Tax Strategies & Business Planning for 2014 Seiler Insights

Tax Strategies & Business

Planning for 2014

Seiler Insights

February, 2014

Expired Tax Provisions

Over fifty “temporary” tax breaks expired at the end of 2013, some of which are outlined below:

Exclusion for qualified small business stock

Investors could sell stock of qualified small businesses (acquired after 9/27/2010) and exclude 100% of

the gains from being included in income. This 100% exclusion expired at the end of 2013. Starting in

2014, only 50% of gains can be excluded. Small business stock is stock in a small C-corporation where

the stock has been held for at least five years.

Provisions relating to depreciation

For tax years beginning in calendar year 2014 and beyond, one major tax break for assets used in

business has been drastically reduced. Also, for most assets placed in service in calendar year 2014

and beyond, another tax break is scheduled to be completely eliminated. Specifically, “expensing” under

Code Sec. 179 (a 100% first-year write-off) is drastically reduced from 2013 levels, and additional

enhanced first-year depreciation (bonus depreciation) is, for most assets, completely eliminated. As

more fully discussed below, the reduction in Code Sec. 179 expensing impacts, generally, only smaller

businesses, and the elimination of bonus depreciation is, generally, but not exclusively, of interest to

larger businesses.

Reduction in Code Sec. 179 expensing

Code Sec. 179 expensing is available, on an elective, asset-by-asset basis, for the following types of

property, whether new or used (“section 179 property”): machinery, equipment, and other tangible

personal property; most publicly sold computer software; some non-building land improvements; and

some limited types of building improvements and buildings (certain leasehold, retail and restaurant

improvements, and restaurant buildings).

For tax years (whether calendar or fiscal) beginning in 2013, the election is available for up to $500,000

of section 179 property per year (the dollar limit). The dollar limit is reduced, dollar for dollar, to the

extent that the taxpayer's total section 179 property placed in service during the year is more than $2

million (the phaseout rule). Expensing of the limited types of building improvements and buildings

described above is subject to a $250,000 limit (in addition to counting against the $500,000 per-year

limit).

For tax years (whether calendar or fiscal) beginning in 2014, the above benefits are drastically reduced.

Thus, the dollar limit would be $25,000 and the beginning-of-phaseout level would be $200,000.

Additionally, the computer software and limited types of building improvements and buildings described

above would no longer qualify as section 179 property.

Bonus depreciation

50% bonus depreciation applies, subject to an election-out on a depreciation-class-by-depreciation class

basis, to the following types of new (not used) property (“qualified property”): tangible property with a

depreciation period of not more than 20 years (machinery, equipment, other tangible personal property,

and non-building land improvements); most computer software; and certain leasehold building

improvements.

1

Bonus depreciation results in a deduction of 50% of the cost of an item of qualified property in the

placed-in-service year and depreciation, under the regular depreciation rules, for the remaining cost of

the item over the item's assigned depreciation period (beginning with the placed-in-service year).

However, 50% bonus depreciation has ended for property placed in service after Dec. 31, 2013 (except

that for certain property with a long production period and certain aircraft, the placed-in-service deadline

is Dec. 31, 2014).

Fifteen-year straight-line cost recovery for certain improvements

Starting in 2014, taxpayers are not allowed to use 15-year straight-line recovery for qualified leasehold

improvements, qualified restaurant buildings and improvements, and qualified retail improvements.

S corporation built-in gains tax

Although an S corporation is normally not subject to tax, where a C corporation converts to S corporation

status the tax law imposes a tax at the highest corporate rate (35%) on the net built-in gains of the

corporation. The idea is to prevent the use of an S election to escape tax at the corporate level on the

appreciation that occurred while the corporation was a C corporation. The tax applies to the lowest of the

following:

•

•

•

The amount that would be the taxable income of the S corporation for the tax year taking

into account only recognized built-in gains and recognized built-in losses;

The corporation's taxable income for that tax year; or

The excess of the net unrealized built-in gain over the net recognized built-in gain for

earlier tax years during the recognition period.

For tax years 2009 and 2010, legislation shortened from 10 years to 7 tax years the period during which

the built-in gain tax is applicable. Subsequent legislation shortened the recognition period to 5 tax years

for 2011, 2012, or 2013. The 10 year recognition period applies to conversions in 2014.

Expiring Deductions and Depreciation

The seven-year recovery period for motorsports entertainment complexes

Accelerated depreciation for business property on an Indian reservation: Provided owners of qualifying

property used predominantly in the active conduct of a trade or business within an Indian reservation

with accelerated recovery periods.

The increased charitable deduction for contributions of food inventory

Allowed businesses to make contributions of “apparently wholesome food” to charities that will use it for

the care of the ill, the needy, or infants and to take an above-basis deduction.

The election to expense advanced mine safety equipment

Permited taxpayers to elect to treat 50% of the cost of any qualified advanced mine safety equipment as

an expense that is not chargeable to capital account but instead as a deduction in the year the property

is placed in service.

2

Special film and television production expensing rules

Allowed taxpayers to treat costs of any qualified film or television production as an expense that is not

chargeable to capital account but instead as a deduction.

The deduction for domestic production activities in Puerto Rico

Treated Puerto Rico as part of the United States for purposes of the domestic production activities

deduction.

The special depreciation allowance for second-generation biofuel plant property

Provided a depreciation allowance equal to 50% of the adjusted basis of qualified second-generation

biofuel plant property.

The placed-in-service date for partial expensing of certain refinery property

Allowed taxpayers to treat 50% of the cost of any qualified refinery property as an expense that is not

chargeable to capital account but instead as a deduction in the year the property is placed in service.

The energy-efficient commercial buildings deduction

Permitted businesses to deduct the cost of energy-efficient commercial building property placed in

service during the year, up to a limit of $1.80 per square foot and limited by prior Sec. 179D deductions

on the building.

Expiring Exclusions and Other Provisions

Qualified zone academy bond

Allowed qualified schools to issue bonds for renovations (but not new construction), equipment

purchases, teacher training, or developing course materials when they partner with private businesses.

The modification of tax treatment of certain payments to controlling exempt organizations

Provided that certain specified payments paid to a controlling tax-exempt organization by a controlled

entity are not included in unrelated business taxable income.

The special treatment of dividends from regulated investment companies

Exempted interest-related dividends and short-term capital gain dividends from a regulated investment

company from tax.

Regulated investment company treatment under Foreign Investment in Real Property Tax Act (FIRPTA)

Provided that qualified investment entity includes any regulated investment company that is a U.S. real

property holding corporation.

Subpart F active financing income exceptions

Exempted certain insurance income and net gains from sale of property that produces qualified banking

or financing income from income that is treated as subpart F income.

