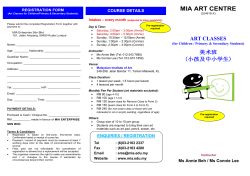

HOW TO SUCCEED