Made for You. - Chemical Bank

Made in Michigan. Made for You. We’re excited to welcome you to Chemical Bank! It is with great pleasure that I welcome you to Chemical Bank. Like Monarch Community Bank, Chemical Bank is a Community Bank with deep roots in the state of Michigan. With over 95 years of demonstrated dedication to the customers and communities across Michigan, I am confident that the level of service you have come to expect from Monarch Community Bank will continue through Chemical Bank. Chemical Bank’s mission is to create enjoyable, valuable and memorable experiences for our customers by choosing every day to display a positive attitude and a passion to serve. Our team is committed to providing you with an unparalleled banking experience and is dedicated to helping you reach your financial goals. To help make this transition a smooth one, we have developed this guide, which will provide you with an overview of Chemical Bank’s products and services. This guide will also detail the benefits we expect you will receive from the products you will be transitioned into once you become a customer of our Community Bank. Should you have any additional questions, please do not hesitate to stop by your local branch or call our Customer Care Center at 800.867.9757. For your convenience, we have provided additional information about this conversion on our website at ChemicalBankMI.com/monarch. David B. Ramaker Chairman, CEO & President 1 Table of Contents Branch Locations 03 About Chemical Bank 04 What’s Changing 05 To Do List 06 Checking 07 Savings 11 Mobile & Online Banking 15 Business 19 Wealth Management 27 Card Options, Loans & Other Services 29 2 Branch Locations Visit ChemicalBankMI.com for more details about each of our locations including Branch and Drive-up Hours, ATM’s, Safe Deposit Box Availability and Contact Information. Marshall W. MI Ave. Marshall Union City Willowbrook Coldwater Headquarters Marshall Street Coldwater Drive-Up Marshall W. MI Ave. Marshall Union City Willowbrook Coldwater Headquarters Marshall Street Coldwater Drive-Up 3 3 Hillsdale Hillsdale About Chemical Bank Chemical Bank was founded in 1917 in Midland, Michigan with the purpose of providing banking services for the local community. We have grown extensively over the years and now serve well over 100 different communities throughout Michigan. Despite our growth, we have remained, at our core, a Community Bank committed to helping provide financial services to all of the communities we serve. We are dedicated to providing strong community leadership, rapid local response and personalized service to develop solutions that meet the needs of our customers. We have a vested interest in the financial well-being of the people, businesses and communities across the state. Our decision-makers live in our local communities and want to help our customers make their financial dreams come true. Financial Strength Chemical Bank remains a safe and secure financial institution with a capital position that continues to far exceed regulatory guidelines for being considered well-capitalized, the highest category of capitalization as defined by Federal bank regulators. We remain committed to supporting growth across the state and have the capital necessary to lend money to customers that meet our lending standards. Customer Care Center Monday through Friday: 7 AM - 9 PM Saturday: 8 AM - 2 PM Call Toll Free: 800.867.9757 Chat through online banking or ChemicalBankMI.com. Send an email to: [email protected] Notice: Information sent by email is at risk of loss of confidentiality if the information is transmitted over the Internet. We do not recommend sending confidential information such as account numbers or social security numbers by email. Mailing Address Chemical Bank Attn: Customer Care Center 333 East Main Street | P.O. Box 569 Midland, Michigan 48640-0569 Lost or Stolen ATM/Debit Cards Call Toll Free: 800.722.6050 4 What’s Changing FDIC Insurance When an insured bank assumes deposits of another insured bank, the assumed deposits are separately insured from deposits at the assuming bank for at least six months after the assumption. This grace period gives a depositor the opportunity to restructure his or her accounts, if necessary. Branch Locations All of the Monarch Community Bank offices will remain open, with the exception of the Marshall Plaza office located at 15975 W. Michigan Ave, which will be consolidating with Chemical Bank’s Marshall – Main office located at 115 West Drive South. Chemical Bank has 178 additional banking offices located throughout Michigan for your convenience. Safe Deposit Boxes Safe Deposit Boxes in Coldwater – Willowbrook will remain as they are; however, the Safe Deposit Boxes located at Monarch Community Bank’s Marshall – Plaza office will be consolidating with Chemical Bank’s Marshall Main office, which is located at 115 West Drive South. Name The current branches of Monarch Community Bank, along with the current signage, will change over to Chemical Bank as of conversion on May 8, 2015. Website Chemical Bank’s website is ChemicalBankMI.com. 5 Routing Number After conversion, you will need to use Chemical Bank’s ABA or Routing Number: 072410013 ATM/Debit Card You will receive a new Chemical Bank debit card or ATM card to replace your existing Monarch Community Bank card. Checks You may continue using your Monarch Community Bank checks. After conversion, any checks ordered through Deluxe will automatically be adjusted to your Chemical Bank Routing number. If you order checks through another service provider, please use the Chemical Bank Routing Number: 072410013 My Chemical Bank To Do List and Important Information Prior to Thursday, May 7th Verify your payee names prior to 12 PM on Thursday, May 7th to ensure that the full legal business or personal name is listed or the payee will not convert. • We recommend capturing this information for your records in order to make alternate arrangements for future tax payments. So that you have a record of your electronic bill payments at Monarch Community Bank, we recommend you capture and save screenshots of all your Bill Pay Information at Monarch Community Bank prior to conversion. Thursday, May 7th Bill Pay will be unavailable from 12 PM until 9 AM Monday, May 11th. • Your login ID will remain as it currently is, and you will receive an email with your new temporary password the week prior to conversion. My Chemical Bank To-Do List and Important Information Friday, May 8th Voice Banking and Mobile Banking will be unavailable beginning 4 PM until 9 AM, Monday, May 11th. Monday, May 11th You may begin using your new Chemical Bank ATM or Debit Card. You will no longer be able to use your Monarch Community Bank ATM or Debit Card after May 10th. • Please DO NOT destroy your Monarch Community Bank ATM or Debit Card until after May 10th. • Upon receipt of your ATM or Debit Card, you may activate the card and select your Personal Identification Number (PIN) by calling 866.392.9952, which is also located on the card carrier and the activation sticker. • If you have recurring payments tied to your Monarch Community Bank card, you will need to contact those companies to update your card information. Sign Into Chemical Bank’s Online Banking systems after 9 AM. Register for Chemical Bank’s Mobile and Voice Banking after 9 AM. After Monday, May 11th Enroll your new Debit Card into Preferred Rewards and MasterCard®Secure CodeTM. Please refer to the ATM and Debit Card section of this booklet for more information. We highly recommend verifying several items after conversion to ensure that your scheduled Transactions and Bill Pay information have converted correctly. • Items that you will need to verify include: Payee Information - including Account Numbers and Addresses, Payee Nicknames, Funding Accounts and Scheduled or Recurring Transaction details. 