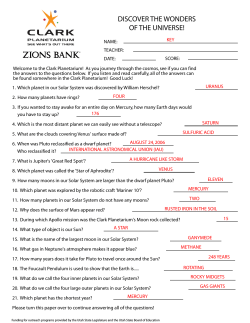

B u s i