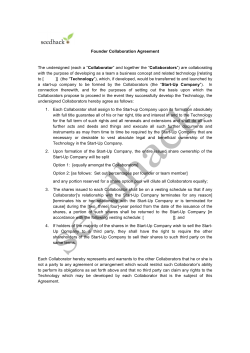

H : T B P