Document 184266

Tax Management International ™ Journal Reproduced with permission from Tax Management International Journal, 42 TMIJ 391, 07/12/2013. Copyright 姝 2013 by The Bureau of National Affairs, Inc. (800-3721033) http://www.bna.com How to Prepare for FATCA If You Are a Nonfinancial U.S. Company by Kimberly Tan Majure, Principal KPMG LLP Washington, D.C. and Bruce W. Reynolds Managing Editor — International Tax Arlington, VA The Foreign Account Tax Compliance Act is a complex reporting and withholding regime that was enacted to shed light on offshore accounts, investments, and income of U.S. people who may not have been rigorously reporting those holdings in the past. At a high level, FATCA imposes a 30% withholding tax on what are classified as ‘‘withholdable payments’’ made to a foreign person, unless that person identifies its U.S. interest holders or owners, and discloses required U.S. tax information. FATCA further requires those withholdable payments to be reported annually to the Internal Revenue Service, regardless of whether withholding from the payment had been required or done. Since FATCA was enacted in March 2010,1 a great deal of attention has been paid to issues faced by foreign financial institutions, who in fact do have signifi1 FATCA was enacted as part of the Hiring Incentives to Restore Employment (HIRE) Act of 2010, P.L. 111-147, 124 Stat. 71. cant compliance obligations involving review of existing accounts; establishing new ‘‘know your customer’’ requirements; modifying systems to track customers, receipts and payments; and preparing for reporting of taxpayer information at varying levels of detail. With the sturm und drang of FATCA surrounding financial institutions, though, relatively little attention has so far been given to explaining in simple terms (as simple as this area can be made) what an ordinary business must do to ensure that it will be in compliance when FATCA comes fully into force. That point is now six months away. The IRS has issued regulations that detail the fundamental rules2 (although they are informally promising corrections and changes),3 and has issued at least some draft forms that will be used for compliance.4 These set out at least a sketch of the landscape and a path to compliance. A BIT OF BACKGROUND Unusually, although it is structured as a withholding provision, FATCA itself is not actually looking to 2 Regs. §§1.1471-0 through 1.1474-7, T.D. 9610, 78 Fed. Reg. 5874 (1/28/13). All section references are to the Internal Revenue Code of 1986, as amended, or the regulations thereunder, unless otherwise specified. 3 Bennett, ‘‘Musher Says IRS to Issue Forms, Agreements for FATCA Compliance Soon,’’ 92 BNA Daily Tax Rpt. G-11 (5/13/13). 4 W-8BEN (individuals), http://www.irs.gov/pub/irs-dft/ fw8ben—dft.pdf; W-8BEN-E (entities), http://www.irs.gov/pub/ irs-dft/fw8bene—dft.pdf; W-8IMY, http://www.irs.gov/pub/irs-dft/ fw8imy—dft.pdf; W-8ECI, http://www.irs.gov/pub/irs-dft/ fw8eci—dft.pdf; W-8EXP, http://www.irs.gov/pub/irs-dft/ fw8exp—dft.pdf. Tax Management International Journal subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 1 impose the withholding tax that its provisions call for. When withholding is required, it actually could fall on payments that either would not be taxable themselves, or would go to payees who otherwise would not be subject to tax. The FATCA regime uses withholding only as a penalty to force required information from foreign businesses, particularly focusing on their significant U.S. account holders and U.S. owners, who otherwise might not be reporting their foreign income or assets. The information disclosed by the foreign businesses will be used to check the items reported on the U.S. investors’ tax returns. The revenue that is predicted from FATCA is anticipated partly from FATCA withholding itself, but mostly from increased compliance by the U.S. investors (particularly individuals) who may previously have resisted paying their dues to the taxpayers’ club. In some sense, FATCA withholding operates analogously to backup withholding. Upon receipt of appropriate documentation (IRS forms or other permitted information) from a payee that facilitates the required income-information reporting, the obligation to withhold is automatically eliminated.5 By contrast, chapter 3 — the provisions that require withholding from payments to foreign persons6 — begins with the presumption that the payments are subject to 30% withholding tax, and uses documentation to determine whether the foreign payee qualifies for a substantive tax reduction or exemption. In that context, the focus of nonfinancial businesses trying to be compliant should be on payee documentation and payment reporting, rather than on withholding. Proper documentation enables a withholding agent to perform the required reporting; proper reporting eliminates any penalty for failure to report.7 Withholding, then, will be necessary only for certain payees lacking proper documentation, and only with respect to certain limited payments. It is easy to lose sight of the reporting requirements, as a great deal of the spotlight has rested on the time-consuming and expensive financial institutions’ systems changes that are necessary for those payees to avoid FATCA withholding. For nonfinancials, who are largely making 5 §3406. Especially §§1441–1446, which are the provisions determining the amounts required to be withheld. 