6 Checking Chemical Bank offers a variety of personal checking accounts that are designed to meet the needs of your unique lifestyle! To learn more about our checking accounts, please visit your local Chemical Bank office today or visit ChemicalBankMI.com/personal-banking. The following benefits are included with our Checking Accounts: • FREE ATM transactions at Chemical Bank ATMs • FREE unlimited Debit Card transactions • FREE unlimited eBillPay services • FREE Online Banking and Voice Banking service • FREE Mobile Banking (Deposit restrictions apply, ask a representative for details) 7 ChemBasic Checking Chemical Bank’s ChemBasic Checking is a personal checking account with no minimum balance requirement, no check writing limitations and no per check charge. Green Account Our Green Account is a paperless checking account designed for individuals who wish to access their funds electronically using eBanking and rarely write checks. With features like Debit Card, Mobile Remote Deposit Capture, eBillPay and eStatements, our Green Account allows you to bank on your schedule. Advantage Checking Enjoy the benefits of higher earning power with Chemical Bank’s Advantage Checking account. Advantage Checking allows you to earn interest on your daily balances and provides you with all the benefits Chemical Bank has to offer. Health Savings Account A Health Savings Account (HSA) is a designated account to help you save for qualified medical expenses on a tax advantage basis. It’s easy – you contribute money saved on lower premiums to your HSA and that money has the potential to grow so you can more easily afford the deductible when needed. Overdraft Privilege Overdraft Privilege is a convenient service available with any qualifying Chemical Bank Checking account in the amounts notated in the chart below. If you write a check with insufficient funds in your account, rather than returning it unpaid, Chemical Bank will consider paying your reasonable overdraft. Chemical Bank Account Amount ChemBasic Checking $500 Green Account $500 Classic Checking Advantage Checking $1200 Classic Checking is a personal checking account with a low minimum balance requirement, no check writing limitations and no per-check charge. Classic Checking $800 ChemPlus Checking $500 ChemPlus Checking Chemical Bank’s ChemPlus Checking is a personal checking account for individuals 55 and older. Enjoy a checking account that’s economical and flexible with unlimited check writing, no monthly service charge and no minimum balance requirement. Posting Order 1. Force posts and Closing transactions 2. Service fees 3. ATM Withdrawals 4. Bank transfers (including eBanking) 5. Pin-based ATM transactions and Debit Card transactions 6. ACH debit 7. Withdrawals and cashed checks at Chemical Bank offices 8. All other checkbased transactions 8 Product Comparison Chart | Checking Monarch Community Bank Product Free Style Checking Ambassador Club Homeowners Checking Monarch Club 50 9 Refer to your current Monarch Community Bank Statement to locate the name of your account type to determine how your account will be converted. Chemical Bank Product Major Differences ChemBasic Checking - Bounce Protection of $800 will transfer to Overdraft Protection of $500 - Check images will not be available with the statement (paper or electronic) - Paper Statement Delivery fee of $3 will be assessed for mailed statements; this will be waived for the first three months after the conversion is complete - OD Transfer Sweep fee will increase to $10 from $7 Advantage Checking1 - Minimum balance will be $1000 or monthly average balance of $1500 Monthly Service Charge of $7 will only apply if the minimum balance is not met Bounce Protection of $800 will transfer to Overdraft Protection of $1200 Interest will be paid on all balances, not just those balances over $500 Protection/Rewards Package will not be available on the account Paper Statement Delivery fee of $3 will be assessed for mailed statements; this will be waived for the first three months after the conversion is complete - OD Transfer Sweep fee will increase to $10 from $7 Advantage Checking1 - Minimum balance requirement and service charge will continue to be waived - Bounce Protection of $800 will transfer to Overdraft Protection of $1200 - Paper Statement Delivery fee of $3 will be assessed for mailed statements; this will be waived for the first three months after the conversion is complete - Customers will be responsible for the entire cost of their checks - OD Transfer Sweep fee will increase to $10 from $7 ChemPlus Checking - Customers will no longer earn interest on the account Bounce Protection of $800 will transfer to Overdraft Protection of $500 Customers will no longer pay the shipping and taxes on their check orders Customers will no longer receive a discount on Safe Deposit Boxes OD Transfer Sweep fee will increase to $10 from $7 Monarch Community Bank Product Chemical Bank Product Major Differences Advantage Checking1 - Minimum balance will be $1000 or monthly average balance will increase from $500 to $1500 - Monthly Service Charge will increase to $7 if customer does not meet minimum balance - Bounce Protection of $800 will transfer to Overdraft Protection of $1200 - Paper Statement Delivery fee of $3 will be assessed for mailed statements; this will be waived for the first three months after the conversion is complete - Interest paid on account will be tiered differently - OD Transfer Sweep fee will increase to $10 from $7 Totally Free Checking ChemBasic Checking - Bounce Protection of $800 will transfer to Overdraft Protection of $500 - Check images will not be available with the statement (paper or electronic) - Paper Statement Delivery fee of $3 will be assessed for mailed statements; this will be waived for the first three months after the conversion is complete - OD Transfer Sweep fee will increase to $10 from $7 Majestic Money Market Money Market Account - Monthly Service Charge will decrease from $15 to $10 if the minimum balance of $2500 is not met - Interest paid on the account is tiered differently - OD Transfer Sweep fee will increase to $10 from $7 Money Market Account - Monthly Service Charge of $10 will be assessed if the minimum balance of $2500 is not met - Interest is paid on any balance and the account is tiered differently - OD Transfer Sweep fee will increase to $10 from $7 My Style Checking Investors Money Market A minimum balance of $1000, or a monthly average balance of $1500, must be maintained in order to avoid a monthly service charge of $7. The monthly service charge is waived if you maintain a $10,000 aggregate account balance in all other Chemical Bank deposit accounts or if you have a MI Savings account. Please see a Chemical Bank representative to waive the fee. Sign up for eStatements to avoid the $3 monthly Paper Statement Delivery charge. You will no longer receive one free box of checks per year, free cashier’s checks and money orders or discounted Travel Cards. Please see the Disclosure Booklet for additional information. 1 10 Savings We have many savings account options designed to meet your needs! To learn more about our savings accounts, please visit your local Chemical Bank office or visit ChemicalBankMI.com/ personal-banking/savings. The following benefits are included with our Savings Accounts: • FREE ATM transactions at Chemical Bank ATM’s • FREE Online Banking and Voice Banking service • FREE Mobile Banking (Deposit restrictions apply, ask a representative for details) 11 MI Savings Premier Money Market Chemical Bank’s MI Savings account provides a flexible savings product with a competitive rate and no minimum balance. Chemical Bank’s Premier Money Market account has all of the same features as our traditional Money Market account while earning a higher interest rate on balances of $50,000 or greater. Visit your local branch to learn more about the interest rate tiers and the benefits of this account. Classic Savings Chemical Bank has savings solutions to fit your needs. The Classic Savings account allows you to save for short- or long-term goals while maintaining access to your funds and earning interest. Classic Savings — Minor Our Classic Savings — Minor account is a savings account for children under the age of 18. Save as much as you want, earn interest and have your money available whenever you need it. Download our FREE Chemical Banker Jr. App for iPhone, iPad and Android devices! Chemical Banker Jr. teaches young children ages 2 through 12 how to set savings goals, keep track of their accounts and other money concepts via a fun and interactive learning platform! Holiday Club Holidays are made easy with our Holiday Club account. It’s a great way to save money throughout the year for your next holiday season. Watch small amounts grow with a recurring savings routine. Money Market Chemical Bank’s Money Market account is perfect for individuals who want to earn interest and still have complete access to their funds. 12 Product Comparison Chart | Savings Monarch Community Bank Product Chemical Bank Product Major Differences Simple Savings MI Savings - Interest will be paid based on a tiered structure Tree House Club Classic Savings Minor - Monthly Service Charge is waived until the child’s 18th birthday - Newsletter and birthday card will no longer be received - Free Chemical Banker Jr. App will be available to download for iPhone, iPad and Android devices. Christmas Club Holiday Club Early - Payout on the Holiday Club will change to October 10th Passbook Savings Classic Savings - Account will no longer be considered a Passbook account after the conversion is complete; the Passbook may be updated, but it is no longer the official receipt Statement Savings Classic Savings - Minimum balance service charge will increase from $2 to $3 Transactional Savings Savings Non-IBA - Accounts will continue to be considered transactional Please see the Disclosure Booklet for additional information. 