The Model Code Background - ACI The Financial Markets Association

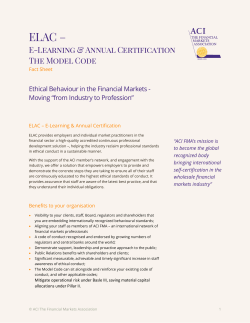

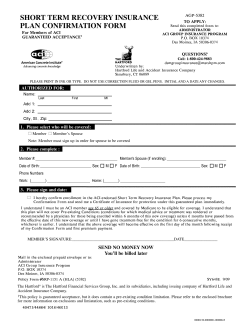

Ethical Behaviour in the Financial Markets Industry Moving “From Industry to Profession” Management Summary The financial services industry is facing a severe challenge in the aftermath of the global crisis and a number of fixing/benchmarking scandals. Demonstrating best practice to the Board, clients, shareholders, staff and general public is of prime importance. ACI Financial Markets Association (ACI FMA) can be the perfect partner to assist you with this, both within your country of residence, and globally. ACI FMA has an existing asset in The Model Code of Conduct that sets out both a wider code of conduct as well as a large number of specific examples as to how professionals in the wholesale markets should behave. The Model Code is endorsed by a number of regulators and central banks, and is acknowledged as the current definition of best practice. To support the ACI FMA in continuing to promote best practice, and to visibly demonstrate its commitment to the highest expectations of ethical conduct, puts you in a leadership position relative to your local and international clients and regulators. functions across jurisdictions the ACI FMA has targeted institutions to sign-up for ELAC to enable this work. ELAC – ACI’s eLearning & Annual Certification Portal allows institutions to embed The Model Code within their wider compliance-learning programme and offers a true up-to-date transparent “industry sourced” compliance continuous learning portal helping institutions to recognize the risks and actively implement the necessary cultural change in financial markets. ELAC can be implemented alongside existing in-house learning as a ‘standard’ that crosses geographies and institutional approaches, in the sure knowledge that regulators and central banks across the world are recognising this as a behavioural standard. This is far more than developing an elearning tool. At a time of poor public perception regarding behaviour within the wholesale markets, the ability to point to a neutrally recognised ‘badge’ that demonstrates most strongly the institution’s support of a global behavioural standard is of immense value. Institutions that are visible in their concrete actions to assist the industry will be rewarded in numerous ways. In sponsoring and supporting the ACI FMA, eligible industry staff can benefit from the individual membership scheme, with a wide variety of local ways to participate. Institutionally, will be recognised among the emerging leaders on ethical conduct, and appreciated for its commitment to this area. This is what ACI FMA offers to Industry. In order for the Model Code to be developed on an ongoing basis, as well as to be made available to compliance Background Conduct risk is of keen interest currently and many institutions are wrestling with how best to best mitigate the risk, and enhance their individual staff accountability and awareness. This is less straightforward than it may at first appear, as it is less about a single piece of legislation and more about elements of others such as Markets Abuse Directive (MAD) in EU or the Dodd-Frank Act in the US, or indeed codes of conduct that have been published by the authorities in their jurisdictions. Many have acknowledged the ACI FMA Code of Conduct as the basis for a global approach. (example: Global Preamble – Global FX Committees. © ACI The Financial Markets Association Following the fines and other sanctions that are attached to the LIBOR investigations, and the alleged wrongdoings that are subject to investigation in the FX fixings area, the behaviour of front office staff is under a focused scrutiny. Coupled with the new more high-profile approach that regulators are taking around the world, with record fines and the threat of management being held personally responsible, it is no surprise that conduct risk is high on the agenda. Educating staff on the correct ethical standards, based both upon fundamental guiding principles as well as actionable process, is required. A management-led programme must be in place. There are technical elements such as monitoring of chat conversations, education and testing of staff to demonstrate that they understand and subscribe to a code of behaviour and the deeper cultural change that becomes embedded within the firm’s cultural DNA. The ACI FMA is positioned to help mitigate at least part of this risk and in doing so, help financial institutions address the challenge of how to demonstrate best practice, both to their regulators and to the wider public. 1 ACI FMA The ACI FMA is a leading non-profit, nonpolitical association of wholesale financial market professionals. Members of ACI FMA are for the most part engaged in professional trading, broking, operations, regulatory and compliance activities in foreign exchange, money, fixed-income and derivatives markets. ACI was founded in Paris in 1955 as Association Cambiste Internationale and has a proud and illustrious history of helping its membership through various market iterations/interactions. ACI FMA currently counts some 13,000 international members from 68 countries, with growing interest globally. A significant difference between ACI FMA and other associations is that ACI FMA has individual (not institutional) membership. This is a clear differentiator and means that ACI FMA is not constrained as only a “banking industry voice” but provides supportive training for the buy-side and the sell-side.. There are three core benefits that ACI FMA brings to the industry: • • • ACI Code of Conduct – The Model Code - with testable and practical applications Education on best practices Professional networking opportunities Professional networking is a visible ACI FMA benefit, connecting members to a global expanse of clients and fellow