7 Chapter 3 and chapter 4 require a withholding agent to file a return (which is characterized as an income tax return) on Form 1042 each year. Regs. §1.1474-1(c)(1). Withholding agents are also required to file an information return (Form 1042-S) reporting payments to each relevant payee, and to provide a payee statement (a copy of Form 1042-S) to each payee. Regs. §1.14741(d)(1). Potential penalties therefore include those for failure to file an income tax return (§6651) and substantial understatement (§6662); failure to file an information return (§6621) and failure to provide a payee statement (§6623) 6 and receiving excluded (but still reportable) payments, the stakes are very different. Procedurally, FATCA joins an already existing, integrated system of documentation, withholding and reporting. The relevant FATCA payee status will be documented using the same forms — although enhanced in length and complexity — as the forms currently used to document status for chapter 3 and backup withholding purposes. Chapter 3 and backup withholding documentation operate much like two sides of one coin. As a working summary of backup withholding, you must have a U.S. payee’s U.S. tax identification number if you are required to send that person a Form 1099 (information return about income). If you do not have a valid tax identification number, then you must backup withhold. You use Form W-9 to document a payee’s U.S. status and also to get certification of the person’s tax identification number. Under chapter 3, if you make a U.S.-source payment of FDAP (fixed or determinable annual or periodical) income to a foreign person, that payment is subject to 30% withholding unless a reduction or exemption can be claimed. Under regulations in effect since 2001, most income items are FDAP,8 and so within that category of income are many items that would also be subject to reporting on a Form 1099 if paid to a U.S. person. A Form W-8 first identifies a foreign person as a foreign person and turns off the possibility of backup withholding.9 It is also used to adjust the withholding tax rate (if a treaty rate reduction applies, for example) or to negate it in appropriate circumstances (if a statutory exemption applies, or the income is ‘‘effectively connected income,’’ for example, and taxed by return rather than withholding). When FATCA joins this mix, the W-8 series of forms will be used by foreign payees to identify themselves; indicate that they are foreign and whether they are a beneficial owner of a payment; and certify to their FATCA reporting status as well as their chapter 3 status. Although the sheer bulk of the revised forms may be intimidating to foreign payees, they will essentially be the same forms that are currently used, just including additional information. Until 2017 (or perhaps later), the payments encompassed by chapter 4 are generally the same as payments that currently are encompassed by chapter 3, although lacking some of the exemptions from withholding that exist under chapter 3. That is, beginning 8 Regs. §1.1441-2(b)(1) [‘‘all income included in gross income under section 61 . . . except for the items specified in paragraph (b)(2)’’]. The effective date was set by T.D. 8856, 63 Fed. Reg. 72183 (1998). See also T.D. 8881, 65 Fed. Reg. 32151 (2000). 9 Similarly, Form W-9 identifies a person as a U.S. person, and turns off the possibility of chapter 3 withholding. Tax Management International Journal 2 subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 January 1, 2014 — and subject to payments exceptions discussed below — chapter 4 withholdable payments include U.S.-source FDAP income paid to foreign persons.10 At the same time, withholding agents will continue to report payee and payment information on Forms 1042 and 1042-S. Principally, Forms 1042-S will report payments to foreign beneficial owners; if the foreign payee is not itself the beneficial owner and documents U.S. people for whom it receives payments (e.g., the foreign payee is acting as a payment agent on behalf of U.S. persons), Forms 1099 may be sent to the U.S. people. The interaction of these three regimes is therefore like three roads that sometimes run parallel, sometimes cross each other, and sometimes go in different directions, addressing similar kinds of payments, classifying payees into one (or more) of the three regimes, and then applying coordinated but separate rules for withholding and reporting. Consequently, a FATCA compliance project should be approached as part of overall withholding and reporting compliance. One of the three regimes is very likely to apply to any payment that you make, and you will need documentation