13 Refer to your current Monarch Community Bank Statement to locate the name of your account type to determine how your account will be converted. CDs and IRAs Safe Deposit Box At Chemical Bank, we are committed to providing our customers with the best investment opportunities available. Rest assured you’ll receive a competitive rate of interest and the security of knowing you are banking with a trusted partner. At Chemical Bank, we understand how important it is to keep your valuables safe. With a Chemical Bank Safe Deposit Box, you can rest easy knowing your treasured personal belongings will remain safe and sound. CDs | Rates and terms of your existing Certificate of Deposit (CD) will not change at this time. For your convenience, CDs automatically renewing will continue to do so at Chemical Bank and you will receive a renewal notice. If you are presently having interest from your CDs credited to an account or are receiving interest checks, this process will remain the same. IRAs | Rates and terms on Individual Retirement Accounts (IRAs) will not change at this time and will automatically renew at the maturity date. Safe Deposit Box Size* Price 3x5 $32.00 5x5 $40.00 3x10 $50.00 5x10 $65.00 10x10 $105.00 *Safe Deposit Boxes are subject to availability and one-year agreement. The pricing above reflects Safe Deposit Boxes. Safe Deposit Box prices will change on the next billing date. 14 Mobile & Online Banking Welcome to Chemical Bank! For more information visit ChemicalBankMI.com/monarch 15 ePersonal Online Banking Our ePersonal online banking system allows you to balance your accounts, view transactions and transfer funds between accounts — all with the click of a mouse. If you currently use personal Online Banking at Monarch Community Bank, you will automatically have access to Chemical Bank’s ePersonal Online Banking service after conversion. If you don’t currently have online banking, after conversion, sign up for instant access by visiting our website at ChemicalBankMI.com and clicking on Online & Mobile. Important Notes about the Online Banking Conversion: • Online Banking will go into inquiry only mode beginning at 4 PM on Friday, May 8th until 9 AM Monday, May 11th. You will be able to sign into your new online banking at Chemical Bank at 9 AM on May 11th. • Your login ID will remain as it currently is at Monarch Community Bank. You may change your login ID under the eServices section after your initial login. • You will receive an email with your new temporary password the week prior to conversion. • One-time and Recurring Account Transfers will convert. • You will receive a paper statement detailing all of your account activity from your last statement date through our May 8th conversion date. • Please verify all of your online account information after the conversion to ensure it converted correctly. • For your convenience, three months of account transaction history will be available on the new system. Important Notes about Online Banking: • In order for transfers to be posted the same day, they must be initiated by 9 PM. • Monarch Community Bank’s deposit images will no longer be viewable through your Online Banking. eBill Pay Important Notes about the eBill Pay Conversion: • Bill Pay will be unavailable from 12 PM, Thursday, May 7th until Monday, May 11th at 9 AM. • So that you have a record of your electronic bill payments at Monarch Community Bank, we recommend you capture and save screenshots of your eBill Pay activity at Monarch Community Bank prior to conversion. We also recommend verifying several items after conversion to ensure that your scheduled Transactions and Bill Pay information have converted correctly. Items that you will need to verify include: Payee Information - including Account Numbers and Addresses, Payee Nicknames, Funding Accounts and Scheduled or Recurring Transaction details. • Please verify your payee names prior to 12 PM on Thursday, May 7th to ensure that the full legal business or personal name is listed or the payee will not convert. For example, “Mom” or “Rent” should be displayed as the full legal name. Importantly, any payees used to make tax payments (e.g., City Treasurer, County Treasurer or IRS) will not convert. We recommend capturing this information for your records in order to make alternate arrangements for future tax payments. 16 • Items scheduled for payment will be processed if they are in the system prior to 12 PM on May 7th. During this blackout time, you will not be able to make any changes or cancel scheduled payments. The Bank will not be able to make changes for you or cancel payments on your behalf during this time. • eBills will not convert. If you would like to continue receiving eBills, you may set them up in your Chemical Bank Bill Pay after conversion. • Payee information and scheduled payments will convert to our system and will be available for use on May 11th. At your first login after conversion, please verify all of your payee information, including any scheduled payment information. • For your convenience, bill pay history from January 1, 2015 and going forward will be available on the new system. Important Notes about Bill Pay: • When initiating a Bill Payment, click on the calendar icon to select the “Deliver By” date. To determine when the funds will be debited from your account, move your cursor over the “Deliver By” date and the “Send On” date will display below the calendar. The “Send On” date is the date funds are debited from your account, and your payment will be sent. Please verify all payments are scheduled with sufficient time for processing. • In order for payments to be sent on the same day, they must be initiated by 12 PM. • Bill Pay has a daily limit of $25,000. • You can make expedited bill payments for a nominal fee, where applicable. • When adding a new Payee, if the Payee appears in the Frequently Paid Business list, the transaction will be sent electronically and will be received by the Payee in 1-2 business days. If the new Payee is not on the Frequently Paid Business list, you may manually enter 17 the Payee information. However, the first payment will be sent by check and will be received in 5-8 business days. If the Payee confirms that they are able to accept electronic payments, the subsequent payments will be sent electronically and received in 1-2 business days after the payment is sent. eStatements Streamline your finances by signing up for eStatements from Chemical Bank. Enjoy safe, secure, and fast access to your bank statements from your computer. Simply register for online banking or log into your online banking account and select “eStatements.” You will enjoy these additional features: • • • • Retrieve your statements from any computer with internet access Access and maintain electronic records of your account statements Monthly statement history will begin upon enrollment Access to a rolling 3 years of statements If you are currently enrolled at Monarch Bank to access your state ments online, after conversion you will need to log into Chemical Bank’s Online Banking service and enroll in our eStatement service by accepting the terms and conditions to continue receiving your electronic statement. Once you have enrolled in our eStatement service, you will receive an email when your eStatement is available. Statements can then be securely accessed by logging into Online Banking. Please note that upon conversion, your last Monarch Bank statement(s) will be mailed to you. Retain these documents for your records. You can visit us at ChemicalBankMI.com to find out more about our eBanking Services. Mobile Banking Important Notes about Voice Banking Conversion: Enjoy the convenience and simplicity of Chemical Bank’s Mobile Banking service anywhere, any time. You do not need to be a current Monarch Community Bank Mobile Banking or Online Banking user. Anyone with a personal account can sign up for Mobile Banking at Chemical Bank. Our free app is available at the App Store, Android Market or Blackberry App World and we also offer Mobile, Web and Text Banking. • Voice Banking will be unavailable from 4 PM, Friday, May 8th until 9 AM, Monday, May 11th. • If you currently use Voice Banking at Monarch Community Bank, you will need to re-register for Chemical Bank’s Voice Banking service. • For customers who are not listed as Primary Owners on any of their Chemical Bank accounts, contact the