The foreign personal holding company lookthrough rules for payments between related controlled

foreign corporations

Treated dividends, interest, rents, and royalties received or accrued from a controlled foreign corporation

3

that is a related person as not foreign personal holding company income to the extent they are

attributable or properly allocable to income of the related person that is neither subpart F income nor

income treated as effectively connected with the conduct of a trade or business in the United States

(Sec. 954(c)(6)).

Various empowerment zone tax incentives

Includes the designation of empowerment zones, tax-exempt enterprise zone facility bonds, the

empowerment zone employment credit, increased expensing under Sec. 179 for enterprise zone

businesses, nonrecognition of gain on rollover of empowerment zone investments, and increased

exclusion of gain for small business stock of empowerment zone businesses.

The temporary increase in limit on cover over of rum excise tax revenues

Increased the limit on cover over of rum excise taxes from $10.50 to $13.25 per proof gallon to Puerto

Rico and the Virgin Islands (Sec. 7652(f)).

Energy-related provisions

Various energy-related tax provisions expired. Many promoted energy efficiency or alternative fuels

The special rule for sales or dispositions to implement Federal Energy Regulatory Commission (FERC)

or state electric restructuring policy: Allowed taxpayers to elect to defer the recognition of qualified gain

from a qualifying electric transmission transaction.

Expiring Credits

Health Coverage Tax Credit

This tax credit paid 72.5% of qualified health insurance premiums for eligible individuals and their

families.

Work Opportunity Tax Credit

The Work Opportunity tax credit provided an incentive for businesses to hire specific types of

employees, such as veterans and recipients of public assistance. Employers could qualify for a tax credit

of up to $4,800 for each new disabled veteran hire.

Research and Development Credit

The statutory rules for the research tax credit essentially provide for a credit equal to the sum of (1) 20%

of the excess of the “qualified research expenses” (QREs) over the greater of (a) 50% of the QREs or (b)

an amount based on a formula that takes account of the QREs and gross receipts in certain earlier tax

years, (2) 20% of the excess of research payments paid to certain outside organizations over an amount

calculated under a complex formula, and (3) 20% of amounts paid or incurred to an energy research

consortium for energy research. Amounts (i.e. otherwise qualified research expenses) paid or incurred

after Dec. 31, 2013 aren't eligible for the credit.

New Markets Tax Credit

A credit for investments in business or real estate in low-income communities.

4

Determination of low-income housing credit rate for credit allocations with respect to nonfederally

subsidized buildings

This provision allowed a 9% minimum low-income housing credit rate for nonfederally subsidized new

buildings.

The Indian employment tax credit

A credit for employers of enrolled members of Indian tribes (or their spouses) who work on and live on or

near an Indian reservation.

The railroad track maintenance credit

A credit equal to 50% of the qualified railroad track maintenance expenditures paid or incurred by an

eligible taxpayer.

The mine rescue team training credit

A credit for a portion of training costs for qualified mine rescue team employees (Sec. 45N).

Treatment of military basic housing allowances under the low-income housing credit

Treats buildings located in counties with qualified military installations as qualified buildings for purposes

of the low-income housing credit.

The alternative fuel (non-hydrogen) vehicle refueling property credit

A credit of 30% of the cost of any qualified alternative fuel vehicle refueling property placed in service by

the taxpayer during the tax year.

The credit for two- or three-wheeled plug-in electric vehicles

A credit of up to $7,500, based on battery capacity, for each new qualified plug-in electric drive motor

vehicle placed in service by the taxpayer during the tax year.

The second-generation biofuel producer credit (cellulosic biofuel producer credit)

A credit for each gallon of qualified second generation biofuel production.

The biodiesel and renewable diesel fuel credits

Includes the biodiesel mixture credit, the biodiesel credit, and the small agri-biodiesel producer credit.

The biodiesel and renewable diesel fuel excise tax credits and outlay payments

A credit based on the number of gallons of biodiesel used by the taxpayer in producing any biodiesel

mixture for sale or use in the taxpayer’s trade or business. As an alternative, a taxpayer may have

received a payment in the amount of the credit.

Beginning-of-construction date for renewable power facilities eligible to claim the electricity production

credit or investment credit in lieu of the production credit

A credit allowed for the production of electricity by a renewable power facility, or in the alternative, an

energy credit for the cost of the construction of the facility, if construction of the facility began before

2014. These credits applied to wind, closed-loop biomass, open-loop biomass, geothermal or solar,

small irrigation power, trash, refined coal production, qualified hydropower, Indian coal production, and

marine and hydrokinetic renewable energy facilities.

5

The Indian coal production credit

Provided an increased credit for each ton of Indian coal produced by the taxpayer.

New energy-efficient homes credit

A credit for each qualified new energy-efficient home constructed by an eligible contractor and acquired

by a person from the eligible contractor for use as a residence during the tax year.

Energy-efficient appliances credit

A credit for qualified energy-efficient appliances produced by the taxpayer.

The excise tax credits for alternative fuel mixtures

A credit of 50 cents per gallon of alternative fuel used in producing an alternative fuel mixture for sale or

use in a trade or business.

For more information, see Tax Provisions Expiring in 2013 (”Tax Extenders”) by Molly F. Sherlock,

published by the Congressional Research Service and List of Expiring Federal Tax Provisions 20132023 prepared by the Staff of the Joint Committee on Taxation.

6

Tax Developments

For 2013

2013 was a busy year for federal tax developments, distinguished from its onset by the enactments of

the American Taxpayer Relief Act of 2012 and then a fizzle at the end of the year with no movement on

the tax extenders. The year saw other tax developments impacting individuals and business owners.

American Tax Relief Act of 2012 (ATRA)

ATRA was a sweeping tax package that includes, among many other items, permanent extension of the

Bush-era tax cuts for most taxpayers, revised tax rates on ordinary and capital gain income for highincome individuals, modification of the estate tax, permanent relief from the AMT for individual

taxpayers, limits on the deductions and exemptions of high-income individuals, and a host of

retroactively resuscitated and extended tax breaks for individual and businesses, many of which were

not extended once again at the end of 2013. Here's a look at the key elements of the package:

Tax rates

For tax years beginning after 2012, the 10%, 15%, 25%, 28%, 33% and 35% tax brackets from the Bush

tax cuts will remain in place and are made permanent. This means that, for most Americans, the tax

rates will stay the same. However, there is now a new 39.6% rate, which will begin at the following

thresholds: $400,000 (single), $425,000 (head of household), $450,000 (joint filers and qualifying

widow(er)s), and $225,000 (married filing separately). These dollar amounts will be inflation-adjusted for

tax years after 2013.

