HOW TO IMPROVE ACCESS TO FINANCE IN LEBANON BUILDING HIGH-IMPACT ENTREPRENEURSHIP ECOSYSTEMS

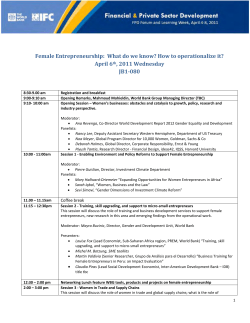

BUILDING HIGH-IMPACT ENTREPRENEURSHIP ECOSYSTEMS HOW TO IMPROVE ACCESS TO FINANCE IN LEBANON a report from: supported by: Lebanon needs a big win. We need at least one major success story to gain momentum around startups and entrepreneurship. 4 Endeavor Insight Access to Finance in Lebanon I. II. written by Rabia Qari Endeavor Insight 5 Introduction 6 Mapping the Finance Landscape 8 III. How to Improve Access to Finance in Lebanon 12 IV. Appendix 14 About 15 V. 6 Endeavor Insight Access to Finance in Lebanon I. Introduction When entrepreneurs and investors in Lebanon are interviewed, the need for a first home run is a resounding theme. “Lebanon needs a big win. We need at least one major success story to gain momentum around startups and entrepreneurship,” said Elie Khoury, Co-Founder of Woopra and YallaStartup. Achieving this type of success story is a difficult feat, and one that is paradoxically tied to the existence of the very entrepreneurial ecosystem which a big success could help create. In countries with a nascent entrepreneurial ecosystem, it is often difficult for entrepreneurs to access venture capital, a key component of funding during a startup’s crucial growth stage. When companies cannot access debt or rely on friends and family for funding, venture capital becomes especially relevant. Infusion of capital can propel a local star into a monumental success. In a study done by the Center for European Economic Research, which surveyed 6,000 small- and medium-sized enterprises (SMEs) in Germany, equity investment was found to be a key driver for R&D in SME’s.1 In Lebanon, this kind of R&D is a needed asset. As seen below (Figure 1: Access to Venture Capital for Innovative Entrepreneurs), Lebanon rated 2.7 (on a scale of 1-7) for ease of access to venture capital, the lowest amongst many MENA countries.2 Figure 1: Access to Venture Capital for Innovative Entrepreneurs In your country, how easy is it for entrepreneurs with innovative but risky projects to find venture capital? (1–7)* 4.2 Saudi Arabia 4 UAE 3.3 Morocco 3 Egypt Jordan 2.7 Lebanon 2.7 *1 = very difficult ; 7 = very easy There is a strong consensus that access to finance remains a pressing challenge for entrepreneurs in Lebanon. Which begs the questions, what are the real obstacles to obtaining finance and how can these issues be tackled? 1 Center for European Economic Research, 2006 2 World Economic Forum, “The Global Competitiveness Report”, 2011-2012 This report examines the financing landscape in Lebanon and relies on primary interviews with 18 entrepreneurs, banks, venture capital funds (VCs), incubators and government representatives. (See appendix for a full list of names.) The subsequent sections will first layout the current state of financing options in Lebanon and then provide recommendations for how the situation can be improved in the short-term via quick wins. These recommendations focus not on policy changes that would take years to fully roll-out, but rather on proactive measures that entrepreneurs, funders, and the government can take to rapidly improve financing options. 7 8 Endeavor Insight Access to Finance in Lebanon II. Mapping the Finance Landscape Over the course of the last decade, Lebanon has experienced tremendous political turmoil and government upheaval. This instability has hindered its ability to attract foreign investment and increased its dependence on domestic capital. The local Lebanese financing landscape appears minimal upon first inspection. Deeper analysis, however, reveals that despite a limited VC presence, a robust environment of incubators and entrepreneurial support organizations has emerged in the last three years. Figure 2: Investment Landscape in Lebanon Early Berytech Seeqnce Funders LBA Berytech Fund MEVP Cedrus RED Wamda Fuacilitators Kafalat BIAT Center SME Unit of Ministry Late AltCity Arab Net Bader Mowgli SouthBIC Endeavor 2000 # of VC Deals 0 you see so many accelerators and incubators coming up now - to help these companies grow.” Lebanon is now in a stage of waiting. New incubators and facilitators must do their work and assist companies in growing large enough to warrant active VC deal flow. A detailed look at both facilitators and funders further demonstrates the distinct roles each must play to create the financial landscape so crucial to an entrepreneurial ecosystem. DEBT FINANCING: Banks In Lebanon, only 23.8% of firms use banks to finance investments, compared to 51.9% in Turkey.3 This stark distinction seems to be rooted in the risk-averse nature of Lebanese banks; banks often require collateral of up to 200% of the loan, making it impractical for start-ups to borrow money. A solution to this problem emerged in 2000, with the founding of Kafalat, a financial company that guarantees loans for SMEs, allowing them to obtain loans from banks with little or no collateral. Kafalat offers different loans depending on business needs. Its loans can reach up to $400,000. Since its inception, Kafalat has provided loans worth a combined total of $123 million.4 With interest rates subsidized by the Lebanese treasury, Kafalat is the easiest way for a new business to get financing with reasonable collateral and interest rates. “Kafalat is a great product”, says Walid Hanna of MEVP, “when we see a company has received a Kafalat loan, it automatically checks a lot of boxes for us in our diligence process.” Several Lebanese banks, including BLC Bank, are beginning to create programs and loans with the specific aim of supporting entrepreneurs. As long as more banks adopt this approach and this attitudinal shift continues, there will be more and more opportunities for entrepreneurs to get funding. 