Document 178223

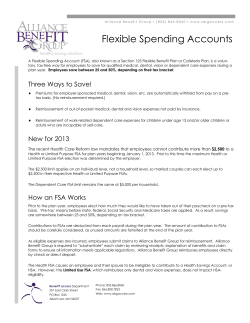

Sample Employee Communication Booklet LEARN HOW TO REDUCE YOUR TAXES AND INCREASE YOUR SPENDABLE INCOME! IT IS NOT AN INSURANCE POLICY. It is an I.R.S. Approved vehicle to convert eligible expenses that you incure from a PostTax to a Pre-Tax basis. You save money by reducing your Federal, FICA, and most State Income Tax (excluding N.J.). 2 $2,500 per year to the Unreimbursed Medical Plan. ($100 minimum to participate) $5,000 to the Unreimbursed Dependent Care plan if married and filing a joint return or a single custodial parent. $2,500 if married filing a separate return. ($100 minimum to participate) Contributions are deducted in equal installments from your paycheck during the Plan Year, which runs from January 1 through December 31st of each year. The maximum annual deduction that can be contributed to each Flexible Spending Plan is indicated on the enclosed Salary Reduction Agreement. 3 • By converting eligible expenses from an After-Tax basis to a Pre-Tax basis you will reduce your FICA, State (N.J. does not currently allow for a State Tax deduction) and Federal Income Tax. • The net result is a reduction in the taxes you pay and an increase in your spendable income! 4 5 A participant may change his or her Pre-Tax election(s) under only certain Limited Qualified conditions as outlined in your Summary Plan Description/Plan Information Summary, as well as in accordance with the I.R.S. consistency rules. Sample Life Event Changes Legal Marital Status – Marriage, death of a spouse, divorce, legal separation or annulment (Example: If Employee gets Married, FSA election can be increased) Change In Number of Tax Dependents – Birth of a child, adoption or placement for adoption of a dependent or death of a dependent (Example: If Employee has birth of a child, FSA election can be increased) Change In Employment Status – Termination or commencement of employment, strike or lockout, commencement of or return from an unpaid leave of absence, change in worksite, switching from salaried to hourly paid, union to nonunion or part-time to full-time (Example: If Employee loses full-time status, FSA election can be decreased) * Election changes must be made within 30 days of the event or during the annual election period, which takes place each December by completing a Change of Status form. A sample Change of Status form is enclosed. Please see your Human Resources Department for an original. The above events represent a mere sampling of the types of conditions in which a change in election is permissible and what action to take. Please consult your Summary Plan Description/Plan Information Summary, which should or will be distributed to you by your employer. For further guidance on other permissible events/actions, please visit www.ChangeofStatus.com. * You can also change your pre-taxed medical, dental or other premium elections once a year during the open enrollment period for any reason. If you wish to continue or change your FSA Medical or Dependent care deductions, these elections MUST be re-elected each year. 6 IS THERE ANY RISK? YES Revocation of Election: A Participant can not make any changes to his or her Pre-Tax election(s) under the plan except for election changes which are permitted within the Section 125 Cafeteria Plan as outlined in your Summary Plan Description/Plan Information Summary. Use-It-Or-Lose-It Rule: If a Flexible Spending participant does not utilize their entire Unreimbursed Medical and/or Unreimbursed Dependent Care annual election(s) within the plan year and submit within the 90 day Run Out Period, the unclaimed portion of that election will be forfeited. To reduce your risk there is a 75 day Grace Period which will allow additional services to be incurred after the plan year and submitted for reimbursement. (See example on next page which includes information about the Grace Period.) There is a potential for Social Security retirement benefits to be reduced slightly for those individuals nearing retirement. 7 Only qualified unreimbursed FSA Medical expenses incurred during the plan year or 1 during the 2 ½ month Grace Period are eligible for reimbursement. You will have a 90 day Run Out Period from the end of your plan2 year to submit eligible expenses for reimbursement. Example: Plan Year 01/01/2007 12/31/2007 Grace Period 01/01/2008 03/15/2008 Run Out 01/01/2008 03/31/2008 All dates listed above change during a leap year. In leap years Run Out ends 03/30 1 - 2 ½ month Grace Period not to exceed 75 days. 2 - Not from the 2 ½ month Grace Period. 8 SAMPLE EXPENSES ELIGIBLE FOR REIMBURSEMENT UNDER THE FLEXIBLE SPENDING PLANS • Insurance Deductibles • Prescription Drugs • Physician Co-payments • Individual Psychiatric Care • Certain types of over-thecounter items (i.e. band-aids, and heating-pads)* • Noncosmetic Dental services/braces • Routine Exams • Blood-sugar test kits and test strips • Lasik Surgery • Insulin and syringes • Prescription eyeglasses • Physical Therapy • Contact Lenses/Solution • Hearing devices and batteries • Travel expenses for person to receive medical care • Wheelchair • Immunization/Flu Shots • Chiropractic Fees • Birth Control Pills • In-Vitro Fertilization For Dependent Care: Day Care expenses for eligible dependent(s) as necessary for employment so long as the primary purpose of the care giver is NOT for education. *As of January 1st, 2011 over-the–counter medications such as Aspirin, cold medicine, antacids, etc are no longer eligible under the FSA plan unless accompanied by a Doctor’s note explaining why they are medically necessary. 