SEPA Direct Debits Timelines What do you Need to Do

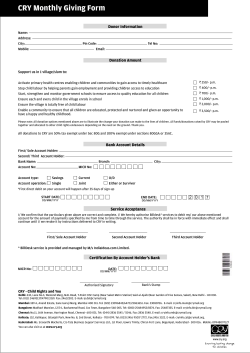

SEPA Direct Debits Timelines What do you Need to Do Customer Example Your company is due to collect monies from customers via the SEPA DD Scheme on 25.04.2013. What dates should you be aware of, both in submitting the file, and after the file has been submitted to the bank? Please see the flow charts below: Submitting your SEPA DD File 1 6 business banking days File Type 1: First Presentation Month 17 18 19 22 23 24 25 You ‘The Client’ First Presentation S S S S S S S S Allow 6 business banking days € You collect monies from your customers File Type 1: First Presentation For new DD instructions (i.e. First Presentation) you must submit your file to the bank six business banking days prior to the due date. In this case, first presentations must be received by the 17.04.2013 to be processed on the 25.04.2013. Note: This includes ‘once-off’ presentations. 3 business banking days File Type 2: Recurring Item Month 22 23 24 25 You Recurring Item 1. All direct debit customers under SEPA will have to upgrade their payment software to produce SEPA-compliant XML files. AIB recommends that you contact your payment software provider (if applicable) for further information on the impacts of SEPA on your payment software and to get a SEPA software update. If you do not have a software provider, AIB has been working closely with the majority of payment software providers in Ireland, and has compiled a list of vendors who can help ease your migration to SEPA. This list is regularly updated and available on www.aib.ie/sepa. Once your company has upgraded its payments software to produce a SEPA-compliant XML Standard file, it is important that you engage with AIB to test and ensure your new SEPA DD payment file meets the correct standards. AIB has two key checks that should be done ahead of the submission of a live payment file to AIB: • A sample SEPA DD output file should be sent to [email protected] to confirm that your XML Standard file format meets SEPA specifications. • Once confirmation is given, a penny test file (e.g. a sample file) should then be uploaded through iBB to ensure it processes successfully through the new iBB payments platform. 2. AIB requires that all direct debit originators, in advance of their migration to SEPA DD, download and complete the “AIB SEPA Direct Debit Creditors Agreement” form (available on www.aib.ie/sepa). The completed form should be returned to your account holding branch. If you have any questions in relation to the AIB SEPA Direct Debit Creditors Agreement, please email [email protected] or visit our website www.aib.ie/sepa. 3. AIB also requires all direct debit originators send a sample of their new SEPA customer direct debit mandate form for validation. A sample SEPA mandate form and ‘how to’ guide is available on www.aib. ie/sepa. Please send your sample SEPA DD mandate to your account holding branch for validation. You will not be able to start processing live SEPA DD transactions until this task is completed. Timeline: Six business days. 2 Key SEPA requirements from AIB S S S S S S S S Allow 3 business banking days € You collect monies from your customers File Type 2: Recurring Items For subsequent recurring items you must submit your file to your bank a minimum of three business banking days prior to the due date. In this case, recurring items must be received by the 22.04.2013 to be processed on the 25.04.2013. Timeline: Three business days. How to get in touch This brochure has been prepared by AIB for general guidance to business customers on SEPA Direct Debits. As ever, we would be very happy to answer any questions you may have or discuss any aspect in greater detail. Getting ready for SEPA. Please email [email protected] or visit our website: www.aib.ie/sepa for further information on SEPA. Direct Debits in Ireland and across Europe. Please email [email protected] or visit www.aib.ie/sepa Important information: If this file contains any First Presentations the entire file will be rejected. Allied Irish Banks, p.l.c. is regulated by the Central Bank of Ireland. Registered Office: Bankcentre, Ballsbridge, Dublin 4, Ireland. Registered in Ireland, No. 24173. What is a SEPA Direct Debit? Key features of SEPA Direct Debits A SEPA Direct Debit (DD) is the new standard across Europe for the collection of funds between a debtor (payer) and the creditor (payee). The SEPA DD Scheme allows you to collect direct debit payments across all 32 SEPA countries. With effect from 1st February 2014, the national direct debit scheme will be retired and all Euro currency direct debits in Ireland and across Europe will be processed via SEPA. This switch will coincide with the closure of Ireland’s domestic payment system (EMTS) and the replacement of National Sort Code (NSC) and Account Number with the Bank Identifier Code (BIC) and International Bank Account Number (IBAN). BIC and IBAN Under SEPA, creditors are required to use Bank Identifier Code (BIC) and International Bank Account Number (IBAN) as the primary identifier of a debtor’s account. Creditors can collect their debtors’ BIC and IBAN in two ways: 1. Creditors can go directly to their debtors 2. There is a free BIC and IBAN conversion service provided by the Irish Payment Services Organisation (IPSO) for