2012 0 0 VC/ Growth Capital 0 0 0 Incubator/ Accelerator 0 0 2 Bank Guarantor 1 7 Facilitator 9 5 Angel Size of bubble indicates how many investments have been made *YTD Source: Zawya Investor The chart above (Figure 2: Investment Landscape in Lebanon) outlines the evolution of the entrepreneurial ecosystem in Lebanon since 2000. Two trends are immediately apparent. First, the number of VC deals done over the last three years (from 2010 – 2012) is twenty-one versus just three over the previous ten years (from 2000 – 2009). Beyond number of deals, most of the funders and facilitators in the entrepreneur ecosystem have also emerged in the last five years. Because the ecosystem is still at a nascent stage, it is likely too early to see the impact of these new VCs, incubators, and facilitators. There appears to be tremendous potential for the future as they gain traction. Omar Christidis of ArabNet, the hub for Arab digital professionals and entrepreneurs, commented, “You don’t have that many VC-ready startups” he says, “this is why EQUITY FINANCING: Angels Angel investors are a common source of seed funding for entrepreneurs. Perhaps the smallest community in the ecosystem, the angel community in Lebanon is still in an early-stage of development, consisting mostly of “family and friends” investments. The only formal network, the Lebanese Business Angels (LBA), was started in 2009 by Bader, a program whose mission is to support entrepreneurship throughout the entire life-cycle of an entrepreneur. LBA has completed two investments to date. Several of our interviewees also noted that the potential exists for an angel network to develop outside of Lebanon that consists of Lebanese expats currently residing in the US, Europe and all over MENA. There is a large Lebanese ex-pat population, some of whom may be willing to invest in their home country. VCs VCs were most often cited in interviews as the primary source of growth capital in Lebanon. Yet, one recurring complaint from Lebanese entrepreneurs is that there are not enough VCs to approach. (The real issue may be, however, that there are not enough start-ups ready to approach VC firms). The main VC players in Lebanon are Berytech 3 IFC Data, 2009 4 Kafalat website (kafalat.com.lb) 9 10 Endeavor Insight Access to Finance in Lebanon Fund, Cedrus Ventures, MEVP, Riyada Enterprise Development (RED), and the Wamda Capital Fund. The chart below (Figure 3: VC Investment in Lebanon) summarizes the number and average value of transactions that have been publicly disclosed by these firms for solely Lebanese investments. Figure 3: VC Investment in Lebanon Average Amount Invested by VCs Number of VC Deals 2010 2011 $0.84 7 $0.46 8 Source: Zawya Investor From 2010 to 2011 there were a total of 15 VC deals done for 11 companies. Regardless of this limited scope, the fact that VC funding has steadily grown over the last two years is encouraging. Typically, VC funding is considered a viable way to raise funds for those companies that have a proven model and are ready for growth capital. Few startups in Lebanon are currently at this stage. Any further trajectory upward for growth in VC deal-flow will require significant investment on the part of incubators and accelerators and other facilitators to ensure start-ups are scaling to the next level. Incubators/Accelerators Incubators and accelerators are designed to support startups by offering resources like mentorship, development and training in addition to financial assistance. In Lebanon, there are currently only two accelerators: Berytech and Seeqnce. The next few years should give rise to additional incubators to spur the development of early-stage companies. ENTREPRENEURIAL SUPPORT: Facilitators Facilitators include a wide range of organizations that do everything from plan conferences and educational events to mentor and provide resources and connections for entrepreneurs. The main players in this space include AltCity (startup and SME support), ArabNet (platform for digital startups), Bader Young Entrepreneurs Program (mentorship, workshops), BIAT or Business Incubation Association Tripoli (business creation support for Northern Lebanon), Endeavor (resources, mentorship), MIT Enterprise Forum of the Pan Arab Region (business plan competition), Mowgli Foundation (mentorship), SME Unit for the Ministry of Economy and Trade (platform providing resources), South Business Innovation Centre or SouthBIC (business creation support for Southern Lebanon) and Yalla Startup (startup weekend event). This group of organizations, along with the incubators, will be a main source of entrepreneurial activity in the coming years as they continue to support young companies in the development and scaling of their businesses. Also of note is the facilitative role that IDAL (Investment Development Authority of Lebanon) and the Office of the Prime Minister play in the ecosystem. In addition to coordinating the database of all ecosystem actors, the Office of the Prime Minister has created the Entrepreneurs Lebanon website with the Central Bank, piloting a project for innovative ideas with the European Union, and planning to launch a seed fund in conjunction with the World Bank. IDAL, a support branch of the Office of the Prime Minister, focuses on coordinating all of the ecosystem actors. Some of IDAL’s main initiatives include holding workshops for accelerators andamending laws to be more favorable for IT companies. 