Trade Induced Technical Change?The Impact of Chinese Imports on

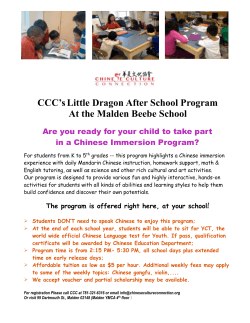

Trade Induced Technical Change? The Impact of Chinese Imports on Innovation, Diffusion and Productivity Nick Bloom (Stanford) Mirko Draca (Warwick) John Van Reenen (LSE & CEP) Chicago April 2015 What is the impact of Southern trade on Northern technical change? • Limited empirical evidence, partly from lack of micro data and partly due to a lack of North-South trade natural experiments • Theoretical literature also inconclusive (e.g. ambiguous effects of competition on innovation & adoption) • But this is a major economic and political issue because of the rapid growth of Chinese & low-wage country imports 15 Low-wage % of imports in Europe and the US 10 All low wage 0 5 China 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 Low wage countries list from Bernard, Jensen and Schott (2006). Countries <5% GDP/capita of US 1972-2001. Clear political importance – for example tires trade war in 2010 Major election issue in 2012 Summary: we study the impact of Chinese imports on technology in Europe (1/2) Use panel data on ~90,000 firms & establishments in 1990s & 2000s in 12 EU countries. We find that higher threat of Chinese imports leads to: A) Within-firm increase in volume of innovation (patenting and R&D) as well as greater IT, productivity & management quality B) A reallocation of jobs towards higher tech firms (as measured by patents, TFP, IT, etc.) So there is aggregate technological upgrading in the North from liberalization with a lower wage country like China Summary: we study the impact of Chinese imports on technology in Europe (2/2) Results robust to using IV strategy of quota relaxation post China’s entry into the WTO Overall magnitudes moderate but rising: China “accounts” for: • ≈ 15% of increase in IT, patents & productivity 2000-2007 Suggests the impact on innovation is another positive outcome (alongside static gains) from low wage country trade Some econometric ‘case-studies’ illustrate our results Freeman and Kleiner (2005) look at a large US shoe maker’s response to increasing low wage country competition Bartel, Ichniowski & Shaw (2007) on US valve manufacturers’ response to cheaper imports Bugamelli, Schivardi & Zizza (2008) Italian manufacturers reactions to Chinese import threats All find very similar changes: • Increased innovation to develop new product ranges • Investment in IT, worker skills and management practices Seems to fit a ‘Trapped-Factor’ innovation model (Bloom, Romer, Terry & Van Reenen, 2014) Caveat: Main empirical analysis is partial equilibrium Build Endogenous Growth GE model with “Trapped factors” – Some factors of production with firm-specific investment (skilled labor, management time, specific capital, etc.) – China shock reduces profits from old products – Lower opportunity cost to shifting trapped factors to innovate in new products Chinese are not making – Amplifies the standard positive effect on innovation from larger market size Consistent with case-studies & results from the paper: 1. Import competition increases innovation 2. Mainly within the narrowly impacted industry 3. Main response from imports from low skilled countries Related Literature • Trade & Productivity. De Locker & Goldberg (2014) survey; Empirics: Pavcnik (2002), Trefler (2004), Dunne et al (2008) Theory: Heterogeneous firms Melitz (2003), Arkollakis et al (2008, 2010); Redding & Melitz (2015); product switching: Bernard et al (2007); offshoring Grossman & Rossi-Hansberg (2008) • Trade & Innovation. Empirics: Bustos (2011), Acemoglu et al (2015); Theory: market size Krugman (1980), Grossman & Helpman (1992), Eaton & Kortum (2002), Atkeson & Burstein (2010); competition (Raith, 2002; Schmidt, 1997); Aghion et al, 2005); learning (Coe & Helpman, 1995; Acharya & Keller, 2008); Inputs (Goldberg et al, 2010a,b), • Impact of China. Bernard Jenson & Schott (2006); Ossa & Hsieh (2010); Levchenko & Zhang (201) • Low wage countries & labour markets: Machin & Van Reenen (1998), Autor, Dorn & Hanson (2013, 2014) Data Within plant/firm effects Reallocation effects between plants/firms Extensions & Robustness Innovation and Productivity data: firm panel • European Patent Office data (patents and citations) matched to population of public and private firms (living & dead) from BVD AMADEUS for 12 European countries 1996-2005 • France, Italy, Spain and Sweden have good materials data so estimate production functions to get TFP (separately by industry). Use de Loecker (2011) version of Olley-Pakes • Harte Hanks plant survey on IT. Focus on computers per worker as consistent across time & countries, but also use other software-based (e.g. ERP) • Smaller samples: – Subset 459 quoted firms reporting R&D for 5+ years – 1,576 firms with management data Trade data: UN Comtrade • Trade data at 6-digit level product matched to 4-digit SIC using Feenstra, Romalis, & Schott (2006) concordance • Our main measure is IMPCH = (Chinese Imports/All Imports): • Well measured annually at 4-digit SIC level • Also use import penetration measures – Chinese imports/apparent consumption – Chinese imports/production Chinese Imports into EU by SIC-2, 2000-2005 Food Tobacco Chemicals Transport 20 21 28 37 30 29 33 24 27 38 35 26 22 32 36 34 39 31 23 25 Textiles Fabricated metals Toys Leather Apparel Furniture 0 .02 .04 .06 5-year change in export share, 2000 to 2005, for our sample .08 .1 Data Within plant/firm effects Reallocation effects between plants/firms Extensions & Robustness Basic Technology Equation = Yijkt α IMP ln CH jkt patents, IT, R&D, TFP, management Example: For IT i = plants (22,957) j = industries (366) k = countries (12) jk = 2,816 cells t = 2000,…,2007 + f kt + ηi + ε ijkt Chinese import share Fixed Effects fkt : country*time dummies Cluster at industry-by-country (jk) Estimate in (5-year) long differences Table 1A: Within Firm OLS Results (1) (2) (3) ΔlnPATENT Δln(IT/N) ΔTFP 5 year diffs 5 year diffs 0.321*** (0.102) 0.361** (0.076) 0.257*** (0.072) 1.213** (0.549) 0.891*** (0.337) Sample period # units 2005-1996 2007-2000 2005-1996 2007-1996 2010-2004 8,480 22,957 89,369 459 1,576 # ind*cty clusters Obs 1,578 2,816 1,210 196 579 30,277 37,500 292,167 1,626 3,607 Method Change in Chinese Imports Δln(R&D) 5 year diffs 5 year diffs ΔManagement 3 year diffs Notes: SE clustered by industry-country, Country-year dummies included. Estimate TFP separately by industry (on 1.4m obs). Use Olley-Pakes (1996)/de Loecker (2011). Management data from Bloom and Van Reenen (2010), management mean (std dev.) is 3.09 (0.59). Because of short-panel run regressions in 3-year diffs. Endogeneity - use MFA policy experiment • The Multi Fiber Agreement (1974) restricted apparel and textile exports from developing countries • When China entered the WTO in 2001 it gained access to this phased abolition, occurring between 2002 and 2005 (Brambilla, Khandelwal & Schott, 2010) • As Chinese textile products came off quota there was huge surge of imports into EU (led to “bra-wars”) • 31,052 patents in the textile & apparel sub-sample • Use (value weighted) proportion of HS6 products covered by a quota in each 4 digit SIC in 2000 IV with share of SIC4 on quota under MFA – almost random - making this a great instrument | % industry covered by ussic | quotas (all stages) 4-digit | Mean Freq. ------------+---------------------------------------------------2211 | .77447796 210 (BROADWOWEN FABRIC, COTTON) 2221 | .23278008 63 (BROADWOWEN FABRIC, SILK) 2231 | .02347782 134 (BROADWOWEN FABRIC, WOOL) 2321 | .86472106 32 (MEN'S AND BOYS' SHIRTS) 2322 | 1 22 (MEN'S AND BOYS' UNDERWEAR) 2323 | .78554922 26 (MEN'S AND BOYS' NECKWEAR) 2325 | .05432023 10 (MEN'S AND BOYS' TROUSERS) 2329 | .74802500 12 (MEN'S AND BOYS' CLOTHING NEC) 2337 | .48232245 137 (WOMEN’S AND GIRLS SKIRTS) 2339 | 0 22 (WOMEN’S AND GIRLS CLOTHING NEC) IV with share of SIC4 on quota under MFA – almost random - making this a great instrument | % industry covered by ussic | quotas (all stages) 4-digit | Mean Freq. ------------+---------------------------------------------------2211 | .77447796 210 (BROADWOWEN FABRIC, COTTON) 2221 | .23278008 63 (BROADWOWEN FABRIC, SILK) 2231 | .02347782 134 (BROADWOWEN FABRIC, WOOL) 2321 | .86472106 32 (MEN'S AND BOYS' SHIRTS) 2322 | 1 22 (MEN'S AND BOYS' UNDERWEAR) 2323 | .78554922 26 (MEN'S AND BOYS' NECKWEAR) 2325 | .05432023 10 (MEN'S AND BOYS' TROUSERS) 2329 | .74802500 12 (MEN'S AND BOYS' CLOTHING NEC) 2337 | .48232245 137 (WOMEN’S AND GIRLS SKIRTS) 2339 | 0 22 (WOMEN’S AND GIRLS CLOTHING NEC) Table 2A: IV estimates using changes in EU textile & clothing quotas - IT Method ΔChinese Imports Δln(IT/N) ΔChinese Imports Δln(IT/N) OLS First Stage IV 1.284*** (0.172) Quotas removal 1.851*** (0.400) 0.088*** (0.019) Sample period 2005-2000 2005-2000 2005-2000 Number of units 2,891 2,891 2,891 industry clusters 83 83 83 2,891 2,891 2,891 Observations SE clustered by 4 digit industries, Country-year and site type dummies included. All columns using just textiles and apparel sample Table 2A- Cont: IV estimates using changes in EU textile & clothing quotas – Patents and TFP Method ΔlnPATENTS ΔlnPATENTS Δln(TFP) Δln(TFP) OLS IV OLS IV 0.902*** (0.087) 1.629** (0.326) ΔChinese Imports ΔChinese Imports 1st Stage F-stat Sample period Units Industry clusters Observations 1.160*** (0.377) 1.864* (1.001) 24.1 11.5 2005-1999 2005-1999 2005-1999 1999-2005 1,866 1,866 12,247 12,247 149 149 177 177 3,443 3,443 20,625 20,625 SE clustered by 4 digit industries, Country-year dummies included Maybe quota sectors had pre-existing trends? Table 3: Control for these & results robust (1) Dependent Variable: Quotas removal (SIC4*year>=2001) Firm-specific trends? Sample period Number of units Number industry clusters Observations (2) Δln(PATENTS) Δln(PATENTS) (5) (6) ΔTFP ΔTFP 0.129** (0.063) 0.216** (0.105) 0.143*** (0.018) 0.178*** (0.037) No Yes No Yes 2005-1992 2005-1992 2005-1992 2005-1992 2,435 2,435 16,495 16,495 159 159 187 187 14,768 14,768 55,791 55,791 SE clustered by 4 digit industries, Country-year and dummies included. All columns using just textiles and apparel sample *No significant correlation between quota IV and pre-WTO change in observables like TECH, industry size, wages, etc. (see Table A3) Other ways of controlling for unobserved technology shocks • Include three digit industry trends (Table 1B) • Use level of Chinese imports share in 1999 in all EU & US four digit industry as IV for subsequent growth (Table 8) – Trade analogue of Card’s “ethnic enclave” instrument • Include lagged dependent variable (Table A4) • Find supportive results to the quota IV approach Data Within plant/ firm effects Reallocation effects between plants/firms Extensions & Robustness C) Employment Equation If high TECH plants “protected” from Chinese imports then γn > 0 Employment growth ∆= ln N ijkt γ [TECH ijkt −5 * ∆IMP n α ∆IMP n CH jkt expect αn < 0 CH jkt ]+ + δ TECH ijkt −5 + ∆f + ∆ε ijkt n expect δn > 0 n kt n EMPLOYMENT GROWTH BY INITIAL IT INTENSITY .1 0 -.1 -.2 Employment Growth Top Quintile China Import Growth Bottom Quintile China Import Growth 