use by both individual consumers and businesses. It enables the conversion of existing NSC (National Sort Code) and Account Number information to the BIC and IBAN standard required for SEPA. For further information on the BIC and IBAN conversion service, please visit the IPSO website www.ipso.ie. Mandate Management Differences between the Direct Debit Schemes for Businesses Current Scheme New SEPA DD Scheme • Creditors must have an account in the Republic of Ireland (RoI) and can only debit accounts held in the RoI. •C reditors may have an account anywhere in the SEPA zone and can debit bank accounts across the SEPA zone. • Debtor account details are in National Sort Code (NSC) and Account Number format with the debtor account held in the RoI. •D ebtor account details are in BIC and IBAN format. The debtor account can be held anywhere in the SEPA zone. • Submission of a DD payment file to AIB can be made up to one business banking day before the collection of funds on both a first and recurring presentation. •A SEPA DD payment file must be submitted to AIB a minimum of six business banking days before the collection of funds, for a first presentation, and three business banking days for the collection of funds on a recurring transaction. • Indemnity claim/counter claim process - limited to 13 months for unauthorised debits since November 2009. • ‘ No Questions Asked’ refund applies to authorised debits for eight weeks after the debit date and up to 13 months for unauthorised debits. Claims for ‘No Questions Asked’ refunds must be honoured by the creditor. Mandates Mandates • Creditor must hold a copy of the mandate for up to seven years from date of final debit under the agreement. •C reditor must hold the original mandate for the entire lifetime of the agreement and a minimum of 13 months after the last debit is presented. Retention of paper is subject to national legal requirements (seven years in the RoI). Under the SEPA DD scheme, creditors will be required to manage their own direct debit mandates. This means the creditor must physically store the mandate in paper and/or electronic format. All direct debit originators in the RoI must design internal processes to cope with these mandates. Certain mandate related information will have to be collected and submitted with each SEPA DD collection (i.e. Debtor Name, debtor IBAN, debtor BIC, UMR, type of payment, date of signing, SEPA Originator Identification Number and Creditor Name). Creditors will not be required to obtain a new signed mandate for existing customers held under the current national direct debit scheme. Unique Mandate Reference Creditors will be required to give every mandate they hold a unique mandate reference. Creditors can generate this mandate number, with a maximum of 35 alphanumeric characters, in a free format. It could be a contract number, a client number or just an ascending or descending number. AIB recommends using something similar to a client number, so that it is easy to recognise individual client mandates. It is important to note that this unique mandate reference number must remain the same for each transaction submitted under the customer mandate. Creditors will also be required to make this available to their customers. SEPA Originator Identification Number / Creditor Identifier • Depending on the scheme a creditor uses, the original mandate is either physically held and managed by the debtor bank or managed by the creditor. • Mandate may be on paper, captured online or by telephone voice recording. • AIB offers a debtor the facility to cancel a direct debit mandate. AIB communicates mandate cancellations to creditors in writing. • First six characters of the Mandate Reference must remain unchanged, the remaining 12 characters can be variable. •T he original mandate is physically held and managed by the creditor. •M andate default is in paper format. There is a service available for the RoI only, whereby mandates can also be given online or by telephone. Cross border mandates must be in paper format. •A IB will offer a mandate cancellation service to customers, however, AIB does not advise the creditor directly of mandate cancellations. The debtor is ultimately responsible for cancelling the mandate and informing the creditor. •T he Unique Mandate Reference (UMR) must be unique for each mandate and must be submitted unchanged for each collection. Creditors will need to obtain their new SEPA Originator Identification Number (OIN), also known as the SEPA Creditor Identifier, which will uniquely identify each creditor through an alphanumeric code. AIB will provide all originators with their new SEPA OIN / Creditor Identifier in advance of their migration to SEPA. Return Transactions For return transactions (R-transactions), SEPA DDs have different reason codes on the account returns file. Based on the reason code for a return transaction a creditor can decide whether to generate a new direct debit, call the client or choose from a number of other actions. If an automated process is in place, you may have to re-programme your system based on these new return reason codes. Unauthorised Debits A direct debit is deemed to be unauthorised in the following situations; 1) no mandate exists; 2) the mandate was invalid; or 3) the mandate has expired (no transactions for 36 months).

© Copyright 2026