9 1. Determine if you can benefit from either the Premium Conversion Plan, Unreimbursed Medical Plan and/or Unreimbursed Dependent Care Plan. If you can, fill out the appropriate Salary Reduction Form. 2. Use the guide on the following page to help you determine if either the Unreimbursed Medical Plan and/or Unreimbursed Dependent Care Plan will help you reduce your taxes and save you money. Be conservative with your estimates. 3. On your Salary Reduction Form, fill in the annual amount you want to set aside for your applicable Unreimbursed Medical and/or Dependent Care Plans. 4. Sign and date the forms. They must be returned with the rest of your benefit forms to your Human Resources Department prior to your effective date. 10 THE MAGIC FORMULA! OUT OF POCKET UNREIMBURSED MEDICAL, DENTAL & VISION EXPENSES ESTIMATE ALL KNOWN EXPENSES FOR THE PLAN YEAR (Medical, Dental, Vision) ESTIMATE ALL ANTICIPATED EXPENSES FOR THE PLAN YEAR a) Health insurance deductibles $_______ $_______ b) Co-insurance (% not paid by insurance) $_______ $_______ c) Vision care (eye exams, contacts, glasses) $_______ $_______ d) Exams (OB-GYN, school physicals, etc) $_______ $_______ e) Travel costs related to medical care $_______ $_______ f) Prescription drugs $_______ $_______ g) Medically required equipment $_______ $_______ h) Wheelchairs, crutches, medical appliances $_______ $_______ i) Dental exams, cleanings, x-rays, etc. $_______ $_______ j) Braces, retainers, fillings, etc. $_______ $_______ k) Orthodontics, implants, inlays, other $_______ $_______ l) Other $_______ $_______ TOTAL (A): $_______ (Use 100% of this number) TOTAL (B): $_______ (Use 50% of this number) Add the two totals together and divide by the number of pay periods you have remaining in your plan year to arrive at your contribution amount: _____________ + _____________ = _____________ / _____________ = ____________ Total (A) Total (B) # Pay Periods Contribution Amt DEPENDENT CARE ASSISTANCE If you are a single parent or your spouse works or is a full-time student, how much do you pay for dependent day care for children 12 years or younger? $_______ Divide this number by the number of pay periods you have remaining in your plan year to arrive at your contribution amount: _____________ / _____________ = _____________ Child Care Amt # Pay Periods Contribution Amt 11 1. Fully and accurately complete an Unreimbursed Medical and/or Unreimbursed Dependent Care request form. The request form should be forwarded to O.C.A. Benefit Services accompanied by the appropriate third party documentation. 2. Unreimbursed Medical and Unreimbursed Dependent Care claim forms are available in your Human Resources department, as well as on myRSC.com. 3. As a helpful reminder, make a copy of your request form and third party documentation for your records prior to forwarding them to O.C.A. Benefit Services. 4. We typically process claims within 48 hours upon receipt*. The 48 hours does not include weekends and holidays. (90% of claims received are processed same day) * Processing means just that – it does not mean you will receive reimbursement within in 48 hours. However reimbursements are generated daily. 12 To register for the first time, access your online account, or activate your debit card simply visit www.oca125.com and click on either of the links circled above. 13 Finding a list of all merchants that can legally accept the mySource debit card is just 2 clicks away. 14 mySource Debit MasterCard and Your FSA! 1. Your mySource card should ONLY be used for purchases deemed eligible under Section 213(d) of the IRS Code. For a list log onto www.myRSC.com. 2. When using your card at a pharmacy, always show your health insurance identification card. This will ensure the pharmacist runs your prescription through your insurance and is applied appropriately. (Remember the mySource card is simply a vehicle to make your purchase. It does not replace your insurance card.) 3. By Government requirements in order for the mySource card to work, be sure the merchant is considered I.I.A.S. (Inventory Information Approval System) certified. There are two different ways I.I.A.S. certified merchants transmit the purchase information: a. If the pharmacy supports what is called “Prescription Subtotals” (*Category 10 & 11), then the pharmacy will transmit back to our system all the information about the prescription we will need (and in most cases) to auto-substantiate the debit transaction with no further information required from you. b. If the pharmacy does NOT support “Prescription Subtotals” (Category 10 Only), then these pharmacies will transmit all eligible Section 213(d) healthcare items (including prescription purchases) back to our system coded strictly as a healthcare items. When this happens our system cannot differentiate between a prescription from a bottle of vitamins, thus requiring you to submit paperwork supporting the purchase to ensure that it is FSA eligible. c. Dental, Vision and other “services” within the medical arena currently do not auto-substantiate in accordance with I.R.S. rulings. Therefore, you will be required to submit paperwork to O.C.A. to support those charges 4. Depending on which merchant you choose to use, your mySource card purchase may or may not necessitate the need to submit