1 2 3 4 5 IT LOW IT HIGH Quintiles of initial IT Intensity 1 2 3 4 5 IT LOW IT HIGH Quintiles of initial IT Intensity Table 4A: High Tech firms shed less jobs when faced with rising Chinese imports Dependent Variable: TECH Measure: Chinese Import Growth Ln(pat stock/worker) at t-5 Ln(pat stock/worker) at t-5* Chinese imports growth IT intensity (t-5) (IT/N) (t-5)*Chinese Imp Growth Δln(N) Patents -0.434*** (0.136) 0.348*** (0.049) 1.434** (0.649) Δln(N) IT -0.379*** (0.105) Δln(N) TFP -0.377*** (0.096) 0.230*** (0.010) 0.385** (0.157) Ln(TFP) at t-5 Ln(TFP) at t-5* Chinese import growth Clusters 1,375 2,816 Observations 19,844 37,500 SE clustered by country- industry, all standard additional controls included 0.136*** (0.012) 0.795*** (0.307) 1,210 292,167 C) Survival Equation If high TECH plants partially “protected” from effect of Chinese imports then γs > 0 Survival s CH = ∆ SURVIVAL γ TECH IMP [ * ijkt ijkt −5 jkt ] + α ∆IMP s CH jkt expect αs < 0 + δ TECH ijkt −5 + ∆f + ∆ε ijkt s expect δs > 0 s kt s Table 4B: High tech firms more likely to survive Chinese imports Dependent Variable TECH measure: Change in Chinese Imports Ln(patent stock/workert-5) *Change in Chinese Imports (IT/N) t-5*Change in Chinese Imports Survival Survival Survival patents -0.079 (0.051) 0.288** (0.138) IT -0.182** (0.072) TFP -0.208*** (0.050) 0.137 (0.112) ln(TFPt-5) *Change in Chinese Imports 0.110* (0.059) IT Intensity (IT/N)t-5 Ln(patent stock/workert-5) -0.002 (0.006) -0.008 (0.009) Ln(TFPt-5) Observations 7,985 28,624 -0.003 (0.003) 60,883 SE clustered by up to 2,863 country- industry pairs, lagged size & all standard additional controls Magnitude calculation Table 6: Aggregate effect of trade on technology, 20002007, % of Technology Measure that Chinese trade ‘accounts for’ Measure Within (%) Between (%) Exit (%) Total (%) Patents 5.1 6.7 2.1 13.9 IT Intensity 9.8 3.1 1.2 14.1 TFP 9.9 2.4 0.2 12.5 Notes: calculated for the regression sample using OLS coefficients Table A5: Comparison of Industry level results to firm results confirms simulated magnitudes Panel A: Industry-level regressions Dependent Variable: Change in Chinese Imports Sample period Observations Δln(PATENTS) Δln(IT/N) Δln(TFP) 0.368* (0.200) 0.399*** (0.120) 2005-1996 6,888 2007-2000 7,409 0.326*** (0.072) 2005-1996 5,660 Panel B: Firm-level (firms allocated to single SIC4) Dependent Variable: Change in Chinese Imports Years Observations Δln(PATENTS) Δln(IT/N) Δln(TFP) 0.171** (0.082) 2005-1996 30,277 0.361** (0.076) 2007-2000 37,500 0.164*** (0.051) 2005-1996 241,810 Data Within plant/firm effects Reallocation effects between plants/firms Extensions & Robustness Extensions & Robustness • Dynamic Selection (we bound the bias) • General Equilibrium • Heterogeneity of China effects – Within firm innovation effects strongest in industries where there are more “trapped factors” • Other low wage countries (yes, similar to China) • Lawyer effects on patents (find no evidence for this) • Offshoring (find some effect on IT and TFP) • “I-Pod” story (firms innovate here to produce in China – but imports reduce profits) • Exports (find small & insignificant effects) • Product Switching Table 7: Dynamic Selection - Worst Case Lower Bounds Δln(PAT) Δln(PAT) Baseline 0.321*** (0.102) Worst case Lower Bound 0.271** (0.098) Number of units 8,480 8.732 Number of clusters 1,578 1,662 Observations 30,277 31,271 Dependent Variable: Change in Chinese Imports Use Manski & Pepper (2000) idea of imputing lower bound of zero patents to all the firms who exited to calculate worst case lower bound. Similar results for Negative Binomial model & using quota IV What about general equilibrium – does that reduce China’s estimated impact? Bloom, Romer, Terry & Van Reenen (2014) detail model of impact of falling trade costs with China on global Growth in a GE model of endogenous growth with “trapped factors” Calibrating this model to 1996-2007 we find that China raises: - Long-run global growth in OECD by ≈ 0.2% (market size) - Short-run (10 year) growth by further ≈ 0.2% (trapped factors) Quantitatively important (equivalent to 16% ↑ in consumption) GE effects magnify the impacts we find in micro data Any evidence for trapped factor mechanism? Looks at heterogeneity of Chinese import effect • We want to capture the firm specific ‘trapped’ capacity to innovate • Two measures of ‘trapped factors’ – Industry wage premia (estimated via UK LFS) – Measured firm-level TFP (can be show to incorporate trapped factors) • We allow China effect to be heterogeneous across firms/industries depending on these proxies The heterogeneity of the China treatment effect consistent with trapped factor mechanism Change Chinese Imports 0.321*** (0.102) Industry wage premia Change Chinese Imports * Industry Wage premia TFPt-5 0.202*** (0.092) -0.411*** (0.069) 2.467*** (1.171) 0.284* (0.157) -0.287*** (0.050) 1.464*** (0.462) Change Chinese Imports *TFPt-5 Number of units Number of clusters Number of Observations -2.466*** (0.848) 8,480 1,578 30,277 8,480 1,578 30,277 5,014 1,148 5,014 1,148 14,500 14,500 Is there something specific about China? No: similar to all low-wage countries Δln(Patents) Dependent variable: Change in Chinese 0.182*** (0.074) Imports Change in Non-China Low Wage Imports Change in All Low Wage country Imports Change in High Wage Country Imports Change in World Imports Observations 0.063 (0.125) 0.182*** (0.073) 0.152 (0.128) 0.106*** (0.040) 0.003 (0.019) 29,062 29,062 29,062 0.004 (0.019) 29,062 Low wage countries list taken from Bernard et al (2006). Defined as countries <5% GDP/capita relative to the US 1972-2001. Chinese imports normalized by domestic production The lawyer effect? Maybe firms just patenting more to protect IP? So investigate this in three ways: • R&D: seem to spend more on innovation • Cites/patents: should drop if more marginal ideas patented. We find the opposite • Timing of patents: if this is simply a legal response should happen immediately (or in advance), while it is an innovation response more likely to be lagged (which is what we find, Table A14) What about offshoring instead? Is effect all driven by firms offshoring low value inputs to China? Investigate this by generating a Chinese offshoring proxy (based on Feenstra-Hansen, 1999) • Weight Chinese imports/apparent consumption by SIC 4digit input-output tables (US 2002 tables) • Proxies how much Chinese imports are increasing for each industry averaged across its sourcing industries Table 1D: Offshoring matters for more compositional measures (IT and TFP) but not innovation Dependent Variable Change in Chinese Imports Offshoring (ΔChinese Imports in source industries Observations ΔPATENTS 0.313*** (0.100) 0.173 (0.822) 30,277 Δln(IT/N) 0.279*** (0.080) 1.685*** (0.517) 37,500 ΔTFP 0.189*** (0.082) 1.396*** (0.504) 30,608 Note: We also find bigger jobs shakeout for firms who have branches in China The IPod effect: innovate because of low costs? No, imports reduce industry profits Dependent Variable: Δln(Employment) Δln(EU Producer Prices) Δln(Profits /Sales) Change in Chinese Imports -0.411*** (0.133) -0.453** (0.217) -0.112** (0.052) Observations 8,788 259 5,372 Industry-country pairs 1,913 131 2,295 Aggregation SIC4 SIC2 SIC4 2005-1996 2006-1996 2007-2000 Years Notes: Estimation by OLS in 5 year long differences, SE clustered by industrycountry pair, country-year dummies included, Is this just exporting to China? No exporting