Estate tax

The new law prevents steep increases in estate, gift and generation-skipping transfer (GST) tax that

were slated to occur for individuals dying and gifts made after 2012 by permanently keeping the

exemption level at $5,000,000 ($5,340,000 in 2014 as indexed for inflation). However, the new law also

permanently increases the top estate, gift, and GST rate from 35% to 40% It also continues the

portability feature that allows the estate of the first spouse to die to transfer his or her unused exclusion

to the surviving spouse. All changes are effective for individuals dying and gifts made after 2012.

Capital gains and qualified dividends rates

The new law retains the 0% tax rate on long-term capital gains and qualified dividends, modifies the

15% rate, and establishes a new 20% rate. Beginning in 2013, the rate will be 0% if income falls below

the 25% tax bracket; 15% if income falls at or above the 25% tax bracket but below the new 39.6% rate;

and 20% if income falls in the 39.6% tax bracket. It should be noted that the 20% top rate does not

include the new 3.8% surtax on investment-type income and gains for tax years beginning after 2012,

which applies on investment income above $200,000 (single) and $250,000 (joint filers) in adjusted

gross income. So actually, the top rate for capital gains and dividends beginning in 2013 will be 23.8% if

income falls in the 39.6% tax bracket. For lower income levels, the tax will be 0%, 15%, or 18.8%.

Personal exemption phaseout

7

Beginning in 2013, personal exemptions will be phased out (i.e., reduced) for adjusted gross income

over $250,000 (single), $275,000 (head of household) and $300,000 (joint filers). Taxpayers claim

exemptions for themselves, their spouses and their dependents. Last year, each exemption was worth

$3,800.

Itemized deduction limitation

Beginning in 2013, itemized deductions will be limited for adjusted gross income over $250,000 (single),

$275,000 (head of household) and $300,000 (joint filers).

AMT relief

The new law provides permanent alternative minimum tax (AMT) relief. Prior to the Act, the individual

AMT exemption amounts for 2012 were to have been $33,750 for unmarried taxpayers, $45,000 for joint

filers, and $22,500 for married persons filing separately. Retroactively effective for tax years beginning

after 2011, the new law permanently increases these exemption amounts to $50,600 for unmarried

taxpayers, $78,750 for joint filers and $39,375 for married persons filing separately. In addition, for tax

years beginning after 2012, it indexes these exemption amounts for inflation.

TOP 10 TAX DEVELOPMENTS FOR 2013

The start of a New Year presents a time to reflect on the past 12

months and, based on that history, predict what may happen next.

Here is a list of the top 10 developments from 2013 that may prove

particularly important as we move forward into the New Year.

•

•

•

•

•

•

•

•

•

•

American Taxpayer Relief Act (ATRA)

Unaddressed Tax Extenders

Repair and Capitalization Regulations

NII/Additional Medicare Tax Final Regulations

Supreme Court Decisions/IRS Guidance on Same-Sex Marriage

Affordable Care Act Implementation

Foreign Compliance Measures

Code Sec. 501(c)(4) Organizations

IRS Return Preparer Oversight

Comprehensive Tax Reform Proposals

Tax credits for low to middle wage earners

The new law extends for five years the following items that were enacted as part of the 2009 stimulus

package and were slated to expire at 2012 year end: (1) the American Opportunity tax credit, which

provides up to $2,500 in refundable tax credits for undergraduate college education; (2) eased rules for

qualifying for the refundable child credit; and (3) various earned income tax credit (EITC) changes.

8

Cost recovery

The new law extends increased expensing limitations and treatment of certain real property as Code

Section 179 property. It also extends and modifies the bonus depreciation provisions with respect to

property placed in service after Dec. 31, 2012, in tax years ending after that date.

Tax break extenders

Many of the “traditional” tax extenders are extended for two years, retroactively to 2012 and through the

end of 2013. Among many others, the extended provisions include the election to take an itemized

deduction for state and local general sales taxes in lieu of the itemized deduction for state and local

income taxes, the $250 above-the-line deduction for certain expenses of elementary and secondary

school teachers, and the research credit. For the most part, these tax break extenders were not reextended at the end of 2013.

Pension provision

For transfers after Dec. 31, 2012, in tax years ending after that date, plan provision in an applicable

retirement plan (which includes a qualified Roth contribution program) can allow participants to elect to

transfer amounts to designated Roth accounts with the transfer being treated as a taxable qualified

rollover contribution.

Payroll tax cut is no more

The 2% payroll tax cut was allowed to expire at the end of 2012.

Affordable Care Act

New Medicare Taxes

Effective January 1, 2013, the Affordable Care Act imposed two new Medicare taxes—a 3.8% net

investment income tax and a 0.9% additional Medicare tax on wage and self-employment income.

Here's an overview of these two new taxes.

3.8% net investment income tax.

This tax applies, in addition to income tax, on your net investment income. The tax only affects

taxpayers whose adjusted gross income (AGI) exceeds $250,000 for joint filers and surviving spouses,

$200,000 for single taxpayers and heads of household, and $125,000 for a married individuals filing

separately. These threshold amounts aren't indexed for inflation. Thus, as time goes by, inflation will

cause more taxpayers to become subject to the 3.8% tax.

An individual's AGI is the bottom line on Page 1 of your Form 1040. It consists of one's gross income

minus adjustments to income, such as the IRA deduction. If an individual claimed the foreign earned

income exclusion, the excluded income must be added back for purposes of the 3.8% tax.

If the AGI is above the applicable threshold ($250,000, $200,000 or 125,000), the 3.8% tax will apply to

the lesser of (1) the net investment income for the tax year or (2) the excess of your AGI for the tax year

over your threshold amount. This tax will be in addition to the income tax that applies to that same

income.

9

Take, for example, a married couple that has AGI of $270,000, of which $100,000 is net investment

income. They would pay a net investment income tax on only the $20,000 amount by which their AGI

exceeds their threshold amount of $250,000. That is because the $20,000 excess is less than their net

investment income of $100,000. Thus, the couple's net investment income tax would be $760 ($20,000

× 3.8%).

Now assume that the couple's AGI was $350,000. Because their AGI exceeds their threshold amount by

$100,000, they would pay a net investment income tax on their full $100,000 of net investment income.

Their tax would then be $3,800 ($100,000 × 3.8%).

What is net investment income?

The “net investment income” that is subject to the 3.8% tax consists of interest, dividends, annuities,

royalties, rents, and net gains from property sales. Income from an active trade or business isn't

included in net investment income, nor is wage income.

However, passive business income is subject to the net investment income tax. Thus, rents from an

active trade or business aren't subject to the tax, but rents from a passive activity are subject to it.

Income from a business of trading financial instruments or commodities is also included in net

investment income.

