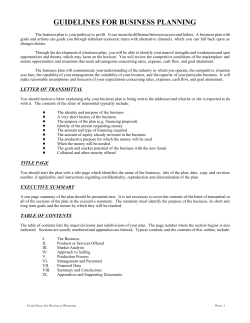

3 Chapter Across the Disciplines