON STRENGTHS AND SEEK TO ALLEVIATE WEAKNESSES Attempting to make a sales manager out of your star salesman may also be folly. Use skills to advantage. The scarcest asset you will have is time. To make the most of it, make sure that you budget your time carefully by spelling out, in advance, o who does what; o who reports to whom; and o where the financial decisions get made. Include: 1. Time for planning and reviewing plans 2. Major operating duties (purchasing, sales, personnel, promotion, production, and so forth as appropriate for your business. 3. Planning. -Page 13- The purpose of your plan is to make your business run more smoothly. If you find you spend a lot of time solving yesterday’s problems, stop, get out of the shop, sit down and start planning so you don’t perpetually run in circles. Allocating duties and responsibilities is critical. If the chain of command is unclear to your employees, you will have the worst kinds of personnel problems. This is a major responsibility of management and must not be evaded under the guise of “we can work it out later when we see where the problems are.” 4. Salaries A simple statement of what the management will be paid is sufficient. Just remember, cut the fat from your personal budget, add 15% for contingencies, and then stick to it. Be realistic about salaries, but don’t be greedy. The payoff comes in the future – after the business becomes successful. Knowing what you need, as distinguished from thinking you know what you need, takes effort – but one sure way to damage a small business is to bleed it for family necessities. If your business can’t afford to pay a living wage, and you have no other income or savings, you had better think your deal over again. 5. Resources available to the business ALL businesses, no matter how tiny, need: 1. An accountant 2. A lawyer 3. An insurance broker If you don’t have these, get them immediately!! Other sources of assistance include: 4. Business Information Centers 5. Chambers of Commerce, Regional Planning Commissions and Councils 6. Business, trade, civic organizations often have a pool of talent available to their members 7. Small Business Administration technical assistance, ACE and SCORE programs 8. Consultants 9. Colleges, universities, schools -Page 14- 10. Federal, state and local agencies 11. Your board of Directors (if appropriate) 12. Your landlord You won’t necessarily have to use all of these resources (except the lawyer, accountant and insurance broker), but it is a good idea to know what help will be available if you need it, and to know where it is ( and who it is) well ahead of time. By listing these resources, and making yourself known to them, you can plug many gaps in your experience and increase your chances of success. Many of them will cost you no more than time and a phone call. -Page 15- F. PERSONNEL Businesses stand or fall on the strength of their personnel. Good employees can make a marginal deal go; poor employees can destroy the best business. Studies have consistently shown that out of 100 customers who stop patronizing the average store, over 70 do so because they didn’t get prompt, courteous attention. Here are some questions to think about in determining your hiring needs: 1. What are your personnel needs now? In the near future? In five years? 2. What skills must they have? 3. Are the people you need available? 4. Full or part-time? 5. Salaries or hourly wages? 6. Fringe benefits? 7. Overtime? 8. Will you have to train people? If so, at what cost to the business (both time of more experienced workers and money)? Be careful – training personnel can be a hidden cost that you have not counted on. One excellent personnel control is the job description. Hire people only when it will result in added profitability to your business, and think before hiring whether the job is really necessary. If it is, then careful selection of a person to fill the job will more than repay the time and effort involved in hiring the best person for that job. There are standard application forms you may find useful in the selection process. You should also check with the SBA for their booklets on personnel management as well as your local Department of Employee Security and perhaps get a copy of “Personnel for the Small Business” from the Small Business Reporter, Department 3120, Bank of America, San Francisco, California 94120. -Page 16- G. FINANCING This section is important, whether you are seeking a loan or planning to finance your deal yourself. In determining how much money you’ll need and for what purposes it will be used, do not rely on guesses when exact prices or firm estimates are available. If you must make an estimate, specify how you arrived at your figures. It may be helpful to make a three-column list: Bare Bones What you can just scrape by with – second-hand, makeshift – the bare minimum. Reasonable What you will most likely get – some new some used, some fancy and some plain. Optimal What you’d like if money were no problem and you weren’t worried about making a profit. Examples: Examples: Examples: Bicycle with large basket (Schwinn ’52 at $12.50) Pick-up truck with camper (used Ford at $1,885) Custom-made El Dorado (Cadillac custom at $18,500) Used desk at $7.00 Renovated desk at $25 Custom teak desk at $750 Fill out the Bare Bones and Optimal columns first, then make your reasonable choice. It may be important to you to have a luxury item or two, but weigh the cost. This tabular worksheet is particularly useful for a start-up business and can be used whenever a purchase of additional equipment is contemplated. Make sure that this section contains responses to the following: 1. How is the loan or investment to be spent? This can be fairly general (working capital and new equipment, inventory, supplies). 