Income that is exempt from income tax, such as tax-exempt bond interest, is likewise exempt from the

3.8% net investment income tax. Thus, switching some of your taxable investments into tax-exempt

bonds can reduce the exposure to the 3.8% tax. Of course, this should be done with due regard to one's

income needs and investment considerations.

Home sales

If one sells their main home, you may be able to exclude up to $250,000 of gain, or up to $500,000 for

joint filers, when figuring your income tax. This excluded gain won't be subject to the 3.8% net

investment income tax.

However, gain that exceeds the limit on the exclusion will be subject to the tax. Gain from the sale of a

vacation home or other second residence, which doesn't qualify for the income tax exclusion, is also

subject to the net investment income tax.

For example, say that a married couple has AGI of $200,000 and in addition sold their main home for a

$540,000 gain. The couple qualified for the full $500,000 exclusion of gain on the sale, leaving only

$40,000 of taxable gain. As a result, the couple isn't subject to the 3.8% tax, because their total AGI

($200,000 + $40,000) falls below the $250,000 threshold.

But if the gain on the home sale was $680,000, of which $180,000 was taxable, the couple would be

subject to the 3.8% tax on $130,000 of the gain. That is the amount by which their total AGI of $380,000

($200,000 + $180,000) exceeds their $250,000 threshold.

Retirement plan distributions

Distributions from qualified retirement plans, such as pension plans and IRAs, aren't subject to the net

10

investment income tax. However, those distributions may push your AGI over the threshold that would

cause other types of investment income to be subject to the tax.

This makes Roth IRAs more attractive for higher-income individuals, because qualified Roth IRA

distributions are neither subject to the net investment income tax nor included in AGI. Distributions from

traditional IRAs are included in AGI, except to the extent of after-tax contributions, although they aren't

subject to the net investment income tax.

How the tax is reported and paid

The net investment income tax will be computed on a new tax form, Form 8960, that is attached to and

filed with your Form 1040. The tax must be paid at that time.

The net investment income tax must be taken into account in calculating your quarterly estimated tax.

Additional 0.9% Medicare tax on wage and self-employment income

Starting in 2013, some high wage earners pay an extra 0.9% Medicare tax on a portion of their wage

income, in addition to the 1.45% Medicare tax that all wage earners pay. The 0.9% tax applies to wages

in excess of $250,000 for joint filers, $125,000 for a married individuals filing separately, and $200,000

for all others. The 0.9% tax applies only to employees, not to employers.

For joint filers, the additional tax applies to the spouses' combined wages. For example, suppose that a

married couple earns combined wages of $300,000. On a joint return, they pay Medicare tax of $3,625

($250,000 × 1.45%) on their first $250,000 of wages and $1,175 on their combined wages the excess of

$250,000 ($50,000 × 2.35%), for a total Medicare tax of $4,800.

Once an employee's wages reach $200,000 for the year, the employer must begin withholding the

additional 0.9% tax from the wages. However, this withholding may prove insufficient if the employee

has additional wage income from another job or if the employee's spouse also has wage income. To

avoid that result, an employee may request extra income tax withholding by filing a new Form W-4 with

the employer. The extra withholding can then be applied to the liability for the additional 0.9% tax.

Self-employment tax

An extra 0.9% Medicare tax also applies to self-employment income for the tax year in excess of

$250,000 for joint filers, $125,000 for married individuals filing separately, and $200,000 for all others.

This 0.9% tax is in addition to the regular 2.9% Medicare tax on all self-employment income. The

$250,000, $125,000, and $200,000 thresholds will be reduced by the taxpayer's wage income.

For example, if a married couple has combined self-employment income of $300,000 (and no wages),

they will pay Medicare tax of $7,250 ($250,000 × 2.9%) on the first $250,000 of that income and $1,900

on the excess of their combined self-employment income over $250,000 ($50,000 × 3.8%), for a total

Medicare tax of $9,150.

While self-employed individuals can claim half of their self-employment tax as an income tax deduction,

the additional 0.9% tax won't generate any income tax deduction.

Individual Mandate

When Congress passed the Affordable Care Act in 2010 it delayed the effective dates of many key

11

provisions. Beginning in 2014, unless your are covered by an exemption, you are required to maintain

basic health insurance coverage (known as minimum essential coverage) for yourself and any of your

dependents, or pay a shared responsibility payment (a penalty). The requirement to maintain coverage

or pay a penalty is generally called the “individual mandate.”

The penalty is the lesser of: (i) the greater of a flat dollar amount or a percentage of your household

income, or (ii) the national average premium for the lowest-level plan providing minimum essential

coverage. You must make the shared responsibility payment when you file your federal income tax

return.

Married individuals who file a joint return for a tax year are jointly liable for any shared responsibility

payment.

You can satisfy the minimum essential coverage standard (and not be subject to a penalty) if you and

your dependent are enrolled in a qualified health plan offered by an Exchange, a qualified employersponsored plan (including a government plan), a government plan, such Medicare, Medicaid or CHIP

(Children's Health Insurance Program), or any other health coverage plan recognized as affording

minimum essential coverage.

Note that minimum essential coverage does not include, workers compensation insurance, disability

insurance, dental or vision benefits, long-term care benefits, and Medigap or MedSupp insurance.

If you are an exempt individual, such as a non-U.S. citizen, incarcerated individual, member of certain

religious sects or health care sharing ministries or a member of an Indian tribe you will not be subject to

the individual mandate. In addition, low income taxpayers, taxpayers for whom basic coverage is

unaffordable and taxpayers who qualify under a hardship exemption are not required to maintain

minimum essential coverage. Moreover, under the short coverage gap exception, any individual who

doesn't maintain minimum essential coverage for less than three consecutive months will not be subject

to the penalty for failure to maintain coverage.

Employer Mandate -- Employer

Health care reporting and mandate payments postponed until 2015. On July 2, 2013, the Administration

announced on the White House and Treasury websites that it will provide an additional year, until Jan.

1, 2015, before the mandatory employer and insurer reporting requirements under the Affordable Care

Act (ACA, commonly referred to as “Obamacare”) begin. Since this will make it impractical to determine

which employers do not provide minimum essential health coverage, and therefore would owe shared

responsibility payments under Code Sec. 4980H for 2014, transition relief is also being extended for

those payments. Any employer shared responsibility payments will not apply until 2015.

The Congressional Research Service (CRS) has issued a report outlining the required functions of

health insurance exchanges under the ACA.

Under the ACA, qualified individuals and small businesses will be able to purchase private health

insurance through exchanges set up by states or by the federal Health & Human Services Agency

(HHS). The initial open enrollment period for all exchanges will begin on October 1, 2013, and all

exchanges are to be operational and offering coverage on January 1, 2014. Exchanges must carry out

a number of functions, including determining eligibility and enrolling individuals in appropriate plans. In

general, health plans offered through exchanges will provide comprehensive coverage and meet the

private market reforms specified in the ACA. To make exchange coverage more affordable, qualifying

12

individuals will receive premium assistance in the form of tax credits. Some recipients of these premium

credits also may qualify to receive subsidies to help cover their cost-sharing expenses. The CRS report

provides a detailed explanation of these exchanges, coverage offered through them, and the cost

assistance features mentioned above.

