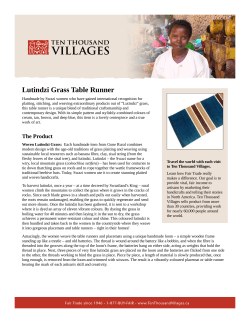

DEVELOPING POWER BUSINESS PLAN: EMPOWERING THE BOTTOM OF THE PYRAMID April 2004