How to transfer your Super to a KiwiSaver scheme 19 August 2013

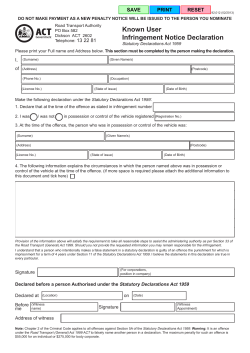

19 August 2013 How to transfer your Super to a KiwiSaver scheme If you’re living in New Zealand on a permanent basis, you might be considering transferring your Australian super benefit to your KiwiSaver account. And although we’d hate to lose you, we’re committed to acting in the best interests of our members. So to make it easier for you, this document provides an explanation of the process, along with a step by step guide. 2 Keep in mind though, if you’re planning to return to Australia at any stage you may want to consider leaving your Australian super benefit in a high performing super fund, like HOSTPLUS. If you’re unsure, simply give us a call on 1300 HOSTPLUS (1300 467 875) and we’d be happy to help. Contents Trans-Tasman portability scheme ................................................................................................................................................ 4 Introduction...................................................................................................................................................................................... 4 Details.............................................................................................................................................................................................. 4 How to transfer your benefit – step by step guide ....................................................................................................................5 3 Your checklist..................................................................................................................................................................................7 This information booklet has been prepared by HOSTPLUS Pty Limited as the Trustee of the HOSTPLUS Superannuation Fund (the ‘Fund’). The information contained in this guide is general information only and is not intended to contain any recommendations, statements of opinion or advice. It does not take into consideration your objectives, financial situation or needs. You should obtain a copy of the HOSTPLUS Product Disclosure Statement and consider the information contained in the Statement before making any decision about whether to acquire an interest in HOSTPLUS. Issued by Host-Plus Pty Limited ABN 79 008 634 704, AFSL No. 244392, RSEL No. L0000093, HOSTPLUS Superannuation Fund ABN 68 657 495 890, RSE No. R1000054, MySuper No. 68657495890198. For further information on Chant West ratings visit www.hostplus.com.au/members/calculators/chant-west-disclaimer. Any reference to the law is as at 22 August 2013. Trans-Tasman retirement savings portability scheme Introduction Until recently, superannuation laws in Australia did not allow Australian and New Zealand citizens living in Australia, who left Australia indefinitely, to either withdraw their super on departure prior to reaching Australian preservation age (between 55 and 60, depending on the individual’s date of birth), or to move their benefits to a super fund in their new country. Recent legislation (known as “Tasman retirement savings portability scheme”) assists Australians and New Zealanders to streamline their financial affairs when they cross the Tasman, consolidate their retirement savings in their country of residence and avoid paying unnecessary fees and charges on multiple accounts held in the two countries. Bringing your KiwiSaver savings to HOSTPLUS HOSTPLUS is not required, by law, to accept money from a KiwiSaver scheme. 4 That is, it is voluntary for providers of Superannuation products to accept transferred retirement savings from New Zealand. This applies to funds receiving a New Zealand sourced amount directly from a KiwiSaver scheme, as well as to funds receiving a rollover from another complying superannuation fund with New Zealand sourced amounts within it. If, in the future, HOSTPLUS decides to accept amounts from a KiwiSaver scheme we will communicate it to all members. Transferring your Australian superannuation to a KiwiSaver scheme As your super benefit is leaving the Australian superannuation system and being sent overseas, we need to make sure that all requirements have been met. The requirements are that: • you have emigrated permanently to New Zealand; • we’ve received an Australian statutory declaration stating that you have permanently emigrated to New Zealand, as well as proof of residence at an address in New Zealand; • you’ve requested and consented to the payment of the whole of your withdrawal benefits to a KiwiSaver scheme; • you have opened a KiwiSaver scheme account; • you have provided the KiwiSaver scheme’s name and account number into which your super benefit is to be paid; and • the KiwiSaver scheme provider has confirmed they will accept the payment. ! Important: Australian-sourced retirement savings held in KiwiSaver schemes: • may not be withdrawn to purchase a first home; •may only be accessed when you reach age 60 and satisfy the Australian definition of retirement at that age; and • may not be transferred to a third country. How to transfer your benefit – step