METROBUS BUSINESS PLAN (start date: July2014) MAY 2013

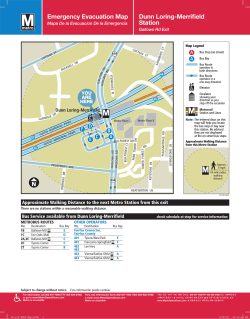

CITY OF JOHANNESBURG FINAL DRAFT METROBUS BUSINESS PLAN (start date: July2014) MAY 2013 TABLE OF CONTENTS SECTION 1: INTRODUCTION........................................................................................................ 4 1.1 ROLE OF BUSINESS PLAN ...................................................................................................... 4 1.2 CONTEXT AND BACKGROUND .............................................................................................. 4 1.3 ROLE FOR METROBUS ........................................................................................................... 6 SECTION 2: APPROACH TO METROBUS BUSINESS PLAN ...................................................... 7 2.1 APPROACH TO OPERATIONAL PLAN AND DETERMINATION OF ROUTES ............................. 7 2.2 APPROACH TO INSTITUTIONAL RESTRUCTURING................................................................. 8 2.3 APPROACH TO BUILDING FINANCIAL MODEL ..................................................................... 10 SECTION 3: ROUTES.................................................................................................................... 11 3.1 CURRENT SITUATION .......................................................................................................... 11 3.2 PROPOSED REVISED AND NEW ROUTES ............................................................................. 11 3.3 PHASE 1B AND 1C OF REA VAYA ......................................................................................... 12 SECTION 4: BUS OPERATIONS .................................................................................................. 14 4.1 CURRENT SITUATION .......................................................................................................... 14 4.2 PROPOSED CHANGES IN BUS OPERATIONS ........................................................................ 15 4.2.1 PROPOSED FREQUENCIES AND HOURS OF OPERATION .................................................... 15 4.2.2 CAPACITY REQUIREMENTS AND FLEET SIZE (NEW AND OLD BUSES) ................................. 15 4.2.3 PROPOSED PASSENGER NUMBERS ..................................................................................... 15 4.3 BUS KILOMETRES ................................................................................................................ 15 4.4 INFRASTRUCTURE AND DEPOT IMPROVEMENTS FOR MORE EFFICIENT BUS OPERATIONS 16 SECTION 5: BUSES ...................................................................................................................... 17 5.1 INTRODUCTION .................................................................................................................. 17 5.2 REFLEETING ......................................................................................................................... 17 5.3 NEW BUS SPECIFICATIONS INCLUDING UNIVERSAL ACCESS .............................................. 17 5.4 FUEL SOURCE FOR NEW BUSES........................................................................................... 18 5.5 BUS BRANDING AND EXTERNAL ADVERTISING................................................................... 19 SECTION 6: IMPLEMENTING THE TRANSITION ..................................................................... 20 6.1 INTRODUCTION ................................................................................................................... 20 6.2 FUNCTIONS THAT WILL BE TAKEN OVER BY THE SSMA ...................................................... 20 6.2.1 FARE MANAGEMENT .......................................................................................................... 20 6.2.2 MARKETING AND COMMUNICATION .................................... Error! Bookmark not defined. 6.2.3 BUS MANAGEMENT ............................................................................................................ 21 6.3 SERVICES TO CONTINUE TO BE OPERATED BY METROBUS ................................................ 22 6.3.1 BUS SERVICES ...................................................................................................................... 22 6.3.2 MAINTENANCE AND TECHNICAL SERVICES ........................................................................ 22 6.4. HUMAN RESOURCES ........................................................................................................... 22 Page | 1 6.4.1 HUMAN CAPITAL STRATEGY ............................................................................................... 22 6.4.2 REMUNERATION AND BENEFITS ......................................................................................... 22 6.4.3 PERFORMANCE MANAGEMENT ......................................................................................... 22 6.4.4 HUMAN CAPITAL PLANNING............................................................................................... 23 6.5 CHANGE MANAGEMENT AND MOVING TO THE TRANSITIONAL ARRANGEMENT ............. 23 6.5.1 CHANGING THE SDA BETWEEN METROBUS AND THE CITY ................................................ 23 6.5.2 HUMAN RESOURCE CHANGE MANAGEMENT .................................................................... 23 6.5.3 ACCOMMODATION IMPLICATIONS .................................................................................... 24 SECTION 7: FINANCIAL MODEL AND APPRAISAL ................................................................ 26 7.1 INTRODUCTION .................................................................................................................. 26 7.2 FINANCIAL MODEL ............................................................................................................. 26 7.2.1 REVENUES (FARES AND ADVERTISING) .............................................................................. 26 7.2.2 COSTS .................................................................................................................................. 28 7.2.3 SSMA COSTS ........................................................................................................................ 29 7.3 FINANCIAL APPRAISAL ........................................................................................................ 30 7.3.1 INCOME STATEMENTS ........................................................................................................ 31 7.3.2 CASH FLOW STATEMENTS................................................................................................... 32 7.3.3 BALANCE SHEETS ................................................................................................................ 32 7.3.4 CONCLUSION....................................................................................................................... 33 SECTION 8: TIMEFRAMES AND ASSUMPTIONS ..................................................................... 34 8.1 PROPOSED TIMEFRAMES .................................................................................................... 34 8.2 CRITICAL ASSUMPTIONS FOR SUCCESS.............................................................................. 34 ANNEXURE 1: MAP OF PROPOSED ROUTES ........................................................................... 35 Page | 2 SECTION 1: INTRODUCTION ROLE OF BUSINESS PLAN 1.1 The Executive Mayor, Cllr Parks Tau in his State of the City Address on 9th May 2013 committed to provide five rights to the residents of Joburg including the “right to a spatially integrated and united city”. He said, “Over the decade we will introduce transport corridors connecting strategic nodes through an affordable and accessible mass public transit that includes both bus and passenger rail” and later he labled these “corridors of freedom”. He said that these corridors of freedom “will mobilise the dynamic energy of this city, connecting important strategic nodes such as Rosebank, Inner City, Sandton and township CBD’s to each other. This business plan sets out how Metrobus can play an important role in the development of Transit Orientated Development and achieving the “corridors of freedom”. It also intends to set Metrobus on a new path of “developmental service delivery” where both Metrobus management and workers can begin to be able to provide its passengers with a higher quality of service, greater reliability and frequency of buses. The business plan arises out of a 7th March 2013, the Mayoral Committee decision which after deliberating on the future options for Metrobusresolved as follows: 1. That Group Governance proceed to put in place the relevant measures to change the SDA between Metrobus and the City to enable Metrobus to have a management contract with the Scheduled Services Management Agency to offer scheduled services in respect of an agreed operational plan and report back to the Mayoral Committee in this regard and to seek relevant approvals. 