per se has little effect Dependent Variable Change in Chinese Imports Change in Exports to China Number of Observations ΔPATENTS 0.322*** (0.100) -0.243 (0.200) 30,277 Δln(IT/N) 0.361*** (0.076) 0.028 (0.118) 37,500 Δln(TFP) 0.254*** (0.072) -0.125 (0.126) 292,167 Conclusions Empirics • Find trade-induced increases in innovation, IT and TFP • Occurs within and between plants and firms • Relatively large and growing: China “accounts” for ~15% of increase in aggregate IT, patents and TFP and rising • Other low-wage countries trade similar effect, but high-wage countries trade appears to have no effect Model • Trapped-factors model seems to be best fit – firms have trapped factors that keep them in the industry – so innovate new products to escape competition Back Up Trapped Factor Model • Set Up – Endogenous Growth with North (R&D performing high tech) and South – Consider that in short run some factors are trapped in a firm (specific due to sunk costs irreversibilities) – Parameter with Northern barriers to Southern trade import changes over time. Consider a shock to this • Results – Standard result that lowering trade barriers increases innovation/growth through market size effect – Trapped factors re-deployed from production to innovation sector in firms affected by shock. This gives an extra short-run kick to innovation Table 1B: Include SIC-3 trends Dependent variable: Change in Chinese Imports Number of Units Number of country by industry clusters Observations Δln(PATEN TS) 0.191* (0.102) 8,480 Δln(IT/N) ΔTFP 0.170** (0.082) 22,957 0.128** (0.053) 89,369 1,578 2,816 1,210 30,277 37,500 292,167 Table A3: Regressing 2000-1995 changes on 2000 Quota IV, Industry Level QUOTA Observatio ns Δln (PATENTS) Δln(TFP) Δln(Output/ Labor) Δln(Capital/ Labor) Δln(Labor) Δln(Wages) -0.263 0.010 0.006 0.059 -0.053 0.032 (0.195) (0.023) (0.041) (0.071) (0.035) (0.023) 203 115 115 114 113 116 Table 8: Initial Conditions IV Dependent Variable Method: Change in Chinese Imports Initial Condition IV First-stage F-Statistic Sample period Number of Units #of industry clusters Observations (1) (2) (3) Δln Δln Δln(IT/N) (PATENTS) (PATENTS) OLS IV OLS 0.321*** 0.495** 0.361*** (0.224) (0.117) (0.106) 95.1 (4) (5) (6) Δln(IT/N) ΔTFP ΔTFP IV 0.593*** (0.252) OLS 0.257*** (0.087) IV 0.507* (0.283) 38.7 2005-1996 2005-1996 2007-2000 2007-2000 8,480 304 30,277 8,480 304 30,277 22,957 371 37,500 22,957 371 37,500 14.5 20051996 89,369 354 292,167 2005-1996 89,369 354 292,167 Summary Statistics: 12 Country Panel Austria Denmark Finland France Germany Ireland Italy Norway Spain Sweden Switzerland United Kingdom Computer Intensity 0.50 0.69 0.59 0.55 0.52 0.63 0.55 0.72 0.49 0.60 0.60 0.64 Employment 352 148 173 243 435 196 222 131 175 161 179 270 Number of Sites 1067 510 677 2911 3679 350 2630 362 1018 1168 1346 3567 Output Quotas rather than Input Quotas matter most Dependent Var. Method Output Quota Removal Δln(IT/N) Δln(IT/N) Means Reduced Form 1.284*** (0.172) Reduced Form 0.133*** (0.045) (standard dev) 0.094 (0.232) 0.311 (0.342) 0.031 (0.041) Input Quota Removal Observations 2,891 2,891 Notes: Input quotas are calculated using the Feenstra-Hansen method but using quotas instead of import flows. 