Document 172376

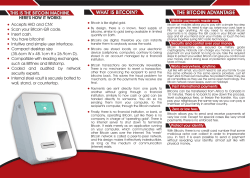

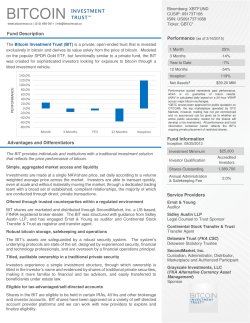

Is Bitcoin the future of currency? WITH ALL THE BUZZ, FEW KNOW MUCH ABOUT BITCOIN OR THE POTENTIALLY MASSIVE IMPACTS THIS CRYPTO-CURRENCY HOLDS DECENTRALIZED = No single entity / everybody owns or controls Bitcoin It’s a decentralized, global, peer-to-peer, digital, online, currency. GLOBAL = Anyone can use it, anywhere PEER TO PEER = Direct transfers, no 3rd parties necessary DIGITAL = No physical “coinage” ONLINE = Only requirement for use is an internet connection EXAMPLE Bitcoin = The System Lingo “Uppercase B” $ “You know, Bitcoin is nothing like traditional currency.” “Lowercase B” bitcoin = The currency $ “I bought a new car with 20 bitcoins.” 600 $ 6.00 $ 0.60 BTC bitcoin cBTC bitcent mBTC mbit, millibit, or bitmill μBTC ubit, microbit 1 BTC = 1 bitcoin 0.01 BTC = 1 centibitcoin 0.001 BTC = 1 millibitcoin 0.0006 0.000 001 BTC = 1 microbitcoin Using Bitcoin 1PHVXxuz FtXCVp2yit9M5 caFxFjCUL4jux “This-is-my super-secret-pass word-for-bitcoin” A UNIQUE IDENTIFIER FOR YOU ONLY!!!! characters, beginning with the number 1 or 3. Never share this, or lose it, because if you do your bitcoin will be lost. Generates addresses to exchange BTC Each wallet has a private key OF 27-34 alphanumeric Download a Bitcoin Wallet On your PC or Mobile Device (acts like a signature) (like an email address) The Bitcoin Wallet allows you to use Bitcoin • Online purchases from vendors who accept bitcoin On your PC or Mobile Device • Face to Face purchases via Mobile and QR codes Scan Vendor’s Wallet QR code, enter agreed amount, done • ATMs Scan a user's palm print, face, and government-issued ID to verify identity or CC BY 2.0 @ Konrad Förstner Get bitcoin by depositing local currency Sell bitcoin and withdraw local cash CC BY 2.0 @ Jesus Solana Get bitcoins £ $ $ € Accept bitcoin Exchanges as payment for goods or services buy bitcoins with traditional currency Online exchanges Bitcoin ATMS Mine bitcoins Anyone with a connected computer can be a Miner • Miners volunteer necessary computer power for security and transaction verification free “Bitcoin Miner” app (run by the app) • Rewards for Miners 1. Small voluntary “thank you” transaction fees paid in bitcoin 2. Blocks of bitcoins are “Mined” or released from the 21,000,000 total bitcoins approximately every 10 minutes More computer power donated = more chances to get the released Bitcoin block (like a raffle) A block currently yields Today there are over 25 BTC 12,450,000+ but the block yield halves over time. bitcoins in circulation. THAT’S 59% OF TOTAL BITCOINS The last Bitcoin block will be released near the year 2040 Keep an eye on the value Bitcoin is very new and extremely volatile 1,400 Over the past year 1 bitcoin 1,200 value ranged from between 1,000 $ 800 68 & 1,151 $ 600 400 200 0 06.13 07.13 08.13 09.13 10.13 11.13 12.13 01.14 02.14 03.14 04.14 05.14 06.14 LIKE MOST CURRENCIES, BITCOIN’S VALUE IS BACKED ONLY BY SUPPLY AND DEMAND, NOTHING PHYSICAL. Value is a combination of • Strength of economy • Risk of economy changing A common misconception: the US dollar is backed by gold – however, it hasn’t been backed by anything since 1971. • Number of notes in circulation Bitcoin has no official value • Buyers and sellers must agree on price • Usually based around value of recent trades elsewhere Why people do like it No country controls Bitcoin • A global online currency can be set up, accessed, and used anywhere with no prerequisites Especially good for emerging markets where banks, ATMs, and credit card machines are rare • Accounts cannot be frozen for any reason No country or company can own or regulate P2P bitcoin use • More bitcoins cannot be printed, controlling inflation • Value is not tied to a country's political security or trustworthines No banks or companies • Less fees Credit Card companies charge sellers 2-3% Financial Services like Western Union charge approx. $7 for every $100 sent to Mexico from the US Bank fees are outrageous checking accounts, ATMs, minimum balance, overdraft, traveling to another country etc. Most Bitcoin transactions are processed without fee Voluntary fees automatically put higher priority for miners to process. (Faster transaction verification) Why people don’t like it Massive security risks • Without countries, banks, or companies Bitcoin security is the responsibility of the individual • No 3rd parties No insurance to replace your money No police to find your culprit • If a thief dupes you or a hacker accesses your bitcoin wallet payment cannot be stopped or refunded without recipient’s consent Bitcoin Exchanges aren’t banks Poloniex $ Exchange lost 50,000 USD worth of bitcoin Flexcoin $ Exchange lost 600,000 USD worth of bitcoin Mt Gox $ Exchange lost 367 million USD worth of bitcoin Losses due to lack of regulation Usability • Nearly instant Direct P2P takes minutes to set up Takes computers minutes to verify • Easy to carry $1 billion worth of Bitcoin fits in your pocket encrypted onto a memory stick Unusable • Not accepted Bitcoin is not accepted many places, especially in physical shops. • No measure of trustworthiness or accountability • Credit Cards are faster, free for consumers, and more available in developed countries Moving $1 billion of gold, bills, or wampum is not easy Anonymous Criminal currency • Accounts are anonymous (when used correctly) Bitcoin’s anonymity has attracted criminals seeking quick untraceable riches Silk Road: an online blackmarket used Bitcoin to generate $1.3 billion in anonymous trafficking of drugs and firearms plus employing hackers and assassins. Added security from hackers and thieves Equal playing field, no special treatment for rich or punishment for poor In the future, virtual currency exchanges like Bitcoin will benefit from implementing Know Your Customer (KYC) policies modeled after reputable exchanges Why? Because it bolsters a safe and trust-driven environment. FUTURE PROJECTIONS FOR BITCOIN “Bitcoin today is at the level where the Internet was in 1994 or 1995, with 20 years of application in its future” Antonis Polemitis, Bitcoin venture capitalist Presented by mtgox.com bitcoin.org/en bitcoinatm.com historyofbitcoin.org coindesk.com/information/why-use-bitcoin cs.stanford.edu/people/eroberts/courses/cs181/projects/2010-11/DigitalCurrencies/advantages/index.html

© Copyright 2026