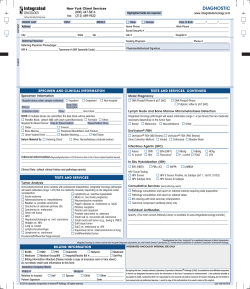

Medicare Part B Enteral Nutrition Reimbursement Manual