to support your treatment of it; you will need to categorize it for reporting purposes; and you will need to track it for withholding, reporting, or both. Some payments may be exempt from FATCA withholding, but still be subject to chapter 3 or backup withholding. Most payments, especially payments to foreign payees, will be subject to some sort of reporting. Two final points about the coordination of withholding and reporting systems are worth keeping in mind. First, companies thinking about FATCA compliance tend to focus on the remaining periods of validity for their existing Forms W-8, with the thought that the existing forms will provide an efficient shortcut to completing FATCA documentation.11 The regulations strictly define (and narrowly limit) what existing Forms W-8, by themselves, can be used to determine: a payee’s status as a foreign individual, foreign gov10 ‘‘Withholdable payments’’ under the FATCA rules consist of (a) payments of U.S.-source fixed or FDAP income, as defined in Regs. §1.1441-2(b)(1) or -2(c), but without exceptions allowed by that regulation; and (b) after Dec. 31, 2016, gross proceeds from dispositions of property that could produce interest or dividends that would be U.S.-source FDAP income. Regs. §1.1473-1(a)(1). Sometime after Dec. 31, 2016, foreign financial institutions will also have to contend with ‘‘foreign passthru payments,’’ which are presently undefined. Regs. §§1.1471-4(b)(4), -5(h)(2). But, until calendar year 2017, while FATCA might apply to more items of U.S.-source FDAP income than chapter 3 does, among other reasons because exemptions are not allowed, it applies to income of the same type as chapter 3. 11 Regs. §1.1471-3(d)(1). ernment, or international organization.12 To determine the FATCA status of any other foreign person or entity, the existing Form W-8 must be supplemented with ‘‘documentary evidence,’’ which regulations define to include articles of incorporation; letters from a foreign government; certain filings on government agency websites (such as the equivalent of the SEC); some post-2011 documentation of preexisting accounts; and opinions of regulated professionals such as attorneys — material unlikely to be lying around in preexisting or easily accessible files.13 In addition to documentation generally identifying the payee, one must also have additional documentation necessary to support a payee’s particular FATCA status, such as identification of substantial U.S. owners of a nonfinancial foreign entity.14 Fulfilling the requirement to supplement existing Forms W-8 with documentary evidence to comply with FATCA’s requirements could easily become a process more burdensome than securing new Forms W-8. Finally, absent any documentation, the final regulations provide presumption rules to determine a foreign payee’s entity status, nationality, and liability to withholding. You should not, however, view presumption rules as a saving grace. They are not intended to, and as a general rule they do not, excuse payments from application of the withholding and reporting rules. Instead, the presumption rules are designed to treat an undocumented payee as subject to one of the three withholding regimes — either FATCA, or chapter 3 withholding, or backup withholding. The presumption rules merely direct a withholding agent to the specific regime that should apply to a particular payment. TIMING FATCA’s timing rules are sprinkled throughout the lengthy final regulations released on January 17, 2013.15 We have pictorially summarized these rules on a table at the end of this article. The action begins in earnest on January 1, 2014, when FATCA withholding generally begins, and is staged from then until 2016 (or later, depending on the timing of future guidance).16 The staging is accomplished under a series of disparate rules. The bottom line is that, beginning in 2014, withholding agents must have the ability to identify affected payees and to identify, track, and re12 The latter two statuses are certified on a Form W-8EXP, which is a reasonably rare form in most U.S. companies’ operations. 13 Regs. §1.1471-3(c)(5)(ii). 14 Regs. §1.1471-3(d)(1). 15 78 Fed. Reg. 5874 (1/28/13). 16 Regs. §§1.1471-2(a)(1) (with respect to payments to FFIs), 1.1472-1(b)(1) (with respect to payments to NFFEs). Tax Management International Journal subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 3 port withholdable payments — especially those from which actual withholding will be required. As noted above, FATCA applies broadly to U.S.source FDAP and, in the future, to gross proceeds from the sale or disposition of any property that could produce U.S.