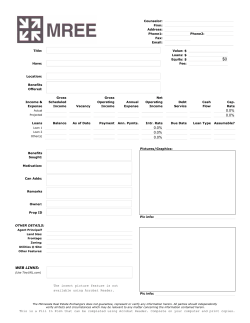

Rate Sheet - Cadence Bank

Austin/San Antonio / Account Manager / Gretchen Rossington / NMLS #555982 / 512.484.1860 Dallas/Fort Worth / Senior Account Manager / Karen Drewek / NMLS #1006967 / 972.786.6500 Houston / Account Manager / Mark Alan Bunting / NMLS #951243 / 832.266.8290 Rates Effective April 27, 2015 TEXAS PURCHASE MONEY/REFINANCE SECOND LIENS 95%* CLTV or Less - 15-Year Term *Max CLTV = 95.00% minus $50.00 $10,000 to $75,000 90%* CLTV or Less - 15-Year Term *Max CLTV = 90.00% minus $50.00 $10,000 to $250,000 80% CLTV or Less - 15-Year Term $10,000 to $350,000 70% CLTV or Less - 15-Year Term $10,000 to $600,000 750+ 749-725 724-700 6.125% 6.250% N/A 750+ 749-725 724-700 4.625% 5.250% 5.625% 750+ 749-725 724-700 4.500% 5.125% 5.500% 750+ 749-725 724-700 4.375% 5.000% 5.375% Jumbo Properties - Values $750,000-to-$2.5 Million have reduced CLTV’s - Call your Account Manager for details! Primary Residence Only 700+ Mid Score (All Wage Earners) Max DTI 40% Minimum Disposable income of $7,000 per month Values >$750,000-to-$1M, 85% CLTV or Less with Loan amounts up to $350,000 Values >$1M-to-$2.5M, 75% CLTV or Less with Loan amounts up to $600,000 Cadence Bank orders Appraisal & Title on loan amounts >$250,000 Borrowers must have excellent cash reserves and net worth 95% CLTV (minus $50) - $75,000 Maximum Loan Amount 725+ Mid Score (all wage earners) Max DTI 40%, Listing Agreements/Rental Leases not accepted to offset current housing No gift funds No escrow holdbacks 3 months PITI liquid reserves required on subject plus all properties owned Loan amounts >$50,000, 6 months PITI liquid reserves required on subject plus all properties owned 2 years with same employer or in same industry (no gaps) Self Employed Borrowers; 3 years in business with 2 years tax returns w/ all schedules including K-1’s Relocating Self Employed Borrowers / Non-Permanent Aliens not eligible Eligible Properties: SFDs, Townhomes, PUDs FTHB’s/Early Professionals are eligible with 750+ Mid Score (all wage earners); Min 6 months PITI liquid reserves; Terms up to 180 months Rate Adjustments 5 Years 10 Years - .50% - .25% 20 Years 30/15 Balloon 2nd Not available for 95% FTHB’s Must qualify on 15Year payment Not available for 95% FTHB’s Homes .25% .25% 1.00% Warrantable Condos < 7- stories .50% Cadence Fees Cadence Bank does not pay compensation of any kind on referrals. Good Faith Estimate Cadence Bank sends Second Lien Good Faith Estimate on all approved loans. Acceptable Properties Reserve Requirements First-Time Home Buyers FTHB’s with 750+ mid scores are eligible for up to $75,000 maximum loan amount! $399.00 Administrative Fee $ 11.00 Flood Certificate $150.00 Escrow Fee to Title Co. $ 30.00 Courier Fee to Title Co. $ 75.00 Recording Fee $ 6.00 E-Doc Fee $150.00 Title Policy** (**on loan amounts >$250,000) 1 point collected on short term loans Call your Account Manager for details. SFDs, PUDs, Low/Mid-Rise Warrantable Condos < 7 Stories, Townhomes, Duplexes, Rural Properties*** 90% Max CLTV (minus $50); 3 months PITI liquid reserves required on Subject Property 95% Max CLTV (minus $50); <$50,000 - 3 months PITI liquid reserves required on all properties owned + Subject Property 95% Max CLTV (minus $50); >$50,001 - 6 months PITI liquid reserves required on all properties owned + Subject Property 95% Max CLTV (minus $50); FTHB’s - 6 months PITI liquid reserves required on all properties owned + Subject Property 90% Max CLTV(minus $50); 750+ mid score (all wage earners); Loan amounts up to $75,000; 3 