2. That the process of developing an operational and business plan for Metrobus be noted and that such plans will be presented to the Mayoral Committee for approval by May 2013” This Business Plan sets out: 1.2 An interim operational plan which can better respond to the present public transport reality and maximise the role of Metrobus on identified corridors; The refleeting programme of between 125 and 175 new buses including how requirements for the new buses to maximise job creation through local content and using alternative fuel sources will be achieved; An new division of roles and responsibilities based on the fact that Metrobus will have a management contract with the City to provide bus services and the consequent new institutional model in this regard including the change management process to achieve it; A financial model and appraisal; and Timeframes for implementation. CONTEXT AND BACKGROUND Metrobus has been in existence since 1942. As part of the eGoli process in 2002, Metrobus become a Municipal Owned Entity with a Board and a Service Delivery Agreement with the City. Historically Metrobus has served “white Johannesburg” although today the majority of its passengers are black. Below is a brief chronology which sets out the important milestones which brings us to where we are today: Page | 4 DATE 2002 2006 2004 and 2007 June 2006 October 2006 August 2009 to January 2011 2010/11 January 2011 May/June 2011 August 2011 October 2011 MILESTONE Metrobus procures 100 Volvo double decker buses and 50 Volvo single decker buses for 2002 World Summit on Sustainable Development. The procurement is through an INCA Loan which takes 12 years to repay at very high terms. Metrobus procures 70 more buses. Metrobus experiences two long protracted strikes which impacts negatively on patronage Metrobus introduced a route in Soweto but meets resistance from the taxi industry and Putco PUTCO seeks to take City to court on proposed Metrobus routes to and from Soweto. City reaches out of court settlement which restricts Metrobus to 22 buses from the Protea area. Metrobus manages the interim bus operating company, Clidet, set up to initiate the first ever full bus rapid transit system (Rea Vaya BRT) in South Africa and Africa. This is done successfully although a number of experienced members of Metrobus leave after January 2011 to join the Rea Vaya BRT project. Transport Department does extensive study to determine an appropriate future option for Metrobus. It proposed that Metrobus is reorganised along the lines of Rea Vaya BRT and that this process should take a period of five years. Mayoral Committee agrees that consultation with various stakeholders including organised labour on the proposed future option can proceed. However due to a labour strike in March 2011 and the upcoming local government elections, consultations are not concluded. A new Mayoral Committee is appointed after local government elections led by Executive Mayor, Parks Tau. The Executive Mayor initiates an institutional review process including in respect of the Municipal Owned Entities (MOE). Mayoral Committee agrees on first level Institutional Review but in respect of Metrobus instructs MMC Transport to bring a proposal based on the future options study conducted in 2010. Mayoral Committee deliberates on Metrobus future options report where four options are presented including to continue as before, close Metrobus down, unbundle over more than 3 years or unbundle over one year. Mayoral Committee resolves that: “1. The preferred option for the future of Metrobus is to unbundle Metrobus within one year and embark on a procurement process with the objective of entering into a gross fee per km bus operating contract with more than one external operator. 2. The Transport Department proceeds with the development of the necessary detailed planning and steps necessary to comply with legislation.” November 2011 to January 2013 MMC for Transport sets up Steering Committee including the chair of the Board to oversee implementation of Mayoral Committee decision and do necessary consultation with stakeholders. Legal steps determined by Transport Department which identify that a longer period than one year is required. Consultations take longer than expected. Page | 5 DATE January 2013 7 March 2013 11 April 2013 1.3 MILESTONE In the meantime, Metrobus buses continue to age and breakdown. Metrobus is forced to take up to 50 buses out of operation because they are too expensive to maintain and cut trips as a result. Transport Department proposes new process to the Executive Mayor to be able to address impasse in the restructuring process and also enable refleeting of Metrobus Mayoral Committee approves that City can purchase buses for Metrobus to operate on condition that the buses using alternative fuel sources and maximise local content and that a new operational and business plan is prepared. The business plan is to focus on a phased approach to the final institutional form of Metrobus, the first phase being Metrobus having a management contract with the Scheduled Services Management Agency in the Transport Department. Mayoral Committee further deliberates on how to maximise job creation, energy efficiency and a low carbon emission producing fuel in respect of the choice of fuel for the Metrobus refleeting programme. The Mayoral Committee approved “that the tender for new Metrobuses is a tender for a turnkey solution including buses and for fuel that must be green and job creating and that the tender evaluation process determine the most economical, environmental and job creating option.” ROLE FOR METROBUS In 2011, the City of Joburg agreed on a GDS strategy which aims to make walking, cycling and public transport the mode of choice by 2040. Thus the role of public transport going forwards is going to increase. The Transport Department is presently working on an Integrated Transport Plan which will inter alia include an Integrated Transport Network which based on the 2012/13 data and with future scenarios be able to determine which is the most appropriate mode on different routes. This Integrated Transport Network will identify a role for rail, BRT and conventional bus. Metrobus can become the key operator on routes identified for conventional bus but not in the state that it is currently in with ageing fleet, outdated fare collection system and low levels of labour stability. Thus this business plan is a plan of how Metrobus can become restructured in the short term to position itself as the main mode for conventional bus within an integrated public transport strategy. This business plan is based on a 12 year horizon since this should be the lifespan of a conventional bus and because this is the maximum length stipulated in the NLTA for a negotiated or tendered bus contract. However, it is envisaged that after the Integrated Transport Network is finalised and after there has been a successful transition to becoming a scheduled service under the Scheduled Services Management Agency, the business plan can be revised and a new business model developed for the final institutional form of Metrobus. Page | 6 SECTION 2: APPROACH TO METROBUS BUSINESS PLAN 2.1 APPROACH TO OPERATIONAL PLAN AND DETERMINATION OF ROUTES The Mayoral Committee agreed that Metrobus needs to develop a revised operational plan which should seek to: “Continue to serve the 90 000 existing passengers; Optimise integration and alignment with Rea Vaya, Gautrain and Metrorail and support the IDP priority project of Transit Orientated Development; Strengthen public transport corridors, especially in areas of high private car use and link residential areas to economic nodes; Extend existing services to new areas of ‘captured car users’ in South/North/North West; Improve frequency, reliability and off peak services; Reduce dead kilometres and maximising use of existing depots; Incorporate scholar transport services currently provided and potential to provide; and Explore potential to receive a portion of Provincial Government bus subsidies.” Taking into account the above objectives, the following steps were undertaken in coming up with the revised operational plan. Firstly the strategic objectives of the City as spelled out in the Spatial Development Framework and Vision 2030, were taken into consideration and the following principles followed: Channelling public transport routing into more focused, high frequency corridors, rather than the present dispersed, less frequently serviced route structure. Provision of access between residential areas and the major economic nodes, and significant decentralised nodes, as well as between the nodes themselves. Improvement of access to captive users and attraction of non-captive users to the network. Provision of a safety net to basic services to the poor, ensuring access to the closest employment centres, health and education facilities, shopping and other social services. Alignment of services to the proposed strategic public transport network. Other bus services largely serve the south-western areas of CoJ, linking these broadly to the southeast. Metrobus routes should be more focused on the north-south and east-west grid of the routes. Secondly, in respect of data collection and analysis, data was collected on the number of trips, number of passengers and number of buses for each of the Metrobus routes, including the contracted routes.Using this information, a workshop was held with the operations and planning personnel from Metrobus where each route was reviewed with the view of assessing whether the route should be maintained, extended or cancelled, as well as estimating the number of buses required given the passenger demand and ridership on the route. Possible integration and alignment with Rea Vaya and Gautrain were also discussed and recommendations made. Through this process routes, existing routes were assessed and 10 key routes to be called “MB routes” identified. These routes will operate on regular frequencies and will link with Rea Vaya and Gautrain stations and other key business nodes. Thirdly, a map of all the Metrobus routes was drawnon which ReaVayaPhase 1A and 1B were superimposed. By physical observation and taking into account recommendations from the workshop, perceived demand in high volume settlements, and route recommendations made in the ITP document of 2003, final routes were proposed with the view of: o Serving high demand areas which were previously not being served. o Promoting linkages with ReaVaya and Gautrain. Page | 7 o o Improving existing coverage on certain routes by re-routing