Customer Care Center at 800.867.9757 after conversion for assistance. Important Notes about Mobile Banking Conversion: • If you currently have Mobile Banking at Monarch Community Bank, you will need to re-register for Chemical Bank’s Mobile Banking any time after 9 AM on May 11, 2015. You are welcome to choose the same user ID for Mobile Banking that you use for Online Banking; however, that is not a requirement of the system. • Online Banking and Mobile Banking are separate platforms with separate logins. • Your Monarch Community Bank Mobile Banking will be unavailable beginning at 4 PM on May 8, 2015. • Please note that Mobile Banking is only available for personal accounts. Business accounts will not be viewable. Visit ChemicalBankMI.com/mobile for more information. Need Help? Visit ChemicalBankMI.com, where you will be able to chat live with a representative Monday through Friday: 7 AM - 9 PM Call our Customer Care Center at 800.867.9757 Monday through Friday: 7 AM - 9 PM Saturday: 8 AM - 2 PM Voice Banking Voice Banking gives you free access to Chemical Bank services at your convenience, 24 hours a day – 7 days a week. Enrolling in Voice Banking is simple and only takes a few moments. If you are listed as Primary Owner on an account at Chemical Bank, simply call 800.757.BANK (2265) after conversion. Please note that you will need to know your account number prior to calling. 18 Business We offer a variety of business accounts to meet the needs of your business! Learn more about the benefits that our business accounts offer by visiting your local Chemical Bank office or ChemicalBankMI.com/business-banking. 19 CHECKING Municipal NOW Checking Business Checking Take advantage of our most popular checking account for business purposes! Save money with the earnings credit feature included with this non-interest-bearing checking account. Business Checking II This account is the perfect option if your business has multiple locations that need to sweep funds to a single account on a regular basis. Business Interest Checking This exclusive account combines the benefits of a Checking and Savings account. All-in-one, all for the success of your business! SAVINGS We are proud to offer great account options that will help your business save and earn more. Learn more about our Business Savings options by stopping into your local Chemical Bank office or by visiting our website at ChemicalBankMI.com/business-banking/savings. ChemFlex Investment Account Business Interest Checking Plus Business Interest Checking Plus offers the high yield earnings of a short-term money market account. Our ChemFlex Investment Account is a special one-month time deposit account that allows investors with $1,000 or more to earn a higher rate of interest on short-term investments. Institutional Money Fund Account Legacy Basic Business Checking This account is designed for current Monarch Community Bank Businesses and features no minimum balance requirements or service charges with eStatements. Interest on Lawyer Trust Accounts The Municipal (Muni) NOW Checking account is an interest-bearing account designed especially for cities, counties, schools and other municipal organizations. This account is compliant with P.A. 20 1943, as amended. It is a deposit account with no activity charges that offers FDIC insurance, complete liquidity and unlimited check writing. The Muni NOW provides a competitive interest return on all collected funds. (IOLTA) With this account, you will experience the convenience of an interestbearing checking account with a tiered rate while earning interest for the Michigan State Bar Foundation. Enjoy a savings account available to any business that pays a competitive rate of interest and allows up to six pre-authorized debits and/or checks per month. Certificates of Deposit Provide your business with a way to earn a higher rate of return on your balances. Our short-term, mid-term, and long-term CDs can help you meet your financial goals. 20 Product Comparison Chart | Business Checking Monarch Community Bank Product Free Business Checking Legacy Basic Business Checking Major Differences - 100 free debits/credits combined, increased from the current 75 Per item charge of $0.50 will remain after the initial 100 free items. Bounce Protection of $800 will be transferred to Overdraft Protection of $1500 Paper Statement Delivery fee of $3 will be assessed for mailed statements; this will be waived for the first three months after the conversion is complete Commercial Checking Business Checking1 - Monthly service charge of $7 will be assessed instead of $10 - Per item fees of $0.16 per check/debit written over 50 and $0.11 per item deposited over 50 will be assessed; this is different from the current $0.15 per transaction fee - Monthly service charge will be waived if no check or deposit activity occurs during the month and the balance is over $1,000 - Bounce Protection of $800 will be transferred to Overdraft Protection of $1500 - Paper Statement Delivery fee of $3 will be assessed for mailed statements; this will be waived for the first three months after the conversion is complete Business Checking Interest Business Interest Checking - No monthly service fee - Bounce Protection of $800 will be transferred to Overdraft Protection of $1500 - Paper Statement Delivery fee of $3 will be assessed for mailed statements; this will be waived for the first three months after the conversion is complete Legacy Basic Business Checking - No minimum balance is required - Monthly service charge of $5 will be replaced with per item charges only - Per item fees of $0.50 per debit/credit over 100 items combined will be assessed - Bounce Protection of $800 will be transferred to Overdraft Protection of $1500 - Paper Statement Delivery fee of $3 will be assessed for mailed statements; this will be waived for the first three months after the conversion is complete Business Checking No Interest 21 Chemical Bank Product Refer to your current Monarch Community Bank Statement to locate the name of your account type to determine how your account will be converted. Monarch Account Chemical Account Major Differences Excel Small Business Legacy Basic Business Checking - No minimum balance is required - Monthly service charge of $7 will be replaced with per item charges only - Per item fees of $0.50 per debit/credit over 100 items combined will be assessed; changed from $0.25 per debit over 100 items and $1 per credit over 20 items - Interest will not be paid - Bounce Protection of $800 will be transferred to Overdraft Protection of $1500 - Paper Statement Delivery fee of $3 will be assessed for mailed statements; this will be waived for the first three months after the conversion is complete Municipal Checking Muni NOW Checking - No fundamental changes IOLTA IOLTA Non-Interest Checking Legacy Basic Business Checking - No fundamental changes - Customers will receive 100 free debits/credits combined Per item charge of $0.50 will be assessed after the initial 100 free items Bounce Protection of $800 will be transferred to Overdraft Protection of $1500 Paper Statement Delivery fee of $3.00 will be assessed for mailed statements; this will be waived for the first three months after the conversion is complete Please see the Disclosure Booklet for additional information. 1 Service charges for remaining items are $0.16 for each check or withdrawal and $0.11 for each check deposited; $7 per month maintenance fee is waived if minimum monthly balance of $1,000 is maintained with no check or deposit activity; Monthly paper statements available for $3 per month (waived for the first 3 months post-conversion). 22 Electronic Business Services Our online banking is a service that allows you to balance your accounts, view transactions and transfer funds between accounts — all with the click of a mouse. If you currently use Online Banking at Monarch Community Bank, you will automatically have access to Chemical Bank’s Online Banking service after conversion. If you don’t have online banking currently, after conversion, sign up for instant access by visiting our website at ChemicalBankMI.com and click on Online & Mobile. Important Notes about the Online Banking Conversion: • Online Banking will go into inquiry only mode beginning at 4 PM on Friday, May 8th until 9 AM Monday, May 11th. You will be able to sign into your new online banking at Chemical Bank at 9 AM on May 11th. • Your login ID will remain as it currently is at Monarch Community Bank. You may change your login ID under the eServices section after your initial login. • You will receive an email with your new temporary password the week prior to conversion. • One-time and Recurring Account Transfers will convert. • You will receive a paper statement detailing all of your account activity from your last statement date through our May 8th conversion date. • Please verify all of your online account information after the conversion to ensure it converted correctly. • For your convenience, three months of account transaction history will be available on the new system. 