months PITI liquid reserves 90% Max CLTV(minus $50); 700-749 mid score (all wage earners); Loan amounts up to $45,000; 3 months PITI liquid reserves 95% Max CLTV(minus $50); 750+ mid score (all wage earners); Loan amounts up to $75,000; 6 months PITI liquid reserves; terms to up 180 months Max DTI 40% Primary Residence; US Citizens, Permanent Resident Aliens Eligible Properties: SFDs, Low/Mid Rise Warrantable Condos < 7 Stories, PUDs No Rural or Duplex Properties allowed Credit History: No delinquency in past 24-Months, Minimum 5 trade-lines with satisfactory 12-Month history Salaried: 24-Month history same employer or 12-Months history same employer with earned degree (no gaps) Qualifying Professions: Doctors, Dentists, CPAs, Attorneys, Architects, Engineers, PhD Level Professors Early Professional Buyers FTHB’s with 750+ mid scores are eligible for up to $250,000 maximum loan amount with Qualifying professions! 90% Max CLTV(minus $50); 750+ mid score (all wage earners); Loan amounts up to $250,000; 3 months PITI reserves on Subject Property 95% Max CLTV(minus $50); 750+ mid score (all wage earners); Loans <$50K; 3 months PITI liquid reserves; Loans >$50K-$75K; 6 months PITI liquid reserves Max DTI 40%; Primary Residence only; US Citizens, Permanent Resident Aliens Eligible Properties: SFDs, Low/Mid Rise Warrantable Condos < 7 Stories, PUDs No Rural or Duplex Properties allowed Credit History: No delinquency in past 24 months, Minimum 5 tradelines with satisfactory 12 month history Salaried: 24 month history same employer or 12 months history same employer with earned degree (no gaps) Debt to Income Requirements 90% Max CLTV (minus $50); 700+ mid score (all wage earners); Loan amounts up to $250,000; 12 months PITI liquid reserves on subject property Max DTI 40% Add 1.00% to rate Texas Residents w/homestead purchasing 2nd Home in Texas Vacation/Resort Locations Eligible properties: SFDs, Low/Mid-Rise Warrantable Condos < 7 Stories, Townhomes, Duplexes, Attached/Detached PUDs 90% Max CLTV (minus $50); 700+ Mid Score (all wage earners); Loan amounts up to $35,000; 3months PITI reserves on subject property Max DTI 40% and Other restrictions may apply. Please call your Account Manager for details! 90% Max CLTV (minus $50); 700+ Mid Score (all wage earners); 3 months PITI liquid reserves on subject property Up to 10 Acres Max No Ag exemptions. Max 43% - Contact your Account Manager regarding 2nd Liens submitted with DU/LP findings with DTI’s greater than 43% Max 40% - 95% CLTV (minus $50), Properties greater than $750,000, 2nd Homes, FTHB’s, Early Professionals, NPRAs Employment 2-Years consistent employment with same employer or in same industry with NO job gaps greater than 3 months Refinance Property off the market a minimum of 6 months Full appraisals required 12 months seasoning requirement to use appraised value on all rate & term refinances. 12 months or less, use the lesser of appraised value or purchase price. nd 2 Homes Maximum loan amounts up to $250,000 Non-Permanent Resident Aliens ***Rural Properties Foreclosures Escrow Holdbacks Requirements: Title policy & Full appraisal required. No HUD Foreclosures. Up to $75,000, Subject to Loan Underwriter’s review - Contact your Account Manager for details! Certain restrictions apply. Rates, programs, guidelines subject to change without notice or at underwriter’s discretion. This material is informational in nature and has been distributed to business entities. It is not intended to be distributed to or used by consumers. Cadence Bank NMLS ID# 525022

© Copyright 2026