2. What is (are) the item or items to be bought? 3. Who is the supplier? 4. What is the price? 5. What is the specific model name and/or number of your purchase(s)? 6. How much did you (will you) pay in sales tax, installation charges, and/or freight fees? -Page 17- You should consider the possible advantages of leasing some of the capital equipment you need. Most importantly, ask yourself: 7. How will the investment (loan or equity) make your business more profitable? Interest is an expense which reduces profits. If you propose borrowing money or investing your own, you must know how the money is going to work for you. MAKE SURE IT EARNS MORE THAN IT COSTS -Page 18- PART II. FINANCIAL DATA Projections or forecasts are an integral part of your FINANCIAL DATA, and are critical to accurately evaluating the feasibility of your deal and to planning just how large an investment is required to get the business to a stable level of operation. Your assumptions must be carefully thought out and explained. Be honest here for your own benefit. Over-optimism can lead to failure. The following items should appear in the FINANCIAL DATA section: A. B. C. D. E. F. Sources and Applications of Funding Capital Equipment List Balance Sheet Break-even Analysis Pro Forma Income Statements Pro Forma Cash Flow Analysis -Page 19- A. SOURCES AND APPLICATIONS OF FUNDING This subsection is an essential part of your BUSINESS PLAN. It is a restatement of the information in part “G. FINANCING.” Major anticipated expenditures should be supported by copies of contracts, lease and/or purchase agreements, or similar documents and included in the APPENDIX. -Page 20- SAMPLE Cash Flow Sources and Applications of Funding SOURCES Bank Loans: 1. 2. 3. 4. Mortgage Loan………………………….………………………………………………$22,000 Term Loan………………………….……………………………………………………..10,700 Reserved Loan………………………………….…………………………………………3,300 Owners Investment…………………………….…………………………………………5,000 TOTAL………………………………….……………………………………………….$41,000 APPLICATIONS Purchase Equipment……………………………………………………………………….$22,000 Tenant Improvements………………………………………………………………………...4,000 Inventory…………………………………………………………………………………………700 Working Capital……………………………………………………………………………….6,000 Reserve for Contingencies…………………………………………………………….………8,300 TOTAL……………………………………………………………………………...$41,000 To be secured By Assets of the Business Signatures of the Principals -Page 21- B. CAPITAL EQUIPMENT LIST Your BUSINESS PLAN should contain a “Capital Equipment List” to help maintain control over depreciable assets, insure against letting your reserve for replacement of capital equipment become too low (or be used as a slush fund), and assist in the creation of a cost accounting system. Capital equipment is that equipment which you use to provide a service, or use to sell, store, and deliver merchandise. It is not equipment that you will use and wear out or consume as you do business (this does not include items which are expected to need replacement annually or more frequently). Examples of capital equipment are office furniture and business machines (desks, typewriters, adding machines), store fixtures (display cases, refrigeration units, permanent fixtures such as air conditioners, lighting fixtures), and vehicles utilized for deliveries. None of this type of item is expected to wear out before a period of years. These goods are depreciable, and their cost is expressed as “depreciation” expense on the income statement. -Page 22- C. BALANCE SHEET BALANCE SHEETS are designed to show how the assets, liabilities, and net worth of a company are distributed at a given point in time. The format is standardized to facilitate analysis and comparison – do not deviate from it. Balance sheets for companies, great and small, contain the same categories. The difference is one of detail. Your balance sheet should be designed with your business information needs in mind. These will differ according to the kind of business you are in, the size of your business, and the amount of information which your accounting system makes available. -Page 23- SAMPLE Retailer December 31, 20— Balance Sheet ASSETS Current Assets Fixed assets Less Accumulated Depreciation Net Fixed Assets Total Assets Footnotes LIABILITIES Current Liabilities Long–term Liabilities Total Liabilities Net Worth Total Liabilities and Net Worth -Page 24- The Categories can be defined more precisely. However, the order of the subcategories is important and should be followed. They are arranged in order of decreasing liquidity (for assets) and decreasing liquidity immediacy (for liabilities). A brief explanation of each principal category follows: 1. Current Assets: cash, government securities, marketable securities, notes receivable (other than from officers or employees), accounts receivable, inventories, prepaid expenses, any other item which will or could be converted into cash in the normal course of business within one year. 2. Fixed Assets: land, plant, equipment, leasehold improvements, other items which have an expected useful business life measured in years. Depreciation is applied to those fixed assets which (unlike land) will wear out. The fixed asset value of a depreciable item is shown as the net of cost minus accumulated depreciation. 