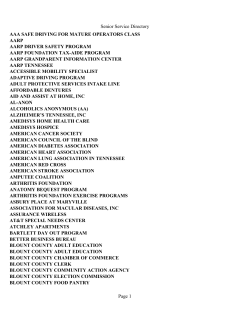

Document 169413