489 SIC4 clusters. List of low wage countries Albania Angola Bangladesh Benin Bolivia Burkina Faso Burundi Cambodia Cameroon Central African Rep Chad China Comoros Congo Djibouti Egypt Equatorial Guinea Ethiopia Gambia Ghana Guinea Guinea-Bissau Guyana Haiti Honduras India Indonesia Ivory Coast Lao People's Dem. Rep. Madagascar Malawi Mali Mauritania Mongolia Morocco Mozambique Nepal Nicaragua Niger Nigeria Pakistan Papua New Guinea Philippines Rwanda Senegal Sierra Leone Sri Lanka Sudan Suriname Syria Tanzania Togo Uganda Viet Nam Yemen Zambia Zimbabwe Low wage countries list taken from Bernard, Jensen and Schott (2006). They defined these as countries with less than 5% average per capita GDP relative to the Unites States in the period between 1972-2001. Tab A10 China associated with skill upgrading (wage bill share of college educated in UK) Sample All All All Textiles & Apparel Textiles & Apparel Method OLS OLS OLS OLS IV Change in Chinese 0.144** 0.099** 0.166** 0.277*** Imports (0.035) (0.043) (0.030) (0.053) Change in IT intensity F-test of excluded IVs Observations 0.081** 0.050* (0.024) (0.026) 9.21 204 204 204 48 48 SE are clustered by 74 SIC3 industries; 2006-1999, UK LFS data, IV is height of quota pre-WTO; all columns control for year dummies, regressions weighted by industry employment in 1999 Table A11: INDUSTRY SWITCHING Dependent variable ΔChinese Imports IT intensity (t-5) Plant Switches Industry 0.138*** (0.050) Plant Switches Industry 0.132*** (0.050) -0.018** (0.008) Switched Industry Employment growth Observations 32,917 -0.002 (0.006) 32,917 Δln(IT/N) Δln(IT/N) 0.466*** (0.083) 0.025** (0.012) 0.023* (0.012) 32,917 32,917 “Switched Industry” is a dummy if a plant switched its main four digit industry over a five Year period. SE clustered by country*industry pair. 2000-2007. Tab A14 Dynamics - Patent effect largest at long lags PANEL A: PATENTS, Δln(PATENTS) 5-year lag of Chinese Imports Change ∆IMP CH t −5 (1) 0.328*** (0.110) 4-year lag of Chinese Imports Change (2) (3) (4) (5) ∆IMP 3-year lag of Chinese Imports Change 0.402*** (0.120) ∆IMP CH t −3 2-year lag of Chinese Imports Change 0.333*** (0.113) ∆IMPt CH −2 1-year lag of Chinese Imports Change 0.074 (0.136) 0.314*** (0.102) ∆IMPt CH −1 Contemporaneous Chinese Imports Change CH Number of country-industry pairs Number of Firms Observations 1,578 8,480 30,277 1,578 8,480 30,277 1,578 8,480 30,277 (7) 0.013 (0.163) 0.280* (0.149) -0.005 (0.178) 0.394*** (0.110) CH t −4 ∆IMPt (6) 1,578 8,480 30,277 1,578 8,480 30,277 0.321*** (0.102) 1,578 8,480 30,277 -0.069 (0.145) 0.203 (0.163) 1,578 8,480 30,277 Table A13 Results on IT appear broadly robust to using other ICT diffusion measures Databases Growth in Chinese Import Share 0.002 (0.070) Highest Quintile Growth in Chinese Import Share Quintile 4 0.030** (0.010) Quintile 3 0.043*** (0.010) Obs. 0.013*** (0.005) 24,741 0.034** (0.014) 0.021 (0.013) 0.006 (0.005) -0.008 (0.013) 0.014*** (0.005) 0.010** (0.005) 0.024*** (0.011) 24,741 0.249*** (0.083) 0.040 (0.034) 0.020** (0.010) Quintile 2 Groupware ERP 24,741 24,741 -0.018 (0.013) 24,741 24,741 Note: All changes in long (5-year) differences. Includes country, year and site-type controls. All standard-errors clustered by country and SIC-4 cell Table A4 Controlling for lagged technology Dep. variable: Quotas removal *I(year>2000) Include lagged dependent variable(t-5)? IV lagged dependent variable? Years Number of units Number of industry clusters Observations (1) Δln(PATENTS) (2) Δln(PATENTS) (3) ΔTFP (4) ΔTFP 0.207** (0.098) 0.490*** (0.157) 0.201*** (0.038) 0.204*** (0.047) No No 2005-1995 675 104 6,075 Yes Yes 2005-1995 675 104 6,075 No No 2005-1995 675 104 3,107 Yes Yes 2005-1995 675 104 3,107 Find Cites/Patents constant as Chinese imports rise – so no evidence patent quality falling Dependent variable Growth in Chinese Imports Cites/ Patent Cites/ Patent Cites/ Patent Log(1+Cites/ Patent) OLS OLS OLS OLS 0.090 (0.242) 0.027 (0.843) 0.082 (0.242) 0.090 (0.242) Log (Patents) 0.020*** (0.007) 4 digit industry controls Yes n/a n/a n/a Firm fixed effects No Yes Yes Yes Country-year fixed effects Yes Yes Yes Yes 21,273 21,273 21,273 21,273 Observations SE are clustered by firm

© Copyright 2026