3. Other Assets: intangible assets such as patents, royalty arrangements, copyrights, exclusive use contracts, notes receivable from officers and employees. 4. Current Liabilities: accounts payable, notes payable, accrued expenses (wages, salaries), taxes payable, current portion of long-term debt, other obligations coming due within the year. 5. Long-term Liabilities: mortgages, trust deeds, intermediate and long-term bank loans, equipment loans. 6. Net Worth: owner’s equity, retained earnings. 7. Footnotes: you should provide displays of any extraordinary item (for example, a schedule of payables). Contingent liabilities (such as a pending lawsuit) should be included in this section. If you need to provide more detail, do so, but remember to follow the standard format. If your balance sheet is assembled by an accountant, he will specify that it was done with or without audit. -Page 25- D. BREAK-EVEN ANALYSIS A Break-even Analysis provides you with a sales objective which is expressed in either the number of dollars or units of production at which your business will be breaking even, that is, where it is neither making a profit nor losing money. If you know your break-even point, you have a definite target that you can plan to reach by carefully reasoned steps. Many businesses have destroyed themselves by ignoring the need for a break-even analysis. It is essential to remember: INCREASED SALES DO NOT NECESSARILY MEAN INCREASED PROFITS Calculating the break-even point can be simple (for a one-product business) or complex (for a multi-line business) but whatever the complexity, the basic technique is the same. Some of the figures you need to calculate the break-even point will have to be estimates. It is a good idea to make your estimates conservative by using somewhat pessimistic sales and margin figures and by slightly overstating your expected cost figures. The basic break-even formula is: S = FC + VC Where S = Break-even level of sales in dollars FC = Fixed costs in dollars VC = Variable costs in dollars FIXED COSTS are those which remain constant no matter what your sales volume may be,* those costs which must be met even if you make no sales at all. These include overhead (rent, insurance, office and administrative costs, salaries, etc.) and “hidden costs” such as interest and depreciation. VARIABLE COSTS are those costs associated with sales including cost of goods sold, variable labor costs and sales commissions. When you want to calculate a projected break-even and you therefore do not know what your total VC will be, it is necessary to use a variation of the “S = FC + VC” formula. If you know what gross Margin (profit on sales) you expect as a percent of sales, the following formula can be used: S = FC / GM Where GM = Gross Margin as a % of sales If, instead of calculating a dollar break-even, you want to determine how many units you need to sell to break even, you simply divide the break-even derived above in dollars by the unit price to get the number of units to be sold. * These costs remain constant in a relevant range. However, if at a greatly increased sales volume you need more space, your fixed costs will rise. “F” and “V” have been notated on the extreme left-hand margin to indicate which types of costs are fixed and which are viable. -Page 26- EXAMPLE Break-even Analysis Fixed Costs = $14,700 (per an.) Variable Costs = 79.3% Gross Margin = 20.7% Thus, BE = FC / GM BE = $14,700 BE = $71, 014.5 BE/Month = $5,917.87 -Page 27- Customers needed per month at BE: Assumptions: Average Unit Selling Price $3.00 Average Customer Repeat Sales = 2 X /Week 4.3 weeks/month – Thus: Average Customer Sale/Month Thus: Customers needed at BE = $3.00 6.00 25.80 230 / month 7.6/day Break-even analysis also may be represented pictorially, and the diagram helps with forecasts, budgets, and projections. Using a chart enables you to substitute different combinations of numbers to obtain a rough estimate of their effects on your business. A helpful technique is to make worst case, best case, and most probable case assumptions, to chart them and then derive more accurate figures by applying the formulas suggested above. This can be of special value if you are contemplating a capital investment and want a quick picture of the relative merits of buying or leasing an item. To make maximum use of your break-even analysis, utilize it in areas other than sales; you have more control over your expenditures than you do over sales.