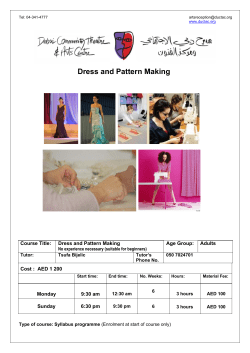

Engaging business and people لاـمـعلأا لـصاوـت دارـفلأاو