by step guide Please follow the steps below if requesting a transfer of your HOSTPLUS account balance to a KiwiSaver scheme: Step 1: Complete the application form Please contact our service centre on +61 (3) 9624 7370 between 8am – 8pm A.E.S.T. and request the form to transfer your HOSTPLUS account balance to the applicable KiwiSaver scheme. Once you have received the form please make sure you complete all mandatory fields. If your form is incomplete, we may not be able to process your request. Step 2: Provide supporting documentation To transfer your HOSTPLUS account to your KiwiSaver account, you’ll need to provide the following documents: (a) Proof of identity In order to prove your identity, the documents you provide must be certified. How to certify documents To certify a document, please take the original identification document and a photocopy of both sides of the original document to an authorised person. The authorised person must: • write in English on the photocopies: ‘This is a true and correct copy of the original’ and • write their name, address, occupation, date and registration number (if applicable) and sign each page. a) Proof of identity c)A signed Australian Statutory Declaration stating you have permanently emigrated to New Zealand We’ve included some important information below to help you complete each of these steps. ! Please note: Certified photocopies need to be clear and legible. Certified documents that have been faxed or photocopied cannot be accepted. We are unable to accept certification on the reverse side of the photocopied document. 5 b) Proof of residence in New Zealand Who can certify your original proof of identity document in New Zealand? You can get your documents certified by any of the following: • Australian Consular Officer or Australian Diplomatic Officer (within the meaning of the Consular Fees Act 1955) • Judge of a court in an overseas jurisdiction • Notary Public • Police officer of an overseas force • Registrar, or Deputy Registrar, of a court in an overseas jurisdiction We also require evidence of the certifier’s status. For example, for a Police Officer: details of their police badge number. What documents do I need for proof of identity? A certified copy of a current driver’s licence or current passport. (b) Proof of residence in New Zealand If the document you‘ve used to prove your identity (drivers licence or passport) doesn’t have your current address on it, you’ll need to provide a supporting document that includes your address. Examples include utility bills, council rate notices or a bank statement. (c) A signed Australian Statutory Declaration stating you have permanently emigrated to New Zealand You’ll need to complete an Australian statutory declaration stating you have permanently emigrated to New Zealand. Australian Statutory Declarations may be made before a person who is able to witness Commonwealth statutory declaration under the Australian Statutory Declarations Act 1959 and Statutory Regulations 1993. This includes an Australian Consular or Diplomatic Officer at the Australian High Commission in Wellington, or the Australian ConsulateGeneral in Auckland. 6 ! Important: Please note New Zealand Justices of the Peace, solicitors etc cannot witness an Australian statutory declaration. Step 3: After you’ve completed your application to HOSTPLUS Once the appropriate form has been completed and the correct information has been supplied; post the completed pack to: Locked Bag 14 Carlton South, VIC 3053 Australia If you require further assistance please call us on +61 (3) 9624 7370. Your checklist I have consulted my financial/tax adviser to determine whether the transfer of my Australian superannuation benefit is appropriate; I have contacted HOSTPLUS and obtained my ‘Request to transfer whole balance of superannuation benefits to KiwiSaver Scheme’ form I have completed the form and have sent it to HOSTPLUS; provided proof of identity, proof of residence in New Zealand as well as an Australian Statutory Declaration that has been witnessed by a person who is able to witness Commonwealth statutory declarations; I request and consent to the payment of the whole of my withdrawal benefits to a KiwiSaver scheme; I have opened a KiwiSaver scheme account; I have given HOSTPLUS the KiwiSaver scheme’s name and account number to which the benefits are to be paid; and I can confirm that the KiwiSaver scheme provider will accept the payment. 7 I have How to transfer your Super to a KiwiSaver scheme Postal address Locked Bag 3 Carlton South VIC 3053 VIC Level 2, Casselden Place 2 Lonsdale Street Melbourne VIC 3000 SA/NT Level 1, 104 Frome Street Adelaide SA 5000 QLD Level 11, 120 Edward Street Brisbane QLD 4000 INH_0690_08/13 Gold Coast Shop 110/111 Pacific Fair Shopping Centre Hooker Boulevard Broadbeach QLD 4218 WA Level 2, 12 St. Georges Terrace Perth WA 6000 ACT Unit 6, Ground Floor 33 Allara Street Canberra ACT 2601 NSW Level 5, Sydney Central 477 Pitt Street Sydney NSW 2000 TAS Level 2, 119 Macquarie Street Hobart TAS 7000 Phone 1300 HOSTPLUS (1300 467 875) Fax 1800 HOSTPLUS (1800 467 875) Visit hostplus.com.au Email [email protected]

© Copyright 2026