* *Break-even analysis can be directly applied to profit-planning by modifying the basic formula, S = FC + VC. The formula for this calculation is: S = FC + VC + P. Here, P stands for Profit. Suppose you wish to determine the volume of sales at which you will make a particular profit. Using P = S – FC – VC, you will be able to figure the amount of sales you need. -Page 28- E. PRO FORMA INCOME STATEMENT INCOME STATEMENTS, also called PROFIT & LOSS STATEMENTS, are complimentary to balance sheets. The balance sheet gives a static picture of the company at a given point in time. An income statement provides a moving picture of the company over a particular period of time. Income statements that are cast into the future are called INCOME PROJECTIONS. Income projections are forecasting and budgeting tools estimating income and anticipating expenses in the near to middle range future. For most small businesses, income projections covering the next three years are adequate, however if your lease term is 10 years, it is recommended a ten year projection be made. You do not need a crystal ball to make your projections. While no set of predictions will be 100% accurate, experience and practice tend to make your projections more precise. Even if your projections are not accurate, they will provide you with a set of benchmarks to test your progress toward short-term goals. They become your budget. There is nothing sacred about income projections. As you begin your business and find them not exact, correct them to make a more realistic guide. However, at what point you should do this is a matter for your judgment. Do not expect to change your predictions more than quarterly or even semi-annually. In a short period, certain trends will be magnified, and these distortions will usually even out in the long run. Of course, if you omit a major expense item or a new source of revenue you ought to make immediate corrections, but use your common sense. The reasoning behind income projection is: Since most expenses are predictable and income doesn’t fluctuate too drastically, the future will be much more like the past. If, for example, you have been operating a similar business at another location and your gross margin has historically been 30% of net sales, it will (unless there is strong evidence to the contrary) continue to be 30% of net sales. If you are in a start-up situation, you can find income ratios for businesses similar to yours (Dun & Bradstreet and Robert Marris Associates, for example). This will improve the accuracy of your financial forecast. It is important to be systematic and thorough when you list your expenses. The expense that makes your business illiquid is often one which is overlooked, and therefore, unplanned for. There are some expenses that simply cannot be foreseen, and the best way to allow for them is to be conservative in your estimates and document your assumptions. Try to slightly understate your expected sales and overstate your expected expenses. It is far better to exceed a conservative projection than to budget optimistically and then fall below the projected margins. However, being too far under can also create problems – such as not having adequate cash to finance growth. Basing income projections on hopes is a frequent cause of business failure. Be realistic; your budget is intimately tied to your forecasted sales and expense figures. Income projections are standardized to facilitate comparison and analysis. They must be dated to indicate the period of time they cover and should also contain notes to explain any unusual items such as windfall profits, litigation expense and judgments, changes in depreciation schedules, and so forth. Any assumptions you make must be footnoted. *Pro Forma simply means “projected.” It represents what the business is expected to look like at some specified time in the future. -Page 29- SAMPLE Pro Forma Income Statement October 15, 20-- - October 14, 20— (1) NET SALES (2) Less: COST OF GOODS SOLD (3) GROSS MARGIN (4) OPERATING EXPENSE Salaries & Wages Payroll Taxes & Benefits Rent Utilities / CAM Maintenance Office Supplies Postage Automobile & Truck Maintenance Delivery Equipment Insurance Legal & Accounting Depreciation Promotions/Advertising Miscellaneous OPERATING EXPENSE TOTAL OTHER EXPENSE: Interest Payments (5) OTHER EXPENSE TOTAL (6) TOTAL EXPENSE: (7) PROFIT (LOSS) PRE-TAX (8) TAXES (9) NET PROFIT (LOSS) -Page 30- Explanation of Sample (1) NET SALES: Gross Sales less returns and allowances. (2) COST OF GOODS SOLD: Includes cost of inventories. (3) GROSS MARGIN: GROSS SALES minus COST OF GOODS SOLD. Represents the gross profit on sales without taking indirect costs into account. (4) OPERATING EXPENSE: These are primarily the costs (when added to OTHER EXPENSE) which must be met no matter what the sales level is. The order in which they are stated is not so important. Thoroughness is. If some costs are trivial, lump them together under a heading of MISCELLANEOUS but be prepared to break them out if the MISCELLANEOUS category becomes more than an arbitrary 1% of GROSS SALES. (5) OTHER EXPENSE: These are non-operating expenses. The most common is Interest expense. It is helpful to have the Interest expense prominently displayed to highlight the cost of money. (6) TOTAL EXPENSE: Sum of (4) and (5). (7) PROFIT (LOSS) PRE-TAX: GROSS MARGIN minus TOTAL EXPENSE. This is the tax base, the figure on which your tax is calculated. (8) TAXES: Consult your accountant. (9) NET PROFIT (LOSS): (7) MINUS (8). This represents the success or lack thereof for your business. There are three ways to make this figure more positive: increase sales, or decrease expenses, or both. For the most useful projections: STATE YOUR ASSUMPTIONS CLEARLY. DO NOT PUT DOWN NUMBERS THAT YOU CANNOT RATIONALLY SUBSTANTIATE. Do not puff your GROSS SALES figures to make the NET PROFIT figure positive. Give yourself conservative SALES figures and a pessimistic EXPENSE figure to make the success of your deal more probable. BE REALISTIC. -Page 31- F. PRO FORMA CASH FLOW The CASH FLOW projection is the most critical planning tool for a new or growing business. Businesses need cash for start-up or growth. The cash flow analysis: 1) shows how