11 12 Endeavor Insight Access to Finance in Lebanon III. How to Improve Access to Finance in Lebanon Based on the number and complexity of issues around access to finance in Lebanon, below are detailed, actionable steps for the three main players in this ecosystem: the government, the funders and the entrepreneurs. These steps reflect the themes which emerged from the direct responses of all 12 interviewees when asked what they would do to improve access to finance. What everyone should do: 1) Engage and organize the Lebanese diaspora: An estimated 14 million people of Lebanese decent live outside of Lebanon compared to just 4 million people in Lebanon itself.5 Ecosystem actors should develop a strategy to leverage this group. The government could invite prominent ex-pat business leaders and entrepreneurs to visit Lebanon, meet with dynamic Lebanese entrepreneurs and experience the entrepreneurial ecosystem. IDAL plans on employing this exact tactic by working with organizations such as LIFE (Lebanese International Finance Executives) and LebNet. Their goal is to help to encourage more mentorship and angel investment. VCs should try to engage Lebanese entrepreneurs in Silicon Valley and other locations, similar to what is being done by LebNet. By involving these entrepreneurs on their boards and in their investment committees, VCs can expose the Lebanese start-up community to the influence, inspiration, and guidance of the most successful Lebanese entrepreneurs across the world. What the government should do: 1) Focus on infrastructure: “The government needs to work on providing the basics,” said Elie Akhrass of Kafalat. 100% of the funders and facilitators interviewed said that the main thing the government should work on was developing infrastructure. In order to foster a truly dynamic entrepreneurial environment, the basics, electricity and internet, need to be reliable utilities. 2) Create a space to foster entrepreneurship: The government should invest in creating a space that is exclusively for entrepreneurs. Similar to the concept of New York’s General Assembly, which receives city funding in order to promote education around technology, design, and innovation, providing a home for this sector will encourage collaboration and foster education amongst entrepreneurs. “We need a home for this space,” comments Omar Christidis of Arab Net, “this is a key way to stimulate growth in the sector.” What entrepreneurs should do: 1) Learn to bootstrap: Too many entrepreneurs see successes in Silicon Valley as evidence that funding should fall at their feet. As Elie Khoury, cofounder of YallaStartup says, “YallaStartup means ‘start working!’ You as an 5 Foreign & Commonwealth Office, United Kingdom entrepreneur have to start figuring out how to make it work with low funding.” Entrepreneurs in Lebanon need to learn the importance of making sacrifices and bootstrapping. Plenty of entrepreneurs have created highly successful businesses with only limited funding in the early stages, but it required great sacrifice to pursue what they believed in. 2) Be investment ready: Entrepreneurs should not plan to approach VCs until they are ready. They need to have something to show, a prototype, a demo or a proven model before approaching funders. Too often, entrepreneurs show up with a “great idea” and a business plan without any proof of concept or revenue model. “Take the time to go through the process,” advises Walid Hanna of MEVP, “build the business, work with incubators, be patient, get good mentors and wait until you are ready to approach VCs.” 3) Look for strategic partnerships: After seeking out family and friends, most Lebanese entrepreneurs in Lebanon approach VC firms for funding. However, there is an alternative to traditional VC that can often be a better match – strategic partnerships or smart money. “Liaise with bigger companies that can benefit you in ways other than capital,” recommends Fadi Daou, serial entrepreneur and founder of MultiLane SAL. For example, rather than seeking traditional VC funding, a startup focused on providing media services might consider developing a partnership with a top media agency in Beirut. These types of partnership can provide strategic direction in addition to funding. What funders (VCs) should do: 1) Build a team that includes former entrepreneurs: VCs should make sure they have a good mix of investment professionals and ex-entrepreneurs on their teams. “VCs need more people who have started their own business and have walked in our shoes,” comments Rabih Nassar, founder of Element^n. Endeavor has seen great examples of successful entrepreneurs becoming VCs in other emerging markets, such as Kaszek Ventures in Latin America. These entrepreneurs-turned-VCs can offer extra value to their investees based on their experience. 