23 Important Notes about Online Banking: • In order for transfers to be posted the same day, they must be initiated by 9 PM. • Monarch Community Bank’s deposit images will no longer be viewable through your online banking. eBill Pay Important Notes about the eBill Pay Conversion: • Bill Pay will be unavailable from 12 PM, Thursday, May 7th until Monday, May 11th at 9 AM. • So that you have a record of your electronic bill payments at Monarch Community Bank, we recommend you capture and save screenshots of your eBill Pay activity at Monarch Community Bank prior to conversion. We also recommend verifying several items after conversion to ensure that your scheduled Transactions and Bill Pay information have converted correctly. Items that you will need to verify include: Payee Information - including Account Numbers and Addresses, Payee Nicknames, Funding Accounts and Scheduled or Recurring Transaction details. • Please verify your payee names prior to 12 PM on Thursday, May 7th to ensure that the full legal business or personal name is listed or the payee will not convert. For example, “Mom” or “Rent” should be displayed as the full legal name. Importantly, any payees used to make tax payments (e.g., City Treasurer, County Treasurer or IRS) will not convert. We recommend capturing this information for your records in order to make alternate arrangements for future tax payments. • Items scheduled for payment will be processed if they are in the system prior to 12 PM on May 7th. During this blackout time, you will not be able to make any changes or cancel scheduled payments. The Bank will not be able to make changes for you or cancel payments on your behalf during this time. • eBills will not convert. If you would like to continue receiving eBills, you may set them up in your Chemical Bank Bill Pay after conversion. • Payee information and scheduled payments will convert to our system and will be available for use on May 11th. At your first login after conversion, please verify all of your payee information, including any scheduled payment information. • For your convenience, bill pay history from January 1, 2015 and going forward will be available on the new system. Important Notes about Bill Pay: • When initiating a Bill Payment, click on the calendar icon to select the “Deliver By” date. To determine when the funds will be debited from your account, move your cursor over the “Deliver By” date and the “Send On” date will display below the calendar. The “Send On” date is the date funds are debited from your account, and your payment will be sent. Please verify all payments are scheduled with sufficient time for processing. • In order for payments to be sent on the same day, they must be initiated by 12 PM. • Bill Pay has a daily limit of $25,000. • You can make expedited bill payments for a nominal fee, where applicable. • When adding a new Payee, if the Payee appears in the Frequently Paid Business list, the transaction will be sent electronically and will be received by the Payee in 1-2 business days. If the new Payee is not on the Frequently Paid Business list, you may manually enter the Payee information. However, the first payment will be sent by check and will be received in 5-8 business days. If the Payee confirms that they are able to accept electronic payments, the subsequent payments will be sent electronically and received in 1-2 business days after the payment is sent. eStatements Streamline your finances by signing up for eStatements from Chemical Bank. Enjoy safe, secure, and faster access to your bank statements from your computer. Simply register for online banking, or log into your online banking account and select “eStatements.” You will enjoy these additional features: • Retrieve your statements from any computer with internet access • Access and maintain electronic records of your account statements • Monthly statement history will begin upon enrollment • Access to a rolling 3 years of statements If you are currently enrolled at Monarch Bank to access your statements online, after conversion you will need to log into Chemical Bank’s Online Banking service and enroll in our eStatement service by accepting the terms and conditions to continue receiving your electronic statement. Once you have enrolled in our eStatement service, you will receive an email when your eStatement is available. Statements can then be securely accessed by logging into Online Banking. Please note that upon conversion, your last Monarch Bank statement(s) will be mailed to you. Retain these documents for your records. You can visit us at ChemicalBankMI.com to find out more about our eBanking Services. Premium eBusiness Services If your business is currently using online banking for ACH, Tax, or Wires, you will have the same features available to you on Chemical Bank’s eBusiness online banking platform after conversion. We will contact you prior to conversion to ensure a smooth transition to 24 Chemical Bank. You will have a dedicated contact person that will work with you, including assisting you with training and understanding Chemical Bank’s online eBusiness Banking site. ONLINE ACH You can use our ACH service to send funds electronically, such as direct deposit. You can also pull funds from another bank. All transactions must be submitted prior to 4 PM for next day availability. Any participants, templates, or ACH batches you had set up in your Monarch Community Bank online system will be converted to Chemical Bank’s eBusiness banking. You will need to log in after conversion to verify your information converted correctly. ONLINE TAX PAYMENTS You can use our online system to pay Federal or State tax payments. You can maintain a template to reuse for recurring payment types. Payments can be effective for next business day if you initiate them prior to our 4 PM cutoff time. ONLINE WIRES Domestic and international wires can be sent through online banking. Initiating the wire is quite simple, and you can maintain templates for repetitive wires. Funds can be sent same day if they are completed before our 2:30 PM cutoff time. Any wire templates you had set up in your Monarch Community Bank online banking will be converted to Chemical Bank’s eBusiness banking. Please log in after conversion to verify all of your information converted correctly. Wire transfers can also be requested at any Chemical Bank Branch location. POSITIVE PAY Our positive pay service quickly identifies possible fraudulent checks to protect your company against check fraud. You will enter your checks into the online system when you issue them. Each day, the eBanking 25 system matches the check number, issue date, and amount against the checks clearing your account. You will receive an email reminder to review your exception list each morning before the 10 AM cutoff time to indicate whether each item should be paid or returned. Chemical Bank’s Processing Cutoff Times For your convenience, we’ve provided a list of Chemical Bank’s processing cutoff times. IMPORTANT: Chemical Bank’s cutoff times differ from those of Monarch Bank. Transaction Type Transmission Day System Cutoff Time Transfers Same Day as the Effective Entry Date 9 PM Bill Transfers Same Day as the Effective Entry Date 8 PM Wires Same Day as the Effective Entry Date 2:30 PM Positive Pay On each Business Day 10 AM ACH Transactions - Payroll - ACH Payments - ACH Receipts - Tax Payments ACH Transactions - 1-2 Business days before the effective date - 1-2 Business days before the effective date - 1 Business day before the effective date - 1-2 Business days before the effective date. 4 PM Lockbox Merchant Services Chemical Bank’s Lockbox service includes a multi-step process by which check payments are received, imaged, and deposited for your company. This customized service provides an efficient and costeffective way to streamline your receivables process. The payment information is available to view by the end of each business day— providing you with a fast, convenient way to view your receipts and reports. Business customers who are currently processing Merchant Services with Monarch Bank/WorldPay US Inc. will continue processing without interruption as no changes will be needed. Chemical Bank would like to help your business succeed in every way possible. That is why we have partnered with First Data®, a leader in payment processing solutions, to offer you easy and affordable payment processing solutions to meet today’s consumer demands. For more information on payment processing services, call 866.901.0321, or visit your local branch. Remote Check Capture Chemical Bank’s Remote Check Capture service provides the capability to image-capture check payments at your location over a secure Internet connection to electronically deliver the images of your deposit to your Chemical Bank accounts until 6 PM each business day. If you currently use Remote Check Capture at Monarch Community Bank, we will contact you prior to May 8th to discuss using Chemical Bank’s Remote Check Capture service after conversion. We will provide login information and training for Chemical Bank’s Remote Check Capture service. 