-source interest or dividends. Notably, withholding is not required at all, from payments under ‘‘grandfathered’’ obligations — principally obligations outstanding on January 1, 2014, and not materially modified thereafter17 — or specified nonfinancial payments.18 Aside from those carveouts, the regulations require withholding and reporting on payments made on or after January 1, 2014, under all new obligations to whomever paid, on all payments to documented nonparticipating foreign financial institutions (FFIs), and on payments under preexisting obligations made to passive nonfinancial foreign entities (NFFEs) documenting at least one substantial U.S. owner. Withholding is deferred for payments under preexisting obligations made to undocumented prima facie FFIs until July 1, 2014 (when they are treated as nonparticipating FFIs until they document a different chapter 4 status);19 for preexisting obligations to remaining NFFEs until January 1, 2015;20 and for preexisting obligations to other undocumented FFIs until January 17 Other grandfathered obligations are those that, as part of a derivative arrangement, generate withholdable dividend equivalent payments under §871(m), if those obligations are executed within six months of the time §871(m) rules so characterize them; and agreements that require payments with respect to collateral for grandfathered obligations. When foreign passthru payments become relevant (after Jan. 1, 2017), the term ‘‘grandfathered obligation’’ will also cover obligations executed within six months of the time regulations defining foreign passthru payments are filed with the Federal Register (i.e., are publicly released). Regs. §1.1471-2(b)(2)(i). 18 Regs. §1.1473-1(a)(4)(iii). 19 Regs. §1.1471-2(a)(4)(ii)(B). Preexisting obligations are those in effect on Dec. 31, 2013, and new obligations or accounts of a person who holds a preexisting obligation of the withholding agent or its expanded affiliated group, if (a) the withholding agent (or group) treats that obligation as part of the preexisting one, and (b) any required anti-money laundering due diligence for the new obligation can be satisfied by procedures performed for the preexisting one. Regs. §1.1471-1(b)(98). For withholding agents that are FFIs, the term can also apply to obligations existing at the time the FFI becomes a participating or registered deemed compliant FFI, but that aspect of the term is not relevant here. 20 Regs. §1.1472-1(b)(2). Informal indications have been given that the deferral to 2015 of withholding from obligations to NFFEs might have been an oversight, that the transition rule might have been intended to defer withholding in those cases to 2016, to coordinate with the rule for undocumented, non-prima facie FFIs, and that this oversight might be corrected in forthcoming supplemental regulations. The date in the regulations is, however, still 2015 until and unless changed by a later pronouncement from the IRS or Treasury. 1, 2016.21 In addition, withholding from ‘‘gross proceeds’’ and ‘‘foreign passthru payments’’ is deferred in all cases until at least January 1, 2017 (later, if further guidance is delayed).22 With all of the exceptions and transition rules, it is easy to lose sight of what has not been deferred. Although payment exceptions reduce withholding for a nonfinancial withholding agent with properly documented payees, payments under • new accounts (new vendors, suppliers, and service providers), • new obligations (new contracts, Statements of Work, accounts, or orders originated after January 1, 2014), or • preexisting arrangements that are materially modified after January 1, 2014, are fully subject to withholding from that date, unless exempt status for the payee has been previously documented or the payment otherwise qualifies for a withholding exception.23 As entities come to the end of their transition periods, they become fully subject to withholding from those dates, which can vary depending on the kind of entity and the reason for the transition delay. It is also important to be aware that, with one narrow exception, transition rules that defer withholding do not defer information reporting on Form 1042-S and Form 1042. As a general rule, U.S.-source FDAP payments made on or after January 1, 2014, are reportable, regardless of whether they are subject to FATCA withholding.24 The transition rule for payments to NFFEs defers the reporting requirement until January 1, 2015.25 But, except for some special adjustments to the amount of information that participating FFIs or FFIs that become compliant under Intergovernmental Agreements must provide about payments to account holders,26 that is the only deferral of reporting provided for withholdable payments. 21 Regs. §1.1471-2(a)(4)(ii)(A). Regs. §1.1473-1(a)(1)(ii) excludes gross proceeds from the definition of withholdable payment until that date. Regs. §1.14714(b)(4) excludes foreign passthru payments from a participating FFI’s obligation to withhold until Jan. 1, 2017, or the later publication of regulations defining the term. 23 Notably, by virtue of being new obligations, these cannot be grandfathered or treated as preexisting so they must constitute ‘‘excluded nonfinancial payments.’’ 24 Regs. §1.1474-1(d)(2)(i). 25 Regs. §1.1472-1(b)(2). And possibly to 2016, as indicated in footnote 20, above. 26 Regs. §1.1471-4(d)(7). These FFIs must report U.S. account holders and other information from 2013, but abbreviated information is required for periods before 2015. 