them to places with perceived higher demand. Improving passage through the CBD which is currently the central point for most routes. These routes are described in the later section in two categories - key MB or primary routes of which there are 10 and further secondary or feeder routes. Finally using the revised map of Metrobus routes, and taking into account the target peak hour frequencies along all the routes and the route turnaround times,the number of buses required and the bus KMs per day were determined through a scheduling process. We are cognisant that not enough time was allocated to the route rationalization exercise and limited information was used to carry out a mini-review of the current Metrobus routes. A detailed study will still need to be carried out taking into account: (i) the Household Travel Surveywhose outcome is expected in the next two months, (ii) the revised Strategic ITP Framework, and (iii) a census of all the current routes to establish peak demand. We believe this detailed study will be able to produce the following outcomes which we could not achieve with the limited analysis that we carried out: A complete review of the current Metrobus routes with the view of increasing frequencies along the MBs as identified in the ITP and reducing service along the minor routes, possibly handing over some of these routes to the taxis so that they can operate as feeder routes to the main MBsThe idea of the MB routes was to increase frequencies along these routes as they are deemed to provide linkages with major economic nodes and other operators, particularly Gautrain. Detailed changes to the operational layout of Metrobus routes including decentralization of route origins from the CBD to other high demand economic nodes such as Rosebank and Midrand, and introducing additional transfer points. This will go a long way in decongesting the CBD and increasing bus frequency along the routes. It is proposed that this be done between the time that the Business Plan is approved and the transition to the Scheduled Services Management Agency occurs. 2.2 APPROACH TO INSTITUTIONAL RESTRUCTURING The Mayoral Committee report of 7th March 2013 proposed that the “change process be incremental with a transitional phase where Metrobus operates according to a new operational plan in terms of a management contract with the Scheduled Services Management Agency (SSMA).” The SSMA has been established in the Transport Department to contract manage all scheduled services in the City and which is presently managing the Rea Vaya BRT Phase 1A service. The Mayoral Committee decision was “based on the assumptions that we should move on one hand to routes being determined by the City and to a single model of the provision of public transport services as envisaged in the Rea Vaya model and as envisaged in the institutional review with the establishment of the SSMA. Page | 8 During this transitional stage the final institutional form is determined. The table below sets out the envisaged differences between the status quo, transitional phase and final institutional form. Components of bus Status quo services Bus ownership Owned Metrobus Transitional Final form by Owned by City Tbd. Could continue to be owned by City or could be owned by private operators Bus services (driving Metrobus Metrobus management Transport Department the buses on employed drivers contractor to SSMA. determines routes scheduled routes) on routes Transport Department which are prescribed determined by determines routes which to Metrobus via SSMA Metrobus are prescribed to Metrobus via SSMA Bus management Metrobus SSMA through control SSMABus contractor management centre (3rd floor JRA) tbd Metrobus as part of management contractor Fare Metrobus SSMA – integrated system SSMA – integrated management with contract with with Rea Vaya BRT, SMMA system with Rea Vaya and collection Questek collects revenue and pays BRT, SMMA collects Metrobus fee per km to revenue and pays run bus services. Metrobus or private bus operating company/s a fee per km to run bus services. Depots and sleeping Metrobus owns Metrobus owns as part of Tbd – could continue grounds management contract to rent depot space from City Maintenance of Maintained in 3/5 year maintenance Tbd but mostly buses house. contract in respect of new outsourced buses. maintenance for first 5 In house maintenance as years. part of Metrobus management contract Metrobus could create a technical centre of excellence for vehicle maintenance at one or more depots. Ensuring patronage Metrobus SSMA SSMA (marketing, passenger information) Governance Metrobus Board Metrobus Board would Tbd continue to manage management contract with the City. Would require change in SDA between Metrobus and the City As set out above, two phases of institutional reform are proposed: Page | 9 2.3 The first ‘transitional’ phase is for Metrobus to sign a management contract with the City (or change their SDA with the City); and The second phase is to determine the final institutional form which will need to be subject to a Section 78 of MSA investigation. APPROACH TO BUILDING FINANCIAL MODEL The approach to the financial model was informed by the understanding of the objectives Metrobus and the Operational Plan. The following process was adopted in developing the model: Obtaining and understanding of the requirement for the financial model for the project life-cycle; Obtaining the base data and the underlying drivers for forecast financial and economic performance; Engineering the engine of the financial model; Stress-testing and review of the financial model; Corrections/adjustments and conclusion. Page | 10 SECTION 3: ROUTES 3.1 CURRENT SITUATION Metrobus operates both apeak and off-peak service, as well as a weekend service. The buses are often full or overloaded during peak periods. The bus fleet comprises 451 buses, 163 doubledecker and 288 single-decker buses. It operates a total of 1,941departures per day. Its loadings average 80,000 passengers per day. Metrobus is currently operating at an average frequency of 15 minutes during peak on its busiest routes such as Rosettenville to Johannesburg Hospital. Metrobus operates numerous routes that are classified into the following categories: Service routes which are open to the general public. Scholar routes which target scholars in different locations. These routes start or end at or near schools. Currently there are more than 80 scholar routes A disability service in the following areas: Kagiso, Eldorado Park, Turfontein, Orlando East, Hope School, Meadowlands, Diepkloof, Riverlea, and Parkview. Contract routes - There are currently seven contracts where Metrobus provides exclusive service to specific institutions such as private schools and corporations. Social service routes: o Slovo Park/Freedom Park Settlement to all the Pimville Schools. o Senior citizen routes in from the Western retirement villages. The original routes and route structure for Metrobus were determined by the City. Over the years, there have been new routes added, whilst some have been withdrawn and others extended in response to passenger demand. Metrobus carries out a thorough investigation of routes before proceeding to open, extend or withdraw a route. 3.2 PROPOSED REVISED AND NEW ROUTES From the route review exercise that was carried out and in line with the approach set out in section 2.1 of the document to align routes with the GDS and corridors of freedom, the following new key MB or primary routes are proposed: Route MB1 Route Description Liefde-en-Vrede→Haddon → CBD →Parktown→Sandton→Sunning Hill MB2 South Crest →Elands Park → South Hills → City Deep → Jeppestown→ CBD Bellevue→ Highlands North→Wynberg→ Alexandra→Woodmead→Midrand MB3 Westgate→ Constantia→ Newlands→ Auckland Park→Braamfontein→Jeppe→BezValley →Eastgate MB4 CBD→ Emmarentia/Greenside→ Cresta→ Laser Park Notes This will be the main corridor linking the south and north of Joburg. Most east/west routes will at some stage bisect this route. This route also links the Gautrain stations at Parktown, Rosebank and Sandton and Rea Vaya in the CBD. This will be the main route linking Joburg with Midrand, another North South Route that will link up with Gautrain stations via the East West corridors discussed later. This route will operate in two sections, from the South to the CBD and from the CBD to Midrand. This Route is one of four east west routes. The Route will link up with Rea Vaya at various stations and will take passengers further east and west from Rea Vaya stations. The route will again be run in two sections from Westgate to Braamfontein and from Braamfontein to Eastgate. The route has been changed from the existing route through Auckland park to now travel via Greenside. This provides Page | 11 MB5 CBD→Greenside →RandburgStrijdom Park → Northgate →Kyasands→ Cosmo City MB6 CBD → Hyde Park → Randburg →Fourways → Diepsloot MB7 Flora Park→ Constantia→Cresta→Randburg→Sandto nWunberg→Linbro Park MB8 Wilro Park→Ruimsig→ Laser Park→ Northgate→Fourways Sunning Hill→Woodmead Sophiatown police station →Greenside→Rosebank→ Highlands North→ Lombardy East→ Longmeadow→Greenstone Mall MB9 MB10 Protea Glen→ Moroka→ Orlando→ New Canada→ Parktown better access to areas not currently covered by Rea Vayaand furthermore provides easier access to the RosebankGautrain station. This route links Cosmo City with the CBD and to other areas of Joburg via other MB routes, Rea Vaya and the Gautrain stations. The route has been extended to the North and will now travel directly from Cosmo City to the CBD. This route links Diepsloot with the CBD and to other areas of Joburg via other MB routes, Rea Vaya and the Gautrain stations. The route has been extended to the North and will now travel directly from Diepsloot to the