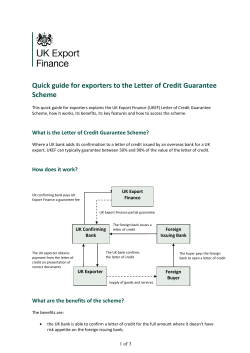

HOW TO RESTORE FINANCIAL STABILITY Philip Whyte CENTRE FOR EUROPEAN REFORM