22 Tax Management International Journal 4 subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 Thus, during transition periods, withholding agents will need to track and report payments that otherwise escape withholding, then accurately identify those payments as permanently nonwithholdable, temporarily nonwithholdable based on a timing rule, or currently nonwithholdable subject to future modification of the underlying contract. And as systems modifications are never easy or quick, withholding agents need to begin collecting documentation and analyzing payments and payees well before January 1, 2014. START A COMPLIANCE PROJECT The IRS is still working out rules for FATCA, and has not begun to turn its audit divisions’ attention to examination and enforcement. The IRS, however, appears to be gearing up to do so in the near future.27 As FATCA is an extension of an already existing documentation, reporting and withholding regime, it makes sense for the first step to FATCA implementation to be a check-up of your chapter 3 withholding procedures, and the second to be a ‘‘gap analysis’’ between what you need for chapter 3 purposes and what you will need for FATCA purposes. And, with the increased IRS attention to withholding generally, it makes sense to check your current systems and design your future systems with an eye toward how the IRS would review your program. In the IRS’s audit manual, withholding audits of nonfinancial entities begin with three steps.28 One is to determine all foreign payees from vendor files and records of other departments; the second is to determine all relevant payments to those foreign payees; the third is to determine which of those is subject to withholding. In starting a compliance project, it may be easier to use a slightly different order of steps than the audit manual lays out, but its steps should guide your process. You should start by taking three inventories. of course, is that you need to be able to find and deal with foreign payments. The other, however, is that as you identify these payment streams, you can identify ‘‘choke points’’ — that is, steps in the process of recording a liability, approving a payment, and actually making the payment — that the payment must pass before it can actually get out the door. Withholding relies on internal controls. Some tax-savvy Horatio must stand at the bridge and make sure that each payment has been appropriately reviewed and dealt with before it can go forward, and must provide for withholding if necessary. The inventory of payment streams should not only look for unexpected payors (i.e., aside from Accounts Payable and Treasury) but should also determine how payments are being approved, and should identify the chapter 3 control points (at which the payment stops to be checked for appropriate documentation and withholding) that can also serve as FATCA control points. The more tightly centralized a company’s payment and payment approval processes are, the easier it will be to establish a FATCA review process. If every payment, for example, were to go through Accounts Payable, that department could manage the process and ensure consistent analysis and treatment of payments. In addition to the Accounts Payable department, though, the following parts of a company may independently authorize and make various payments, which could have FATCA or chapter 3 withholding implications: • The Treasurer’s office tends to be a ‘‘target-rich environment’’ for this exercise. Many forms of financial payment, which are of particular interest to FATCA, come through Treasury. These can include dividends, interest, derivatives, foreign exchange contracts and swap payments, and transactions generating various finance-related fees, both conducted directly and through third-party agents (e.g., transfer agents). • Property Payment Streams The first inventory is to identify all payment streams that might result in a payment going to a foreign payee. There are two reasons behind this. One, 27 The IRS has established new withholding teams in California, Florida, Illinois, New Jersey, and Texas, and has put them and the two existing New York teams (one dealing with QIs and one with U.S. withholding agents) under one territory manager (the ‘‘territory’’ in this case being the subject matter one of withholding and FATCA). The IRS has also hired some 40 new international examiners, who will have an exclusive focus on withholding. IRS personnel speaking at conferences note specifically that U.S. withholding agents should expect to see FATCA included in their audits. 