2) Be transparent: VCs can be more transparent by explaining what they are looking for and how they plan to work with entrepreneurs. By putting out sample term sheets, similar to what Fred Wilson of Union Square Ventures in New York City posts on his blog, companies will get a sense of what they should expect. Similarly, VCs can include templates for the types of presentations and information they are looking for in pitches along with sample financial models. “They also need to talk about the investments they have made and how they are doing” comments Samer Karam of Seeqnce, one of the few accelerators in Lebanon. By being more transparent about their requirements and their performance, both VCs and entrepreneurs can save a lot of time. 13 14 Endeavor Insight Access to Finance in Lebanon IV. Appendix List of people interviewed (in alphabetical order) Antoine Abou Samra, Bader (Facilitator) Elie Akhrass, Kafalat (Funder) Nemr Nicolas Badine, Eastline Marketing (Endeavor Entrepreneur) Ghassan Bejjani, LIFE (Facilitator) Sami Beydoun, Berytech Fund (Funder) Brahms Chouity, At7addak (Endeavor Entrepreneur) Omar Christidis, ArabNet (Facilitator) Fadi Daou, MultiLane SAL (Expert, serial entrepreneur) Lara Ghibril, Zawya (Research) Elie Habib, Riyada Enterprise Development, Lebanon (Funder) Habib Haddad, Wamda (Funder) Walid Hanna, MEVP (Funder) Samer Karam, Seeqnce (Accelerator) Elie Khoury, Woopra, YallaStartup (Facilitator) Jad Khoury, Print Works (Endeavor Entrepreneur) Diana Menhem, IDAL (Facilitator) Rabih Nassar, Element^n (Endeavor Entrepreneur) Salam Yamout, Office of the Prime Minister (Facilitator) V. About About Endeavor Endeavor is leading the global high-impact entrepreneurship movement to catalyze longterm economic growth. Over the past ten years, Endeavor has selected, mentored and accelerated the best high-impact entrepreneurs around the world. To date, Endeavor has screened more than 30,000 entrepreneurs and selected 726 individuals leading 455 highimpact companies. These entrepreneurs represent over 200,000 jobs and over $5 billion in revenues in 2011 and inspired future generations to innovate and become entrepreneurs too. About Endeavor Insight Endeavor Insight is the research arm of Endeavor that seeks to deepen understanding of how high-impact entrepreneurs contribute to job creation and long-term economic growth in order to educate key constituencies, such as policy makers. In addition, Endeavor Insight seeks to serve as a knowledge center for high-impact entrepreneurs, VCs and others in order to provide useful information and tools that assist high-impact entrepreneurs as they grow their business. About Omidyar Network Omidyar Network is a philanthropic investment firm dedicated to harnessing the power of markets to create opportunity for people to improve their lives. Established in 2004 by eBay founder Pierre Omidyar and his wife Pam, the organization invests in and helps scale innovative organizations to catalyze economic and social change. As of August 2012, Omidyar Network has committed more than $550 million to for-profit companies and nonprofit organizations that foster economic advancement and encourage individual participation across multiple initiatives, including entrepreneurship, financial inclusion, property rights, government transparency, consumer Internet and mobile. To learn more, visit www.omidyar.com About The Abraaj Group The Abraaj Group is a leading alternative investment management group in global growth markets. Founded in 2002 by Arif Naqvi, the group has raised over US$ 8 billion and distributed c. US$ 3.5 billion to investors. Employing over 300 people, the group has 33 country offices spread across 7 regional hubs in Bogota, Dubai, Istanbul, London, Mumbai, Nairobi and Singapore. The Abraaj Group currently manages approximately US$ 7.5 billion across 25 sector and country-specific Funds across 3 primary strategies: (i) Private Equity (majority and significant minority investments greater than US$ 50 million); (ii) Small and Mid-Cap (SMC) PE investing (targeting influential minority investments of less than US$ 50 million); and (iii) PE Real Estate (primarily yield-generating real estate investments). Funds managed by the group have holdings in over 150 partner companies that collectively employ in excess of 100,000 people and create sustainable value in sectors including manufacturing, education, retail, aviation, oil and gas, financial payments infrastructure, healthcare and agribusiness. The group’s current partner companies include industry leaders such as Network International, the largest independent payment solutions provider in the Middle East and Africa, Integrated Diagnostics Holding, the Middle East’s largest privately owned medical testing laboratory, Brookside Dairy, the largest dairy in East Africa, and Iasacorp, a long established family run women’s retail business in Peru. The group is committed to the highest environmental, stakeholder engagement and corporate governance standards and is a signatory of the UN-backed Principles for Responsible Investment and the United Nations Global Compact. 15 Endeavor Insight November 2012 Copyright © Endeavor Global www.endeavor.org/insight facebook.com/endeavorglobal @endeavor_global

© Copyright 2026