a claim form. In any event, you will always receive auto-generated system color-coded emails informing you what action, if any, needs to be taken each and every time you use your card. Those emails would be received as follows: a. GREEN – Your transaction was resolved (via auto-substantiation, paper claim supporting the purchase or off-set from another claim reimbursement) and no action is necessary. b. YELLOW - Your transaction did not auto-substantiate and you will have 14 days from the date of purchase to submit the proper supporting documentation to substantiate the charge. c. ORANGE - Your transaction is still outstanding and you have 7 days remaining to submit the supporting documentation to substantiate this charge. d. RED - Your transaction is still unresolved and your debit card has been temporarily timed out. Once we receive the proper substantiation, or if this was for an ineligible item and the amount was paid back to your employer then the card becomes reactivated by the next day. * Category 10 and 11 refers to the specific information I.I.A.S. merchants transmit to third-party administrators across the country. Category 11 is specific to prescription information, where Category 10 relates to all Section 213(d) healthcare items. When a merchant is classified as Category 10 only, it lumps prescription information in with all healthcare items. Therefore, third-party administrators are unable to determine whether you purchased a prescription from an over-the-counter item, thus requiring paperwork to support the purchase. 15 16 To access your online claim form, once you have logged into your online myrsc account, click on either link circled below. 17 Benefit Administration you can Depend On! Fill Out Claim Forms Online Take claim entry into your control! You can now go to www.OCA125.com to fill out your claim forms online. Log in, complete the form, print and fax the transmittal to OCA. No more filling out forms by hand! 1. Log in to www.OCA125.com 2. Click the Online Claims Entry option in the menu. 3. Click Add a New Claim Form and then select which form you need. You will see links to add Medical (FSA or HRA), Dependent Care, and Parking/Transit. 4. Print and fax claim, along with receipts, to OCA at 609-514-2778. As claims are added, you will see them listed. An individual claim can be edited or deleted, until the Transmittal Form is printed. O.C.A. Benefit Services 3705 Quakerbridge Road, Suite 216 Mercerville, NJ 08619 www.OCA125.com 609.514.0777 18 Online Claim Entry Receipt Cover Page Date Printed: 5/20/2010 Fax this page along with receipts for services Fax to: 609-514-2778 Account Holder Info: Plan Service Provider Info: Plan Service Provider: O.C.A. Benefit Services Employer: Commercial Printing Account Holder: Michael Address: 3705 Quakerbridge Road Notsohumble Suite 216 Mercerville, NJ 08619 Access ID: 776423428186 Address: 13821 St. Charles Blvd Voice: 609-514-0777 Little Rock , AR 72211 SSN: Email Address: [email protected] Card Type DOB Claimant N/A 5/3/2000 Michael Medical Dates of Service 5/1/2010 5/1/2010 Amount Service Provider Provider Pay Provider TaxID Receipt Attached 100.00 Prescription/RX Note: Total: Account Holder Signature 100.00 Date I certify that the expenses for reimbursement indicated on this substantiation form were incurred by me (and/or my spouse and/or eligible dependents), and were not reimbursed by any other plan nor will I seek reimbursement from any other source. To the best of my knowledge and belief, the expenses are eligible for reimbursement under my Reimbursement Plans. I (or we) will not use the expense reimbursed through this account as deductions or credits when filing my (our) individual income tax return. Any person who knowingly and with intent to injure, defraud, or deceive any insurance company, administrator, or plan service provider, files a statement of claim containing false, incomplete, or misleading information may be guilty of a criminal act punishable under law. OCE181501 Page 1 19 REGISTER YOUR ACCOUNT AT myRSC.COM WITH YOUR mySource Card 1. Go to www.myRSC.com and click the mySource Card picture on the bottom right of the screen. 2. Type in the entire 16-digit mySource Card number from the primary card, and click next. 3. Fill in the primary card holders entire Social Security Number, and click next. 4. You will now need to setup your personal Login ID a. First create your personal Login ID b. Select an email address to use for security. You can use either the existing email address you supplied O.C.A. with or you can choose another if you prefer. c. Create your security question by using either a predefined question or you can create your own. When completed click Submit. 5. Enter in your password. Please make sure to read the recommendations in order to make your password as secure as possible. 