28 I.R.M. 4.10.21.9.3 (7/29/08). and risk management departments are important because insurance premiums are ‘‘withholdable payments’’ under FATCA, even if they are not subject to chapter 3 withholding because they are covered by the excise tax on insurance premiums. • The HR department may make various payments to foreign recipients, such as various payments (relocation assistance, etc.) on behalf of expatriate executives, if made directly to foreign vendors. • Either HR or the Pension department, if it is a separate department, makes payments connected to retirement plans — investment advisory, custodial, or bank or brokerage fees — that may be subject to FATCA. Tax Management International Journal subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 5 • The General Counsel’s office generates services payments (legal fees) that may have a U.S. source if foreign counsel has performed work in the United States. It also may pay judgments and makes settlement payments, either of which may be withholdable payments. • Whatever department manages the company’s charitable giving should be interviewed. Charitable donations are analogous to services payments, and foreign charities that act in the United States will be implicated as FATCA payees. Finally, payments to affiliates, of any kind, may be made entirely outside any of these departments. Payments to affiliates do not enjoy any special exemption from FATCA, and documentation from any affiliate that receives withholdable payments will be required. Foreign Payees Your second inventory should be of the foreign entities that you have identified as your payees. In this inventory, your objective is to make sure that you identify the actual legal entities that are being paid, and in what capacity they are being paid. FATCA documentation and withholding, like chapter 3 documentation and withholding, is done strictly on an entity basis. Commercially, it is common for businesses to operate under trademarks and service marks, rather than legal entity names. Not only may billheads and bank accounts be labeled with trademarks or service marks, but some businesses’ standard contracts may simply use a common trade name as the signatory, so that, from your perspective, the actual legal entity on the other side of a contract may not be obvious.29 The authors have encountered situations in which the vendor’s own people — their contracting group, operations group, and accounts receivable group — did not know exactly which legal entity was doing work or was due to be paid. This can be especially true if a foreign vendor has a centralized administrative back office that deals with billing and collection separately from operations. As a result of these factors, a vendor-account set-up procedure must correctly record the name of the legal entity that is being paid and the name of the person considered to be the income recipient for U.S. withholding purposes if different (e.g., the owner of an entity is disregarded for U.S. tax purposes). If bank accounts or contracts note a ‘‘DBA’’ or trade name, the 29 The legal entity performing a contract and billing for the result may also not be the same as the one that entered into the contract, if performance may be assigned to any company within a group. vendor files as well as the withholding documentation should tie the various names together. Intercompany Payees The third inventory may surprise you a bit, because it is an inventory of your own corporate structure and payments that are made within it. A multinational corporate group may have foreign subsidiaries that will require documentation with respect to U.S. group members’ payments to them. Like the chapter 3 rules, FATCA does not have an exception for payments within a group. At this point, it is probably worth recalling that FATCA’s reporting and withholding rules cover withholdable payments, which are U.S.-source items, without regard to whether the payor is a U.S. or foreign entity. Also, as was mentioned above, the current chapter 3 regulations, which came into effect in 2001, turned how we define FDAP income on its head. FDAP income is all income under §61, unless it is declared not to be in regulations or other IRS guidance.30 Consequently, a U.S.-source payment by any member of your group to a foreign entity in your group may have some FATCA reporting, and possibly withholding, implications. The nature of a group’s foreign affiliates’ activity can affect how they are classified for chapter 4 purposes, therefore whether FATCA may apply, and what kind of documentation may be needed. In the illustration below, a not-very-aggressively structured U.S. group illustrates some situations in which FATCA could enter into some common payments by group members to foreign members. Remember, all foreign entities receiving FATCA payments will need to provide some type of documentation attesting to or demonstrating their FATCA compliance, to avoid 30% withholding. For an FFI, compliance is a heavy burden of due diligence, account tracking, and reporting. For an NFFE, compliance is generally much easier, as it involves U.S. ownership disclosures or certification of a low-risk FATCA status. Consequently, it is important to focus on foreign entities receiving FATCA payments and determine whether they are governed by the FFI or the NFFE compliance rules. The chapter 4 regulations classify a treasury center of a nonfinancial group as an ‘‘excepted nonfinancial 30 Under the previous regulations, a particular payment would be analyzed to see whether it met certain characteristics, primarily whether the payment was of a kind that was highly likely to be net income, and on that analysis, one would conclude specifically whether that kind of payment was or was not FDAP income. 