26 Wealth Management Chemical Bank Wealth Management is a full-service provider of investment and financial solutions to help our clients grow, protect and preserve their assets. For over 50 years, we have been offering personalized trust and investment services to individuals, businesses and non-profits. Please call 800.808.5404 or visit ChemicalBankMI.com/ wealthmanagement to learn more about our wealth management services. 27 For Individuals Whether you are looking for assistance with your investments, help understanding your retirement planning options or want to ensure that your family is taken care of, the professionals at Chemical Bank Wealth Management are here to help. For Businesses Chemical Financial Advisors Our Financial Advisors provide investment and insurance services throughout Chemical Bank’s branch network, helping clients large and small reach their financial goals. Through an association with Cetera Investment Services, LLC,* our advisors can assist with the following: The experts at Chemical Bank Wealth Management understand the unique needs and challenges businesses face. From retirement planning solutions to business succession planning to managing your business’ assets, we are here with guidance and resources so you can focus on the success of your business. • • • • • • For Foundations and Endowments If you are a Monarch Investment Services customer, you will be receiving additional information on the transfer of your account to Chemical Financial Advisors. Working with foundations and non-profit organizations, Chemical Bank serves as a guide to our clients in deciphering their complex situations and helping them to achieve their organization’s mission and financial goals. Private Banking Chemical Bank’s Private Bankers offer customized, expert solutions to assist their qualified clients with every banking, borrowing, and investing need. Full Brokerage Services Life Insurance Long-Term Care/Life Insurance IRAs Tax-deferred Annuities Financial Planning *Securities and insurance products are offered through Cetera Investment Services LLC, member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with Chemical Bank and its related companies. Investments are: • Not FDIC insured • May lose value • Not financial institution guaranteed • Not a deposit • Not insured by any federal government agency. Cetera is under separate ownership from Chemical Bank and its related companies. Advisory services may only be offered by Investment Adviser Representatives. Registered address: 715 East Main Street | Midland, MI 48640. Our Private Banking clients enjoy: • Convenience: Single point of contact for all banking needs • Flexibility: Customizable financing options and up to 100% financing • Peace of Mind: Expert financial planning 28 Card Options Loans & Other Services If you presently have an ATM card, MasterCard® Debit Card, or Business Debit Card, we will automatically issue you a new Chemical Bank card. Please refer to the To Do List for important information regarding your new card. 29 CARD OPTIONS purchases. Learn more by visiting ChemicalBankMI.com or calling our Customer Care Center at 800.867.9757. ATM Card Chemical Bank’s ATM* Card provides you with the convenience of 24-hour banking for routine banking services. Make deposits, withdrawals, transfers, payments and balance inquiries at any Chemical Bank ATM. You may also make withdrawals and balance inquiries at any ATM displaying the NYCE or Cirrus network symbols. Debit Card Chemical Bank’s MasterCard® Debit* Card is more convenient and safer than carrying checks. With our Debit Card, you have access to over 200 Chemical Bank ATMs across the state and can use your Debit Card to make purchases at millions of locations worldwide where MasterCard® is accepted. Enroll in our Preferred Rewards program and earn points for everyday purchases when completing signature-based transactions. Points can be redeemed for valuable merchandise, dining, shopping, travel and entertainment. Receive 2,000 Bonus Preferred RewardsSM Points after completing your first signature-based purchase. Simply contact your local branch or our Customer Care Center at 800.867.9757 to enroll in the Preferred RewardsSM program. SM While using your Chemical Bank Debit Card for everyday transactions, you’ll begin to receive offers from our MI Rewards program! Log into the Preferred RewardsSM site and click on the “MI Rewards” button to see your offers. MasterCard®Secure CodeTM: This service allows you to protect your card with your own personal password so only you can make online When traveling outside of Michigan, please contact your local Chemical Bank office or our Customer Care Center at 800.867.9757 so we can add travel notes and current phone contact information to your account. To learn more about protecting your Debit Card transactions from fraudulent activity, visit your local Chemical Bank branch or ChemicalBankMI.com. *The maximum daily ATM withdrawal limit, POS, and cash advance limit for Chemical Bank account holders is $500. The maximum daily debit card purchase amount for Chemical Bank account holders is $2,500. Chemical Bank does not reverse surcharges charged from other financial institutions if they are applicable. Your new Debit Card will maintain any special limits you had with Monarch Community Bank. Business Debit Card Chemical Bank’s Business Debit* Card is convenient and safer than carrying checks or keeping petty cash on hand. With our Business Debit Card, you have access to over 200 Chemical Bank ATMs across the state and you and your employees can use it to make routine business purchases at millions of locations worldwide where MasterCard® is accepted. Enroll in our Preferred RewardsSM program and earn points for everyday purchases when completing signature-based transactions. Points can be redeemed for valuable merchandise, dining, shopping, travel and entertainment. Receive 2,000 Bonus Preferred RewardsSM Points after completing your first signature-based purchase. Simply contact your local branch or our Customer Care Center at 800.867.9757 to enroll in the Preferred RewardsSM program. 30 While using your Chemical Bank Business Debit Card for everyday transactions and earning Preferred Rewards points, you’ll begin to receive offers from our MI Rewards program! Based on the way you shop, you’ll receive money-saving deals and discounts tailored just for your business. Log into the Preferred RewardsSM site and click on the “MI Rewards” button to see your offers. For more information, visit our website at ChemicalBankMI.com or stop by your local Chemical Bank location. If you currently have a personal or business credit card through Monarch Community Bank, you will not see any changes to your card. You will continue to receive statements and make payments to Elan Cardmember Services. MasterCard®Secure CodeTM: This service allows you to protect your card with your own personal password so only you can make online purchases. Learn more by visiting ChemicalBankMI.com or calling our Customer Care Center at 800.867.9757. Following is information for contacting Elan’s Cardmember Services: When traveling outside of Michigan, please contact your local Chemical Bank office or our Customer Care Center at 800.867.9757 so we can add travel notes and current phone contact information to your account. To learn more about protecting your Debit Card transactions from fraudulent activity, visit your local Chemical Bank branch or ChemicalBankMI.com. *The maximum daily ATM withdrawal limit, POS, and cash advance limit for Chemical Bank account holders is $500. The maximum daily debit card purchase amount for Chemical Bank Business account holders is $3,500. Chemical Bank does not reverse surcharges from other financial institutions, if they are applicable. Your new Debit Card will maintain any special limits you had with Monarch Community Bank. Personal and Business Credit Cards Chemical Bank offers a variety of personal and business credit cards to meet your needs. Choose the card and rewards that are right for you. Become a card member and enjoy a wide range of benefits including competitive introductory rates and your choice of rewards programs. 