much cash will be needed, 2) when it will be needed, and 3) where it will come from. The CASH FLOW projection attempt to budget the cash needs of a business and shows the flow of cash into and out of the business over a period of time. Cash flows into the business from sales, collection of receivable, capital injections, etc., and flows out through cash payments for expenses. This financial tool emphasizes the points in the calendar when money will be coming into and going out of the business. The advantage of knowing when cash outlays will be made is the ability to plan for those outlays and not be forced to resort to unexpected borrowing to fulfill cash needs. By constructing a cash flow projection for the near to intermediate future, you can see the effect of an investment in your business more clearly than you can from an income statement. Often, you can find ways to finance your business operations or to only borrow a specific amount which will help you to keep your interest expense as low as possible. Cash is generated primarily by sales. However, not all sales are cash sales. Perhaps this does not apply in your business, but if you offer any credit (charge accounts, term payments, trade credit, etc.) to your customers, you may want to have a means of telling when your sales turn into cashin-hand. Unlike the income projection, the cash flow can indicate this. Your business may be subject to some seasonal bills, and again, a cash flow makes the liquidity problems attending such large occasional expenses clear. A cash flow deals only with actual cash transactions. Depreciation, a non-cash expense, does not appear on a cash flow. Loan repayments (including interest), on the other hand, do since they represent a cash disbursement. After it has been developed, the cash flow should be used as a budget. If the expenses for a given item increase over the amount allotted for a given month, you should find out why and take corrective action as soon as possible; if the figure is less, then also find out why. By reviewing the movement of your cash position you can better control your business. If expenses are lower than anticipated, it is not necessarily a good sign; it may be that a bill wasn’t paid. On the other hand, the lowered expense may alert you to a new way of economizing. Discrepancies between expected expenses and revenue and the actual flow of cash are indicators of problem or opportunity areas. If the sales figures don’t follow the cash flow, look for the cause. Perhaps the projections are too low. Your CASH FLOW projection is not a universal cure which will make your job as manager or owner superfluous. It is a tool which you must use and use consistently. In contrast to balance sheets and income statement, there is no standardized form to follow in devising a cash flow. The following sketch and outline can be used as a guide for the development of a cash flow projection that fits your business. -Page 32- Cash flow Outline: The first year cash flow projection is basically your budget for the first year of operation. -Page 33- Cash Flow Sketch: 1. Cash at the beginning of period Add Revenues 2. Sales of products to be collected currently 3. Cash to be received from other sources 4. Cash received from prior period sales 5. Cash received from assets sold 6. Cash received from equity investment 7. Cash received from loans 8. Cash from bad debts recovered 9. Miscellaneous cash received Total Cash Received Subtract Expenses 10. New inventory purchased 11. Salaries/ Wages to be paid 12. Fringe benefits to be paid 13. New Equipment to be purchased 14. processing equipment 15. office, sales equipment 16. transportation equipment 17. Insurance 18. Fees 19. accounting 20. legal 21. Utilities 22. telephone 23. heat, light, power 24. Advertising 25. Principal & Interest on debt 26. Transportation 27. oil, gas 28. vehicle maintenance 29. tires 30. Freight 31. Provision for bad debts 32. Taxes to be paid 33. income (state, federal) 34. property/excise 35. payroll 36. sales 37. Dividends to be paid 38. Provision for unforeseen contingency Total Expenses Cash at end of period This is a handy addition to your cash flow: APPLICATION OF FUNDS STATEMENT Use of Funds Total Amount Required From Equity From Loan In most cases, spreading the use of cash in this manner for major acquisitions will make your decisions stronger. -Page 34- G. HISTORICAL FINANCIAL REPORTS (For existing Businesses) Please attach a balance sheet and income statement (independently prepared with footnotes, if available) for each of the three most recent full years of operation of your business. Also, please attach copies of your three most recent Federal Tax Returns. -Page 35- PART III. SUPPORTING DOCUMENTS You will want to include any documents which lend support to statements you have made in the body of the buiness plan. Items included here will vary according to the needs and stage of development of your particular business. The following list suggests some things which might be included: 1. Resumes of principals, owners and partners (very important). 2. Credit information on each of the above. 3. Copies of personal tax returns for each of the above. 4. Quotes or Estimates. 5. Letters of Intent from prospective customers. 6. Letters of Support from creditable people who know you. 7. Leases or Buy/ Sell Agreements. 8. Legal Documents relevant to the business. 9. Market data. -Page 36-

© Copyright 2026