Guidance on health care premium tax credit

The IRS has issued proposed regulations on the health care premium tax credit, which applies for tax

years ending after Dec. 31, 2013. The credit is designed to make health insurance affordable to

individuals with modest incomes (i.e., between 100% and 400% of the federal poverty level, or FPL)

who are not eligible for other qualifying coverage, such as Medicare, or “affordable” employersponsored health insurance plans that provide “minimum value.” It is available for individuals who

purchase affordable coverage through “Affordable Insurance Exchanges.” In general, an employersponsored plan is not affordable if the employee's required contribution with respect to the plan

exceeds 9.5% of his household income for the tax year. The proposed regulations address (i) minimum

value, including the treatment of health reimbursement arrangements, health savings accounts,

wellness program incentives, arrangements that reduce premiums, and methods for determining

minimum value; (ii) the definition of “modified adjusted gross income” as it comes into play in

determining household income for purposes of the credit; (iii) coverage for retirees, newborns and

newly adopted children; and (iv) premium assistance amounts for partial months of coverage.

Guidance on required employer notice on health care coverage options

Beginning Jan. 1, 2014, individuals and employees of small businesses will have access to affordable

health care coverage through a new competitive private health insurance market called the “Health

Insurance Marketplace” (the Marketplace). Certain employers must provide written notice to employees

about health insurance coverage options available through the Marketplace. A government agency has

provided the following guidance on the notice requirement and has issued model notices:

Who must provide notices

Notices must be provided by any employers to whom the Fair Labor Standards Act applies. Generally,

this means an employer that employs one or more employees who are engaged in, or produce goods

for, interstate commerce. For most firms, this rule doesn't apply if they have less than $500,000 in

annual dollar volume of business.

To whom must notices be provided

Employers must provide a notice to each employee, regardless of plan enrollment status (if applicable),

or of part-time or full-time status. Employers do not have to provide a separate notice to dependents or

other individuals who are, or may become, eligible for coverage under any available plan, but who are

not employees.

Form and content of notice

The notice must be provided in writing in a manner calculated to be understood by the average

employee. The notice must include information regarding the existence of a new Marketplace, as well

as contact information and a description of the services provided by the Marketplace. In addition, the

notice must: (1) inform the employee that the employee may be eligible for a premium tax credit if the

employee purchases a qualified health plan (QHP) through the Marketplace, and (2) include a

statement informing the employee that if the employee purchases a QHP, the employee may lose the

13

employer contribution (if any) to any health benefits plan offered by the employer, and that all or a

portion of such contribution may be excludable from income for federal income tax purposes.

Timing and delivery of notice

Employers must provide the notice to each new employee at the time of hiring beginning Oct. 1, 2013.

For 2014, a notice is considered to be provided at the time of hiring if it is provided within 14 days of an

employee's start date. For employees who are current employees before Oct. 1, 2013, employers must

provide the notice no later than Oct 1, 2013.

Health Benefits

Health FSA "use-or-lose" rule relaxed for health FSAs

Last fall, the IRS modified the “use-or-lose” rule for health flexible spending arrangements (health

FSAs) in order to allow, at the plan sponsor's option, participating employees to carry over up to $500 of

unused amounts remaining at year-end. Previously, any amounts that weren't used by year-end would

be forfeited. The IRS emphasized that the plan sponsor can specify a lower amount as the permissible

maximum carryover amount, or it can decide to not allow any carryover at all.

Final regulations on wellness incentives in group health plans

The IRS, acting in concert with other government agencies, has issued final regulations on

nondiscriminatory wellness incentives offered in connection with group health plans. Before

Obamacare, group health plans and group health issuers were prohibited from discriminating against

individual participants and beneficiaries regarding eligibility, benefits and premiums, based on a health

factor. However, an exception allowed premium discounts or rebates or modifications to otherwise

applicable cost sharing in return for adherence to certain programs of health promotion and disease

prevention. The exception allowed benefits, premiums, and contributions to vary depending on the

employees' participation in a wellness program. Obamacare made changes to the rules impacting

wellness programs, most notably increasing the maximum financial incentives available to employees

who participate in wellness programs. The new regulations provide numerous examples of participatory

wellness programs, including a program that reimburses employees for all or part of the cost of

membership in a fitness center; a diagnostic testing program that provides a reward for participation

and does not base any part of the reward on outcomes; and a program that provides a reward to

employees for attending monthly, no-cost health education seminars. They also clarify that participatory

wellness programs are permissible as long as they are available to all similarly situated individuals,

regardless of health status.

Business Deductions/Credits

Final “repair" regulations

The IRS issued much-anticipated final regulations (the so-called "repair" regs) on the treatment of costs

to acquire, produce or improve tangible property. The regs explain when those payments can be

deducted, which confers an immediate tax benefit, and when they must be capitalized.

14

These final regs retain many provisions of the temporary regs that were issued in 2011. However, the

final regs refine and simplify the temporary regs and add new safe harbor provisions that will help you

to nail down expense deductions.

The regs must be followed for tax years that begin after Dec. 31, 2013—whether a calendar year or a

fiscal year, such as a fiscal year beginning July 1, 2014. Taxpayers have the option of applying the final

regs retroactively to the 2012 and 2013 tax years. There's also a third option to apply the temporary

regs to the 2012 and 2013 tax years.

The regs are lengthy and complex. The summary below is intended to give an overview of how they

treat issues of deduction and capitalization.

Capitalization or deduction

The regs set forth the general rule that amounts paid to improve a unit of property must be capitalized.

An improvement is defined as an expenditure that betters a unit of property, restores it, or adapts it to a

new and different use.

On the other hand, the regs allow a current deduction for repairs and maintenance to property.

Deductible repair and maintenance expenses are defined in a negative way—they are deductible if not

otherwise required to be capitalized.

Unit of property

One key concept in the regs is the “unit of property” (UOP) that is being improved or repaired. The

smaller the UOP, the more likely it is that costs incurred in connection with it will have to be capitalized.

For example, work on an engine of a vehicle is more likely to be classified as an expense that must be

capitalized if the engine is classified a separate UOP. By contrast, if the UOP is the vehicle, the engine

work has a better chance of passing muster as a repair.

Property other than buildings

In general, for property other than buildings, a single UOP consists of all components that are

functionally interdependent, such that one component can't be placed in service without the other

components.