practitioners and is well recognised. The ACI FMA suite of education examinations is recognised by many jurisdictions, and in some is a prerequisite for an individual to begin trading in their wholesale markets. The education suite includes the Dealing Certificate and Operations Manager Certificate, both of which have long included a proportion of the exam that examines the ACI FMA Model Code of Conduct. This provides evidence to interested parties of the importance placed on the highest standards of practice and ethical conduct. The Model Code is a global industry standard, officially endorsed by over 15 countries’ central banks/regulators, with active participation in its maintenance by all sides of the industry via the ACI FMA Committee for Professionalism (CFP). The Model Code is monitored and maintained by the CFP and includes members from banks, brokers and customers. Additional feedback and suggestions are submitted from central banks and regulators. Here is an illustration of the ACI’s Code of Conduct: The Model Code benefits when compared with the other forms of codes in various jurisdictions Attributes The Model Code NIPS Code FED NY JSC Tokyo Code “Bankers” Oath Individual Bank Codes Y some Up-to-date 2015 Y Up-to-date in 2010-14 Y Regionally accepted by members Y Y Y Y Globally accepted by members Y N N N N Written by a diverse group of constituents Y Governed by non-partisan, non-profit organisation Y Y Y Y Y Accepted by over 13,000 professionals Y Directly applies to FX and other OTC markets Y Y Y Y Y Y Y Regionally focussed Code Globally focussed Code Y Has positive impact on “frontier markets” Y Provision made for training and education Y Continuous self-certification available Y Rigorous exam on code of conduct publically available Y Used as basis for many other codes Y Directly addresses recent conduct issues Y Written with commercial incentives in mind N © ACI The Financial Markets Association Y Y Y some some N N N Y 2 RECENT PRESS February 19, 2015 City of London ‘black book’ is called for to track ‘bad apple’ traders ...information about traders who break rules, in order to prevent “badapples...one firm to another, a group of industry...proposal for an industry-wide “black book” recording why traders leave a company is one ofthe...cleaning up the City of London from a panel... Martin Arnold and Caroline Binham in London “Ms Corley says the key areas of focus are the structure of the fixed income, currency and commodity markets and the conduct of traders, which make up a big chunk of activity in the City and other financial centres. She has no doubt that trader conduct is the area in need of most attention. “Changing the attitudes of managing directors and those on the first line of defence on the trading floor is absolutely key,” she added. However, she plays down the idea of establishing a licensing regime for traders or a professional standards system requiring them to all take exams to qualify. “We are not saying it’s a bad idea but we are saying it’s not the panacea. Many of these issues we face are not technical qualification issues, they are conduct and ethical issues.” Instead, she recommends that traders are required to make an annual attestation that they have complied with their code of conduct — preferably one that is included in their employment contract. She says the approved persons register, which is in the process of being replaced by regulators, should be maintained and improved as a vehicle for the industry to share notes on “bad apples”. She also calls for the establishment of an industry-financed body to develop common codes and standards for the sector. Ideally, these could also be promoted globally”. bba 4th February 2015 British Bankers Association: “licence to trade” qualifications and tougher codes of conduct will strengthen trust in financial markets The BBA supports the objectives of the review and sees reform as vital to restore trust and confidence in financial markets and believes it is important for the UK to play a leading role in shaping the global agenda. As such the BBA submission makes a number of positive proposals for policymakers to consider: “Licence to trade” qualifications for all in financial markets. The BBA believes that everyone undertaking activity in wholesale FICC markets should be required to pass exams and become professionally qualified. This would not need to be one single qualifications for all markets but policymakers should work with the industry to identify which qualifications should be recognised as giving a “licence to trade”. Giving “teeth” to codes of conduct. Global principles should be implemented nationally and explicitly endorsed by regulators so that they are given “teeth”. These should then be integrated into company and board mission statements, job descriptions and remuneration policies, with proof of continuing adherence for individuals being required in annual appraisals, promotion requisites or mandatory regular face-to-face training courses. © ACI The Financial Markets Association 3 How it works: Step One: Sign up eligible staff for membership in ACI FMA, either via their National Association (if possible) or as a Direct member in ACI FMA International. Step Two: Sign up eligible staff for the ACI ELAC Portal, and begin seeing the benefits of the behavioural education. Step Three: Engage with the ACI FMA internationally across any of a number of networks, working groups, formal ACI FMA Committees, or participate in our on-going education Contact ACI FMA to discuss further. All discussions are confidential. Contact ACI FMA Latin America www.acifma.com/latinamerica [email protected] www.acifma.com ACI – The Financial Markets Association 8 Rue du Mail, Paris 75002, France Marshall Bailey, CFA, President ACI [email protected] Tel: +33 1 42 97 51 15 (Paris) Tel: +44 207 537 6250 (Londres) © ACI The Financial Markets Association 4

© Copyright 2026