CBD. This east west route will link up Rea Vaya Routes and key junctions to the East, as well as provide a link between the Sandton and Marlboro Gautrain stations. This routes provides easy access along Northern Suburbs and links up with the main North South Routes listed above. This route provides access along its path to various south North routes and links up with Rea Vaya in the west. Furthermore it travels past the RosebankGautrain station towards the South of Alexandra. The main Soweto route will provide commuters easy access to various Rea Vaya stations and will link up with Rea Vaya and the Metrobus MB3 route in Parktown. The 10 MBroutes above were carefully structured to provide sufficient coverage of the NorthSouth and East-West traffic corridors, as well as linkages with Gautrain and Rea Vaya. TheseMB routes will be serviced on regular intervals during peak and off-peak times and will allow citizens of Johannesburg easy access to any area within the Metropolis, as well as easy access to areas outside Johannesburg through services such as Gautrain. In addition to the 10 Main routes identified, Metrobus will operate “feeder” or secondary routes in 10 key zones in the City. Contract and school routes will either be included in the 10 MB routes or will become secondary or feeder routes to the MB routes. Emphasis will be placed in scheduling to minimise dead kilometrestravelled by buses. As indicated earlier, it is proposed that these routes are refined and scheduled after a more detailed study. 3.3 PHASE 1B AND 1C OF REA VAYA Metrobus is an affected operator in respect of Phase 1B and most likely Phase 1C of Rea Vaya BRT since it operates routes that in the future will be operated by Rea Vaya BRT. However Metrobus unlike other affected operators can’t become part of the new bus operating companies since section 93K(1) of the Municipal Systems Act prevents Municipal Owned Entities from being part of other companies if there shareholding is less than 51%. Page | 12 In addition it would be a serious conflict if as per the Rea Vaya BRT model, the City of Johannesburg is the shareholder of Metrobus and is also contracting with Metrobus to offer bus services. In respect of Phase 1B, Metrobus is affected by a total of 1595 seats which equates to about 14 buses. However if seat utilisation is taken into account this could decline by about 50%. The Mayoral Committee made a decision on 16 August 2012, that Metrobuspotential shareholding be ‘kept in reserve’ and not allocated to any other potential shareholder(s) pending the final decisions on the future institutional form of Metrobus and that until such time, Metrobusshould attends the Rea Vaya Phase 1B negotiations as observers. The Mayoral Committee still has to make a final decision about what would happen to the seats allocated to Metrobus but for purposes of this business plan, no services have been anticipated on the Phase 1B Rea Vaya routes. In respect of Phase 1C, it is anticipated to be operational in 2016. This is still some time away and Metrobus needs to continue to service commuters on these routes. These services have thus been included in the business plan. It is possible in 2016 to either redirect the services to other routes or reduce services and retire further old buses without replacing them. Page | 13 SECTION 4: BUS OPERATIONS 4.1 CURRENT SITUATION Buses Metrobus has a fleet of 451 buses which are aging. The table below indicated the average age of the existing Metrobus bus fleet. Depot Milner Park Roodepoort Village Main Total 6 to 10 yrs 68 59 127 Number of buses 11 to 16 yrs 17 to 20 yrs 80 49 59 7 59 54 197 110 >20 yrs 11 6 Total 208 72 171 451 17 The last buses purchased by the company were bought some seven years ago. As indicated in the table, the bulk of its current fleet is between 11 and 20 years old whereas the estimated useful life of a bus is 12 years. This has led to high operational and maintenance costs for the fleet as well as numerous cancellations of trips, leaving passengers stranded. Currently there are 49 buses which are out of service Depots There are three main depots which are further complemented by satellite depots and sleeping grounds as tabulated below: Main Depot Milpark Village Main Roodepoort Satellite Depots Fordsburg Soweto Eldorado Park - Sleeping grounds Zondi Ferndale Eldorado Park - Current Patronage The current patronage was estimated by looking at average historical initial boardings for each of the Metrobus routes and escalating by 10% to take into account system pilferage due to nonpayment, and by 20% to take into account transfers. The patronage is based on the initial boardings recorded in the two year period ending January 2013. The relevant figures are set out below System Ridership Initial boardings for 2 years Estimated pilferage @ 10% Estimated transfers @ 20% Adjusted Initial Boardings for 2 years Average annual initial boardings Estimated daily passengers Number of passengers 29,785,755 2,978,576 5,957,151 38,721,482 19,360,741 80,670 Page | 14 4.2 PROPOSED CHANGES IN BUS OPERATIONS 4.2.1 PROPOSED FREQUENCIES AND HOURS OF OPERATION It is proposed that Metrobus continues to operates both a peak and off-peak service and that the off peak services should be increased on key corridors. The morning peak will start at5.30am to 9am whilst the afternoon peak will start from 3pm to 6pm.The targeted frequencies will be 15 minutes in the peak and every 30 to 60 minutes in the off-peak. 4.2.2 CAPACITY REQUIREMENTS AND FLEET SIZE (NEW AND OLD BUSES) To arrive at the proposed capacity requirements, the following key variables were used: Revised route structure Peak hour frequencies Route length Route turnaround time. Using this information, it was determined that the required number of busesis 450 buses. The breakdown of the buses is summarized in the table below: Number of buses 175/125 276/326 175/125 New buses to be purchased Old buses to continue in use Old buses to be discontinued See below for a further discussion on why the number of new buses is either 175 or 125. 4.2.3 PROPOSED PASSENGER NUMBERS Taking into consideration the proposed changes to the routes and the number of buses that will be in operation, an estimate of the number of passengers was made by assuming multiplying the maximum possible capacity, given 6 peak period trips and 2 off peak trips per bus, by an assumed level of occupancy. The outcome was annualized by multiplying by 248 working days in a year. The calculation for year one is summarized in the table below: Period Avg. Bus Number Capacity of Buses Daily frequency Peak Off-peak Total 76 76 6 2 396 396 Maximum Annual Capacity 44,782,848 14,927,616 59,710,464 Average Occupancy 50% 20% Annual Boardings 22,391,424 2,985,523 25,376,947 From the above table, the estimated ridership in year 1 is 25,376,947 boardings, which translates to an average of 102,326 boardings per day. This represents a 26% increase from the current average daily boardings which can be justified by: 4.3 Metrobus servicing a revised and leaner route structure at higher frequencies with reduced distances and improved linkages to other public transport operators; and A reduction in breakdowns and the need to take buses off the road for maintenance following the acquisition of new buses. BUS KILOMETRES Bus KMs were estimated by multiplying the route length by the number of trips for each route. The route lengths used in the calculations are inclusive of the dead KMs. Using this approach, we arrived at an average of 14.3 million annual bus KMs. The bus KMs were split into 12.2 millionrevenue KMs and 2.1 milliondead KMs. These KMs take onto account existing school Page | 15 routes as well as contracted services routes, but do not factor in private hires, which will only be run on a profit basis. The summary of kilometres has been detailed below. Summary of kilometres Routes MB Routes Weekdays MB Routes Weekends Secondary Routes Contract Routes Additional school routes Breakdowns and in yard estimate (1%) Total 4.4 Total active km 8 933 792 437 875 2 542 857 222 978 97 768 - Total dead km 1 348 936 109 813 414 029 282 161 Total km 10 282 728 547 688 2 956 886 222 978 97 768 282 161 12 235 270 2 154 939 14 390 209 INFRASTRUCTURE AND DEPOT IMPROVEMENTS FOR MORE EFFICIENT BUS OPERATIONS The following infrastructure improvements are proposed to improve the speed of buses and to reduce dead KMs: 1 Proposal Public transport care lanes 2 Sleeping grounds 3 Day time holding Justification Dedicated bus lanes are required within the CBD and on major routes leading into and out of the CBD to make the service more efficient and reduce turnaround times during the peak periods. In order to serve the Cosmo City, Diepsloot and Midrand routes efficiently, at least two new sleeping grounds will be needed in areas closer to these places. The Cosmo City public transport facility will be explored as well as Pikitup sites. Additional day time holding grounds will be identified to safely hold buses during the off-peak to improve efficiency and reduce dead kilometres. Page | 16 SECTION 5: BUSES 5.1 INTRODUCTION This business plan requires 450buses. Of these buses, between 125 and 175 may be new buses and the oldest buses will be retired and auctioned. There will also be a larger reserve fleet when buses breakdown and when they need to be maintained. Below we set out the details of the bus refleeting programmes as well as what Metrobus will do to improve the condition and energy efficiency of their existing fleet. 