31 • 24-Hour Service: 800.558.3424 or Technical Support: 877.334.0460 • Online: myaccountaccess.com/onlinecard/login Send a Payment: Cardmember Service P.O. Box 790408 St. Louis, MO 63179-0408 Reloadable Pay Card Our reloadable Pay Card service facilitates 100% electronic payment for payroll direct deposit and is compliant with Michigan employment legislation. This card is funded using Chemical Bank’s online ACH service. Reloadable Business Expense Card Chemical Bank’s Expense Card service provides an alternative for employee expenses to the traditional credit or purchasing card programs, or employee reimbursements for cash expenses. This card is funded using Chemical Bank’s online ACH service. Pre-Paid Gift Cards & Reloadable Cards LOANS Flexible spending options for gifts, groceries, holidays, traveling, and more. Visit your local Chemical Bank branch for more information. The following Lending Offices will remain open: Please Contact Us With Questions! Monday through Friday: 7 AM - 9 PM Call our Customer Care Center at 800.867.9757 Monday through Friday: 7 AM - 9 PM Saturday: 8 AM - 2 PM Angola Lending Office 330 Intertech Parkway, Suites 256, 257 Angola, IN 46703 East Lansing Lending Office 3496 Lake Lansing Rd., Suite 120 East Lansing, MI 48823 In addition to the offices listed above, you may also visit any of our Chemical Bank locations for your lending needs! Personal Loans Rates are at some of their lowest points in years, so now is the time for a new loan.* Whether it’s for a new vehicle, a once-in-a-lifetime vacation or opening a new business venture, Chemical Bank is a trusted partner when it comes to getting you the right loan at the right rate. If you currently have a personal loan, you will receive a new payment book or loan statement after conversion. For your convenience, auto-pay transfers will continue without interruption; please check your accounts to verify that the auto-pay transfer was converted successfully Refer to the “Additional Information” section at the back of this book to review our loan payment policies. If applicable, to ensure that we have current insurance coverage information on file for your loan, you will receive a letter at a later date confirming proper coverage. *Loans subject to credit approval. 32 Mortgages At Chemical Bank, we can make you just as comfortable financing your new home as you are in it. Our knowledgeable and friendly staff make buying, building or refinancing a home a lot less intimidating. We’ll help you make the most of every opportunity and find the right solution for your needs. Mortgage and Loan Payments To ensure that your payment is promptly applied to your loan, please review the following loan payment policies: • Payments will be accepted on business days, which are defined as days on which Chemical Bank offices are open to the public for all of our business functions, excluding Saturdays, Sundays and holidays. • You may make payments at your local Chemical Bank office or online if you have signed up for our ePersonal Online Banking service. You may also mail your payments to: Chemical Bank Attn: Loan Service Center P.O. Box 1527 Midland, Michigan 48641-1527 PLEASE NOTE: Payments received after 4 PM will not be credited to your account until the following business day; however, payments made through our ePersonal and eBusiness Online Banking systems may be processed until 6 PM. • Chemical Bank will hold funds for partial payments until enough funds have been received to make a full payment, at which time we will apply the payment to your outstanding balance. A 33 full payment equals the entire contractual amount of applicable principal, interest and escrow. • If your payment is received in a substantially different manner than outlined above, Chemical Bank will have up to five days to credit your loan account. You may be charged a late fee for these types of payments as they may take longer to process. If at any time you feel that an error has been made in the processing of your loan payment, or have other service related issues, please write to us at the address listed above. Escrow Accounts All escrow accounts will transfer during this conversion and should not require any action on your part. You will see a new escrow analysis performed in the months following the conversion as we move all escrow accounts into the new escrow process. At Chemical Bank, all escrow accounts are reconciled each year in March and you will see a new analysis at that time. Home Equity and ChemLine Loans Now is the time to take advantage of the equity you have in your home. With rates at their lowest in years, you have the opportunity to open a new ChemLine* home equity line of credit with Chemical Bank today. Use your equity to consolidate debt, take a vacation or pay for home remodeling. If you currently have a home equity line of credit, you will receive new access checks for your ChemLine account after conversion, as your old checks will no longer be usable. *New loans will be subject to credit approval. OTHER SERVICES Loan Service Center Please contact our Loan Service Center for all loan related issues: Monday through Friday: 8 AM - 5 PM 866.731.6414 eMailed Statements Not quite ready for online banking but still want the benefits of eStatements? Our eMailed Statements option offers the same fast, safe, and secure access to your bank statements from your computer but does not require an online banking account. You will enjoy these additional benefits: • Access to your statement the next business day after your statement date • Receive your statements through a secure, encrypted email • Easy sign up and email verification process To enroll in eMailed Statements, visit any of our locations after conversion or contact our Customer Care Center at 800.867.9757. Identity Theft Services Chemical Bank will not be offering Monarch Community Bank’s ID Protection service offered through Deluxe. As a MasterCard® Debit Cardholder you can benefit from the Identity Theft Resolution Services. This benefit assists cardholders with restoring their identity by offering 24/7 access to certified resolution specialists. They will assist you with notifying all three major credit reporting services, placing blocks on cardholders’ records and obtaining free credit reports. They will also provide assistance with alerting various parties of the potential fraud and cancellation of all lost cards in your wallet. 34 Receiving ACH Transactions Please provide the following information to the sending party so that you can continue to conduct ACH transactions (for example, payroll or Social Security Benefits): • ABA or Routing Number — 072410013 • Account Number — Provide your account number as it appears on your current Monarch Community Bank statement or your 10 digit account number as it will appear on your new Chemical Bank statement • Transaction Type — Checking or Savings Your ACH activity posting to your account will be received and processed by Chemical Bank as long as the account number is correct. The Monarch Community Bank ABA numbers will be accepted for up to 3 years. Chemical Bank will create electronic notification of change (NOC) information to the ACH sending vendor. Most vendors will make the requested correction without any action on your part. However, there are a few vendors who typically do not act on the notification of change (NOC), so you will need to contact them directly: • Social Security Administration 800.772.1213 • Veterans Affairs 800.827.1000 • DFAS (Defense Finance and Accounting Service) 800.321.1080 • Rail Road Retirement 877.772.5772 If your vendor does not respond to our notification of change (NOC) request, you may receive a letter at a later date requesting that you contact the vendor directly. Receiving Wire Transfers Please provide the following information to the sending party to continue receiving wire transfers: • ABA or Routing Number — 072410013 • Telegraphic Wire Transfer Name: Chemical Bank • Name of customer receiving wire transfer (name on wire must be identical to name on bank records). • Account Number — Provide your account number as it appears on your current Monarch Community Bank statement or your 10 digit account number as it will appear on your new Chemical Bank statement. • Chemical Bank office street address, city and state where account is located. • Cutoff time for incoming wires to post the same business day is 4 PM. Cutoff time noted applies to business days, excluding bank holidays. Federal Deposit Insurance Limits The standard deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank. For