Say that a business buys a battery-powered golf cart for its foreman to use in getting around a large

warehouse. It buys the chassis from one vendor and the battery from another, and then assembles the

two components. Here, the cart is the UOP, since the chassis can't be placed in service without the

battery.

Buildings

When it comes to buildings, the regs generally treat each building and its structural components as one

UOP—the “building.” The regs also list nine specific building systems that are treated as separate from

the building structure. An improvement to the building is defined by its effect on those systems, rather

than on the building as a whole.

If a taxpayer restores a building structure, such as by replacing the entire roof, the expense is treated

as an improvement to the single UOP consisting of the building. If the taxpayer makes an improvement

15

to a building system, such as the heating, ventilation, and air conditioning (HVAC) system, that expense

is also an improvement to the building UOP.

Deducting materials and supplies

A deduction is allowed for amounts paid to produce and acquire materials and supplies that are

consumed during the year. Materials and supplies are defined to include five specific categories of

property used or consumed in the business operations.

UOPs with an economic useful life of no more than 12 months qualify as materials and supplies under

this rule. Likewise, certain inexpensive items qualify as materials and supplies. Under the final regs, this

rule applies to UOPs that cost $200 or less to acquire or produce, an increase from the $100 threshold

in the 2011 temporary regs.

De minimis safe harbor

The regs allow a taxpayer to deduct certain limited amounts paid for tangible property that are

expensed for financial accounting purposes. Under the 2011 temporary regs, this de minimis safe

harbor was only available to taxpayers that had an applicable financial statement (AFS), which can be a

certified audited financial statement used for credit purposes, reporting to partners, or other non-tax

purposes. The final regs change this by allowing businesses without an AFS to use the de minimis safe

harbor.

A taxpayer with an AFS may rely on the de minimis safe harbor if no more than $5,000 per invoice, or

per item as substantiated by the invoice, was paid for the property. For businesses without an AFS, the

maximum figure is $500 rather than $5,000.

To use the safe harbor, the business must have accounting procedures in place at the beginning of the

tax year that treat as an expense amounts paid for property that costs less than a specified dollar

amount or has an economic useful life of 12 months or less. I can assist you in making sure that your

business meets these requirements.

Routine maintenance safe harbor

The regs include a safe harbor that allows certain expenses of routine maintenance to be deducted

rather than capitalized. Routine maintenance means recurring activities that keep business property in

ordinarily efficient operating condition, such as inspection, cleaning, testing, and replacement of

damaged or worn parts.

Under the 2011 temporary regs, this safe harbor wasn't available for building maintenance. The final

regs expand the safe harbor to cover buildings as well.

For a building structure or system, the taxpayer must reasonably expect to perform the maintenance

more than once during the 10-year period that begins when the structure or system is placed in service.

For property other than buildings, the taxpayer must reasonably expect to perform the activities more

than once during the property's class life for depreciation purposes.

Per-building safe harbor for qualifying small taxpayers.

The final regs add a new safe harbor that allows qualifying small taxpayers—those with average annual

gross receipts of $10 million or less in the three preceding tax years—to deduct improvements made to

a building property with an unadjusted basis of $1 million or less. This safe harbor applies only if the

16

total amount paid during the tax year for repairs, maintenance, and improvements to the building

doesn't exceed the lesser of $10,000 or 2% of the building's unadjusted basis.

This safe harbor may be elected annually on a building-by-building basis. It is elected by including a

statement on the tax return for the year the costs are incurred for the building.

Accounting method changes

A change to conform to the regs is considered a change in accounting method, for which an accounting

adjustment is required. The IRS plans to issue procedures under which taxpayers can get automatic

consent to the accounting method change.

Travel and entertainment expenses

During 2013, the IRS issued the usual annual adjustments to various amounts relating to travel and

entertainment expenses.

Standard mileage rates

The optional mileage allowance for owned or leased autos (including vans, pickups or panel trucks) has

decreased by 0.5¢ to 56¢ per mile for business travel after 2013. The rate for using a car to get medical

care or in connection with a move that qualifies for the moving expense also has decreased by 0.5¢ to

23.5¢ per mile for 2014. The 14¢ per mile rate for charitable miles driven is set by statute, however,

and it remains unchanged for 2014.

Vehicle depreciation dollar limits

The IRS released inflation-adjustments on depreciation deductions for business-use passenger

automobiles.

If the actual expense method in calculating the depreciation allowance is used, an automobile is treated

as an asset with a 5-year recovery period. Under the regular depreciation tables, the cost of an

automobile is actually depreciated over a 6-year span according to the following percentages: Year 1,

20%; Year 2, 32%, Year 3, 19.2%, Years 4 and 5, 11.52%, and Year 6, 5.76%. Six years are involved

because depreciation is deemed to start in the middle of Year 1 and end in the middle of Year 6. (These

percentages are not available for cars used 50% or less for business purposes. For these, straight-line

depreciation is required.)

However, under additional limitations applicable to cars, there is a limitation to specified depreciation

ceilings, under “luxury automobile” rules. These ceilings, which are indexed for inflation, operate to

extend depreciation beyond the sixth year for cars costing more than what the total depreciation

allowance would be over the six years. For most cars first put in service in 2013, the ceiling is $11,160

for that year ($3,160 for cars for which additional first-year depreciation does not apply, including a car

purchased used or not used more than 50% for business). The annual ceiling amounts for later years

are $5,100 for the second year, $3,050 for the third year, and $1,875 for all later years. Slightly higher

ceiling amounts apply for certain light trucks and vans (passenger autos built on a truck chassis,

including minivans and light SUVs) first placed in service in 2013.

You cannot avoid these limitations via an election to “expense” the car (a Section 179 election). With

the limitations applying, it may take longer than the regular 6 years to depreciate the entire cost of the

car, if it is not disposed of sooner.

17

If the car is used partly for business purposes and partly for personal purposes, the limits are reduced

to the business percentage. For example, the maximum depreciation deduction for a qualified

automobile first placed in service in 2013 and used 75% for business is $8,370 (75% of $11,160) for the

first year. The “personal” 25% portion ($2,790) is disallowed.

What is the impact of these limitations from the standpoint of the business decisions you must make?

They raise the “after-tax” cost of automobiles used in your business. That is, the true cost of regular

equipment used in the business will be its actual cost reduced by the tax benefits enjoyed via

depreciation deductions. To the extent these deductions are reduced (deferred to future years,

actually), the tax benefits are less and the true cost is higher. It may be advisable to consider this factor

in deciding how much to spend on automobiles used in your business.

Please note that these limitations cannot be avoided by leasing a “luxury” car instead of buying it.

Although the mechanics of the tax rules are different with leases, essentially your taxable income is

increased to mirror the tax savings you would have lost had you bought the car. (These rules do not

apply to car rentals for less than 30 days.)