5.2 REFLEETING To ensure uninterrupted service as well as service the proposed operational plan, the Mayoral Committee determined thatMetrobus must be refleeted to the extent that it can offer a cost effective and reliable service. This in turn requires that: Sufficient new buses to provide reliable services; Buses that are fuel efficient and have reduced carbon emissions; Maintenance costs be reduced through maintenance contracts with clearly assigned obligations to suppliers; Modern bus and fare management systems are in place to properly manage the new buses, provide high levels of management information and maximise on revenue; 129 buses are beyond their useful life and are not able to be repaired or maintained. This is what motivates that a minimum number of 125 buses be procured. Metrobus is thus currently going out for tender for between 125 and 175 new 79 seater buses with tender specifications that provide for: maximisation of local content in line with the DTI (Department of Trade and Industry) requirements; a three or five year maintenance agreement; and a turnkey solution in respect of an alternative fuel source (fuel for three years and refuelling equipment at two depots) Thus the tender has three parts to it, namely: The supply, delivery and maintenance of buses; The development, supply and delivery of fuel; and The installation and maintenance of fuel equipment. These new buses will be operated from the Metrobus’sMilpark and Roodepoort depots. These buses will be funded by either or a combination of the following sources: PTIS, EFF or financing. The NDOT has indicated that PTIS funds are possible if a business plan is submitted which is in line with the PTIS conditions and integrated transport planning. This is one of the reasons for the urgent submission of the business plan. In line with the new proposed model set out of in this business plan, the buses will be procured by the City of Johannesburg and will be operated on by Metrobus through a change in the Service Delivery Agreement between Metrobus and the City. 5.3 NEW BUS SPECIFICATIONS INCLUDING UNIVERSAL ACCESS The specifications for thenew buses are as follows: The buses will have a seating capacity of a minimum of 60 passengers and a maximum of 19 standing. Priority seating will be available for elderly and physically or mentally impaired persons in the front of the bus. These seats will be clearly identifiable. Page | 17 The engine will provide a minimum power of 180KW and approximately 900Nm of torque at 1830m altitude or equivalent. The equivalent specifications apply to alternately fuelled buses. The transmission will be fully automatic. The following dimensions of the bus will be required; o Maximum length of 12.5m o Maximum width of 2.6m o Maximum height of 3.2m Tenderers will be required to provide the fuel for the buses over a period of at least three years. Tenderers will be required to supply all equipment needed to re-fuel the buses. The bus specifications will include a supply of a completely knocked down chassis and local bus body building to maximize local content or manufacture. The buses will also provide a driver monitoring system to provide exception reporting or information regarding acceleration, deceleration, engine revolutions and idling time. It is anticipated that new buses will be delivered from February 2014 but the exact date will only be known after the tender process is concluded. 5.4 FUEL SOURCE FOR NEW BUSES Energy supply for the transport sector in Johannesburg is predominantly based on fossil fuels. The problem with fossil fuels is that the supply is not unlimited and the burning of fossil fuels contributes to air pollution and generates greenhouse gas emissions which are harmful to the environment creating negative and potentially disastrous climate change events. For South Africa as a whole there is a challenge of fuel security and we are severely impacted upon by global developments and resultant impact on a rising and unstable fuel price. It is mainly due to these reasons that a migration towards alternative sources of fuel such as compressed natural gas, biogas or bioethanol is being proposed. Compressed Natural Gas (CNG) has been extensively used in many countries as a well-known alternative clean vehicle fuel there is currently an extensive natural gas link from Mozambique to South Africa and there is further gas infrastructure being planned for the country.Johannesburg is fortunate that it already has a gas reticulation network in some parts of the city. Biogas is a renewable energy which is formed when Methane is released from waste streams such as solid waste and waste water. The Biogas once cleaned can be injected into a CNG network and the two gases can be used seamlessly. There are opportunities to create Biogas supplies through agricultural feedstock development, waste water treatment technologies as well as solid waste treatment technologies. The consumption of these vehicles seems to be on par with their fossil fuel equivalents. There are drastically reduced emissions and the noise levels of the vehicles are also reduced. Bioethanol is a fuel that is derived from specific crops such as sugar beet and grain sorghum. Anethanol-driven bus was piloted by Metrobus during October 2010. The bus consumed 80 ℓ/100 km and produced 125 g of CO2 for every kilometer. An equivalent diesel bus uses about 48 ℓ/100 km, but produces about 1 285 g of CO2 for every kilometer. Page | 18 The production of bio-ethanol can create significant job opportunities. For every bus that runs on ethanol fuel, two to three jobs are created in rural areas. The South African Industrial Biofuels Strategy however proposes that the market should work towards a bioethanol product comprising of either 2%, 5% or 10% blended with petrol since this route is more fuel and cost efficient. Thus the busspecifications forthe new 125 to 175 buses do not limit a tender in terms of the fuel source to be used. The only specification in this regard is that the bus must not be diesel only. The main aims of using alternately fuelled buses are the creation of jobs and the lowering of bus emission. Both these conditions have been included as part of the criteria in the tender. Metrobus is also looking at how the existing fleet can be adapted to also utilise CNG/Biogas and hence enjoy the benefits of the alternative fuel. Finally Metrobus is looking at a number of pilot technology projects to improve fuel efficiency and reduce carbon emissions of the existing diesel buses. 5.5 BUS BRANDING AND EXTERNAL ADVERTISING There should be a similar brand and branding in respect of all quality public transport in the City. The Gauteng Department of Public Transport and Roads also wants to see similar branding across Gauteng under the banner or slogan of “Gauteng on the move”. There have been proposals made that the Rea Vaya brand should be extended beyond BRT to all forms of quality public transport such as Rea Vaya cycle or Rea Vaya Public Transport Facility. However no decision has been made in this regard and there are equally strong views that say Rea Vaya should only be associated with bus rapid transit. It is thus proposed that the buses have similar external colours to Rea Vaya and that the liveries inside the buses (seats etc.) are also similar. During the transition period under the SSMA, the following is proposed: New buses have Rea Vaya colours and outdoor advertising is allowed only on the back of the buses; and Existing buses continue with Metrobus colours and they can be advertised all over as per existing situation. Until such time as final decisions are made in respect of the Rea Vaya and Gauteng brand, the new buses will be regarded as City of Joburg buses which are operated by Metrobus while the existing buses will be regarded as Metrobus buses operated by Metrobus. Page | 19 SECTION 6: IMPLEMENTING THE TRANSITION 6.1 INTRODUCTION In the section 2.2, the approach to institutional restructuring was set out. Here we set out in more detail what would be required of the functions that shift to the SMMA, the function that remain at Metrobus and the change management process The functions that will shift to the SSMA are: Fare management Marketing and communication Inspection In addition the SSMA will have to carry out bus management and createa time table for the entire Metrobus service. The functions that will remain at Metrobus are operating of buses and bus maintenance. It is also proposed that Metrobus expand their function over time in respect of maintenance and green refuelling and develop themselves as a centre of excellence in this regard. This is discussed further below. 