example, if a person has a certificate of deposit at Bank A and has a certificate of deposit at Bank B, the amounts would each be insured separately up to $250,000. Funds deposited in separate branches of the same insured bank are not separately insured. The FDIC provides separate insurance coverage for funds depositors 35 the same term and in the same dollar amount (either with or without accrued interest) continue to be separately insured until the first maturity date after the six-month period. If a CD matures during the six-month grace period and is renewed on any other basis, it would be separately insured only until the end of the six-month grace period. may have in different categories of legal ownership. The FDIC refers to these different categories as “ownership categories.” This means that a bank customer who has multiple accounts may qualify for more than $250,000 in insurance coverage if the customer’s funds are deposited in different ownership categories and the requirements for each ownership category are met. The FDIC provides separate insurance coverage for a depositor’s funds at the same insured bank if the deposits are held in different ownership categories. To qualify for this expanded coverage, the requirements for insurance coverage in each ownership category must be met. When our banks merge, deposits from Monarch Community Bank are separately insured from deposits at Chemical Bank for at least six months after the merger. This grace period gives a depositor the opportunity to restructure his or her accounts, if necessary. CDs from Monarch Community Bank are separately insured until the earliest maturity date after the end of the six-month grace period. CDs that mature during the six-month period and are renewed for 36 Quick Reference of Service Fees Find out more at ChemicalBankMI.com or at your local Chemical Bank branch. 37 Chemical Bank Fee Description of Fee $25.00 per hour, $10.00 minimum Account Reconciliation $10.00 Account Verification (documentation verifying account) No Charge Additional Statement Fee $5.00 Amortization Schedule $5.00 ATM Card Replacement Charge $10.00 Automatic Acct. Transfers (for OD coverage) $5.00 Cashier’s Checks $10.00 Check Cashing Fee (non-customers) Price Varies with Style Checks $20.00 Closed Account Fee (within 45 days) 10% Coin Counting/Rolling Fee $100.00 Collection Items $1.00 per check w/o a check order Counter Checks (per check) $1.00 per page plus $30.00 per hour Customer Research $5.00 personal, $10.00 business Deposited Items Returned $5.00 on checking with balance < $500 Dormant Account Fee* $75.00 per account Escheating / Escheating Recovery $1.00 per page Fax Service 3% of the transaction amount Foreign Conversion Fee for international ATM and Debit Card transactions $30.00 Foreign Drafts $100.00 Levy / State Warrant $32.00 per item Non-sufficient Funds Charges/Overdrafts** Chemical Bank Fee Description of Fee $2.00 per customer; $10 non-customer Notary Fee $3.00 Paper Statement Delivery Fee $.50 per page Photocopies $60.00 Replacement Debit Card Expedited $125.00 or cost, whichever is greater Safe Deposit Box Drill Fee Prize Varies with Size Safe Deposit Boxes $15.00 Safe Deposit Lost Key $1.00 per bond Savings Bond Reissuance (retitling, etc) $3.00 per signature Signature Guarantee $1.00 per page Statement Copies $32.00 Stop Payment Fee $2.00 Telephone Transfer Done by Individual Not Offered Traveler’s Cheques No Charge, Non-customers not offered Wire Transfers - Incoming $50.00, Non-customers not offered Wire Transfers - International $25.00, Non-customers not offered Wire Transfers - Outgoing $2.00 Withdrawals from a Non-Chemical Bank ATM*** *Dormant Account Fee - This fee is assessed at Monarch Community Bank after 6 months of no activity on all checking and savings accounts. At Chemical Bank, this fee is assessed after 12 months of inactivity on certain checking accounts that have less than $500 balance. **Non-sufficient Funds Charges/Overdrafts - This fee at Monarch Community Bank is not assessed if the negative balance is less than $3. This fee is also capped at 5 overdrafts per day. At Chemical Bank, the fee is not assessed on negative balances of $5 or less and there is no cap on the number of fees. ***Chemical Bank will assess a $2 fee for each ATM withdrawal made at a non-Chemical Bank ATM. Chemical Bank does not reverse surcharges charged from other financial institutions, if they are applicable. 38 ChemicalBankMI.com 235 E. Main Street | Midland, MI 48640-6511 T: 800.867.9757 | W: ChemicalBankMI.com/monarch April 3, 2015 Welcome to Chemical Bank. Welcome to the Chemical Bank family! On Friday, May 8, 2015, your Monarch Community Bank account(s) will convert to a similar Chemical Bank account. Enclosed with this letter is all of the information you need to make this transition smooth and simple. In this package, you will find: • Your personalized account listing, which will appear on the back of this letter. • A Welcome Booklet with descriptions of the type of account(s) available to you at Chemical Bank. • A Chemical Bank Account Disclosure booklet, which contains important agreements and details related to your account that you should read carefully and retain for your records. • Our Privacy Policy outlining how Chemical Bank handles your personal information. If you are not familiar with Chemical Bank, we have been helping communities across Michigan since 1917. Chemical Bank has grown over the years, but our commitment to our customers and communities has remained our focus. We are excited about this partnership and the opportunity to continue bringing you the community banking experience you are accustomed to, characterized by local decision making, individualized solutions and a commitment to our communities. Once again, we would like to welcome you to Chemical Bank. We look forward to the opportunity to serve you in all your banking needs. Should you have any questions or concerns, please do not hesitate to call our Customer Care Center at 800.867.9757 or visit your nearest Monarch Community Bank or Chemical Bank Branch. Sincerely, David B. Ramaker Chairman, Chief Executive Officer and President Chemical Bank Important Dates and facts for your transition to Chemical Bank. Thursday, May 7th eBill Pay unavailable beginning 12 PM until 9 AM on Monday, May 11th. Please note that Chemical Bank’s cutoff times differ from Monarch Community Bank's. Friday, May 8th Voice Banking and Mobile Banking unavailable beginning 4 PM until 9 AM on Monday, May 11th Monday, May 11th • Begin using your new Chemical Bank ATM or Debit Card • Sign into Chemical Bank's Online Banking Systems after 9 AM • Register for Chemical Bank’s Mobile and Voice Banking after 9 AM Helpful Online Banking and eBill Pay tutorial videos are available at ChemicalBankMI.com/monarch Please review the enclosed Welcome Booklet for additional, important details about the conversion of your accounts to Chemical Bank. Branch Information In some communities, including Marshall, both Monarch Community Bank and Chemical Bank have branch offices. As part of the merger transaction, branch offices in those communities have been analyzed to determine how to best serve the banking needs of the community most effectively following the merger. The decision has been made to close and combine the Monarch Community Bank Marshall Plaza Office, located at 15975 W. Michigan Ave with the Chemical Bank Marshall Main Office, located at 115 West Drive South. The last day the Marshall Plaza office will be open is May 8, 2015. Please be assured, branch personnel impacted by this location closing will be transitioned to another Chemical Bank location. Additionally, the following Lending Offices will remain open. In conjunction with these offices listed below, you may also visit any of our Chemical Bank locations for your lending needs. Angola Lending Office 330 Intertech Parkway, Suites 256, 257 Angola, IN 46703 East Lansing Lending Office 3496 Lake Lansing Rd, Suite 120 East Lansing, MI 48823 Your Account Summary Listed below are your transitioning accounts, per your Monarch Community Bank records as of Friday, May 8, 2015. You will also see your new Chemical Bank account(s) listed, which will be effective when the transition occurs on Friday, May 8, 2015. Everything you need to know about your new account(s), including highlights of changes, can be found in the enclosed Welcome Booklet. Please refer to the Chemical Bank Account Disclosures Booklet for more detailed information about your new accounts.

© Copyright 2026

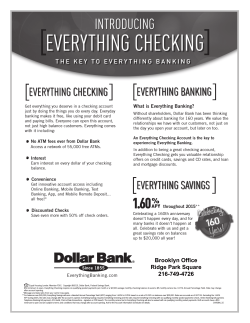

![Poutiainen Opportunities for innovations in banking[1].pptx](http://cdn1.abcdocz.com/store/data/001055548_1-aaae693fa2fcd881bd622fd0ff936cd9-250x500.png)