20 O.C.A. Benefit Services Account Rules and Claim Filing Instructions Rules for Both Dependent and Medical Accounts 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. You cannot submit a claim unless you are participating in the Cafeteria Plan. You can be reimbursed only for eligible expenses occurring during the coverage period in which your contributions are made. You can submit a claim at any time during the plan year and for a specified period after the plan year as described in the Summary Plan Description. If you terminate employment, you can submit a claim for a specified period after the date of termination if so stated in the Summary Plan Description as long as the service occurred before your date of termination. IRS rules stipulate that any money left in your account(s) after all reimbursements for the plan year have been processed cannot be carried forward or returned. Money in one account can not be used for expenses incurred in another account. For instance, any unused amounts left in the medical account can not be used to reimburse dependent care expenses. You cannot receive payment from any other source for expenses reimbursed by claim, and you certify that you are not eligible to bill any other source for the reimbursed expenses. If you have received reimbursement for expenses, you cannot claim the expenses for income tax purposes. You cannot bill for a service period that begins in one plan year and ends in the next plan year. File two reimbursement claims, one for each plan year covering the period during that plan year. Complete ALL the information on the claim form for each amount claimed for reimbursement. Attach copies of receipts from service providers or the Explanation of Benefits Form from Insurance Carriers to the claim. Sign and date the claim form. Make a photocopy of the claim for your records. Submit the Claim with attached receipts to O.C.A. Benefit Services according to the procedures provided. Additional Claims are available from your employer. Dependent Care Expense 1. You can use a Dependent Care Spending Account only if you pay dependent day care expenses to be able to work. Your day care services can take place either inside or outside of your home. If you are married, your spouse must also work, go to school full time, or be incapable of self-care for you to be eligible. 2. Only (a) dependents under the age of thirteen or (b) dependent adults or children thirteen years or older who are mentally or physically incapable of self-care are covered. 3. Your Maximum Contribution Amount can not be more than the smaller of (a) or (b) a. Your income or your spouse’s income, whichever is smaller. If your spouse if a full-time student or incapable of self-care, your spouse is considered to earn $3,000 per year with one dependent or $6,000 per year with two or more dependents. b. $5,000 per year if your tax filing status is married filing jointly and or single head of household or $2,500 per year if your tax filing status is ‘married filing spearately’. 4. You cannot claim expenses if the service provider is your child or stepchild and are under age 19 or if you claim the service provider as a dependent for Federal income tax purposes. 5. To be reimbursed, you must include the facility’s name, address, and tax identification number or the Social Security number of the individual providing the dependent day care service. 6. The maximum amount you can be reimbursed during the time you are covered in the Plan Year can not exceed the salary reduction amounts you have elected and made under the Dependent Care Assistance Plan less any previous reimbursements paid. Unreimbursed Medical Expenses 1. The total annual election for eligible medical expenses (less any previous reimbursements paid) is available when requested for covered expenses. 2. Refer to the provisions in the Unreimbursed Medical Expense Spending Account Plan document for the maximum annual election amount. 3. To be reimbursed, you must include the dependent’s name, date expenditure incurred, name of Service Provider, description of the expense, and the amount of the claim less any amounts that have been or will be paid by insurance or other sources. 21 Benefit Administration you can Depend On! FSA Quiz 1. What is eligible for reimbursement out of your FSA? a) Insurance premiums b) *eligible 213(d) IRS Expenses c) Transit/parking expenses d) Whatever I request *To view all eligible FSA expenses, visit www.oca125.com under the participant portal 2. What is the max contribution you can make into your FSA? $_______________ 3. Where can you use the mySource Debit card? a) Gas Station b) ATM c) Valid Medical/Dental/Vision Merchant d) Casino 4. How long do you have to submit debit card transaction receipts that require substantiation? a) 5 days from time of swipe b) 25 days from time of swipe c) 14 days from time of swipe d) 45 days from time of swipe 5. For FSA purposes, what does the “Grace Period” stand for? a) Allows an additional 75 days into the new plan year to spend previous years FSA money b) Is the period during which no interest is charged on a credit card c) Allows an additional 10 days into the new plan year to spend previous years FSA money 6. How long do you have to submit a claim after the plan year has ended? _____ days from the end of the plan year. Answers: 1.B 2. $2,500 3.C 4.C 5. A 6. 90 days 22 If you should have any questions, do not hesitate to contact us at (609) 514-0777 during our hours of operation Monday thru Friday 9AM - 5PM EST. Your account balance and claims status is available 24 hours a day, 7 days a week by using our Interactive Voice Recognition (I.V.R.) system. You can also access your personal claims account by visiting www.OCA125.com 23 Sample Company, Inc 123 Main Street Anytown, NJ 08880 This brochure is designed to give you only the highlights of your Section 125 Cafeteria Plan. For a complete description of the terms and conditions, please refer to the Summary Plan Description/Plan Information Summary which is the legal document governing this plan. 24

© Copyright 2026