6.2 FUNCTIONS THAT WILL BE TAKEN OVER BY THE SSMA 6.2.1 FARE MANAGEMENT For the successful transition of Metrobus to retain and attract new users along the proposed routes, to integrate with other public transport services and for it be managed effectively on a fee per km basis, new bus and fare management systems need to be introduced. In line with the proposed institutional changes, the fare management system will be managed by the Scheduled Services Management Agency. The new fare collection system will be based on the following principles: Cashless: In order to gain access to the Metrobus System, all commuters need to present valid payment media at entrance and exit of the system. No cash will be accepted on the bus; Scalable: The Automated Fare Collection (AFC) System will be implemented to allow for future growth of the system and minimize development costs and delivery times; “Tap-On” and “Tap-Off”: Commuters will be required to tap-on when boarding and tapoff during alighting, irrespective if monetary and/or ticket value will be deducted during tap-off. This will ensure that the operator has valuable origin/destination data for their public transport network; Minimum disruption to stakeholders: The AFC System shall be implemented in such a way, so as to minimize the impact on all stakeholders, such as public transport operators and passengers; Flexible fare structure: The AFC System shall be easily customizable to over time move from the staged approach currently in place at Metrobus to a distance based system along the line of Rea Vaya BRT. The system will be able to integrate with Rea Vaya BRT and with other modes going forward Secure: All components in the AFC System shall incorporate robust and proven mechanisms to secure all transactions. The integrity of data will be secured while allowing for future integration between other operators; Robust: The AFC System and its components will be proven, reliable, efficient and similar in style and quality to existing systems used in high quality metro public transport systems locally and worldwide; Page | 20 Fast: The AFC System shall accommodate interaction between fare payment devices and fare payment media to enable transaction speeds of 600 mille-seconds or less. ; and Auditable: The AFC system shall be fully auditable In summary, this fare collection system will use the legislated EMV based bank card for payment of trips. It will also enable fare integration between different public transports modes, i.e. one card can be used to pay for trips from different public transport providers. It will work on a “tap-on” / “tap-off” fashion to facilitate distance-based fare collection. It is proposed that the National Department of Transport be approached to fund the introduction of this new fare collection system from the Public Transport Infrastructure and Systems Grant due to the fact that a migration to EMV bank cards is a legislative requirement and a significant step towards the national objectives of integrated ticketing. In the event that this is unsuccessful, a financing strategy will need to be developed in consultation with City Finance. 6.2.3 BUS MANAGEMENT Bus management will take place via an Operations Control Centre managed by the Scheduled Services Management Agency. The centre will be equipped with an Advanced Public Transport Management System which inter alia will be able to track whether buses are on schedule and where scheduled trips are indeed being serviced. The bus controller at the centre will maintain constant communication with drivers of busses that will not be on schedule or would have deviated from the prescribed schedule. The bus controller will also liaise with JMPD in case of serious congestions for clearing. The SSMA already has such a system in place for the Rea Vaya and it would be extended to the Metrobus services. 6.2.2 MARKETING AND COMMUNICATION All activities related to marketing or service promotion will be done by the Schedule Services Management Agency (“SSMA”). The current Metrobus marketing team will be absorbed by SSMA marketing department. The following activities will be carried out by the SSMA: What Passenger information Detail This will include timetables and fares. Information will be available on a website, through call centre, walk in centres and private and public trip finders. Information will also be available at all commuter shelters. Information will be regularly updated. Growing patronage This will be done by marketing and communication campaigns focused on the general public as well as targeted areas and groups such as learners, shoppers etc. External stakeholder relations This includes engaging and informing key commuter and management public transport stakeholder groups. Customer care This includes responding timeously to complaints including through social media as well as providing information etc. The walk in centres will also play a role in this regard including for lost property and to address problems with smart cards. Customer satisfaction surveys These will be carried out annually to get feedback on customer issues and how performance needs to be improved. Page | 21 6.3 SERVICES TO CONTINUE TO BE OPERATED BY METROBUS Below is a summary of the service that will continue to be operated by Metrobus. 6.3.1 BUS SERVICES Metrobus will continue to offer the following bus services: Provision of drivers who will drive the buses on routes that are scheduled by SSMA. Maintenance of a motivated and professional team of bus drivers so that there are minimal service disruptions due to factors such as absenteeism, slowdowns, disciplinary action, etc. 6.3.2 MAINTENANCE AND TECHNICAL SERVICES It is proposed that going forward Metrobus should: Continue to maintain its own fleet (focusing on the older buses only since new buses should have maintenance contract for at least the initial years). Metrobus can also develop the capacity to support the maintenance services of other City services such as Pikitup; and Become a centre of excellence and innovation in respect of alternative fuels and fuel efficiency conversions. Metrobus has participated in pilot projects on green fuels and can become a pioneer in alternative fuels through the new fleet as well as adapting the existing fleet by for example converting old diesel engines to bio-fuels engines. This project can be extended to other diesel engines, not only used by buses but trucks as well. 6.4. HUMAN RESOURCES Critical to the successful implementation of the services to be continued to be operated by Metrobus is the development a new human capital strategy. 6.4.1 HUMAN CAPITAL STRATEGY The current Human Capital Management strategy will be reviewed to ensure total alignment with the new Metrobus Business plan. This approach to be adopted will recognises that employees are the company’s most valuable asset and focuses on developing employees’ skills, knowledge and behaviours in order to maximise their contribution to the success of the company. This in return will enhance Metrobus’ ability to attract and retain good talent. 6.4.2 REMUNERATION AND BENEFITS The overall strategic aim of Metrobus’ reward management is to develop and implement the reward policies, processes and practices required to support the achievement of the organisation’s goals by helping to ensure that the company has the ability to attract and retain competent, well-motivated and committed people. The philosophy underpinning the strategy is that people should be rewarded for the value they create. How the company remunerates employees will reflect the dynamics of the market and context in which it operates. It will at all times align with the strategic direction and specific value drivers of Metrobus and at the same time acknowledge our focus on building a high performance organisation. 6.4.3 PERFORMANCE MANAGEMENT A new performance management system will be developed linked to the organisation’s strategic process, and therefore provides for the translation of the strategic plan into key performance areas.Performance Management must support the implementation of the transportation values. Page | 22 The process of performance management will incorporate the challenges that Metrobus currently faces with regards to introduction of effective measures to deal with abuse of sick leave and heightened efforts to improve productivity company-wide. 6.4.4 HUMAN CAPITAL PLANNING Metrobus will ensure that effective human capital planning is in place to ensure that the process of identifying the organisation’s human capital requirements and developing plans to ensure those requirements are satisfied and motivated. This will ensure that right people, with right knowledge, skills and abilities in the right numbers are in the right jobs, at the right time. 6.4.5 KNOWLEDGE MANAGEMENT All employees will leave Metrobus at some point in time and many of them will take valuable knowledge gained from experience and training with them. Metrobus will develop a plan to ensure that accumulated knowledge, both technical and historical does not leave the organisation when an employee retires or pursues other opportunities. 6.5 CHANGE MANAGEMENT AND MOVING TO THE TRANSITIONAL ARRANGEMENT 6.5.1 CHANGING THE SDA BETWEEN METROBUS AND THE CITY Once the business plan is approved, the City of Joburg Legal will appoint lawyers to make amendments to the current Service Delivery Agreement with the City. The proposed changes will need to be approved by both the Board of Metrobus as well as the Mayoral Committee. Key changes that will be made to the SDA will include: How the subsidy between Metrobus and the City will work Change of functions of Metrobus Clauses in respect of the new buses that will be owned by the City but operated by Metrobus including in respect of insurance and other related risks. In changing the SDA, reference will be made to the draft Bus Operating Contract Agreements that exist or will exist between the City and the private Rea Vaya bus operators for Phase 1A and 1B. 6.5.2 HUMAN RESOURCE CHANGE MANAGEMENT In the transition phase, a number of staff will need to be transferred from Metrobus to the City. The estimated numbers in this regard are set out in the table below: Section Senior Cashiers Cashiers Inspectors Special Services Clerk Marketing Assistant Call Centre Clerks Switchboard Operator Business Development Officer Planning Manager Schedule Assistant Communication Officer Total Estimated number 3 11 13 1 1 8 6 1 1 1 1 47 Page | 23 Please note that these figures are only indicative and would be subject to a detailed process and consultation as per the Section 197 of the Labour Relations Act and other relevant legislation. The following will be adhered to in respect of the legislative framework: New employer assumes all the responsibilities and obligations from the date of transfer and transfer do not interrupt an employee(s) continuity employment. The transfer process does not prevent an employee from being transferred to a new pension, provident, retirement or similar fund, however, the requirements of section 14 (1) c of the Pension Fund Act no. 24 of 1956 must be satisfied. New employer is bound by the collective agreements and arbitration awards in terms of the Act, unless