Simplified per-diem increase for post-Sept. 30, 2013 travel

An employer may pay a per-diem amount to an employee on business-travel status instead of

reimbursing actual substantiated expenses for away-from-home lodging, meal and incidental expenses

(M&IE). If the rate paid doesn't exceed IRS-approved maximums, and the employee provides simplified

substantiation, the reimbursement isn't subject to income- or payroll-tax withholding and isn't reported

on the employee's Form W-2. In general, the IRS-approved per-diem maximum is the GSA per-diem

rate paid by the federal government to its workers on travel status. This rate varies from locality to

locality. Instead of using actual per-diems, employers may use a simplified “high-low” per-diem, under

which there is one uniform per-diem rate for all “high-cost” areas within the continental U.S. (CONUS),

and another per-diem rate for all other areas within CONUS. The IRS released the “high-low” simplified

per-diem rates for post-Sept. 30, 2013 travel. The high-cost area per-diem increases $9 to $251, and

the low-cost area per-diem increases $7 to $170.

Foreign Compliance Measures - FATCA

After June 30, 2014, in addition to the withholding obligations under chapter 3, U.S. withholding agents

must withhold 30% on U.S. source fixed or determinable annual or periodic income (FDAP), such as

dividends and interest, paid to a foreign financial institution (FFI) or nonfinancial foreign entity (NFFE)

unless the agent can reliably associate the payment with valid documentation that establishes that the

payment is not subject to withholding (hereafter “FATCA withholding” or “chapter 4 withholding”).

Generally, a payment to an FFI is not subject to FATCA withholding if the FFI (i) enters into an

agreement with IRS under which it assumes specific due diligence, reporting and withholding

obligations (a participating FFI), (ii) is treated as a deemed-compliant FFI, or (iii) is subject to, and

complies with, an intergovernmental agreement. For these purposes, an FFI includes a foreign bank,

mutual fund, insurance company, investment company, pension fund, broker dealer and private equity

firm.

An NFFE (other than an excepted NFFE) is not subject to FATCA withholding if the NFFE is the

beneficial owner of the payment and either doesn't have any substantial (10%) U.S. owners or identifies

18

its substantial U.S. owners to the withholding agent. Excepted NFFEs include publicly traded

corporations and their affiliates, and active corporations with less than 50% passive income or assets.

The regulations provide additional exceptions and exclusions from the withholding requirements.

Thus, a U.S. withholding agent, or participating FFI that agrees to act as a withholding agent, needs to

have a process in place to collect information about FFIs and NFFEs with whom it does business. The

agent needs enough information to identify the payee and to determine the payee's FATCA status (e.g.,

FFI, participating FFI, NFFE, excepted NFFE) in order to determine whether or not it is required to

withhold on payments. In order to determine the payee's FATCA status, the withholding agent must rely

on certifications, statements and documentation. Presumptions apply in the absence of documentation,

and under certain circumstances, the withholding agent is treated as having reason to know information

is incorrect.

A withholding agent (including a participating FFI) that is required to withhold with respect to a payment

but fails either to withhold, or to deposit any tax withheld, is liable for the amount of tax not withheld and

deposited. In addition, every withholding agent must file an income tax return on Form 1042 showing

the aggregate amount of payments that are FATCA reportable amounts and must report the tax

withheld for the preceding calendar year by the withholding agent. The withholding agent must also file

an information return on Form 1042-S to report FATCA reportable amounts paid to a recipient during

the preceding calendar year.

Payments on certain obligations outstanding on July 1, 2014 (grandfathered obligations) are exempt

from FATCA withholding tax altogether. Payments on certain preexisting obligations outstanding on

June 30, 2014 are exempt from FATCA withholding before Jan 1, 2016. After Jan. 1, 2017, FATCA

withholding will apply to gross proceeds (i.e., proceeds from the sale or other disposition of any

property of a type that can produce U.S. source FDAP) and foreign passthru payments (definition

reserved).

Furthermore, if you have members in your expanded affiliated group that are FFIs or NFFEs, each of

these entities must take steps to comply with the FATCA requirements.

19

What’s on Tap

The President’s Tax Proposals for 2014

President Obama proposes the following percentage changes in federal taxes that over the upcoming

decade (listed by type of tax):

•

Personal income taxes, mostly on the wealthy, would go up by 4 percent.

•

Corporate taxes would increase by 1 percent.

•

Excise taxes would increase by 10 percent.

•

Estate and gift taxes would go up by 40 percent.

•

In total, federal revenues would increase by 2.8 percent over 10 years.

Tax Changes Proposed in President Obama's Fiscal 2014 Budget

The following is a summary list of the tax changes proposed by the President:

10-Year Totals, Fiscal 2014-23; $-billions

Individual income tax increases:

•

Limit the benefits of itemized deductions and certain other deductions and exclusions to

28% of the amount deducted or excluded

•

Reduce the inflation adjustment for tax brackets and other tax items ("chained CPI")

•

Implement the "Buffett Rule" (30% minimum tax on the wealthy)

•

Tax investment managers at regular tax rates on their management fees ("carried

interest")

•

Limit the total amount that can be accumulated in IRAs and other retirement funds to $3

million

•

Other individual income tax increases

Individual income tax reductions:

•

Make the recently extended expansion of the EITC and child credit permanent

•

Expansion of retirement savings tax breaks for low- and moderate-income taxpayers

•

Tax "simplification"

•

Expand the dependent care tax credit

•

Other individual income tax reductions

20

Other tax increases

•

Restore the 2009 estate & gift tax rules, plus other small estate tax reforms

•

Increase the cigarette tax by 94 cents per pack

•

Reduce the tax gap (reduce cheating by individuals and businesses)

•

Increase the unemployment tax

•

Impose a fee on large banks

•

Restore Superfund environmental clean-up tax on polluters

21

Leveraging Tax-Savings Opportunities

And Reducing Tax Risks in 2014

The beginning of the year is traditionally a time when business owners begin organizing their records for

their tax preparers to file last year’s taxes. Considering the tax changes for 2014, this is also a good time

to prepare for 2014 and beyond.

When it comes to taxes, owning a business provides both opportunities and risks. For example, you may

be able to set up a tax-advantaged retirement plan that allows you to make larger contributions than you

could make if you were an employee participating in an employer-sponsored plan. But if you don’t

carefully plan for your exit from the business, you could lose much of the net worth you built up in the

business to taxes.

Retirement saving

If most of your money is tied up in your business, retirement can be a challenge. If you haven’t already

set up a tax-advantaged retirement plan, consider doing so this year. If you might be subject to the new

3.8% Medicare tax on net investment income, this may be particularly beneficial as retirement plan

contributions can reduce your modified adjusted gross income and help you reduce or avoid the 3.8% tax.