reviewed in terms of section 62 of the Labour Relations Act. All relevant information must be disclosed to the employee(s) concerned and / or organised labour. There is a requirement for valuation [due diligence on employee(s) personal files] as at the date of the transfer. For a period of twelve (12) months after the date of transfer the old employer is jointly and severally liable with the new employer to any employee who becomes entitled to receive payments as contemplated by subsection 7 of section 197 of the Labour Relation Act (termination due to operational requirements). The old and the new employer are jointly and severally liable in respect of any claim concerning the term and condition of employment. During the period before the transition and in respect of the remaining staff, the Metrobus will conduct an intensive change management process to ensure that the transition to the SSMA will be inclusive and understood by all. The change management process will include: Awareness – Create an understanding for the need to change – Why is the change necessary? Why is it happening now? What is wrong with what we are doing today? What will happen if we don’t change? What’s in it for the individuals? Desire – Create the desire to support and take part in the change – Which is dependent on the nature of change, the credibility of the person leading the message of change, intrinsic factors, history of the organisation. Effective leading and influencing can go a long way to help people choose to follow the desire to change. Knowledge – Give knowledge so people can understand how to change and what to do – Providing training and education, detailed understanding of new tasks, processes and systems, and understanding new roles and responsibilities. Ability – Provide the skills to implement change on a day to day basis – Providing day to day involvement, access to subject matter experts, provide effect performance monitoring, hands on exercise during training. Reinforcement – Create the ability and environment to sustaining the change and keep it going, keeping the momentum going. – Celebrations and recognition, rewards, feedback to and from employees, audits and performance measurement systems, accountability systems 6.5.3 ACCOMMODATION IMPLICATIONS Metrobus is presently occupying a building next to Wits University which is owned by the City and they do not pay rent. In the medium term it is proposed that this building be sold by the City to Wits University at a market related rate. Wits University is keen to purchase the building for their expansion plans. However for the purpose of this business plan, it is assumed that Metrobus will continue to occupy this building and that the control centre for the buses will reside in this building. Page | 24 The Transport Department is constructing a new depot in Selby and will include a control room. In the medium term, the control room of Metrobus can be relocated there if the Metrobus offices are sold. Page | 25 SECTION 7: FINANCIAL MODEL AND APPRAISAL 7.1 INTRODUCTION The financial model is used to determine sustainability of the bus operator and to calculate the Fee per KM payable to the party. Some basic assumptions and inputs costs were considered when preparing financial model. The financial model includes building the transaction flow through the phases of the model for the number of years required in order to arrive at the required financial model output. The financial model structure is as follows: Assumptions Projected Income Statement Projected Balance Sheet Projected Cash Flow Statement Total capital expenditure and phasing in 7.2 FINANCIAL MODEL The financial model amongst other comprises of revenues, costs, and profits margin. 7.2.1 REVENUES (FARES AND ADVERTISING) Project revenues have been classified into two types, namely direct revenues and indirect revenues. Direct revenues are those revenues that are directly attributable to the project and are collected from primary beneficiaries of the project. They include fares and other sources of revenue – at this stage only bus advertising. The current Metrobus fares are based on zones and the distance travelled. This will change with the new Automatic Fare Collection System (AFC) as discussed above. This will enable a fare structure which bears a stronger relationship to the other modes in the Gauteng and other provinces transport system. The proposed fares which were modelled for the business plan are as follows: Journey Length 2013/14 2014/15 Minimum fare including travel ≤ 5km 5.50 6.50 ≤10km 7.20 5.40 ≤15km 9.00 10.50 ≤26km 10.70 12.50 ≤35km 12.50 14.60 >35km (Maximum fare) 14.20 16.60 EMV Card 20.00 23.40 - - Occasional Users – One Trip 25.00 29.20 Occasional Users – Two Trip 37.00 43.20 Penalty Fees 14.20 16.60 10% off 10% off Loading Fees** Off-Peak Rates The fare revenue has been estimated peak morning hour of 6 trips per bus and 2 trips per bus during off-peak. The number of passenger boarding has been calculated based on the number Page | 26 of buses, trips, and bus capacity for all MB routes, secondary routes and contract and scholar trips. Bus Capacity Estimation Route Description Fleet (Buses) Routes 396 Vehicle Capacity (Pax) Max capacity per bus per day peak Max capacity per bus per day off peak Max capacity per day peak Max capacity per day off peak Ann ual days Max capacity per year peak Maximum capacity per year - off peak 6 2 180 576 60 192 248 44 782 848 14 927 616 76 Total capacity 59 710 464 The revenue has been estimated at R213 million in year one with 25 million passengers per annum at ridership of 50% during peak hour and 20% during off-peak hour. An average estimated fare of R8.40 has been used in the forecast with an average distance travelled of 10 kilometers. Fare Revenue Estimation –2014/15 Vehicle type Maximum capacity per year Average Occupancy/ Ridership Estimated passenger number Peak 44 782 848 50% 22 391 424 8.40 188 087 962 Off- Peak 14 927 616 20% 2 985 523 8.40 25 078 395 Total 59 710 464 Average Fare 25 376 947 Fare Revenue 213 166 356 The revenue has been estimated at R275 million in year two with 31 million passengers per annum at ridership of 60% during peak hour and 30% during off-peak hour. An average estimated fare of R8.80 has been used in the forecast with an escalation of 5% increase per annum. Fare Revenue Estimation –2015/16 Vehicle type Maximum capacity per year Average Occupancy/ Ridership Estimated passenger number Peak 44 782 848 60% 26 869 709 8.80 236 539 421 Off- Peak 14 927 616 30% 4 478 285 8.80 39 423 237 Total 59 710 464 31 347 994 Average Fare Fare Revenue 275 962 657 The revenue has been estimated at R343 million in year three with 37 million passengers per annum at ridership of 70% during peak hour and 40% during off-peak hour. An average estimated fare of R9.20 has been used in the forecast with an escalation of 5% increase per annum. Page | 27 Fare Revenue Estimation – 2016/17 Vehicle type Maximum capacity per year Average Occupancy/ Ridership Estimated passenger number Peak 44 782 848 70% 31 347 994 9.20 288 380 977 Off- Peak 14 927 616 40% 5 971 046 9.20 54 929 710 Total 59 710 464 37 319 040 Average Fare Fare Revenue 343 310 687 In respect of bus advertising, Metrobus has a contract for bus advertising. It is proposed that in respect of the existing buses, the full wrapping of such buses can continue but with the new buses, advertising should only be allowed on the back of the bus. The estimated amount of revenue per year is R9 million in 2013/14 escalating to R10 million in 2014/15 and R11 million in 2015/16. The revenue may slight decrease average of R8 million per annum since the adverting will not cover the entire bus. 7.2.2 COSTS The financial model and the resultant proposed fee per km is calculated taking into account certain assumptions and input costs. The input costs are as follows: Bus running cost o Fuel costs o Lubricant costs o Bus maintenance costs o Tyre costs Bus fixed costs o Insurance (Comprehensive, public liability, Sarsia and Other) o License and registrations Employee Remuneration Overhead costs Bus funding cost Once all the costs have been determined, a profit margin is added to provide Metrobus with profit and positive cash flows over the next 12 years. Page | 28 The following base assumptions have been made in developing the financial model for old buses and new buses. Period Contract period in years Number months per year Number of days per year Equipment number of working days per year Bus Kilometre Annual bus km Repositioning KM/Dead Number of dead km Annual bus km (15% for repositioning) 12 12 365 312 Old 7 477 17.6% 1 317 8 794 Inflation Consumer Price Inflation Licensing Wage/Salaries 2 155 14 390 8% Old 250 25 275 New 166 9 175 Old 10% New 5% Overhead cost allocation Number of vehicles - Ratio Old 61.1% New 38.9% Bus Running Cost Fuel per litre (Excl. green fuels) Lubricants cost (% fuel) Old 11.17 2.50% New 11.17 2.50% Bus Consumption Average fuel consumption per 100/km's Average fuel consumption per KM Fuel cost per KM Lubricants cost per KM Tyre cost per KM Maintenance cost per KM - Chassis Maintenance cost per KM - Body Old 58.70 0.59 6.56 0.16 0.70 3.26 0.81 New 52.00 0.52 5.81 0.15 0.70 1.60 0.41 Buses Reserve Fleet Reserve % Total 12 235 5.60% 6.00% 6.80% Profit margin Profit margin Buses Operational of vehicles Reserve fleet Total number of buses New 4 758 17.6% 838 5 596 years Months Days Days Total 416 34 450 7.2.3 SSMA COSTS There are certain functions that are currently performed by Metrobus that will need to be moved to SSMA. The services that will be transferred amongst others include planning, scheduling, inspectorate, marketing cost, call centre and cashiers. The total estimated cost to be transferred to SMMA is approximately R19.8 million per