Keep in mind that employees generally must be allowed to participate in the plan (provided they work

enough hours). Here are a few options that may enable you to make large contributions:

Profit-sharing plan

This is a defined contribution plan that allows discretionary employer contributions and flexibility in plan

design. You can make deductible 2013 contributions (see Chart for limits) as late as the due date of your

2013 income tax return, including extensions — provided your plan exists on Dec. 31, 2013.

SEP

A Simplified Employee Pension is a defined contribution plan that provides benefits similar to those of a

profit-sharing plan. But you can establish a SEP in 2014 and still make deductible 2013 contributions (see

Chart 3) as late as the due date of your 2013 income tax return, including extensions. Another benefit is

that a SEP is easier to administer than a profit-sharing plan.

Defined benefit plan

This plan sets a future pension benefit and then actuarially calculates the contributions needed to attain

that benefit. The maximum annual benefit for 2013 is generally $205,000 or 100% of average earned

income for the highest three consecutive years, if less. Because it’s actuarially driven, the 2013

contribution needed to attain the projected future annual benefit may exceed the maximum contributions

allowed by other plans, depending on your age and the desired benefit.

You can make deductible 2013 defined benefit plan contributions until the due date of your return,

provided your plan exists on Dec. 31, 2013. Warning: Employer contributions generally are required and

must be paid quarterly if there was a shortfall in funding for the prior year.

22

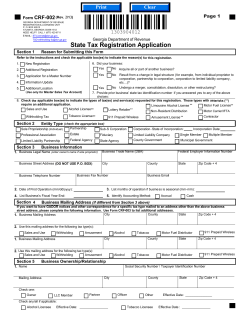

PROFIT-SHARING PLAN VS. SEP:

HOW MUCH CAN YOU CONTRIBUTE?

PROFIT-SHARING PLAN

SEP

2013 maximum contribution:

2013 maximum contribution:

$51,000 or $56,500

$51,000

2014 maximum contribution:

2014 maximum contribution:

$52,000 or $57,500

$52,000

Eligibility: You can’t contribute more than 25% of

your compensation generally, but you can

contribute 100% up to the 401(k) limits if the plan

includes a 401(k) arrangement. To qualify for the

maximum limits, your plan must include a 401(k)

arrangement and you must be eligible to make

catch-up contributions (that is, be age 50 or older).

Eligibility: You can’t contribute more than

25% of your eligible compensation (net of the

deduction for the contribution if you’re selfemployed). So to make the maximum

contribution, your eligible compensation must

be at least $204,000 for 2013 and $208,000

for 2014 ($255,000 for 2013 and $260,000

for 2014, if you’re self-employed).

Note: Other factors may further limit your maximum contribution

Exit planning

An exit strategy is a plan for passing on responsibility for running the company, transferring ownership

and extracting your money from the business. This requires planning well in advance of the transition.

Here are the most common exit options:

Buy-sell agreements

When a business has more than one owner, a buy-sell agreement can be a powerful tool. The agreement

controls what happens to the business when a specified event occurs, such as an owner’s retirement,

disability or death. Among other benefits, a well-drafted agreement.

•

•

•

Provides a ready market for the departing owner’s shares,

Sets a price for the shares, and

Allows business continuity by preventing disagreements caused by new, unwanted owners.

A key issue with buy-sell agreements is providing the buyers with means of funding the purchase. Life or

disability insurance often helps fulfill this need and can give rise to several tax issues and opportunities.

One of the biggest advantages of life insurance as a funding method is that proceeds generally are

excluded from the beneficiary’s taxable income. There are exceptions, however, so be sure to consult

your tax advisor.

23

Succession within the family

You can pass your business on to family members by giving them interests, selling them interests or

doing some of each. Be sure to consider your income needs, how family members will feel about your

choice, and the gift and estate tax consequences.

Now may be a particularly good time to transfer ownership interests through gifting. If your business has

lost value, you’ll be able to transfer a greater number of shares without exceeding your $14,000 gift tax

annual exclusion amount. Valuation discounts may further reduce the taxable value. And, with the lifetime

gift tax exemption at a record-high $5.34 million for 2014, this may be a great year to give away more

than just your annual exclusion amounts.

Management buyout

If family members aren’t interested in or capable of taking over your business, one option is a

management buyout. This can provide for a smooth transition because there may be little learning curve

for the new owners. Plus, you avoid the time and expense of finding an outside buyer.

ESOP

If you want rank and file employees to become owners as well, an employee stock ownership plan

(ESOP) may be the ticket. An ESOP is a qualified retirement plan created primarily to purchase your

company’s stock. Whether you’re planning for liquidity, looking for a tax-favored loan or wanting to

supplement an employee benefit program, an ESOP can offer many advantages.

Selling to an outsider

If you can find the right buyer, you may be able to sell the business at a premium. Putting your business

into a sale-ready state can help you get the best price. This generally means transparent operations,

assets in good working condition and no undue reliance on key people.

Sale or acquisition

Whether you’re selling your business as part of an exit strategy or acquiring another company to help

grow your business, the tax consequences can have a major impact on the transaction’s success or

failure. Here are a few key tax considerations:

Asset vs. stock sale

With a corporation, sellers typically prefer a stock sale for the capital gains treatment and to avoid double

taxation. Buyers generally want an asset sale to maximize future depreciation write-offs and avoid

potential liabilities.

Tax-deferred transfer vs. taxable sale

A transfer of corporation ownership can be tax-deferred if made solely in exchange for stock or securities

of the recipient corporation in a qualifying reorganization. But the transaction must comply with strict

rules.

•

•

•

•

Although it’s generally better to postpone tax, there are some advantages to a taxable sale:

The parties don’t have to meet the technical requirements of a tax-deferred transfer.

The seller doesn’t have to worry about the quality of buyer stock or other business risks of a taxdeferred transfer.

The buyer enjoys a stepped-up basis in its acquisition’s assets and doesn’t have to deal with the

seller as a continuing equity owner.

24

Installment sale

A taxable sale may be structured as an installment sale, due to the buyer’s lack of sufficient cash or the

seller’s desire to spread the gain over a number of years (which could also help you stay under the

thresholds for triggering the 3.8% Medicare contribution tax on net investment income and the 20% longterm capital gains rate) — or when the buyer pays a contingent amount based on the business’s

performance. But an installment sale can backfire on the seller. For example:

•

•

•

Depreciation recapture must be reported as gain in the year of sale, no matter how much cash the

seller receives.

If tax rates increase, the overall tax could wind up being more.

Of course, tax consequences are only one of many important considerations when planning a sale or

acquisition.

25

© Copyright 2026