annum. This comprises of employee cost of approximately R18 million and marketing and telecommunication cost of R1.8 million. Page | 29 7.3 FINANCIAL APPRAISAL The City will pay Metrobus a Fee per KM based on the number of live kilometres travelled. A commercial Fee per KM has been estimated at R38.03 and 36.72 for the old buses and new buses respectively. The Fee per KM has included a commercial profit of 8% to allow the operator to generate positive cashflows. The total number of kilometres per annum is estimated at 14,390 million kilometres and 12,235 live kilometres. The contract cost of Metrobus is estimated at R459 million per annum and the estimated revenue is R222 million resulting in a deficit of R237 million. The deficit is expected to reduce to R196 million in 2015/16 and R158 million in 2016/17 as ridership increase over the period. A 12 year system income statement has been shown in figure 1 below. Figure 1: System income statement Year 1 2014/15 2 2015/16 3 2016/17 4 2017/18 5 2018/19 6 2019/20 7 2020/21 8 2021/22 9 2022/23 10 2023/24 11 2024/25 12 2025/26 Total TOTAL REVENUE 222 166 286 531 356 679 371 135 389 742 409 281 429 800 451 348 473 977 497 741 522 697 548 904 4 960 000 Revenue Marketing revenue 213 166 9 000 276 489 10 042 345 612 11 067 362 892 8 243 381 037 8 705 400 089 9 192 420 093 9 707 441 098 10 251 463 153 10 825 486 310 11 431 510 626 12 071 536 157 12 747 4 836 722 123 279 Bus Operating Cost - Metro 459 056 483 033 514 789 548 656 582 290 611 111 648 651 688 519 730 861 772 993 820 597 866 122 7 726 678 SURPLUS/(DEFICIT) (236 889) (196 502) (158 110) (177 521) (192 549) (201 830) (218 851) (237 171) (256 884) (275 252) (297 900) (317 218) (2 766 677) OPERATING COSTS Page | 30 The Bus Operating Company (Metrobus) projected income statement, projected cashflows and projected balance sheet are in shown in the figure 2 – 4 below. 7.3.1 INCOME STATEMENTS Figure 2: Bus Operating Company (Metrobus) Projected Income Statement Year INCOME STATEMENT REVENUE Old buses New Buses 1 2014/15 2 2015/16 3 2016/17 4 2017/18 5 2018/19 6 2019/20 7 2020/21 8 2021/22 9 2022/23 10 2023/24 11 2024/25 12 2025/26 459 056 284 328 174 728 483 033 299 197 183 836 514 789 318 792 195 997 548 656 339 758 208 899 582 290 360 562 221 728 611 111 176 716 434 395 648 651 187 548 461 103 688 519 199 051 489 468 730 861 211 266 519 595 772 993 137 721 635 272 820 597 146 181 674 416 866 122 866 122 9 000 10 042 11 067 8 243 8 705 9 192 9 707 10 251 10 825 11 431 12 071 12 747 425 052 448 277 478 882 513 140 546 376 564 394 606 414 648 255 693 307 730 315 778 973 814 590 149 513 90 165 2 254 10 073 47 020 159 036 96 258 2 431 10 647 49 700 167 563 101 782 2 595 11 148 52 037 181 086 110 955 2 899 11 862 55 370 192 997 118 851 3 150 12 526 58 471 188 310 120 576 3 195 13 228 51 311 206 157 132 133 3 634 13 968 56 421 222 258 142 070 3 978 14 751 61 460 239 904 152 704 4 352 15 577 67 271 247 730 159 771 4 573 16 449 66 937 265 315 169 455 4 872 17 370 73 618 267 843 176 557 5 120 18 343 67 823 24 609 16 963 7 646 26 035 17 930 8 105 27 364 18 773 8 591 29 082 19 975 9 107 30 747 21 094 9 653 32 507 22 275 10 232 34 369 23 523 10 846 36 337 24 840 11 497 38 418 26 231 12 187 40 618 27 700 12 918 42 944 29 251 13 693 45 404 30 889 14 515 Employee Cost Basic Benefits Other:UIF, Bonus 184 256 184 256 - 192 732 192 732 - 210 167 210 167 - 224 458 224 458 - 239 721 239 721 - 256 023 256 023 - 273 432 273 432 - 292 025 292 025 - 311 883 311 883 - 333 091 333 091 - 355 741 355 741 - 379 932 379 932 - Overhead Costs Overhead expenses 66 674 66 674 70 474 70 474 73 788 73 788 78 514 78 514 82 911 82 911 87 554 87 554 92 457 92 457 97 634 97 634 103 102 103 102 108 876 108 876 114 973 114 973 121 411 121 411 EBITDA Depreciation 34 004 19 543 34 756 19 543 35 907 19 543 35 516 19 543 35 914 19 543 46 717 18 143 42 237 18 143 40 264 1 000 37 554 1 000 42 678 1 000 41 624 200 51 532 200 EBIT 14 461 - 15 213 - 16 364 - 15 973 - 16 371 - 28 574 - 24 094 - 39 264 - 36 554 - 41 678 - 41 424 - 51 332 - 14 461 15 213 16 364 15 973 16 371 28 574 24 094 39 264 36 554 41 678 41 424 51 332 4 049 4 049 4 260 4 260 4 582 4 582 4 473 4 473 4 584 4 584 8 001 8 001 6 746 6 746 10 994 10 994 10 235 10 235 11 670 11 670 11 599 11 599 14 373 14 373 Profit after tax Dividends 10 412 - 10 954 - 11 782 - 11 501 - 11 787 - 20 574 - 17 347 - 28 270 - 26 319 - 30 008 - 29 825 - 36 959 - Retained income 10 412 21 366 33 148 44 649 56 436 77 009 94 357 122 627 148 946 178 954 208 779 245 739 Advertising revenue OPERATING COST Bus km dependent cost Fuel Lubricants Tyres Maintenance Bus Fixed cost Insurance Licensing Finance charges Profit before tax Tax Corporate Tax Page | 31 7.3.2 CASH FLOW STATEMENTS Figure 3: Bus Operating Company (Metrobus) Projected Cashflow Statements CASHFLOW ANALYSIS 1 2014/15 2 2015/16 3 2016/17 4 2017/18 5 2018/19 6 2019/20 7 2020/21 8 2021/22 9 2022/23 10 2023/24 11 2024/25 12 2025/26 Profit after tax Add: Depreciation Add: Interest expense Operating Activities 10 412 19 543 29 955 10 954 19 543 30 497 11 782 19 543 31 325 11 501 19 543 31 044 11 787 19 543 31 330 20 574 18 143 38 716 17 347 18 143 35 490 28 270 1 000 29 270 26 319 1 000 27 319 30 008 1 000 31 008 29 825 200 30 025 36 959 200 37 159 Working capital 5 192 438 103 572 419 (793) 841 657 740 (37) 642 (510) - - - - - - - - - - - - - - - - - - - - - - Financing Activities Funding: Loan Capital repayment Bus Restructuring Dividends 120 000 - Investing Activities Bus Acquisition Bus Restructuring Non-Current Assets (120 000) (52 000) - - - - (5 000) - - - - (1 000) - Free Cashflow (16 853) 30 935 31 428 31 616 31 749 32 923 36 332 29 927 28 059 30 972 29 667 36 649 Cashflow - Opening - (16 853) 14 082 45 510 77 125 108 874 141 797 178 129 208 056 236 115 267 086 296 754 Cashflow - Closing (16 853) 14 082 45 510 77 125 108 874 141 797 178 129 208 056 236 115 267 086 296 754 333 403 7.3.3 BALANCE SHEETS Figure 4: Bus Operating Company (Metrobus) Projected Balance Sheet BALANCE SHEET 1 2014/15 2 2015/16 3 2016/17 4 2017/18 5 2018/19 6 2019/20 7 2020/21 8 2021/22 9 2022/23 10 2023/24 11 2024/25 12 2025/26 ASSETS Non-current assets Vehicles Old Buses New Buses Land & Building and Equipments Land & Building Equipment & Computers Current Assets 102 857 85 714 68 571 51 429 34 286 17 143 - - - - - - 102 857 85 714 68 571 51 429 34 286 17 143 - - - - - - - - - - - - - - - - - - 49 600 47 200 44 800 42 400 40 000 44 000 43 000 42 000 41 000 40 000 40 800 40 600 40 000 40 000 40 000 40 000 40 000 40 000 40 000 40 000 40 000 40 000 40 000 40 000 9 600 7 200 4 800 2 400 - 4 000 3 000 2 000 1 000 - 800 600 357 132 (4 276) 27 315 59 614 92 157 124 827 158 540 195 900 226 920 256 138 288 264 319 236 Accounts receivables:CoJ 12 577 13 234 14 104 15 032 15 953 16 743 17 771 18 864 20 024 21 178 22 482 23 729 Bank and cash (16 853) 14 082 45 510 77 125 108 874 141 797 178 129 208 056 236 115 267 086 296 754 333 403 148 181 160 230 172 985 185 986 199 113 219 683 238 900 268 920 297 138 328 264 360 036 397 732 130 412 141 366 153 148 164 649 176 436 197 009 214 357 242 627 268 946 298 954 328 779 365 739 120 000 120 000 120 000 120 000 120 000 120 000 120 000 120 000 120 000 120 000 120 000 120 000 10 412 21 366 33 148 44 649 56 436 77 009 94 357 122 627 148 946 178 954 208 779 245 739 Accounts Payable 17 769 18 864 19 837 21 337 22 677 22 674 24 544 26 293 28 192 29 310 31 257 31 993 Accounts payable - Bus Dep Km's Accounts payable - Overheads Accounts payable - Employees Cost 12 289 5 480 - 13 071 5 792 - 13 772 6 065 - 14 884 6 453 - 15 863 6 815 - 15 478 7 196 - 16 944 7 599 - 18 268 8 025 - 19 718 8 474 - 20 361 8 949 - 21 807 9 450 - 22 014 9 979 - - - - - - - - - - - - - TOTAL ASSETS EQUITY AND LIABILITIES Equity Equity Retained earnings Current liabilities Non current liabilities Long-term loans PTIS Short term loan - Banks TOTAL EQUITY AND LIABILITIES 148 181 160 230 172 985 185 986 199 113 219 683 238 900 268 920 297 138 328 264 360 036 397 732 Page | 32 7.3.4 CONCLUSION The overall Metrobus contract will require a subsidy of R2,7 billion over 12 years requiring an average subsidy from the City of R230 million per annum. This is based on the achieving a ridership of 70% during peak hour and 40% during off peak hour as from year three. The 12/13 subsidy from the City R320 million and the subsidy for 13/14 is R330 million. Thus a R100 million rand reduction in subsidy will be required from the City while Metrobus will see an increase in passenger numbers per year from 30 million to 37 million after year three. Page | 33 SECTION 8: TIMEFRAMES AND ASSUMPTIONS 8.1 PROPOSED TIMEFRAMES The high level proposed timeframes are as follows: Refleeting and associated improvements: From February 2014 Move to SSMA (change management process): July 2013 to July 2014 Conduct process for final institutional form: July 2014 Agree final form and implement: July 2016 Once the business plan has been approved a detailed project plan and associated timelines will be developed. 8.2 CRITICAL ASSUMPTIONS FOR SUCCESS There are a number of critical assumptions for the successful execution of this business plan. They are: Ongoing political and Board support for the proposed route approved by the Mayoral Committee; Sufficient resources for the change management process including financial and human resource; Funding for the refleeting of the buses and a modern bus and fare management system from either PTIS or through financing from the City; and That the rationalisation plan can be implemented in a way that creates new opportunities for the mini bus taxis industry to the extent that the Metrobus routes take away existing passengers from this mode. Page | 34 ANNEXURE 1: MAP OF PROPOSED ROUTES Legend MB1 MB2 MB3 MB4 MB5 MB6 MB7 MB8 MB9 MB10 Page | 35

© Copyright 2026