915 T.M., Payments Directed Outside the United States—Withholding and Reporting Provisions Under Chapters 3 and 4, XV, B, 1, a. Tax Management International Journal 6 subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 group entity,’’ and therefore an NFFE, if (a) it is part of a nonfinancial group, and (b) its activity is restricted to certain money management or internal group financing activities.31 It is denied that protected status, however, if interests in it have any indexing feature connected to financial activity and are owned by nongroup members, if its activities cover more than those listed in the definition of an excepted nonfinancial group entity, or if it is a member of an expanded affiliated group that includes certain financial entities.32 That could make the treasury center an FFI. Even as an NFFE, the activity of the treasury center could be viewed as passive, making it a passive NFFE.33 As noted above, each of these statuses — excepted nonfinancial group entity, active NFFE, and passive NFFE — have somewhat different compliance requirements with respect to documentation they must give payors and with respect to when and how the payor must deal with FATCA withholding if there is no documentation.34 Going back to the example above (and putting aside the more obvious §956 issues the example may raise): With respect to interest payments that group members might make to the treasury center, the payments from the U.S. Opco are obviously U.S.-source FDAP, and thus withholdable payments under chapter 4. On the surface, it would seem that interest payments from Foreign Opco should not be withholdable payments, because they are apparently foreign-source income. But there are two situations that merit a second look. First (the more common scenario) a foreign company could be acting as payment agent for various affiliates. And if one of those affiliates is a U.S. entity, the interest is U.S.-source income — and the foreign payor constitutes a withholding agent — for 31 Regs. §1.1471-5(e)(5)(i)(D). Id.; Regs. §1.1471-5(e)(1)(v), (e)(5)(i)(B). 33 Regs. §§1.1471-1(b)(88), 1.1472-1(c)(1)(iv). 34 Draft Form W-8BEN-E, http://www.irs.gov/pub/irs-dft/ fw8bene—dft.pdf (May 21, 2013); above, fns. 19–22, and accompanying text. 32 FATCA purposes. Second, Foreign Opco may, in fact, be a disregarded entity. This situation arises surprisingly often, especially for acquisitive groups. Interest paid by a foreign disregarded entity is sourced in accordance with the residence of its owner, in this case a U.S. person. So Foreign Opco has withholding and reporting obligations on interest paid to the Foreign Treasury Center (which has an unexpected §956 investment). The captive insurance company in this example presents another situation with several potential FATCA statuses having varying chapter 4 consequences. Unlike treasury centers and finance companies,35 captive insurance companies enjoy no special status under chapter 4. Furthermore, for FATCA purposes, a foreign insurance company that has made a §953(d) election to be treated as a U.S. corporation, but has not registered to do business in any state, is not considered to be a U.S. person.36 To be considered an insurance company at all (rather than an investment vehicle) the company must have a certain amount of outside business,37 and so they are evaluated like any other insurance company. It would be particularly important to ensure correct determination of the insurance company’s status, because any outside insureds might request chapter 4 documentation in order to manage their withholding agent’s liability. Insurance companies are financial institutions (and therefore FFIs) under chapter 4, if they issue or make payments on ‘‘cash value’’ contracts or annuities.38 The term ‘‘cash value’’ seems to direct FATCA’s focus to life insurance companies, as property or casualty contracts do not commonly have such a value, and would therefore not count toward making the issuer an FFI. (The world is large and the regulation is ecumenical, however, so if property or casualty contracts come with a cash value, then those with a cash value over $50,000 would be counted as insurance contracts, making the insurance company an FFI, and those contracts would be financial accounts with the FFI.)39 If a captive insurance company avoids FFI status under the narrow definitions of insurance contracts, 35 Regs. §1.1471-5(e)(1)(v) (with respect to treasury centers), (e)(5)(i)(E) (with respect to captive finance companies). 36 Regs. §1.1471-1(b)(132). 37 Sears Roebuck & Co. v. Comr., 972 F.2d 858 (7th Cir. 1992); Harper Group v. Comr., 979 F.2d 1341 (9th Cir. 1992). 38 Insurance companies issuing cash value contracts or annuities are labeled ‘‘specified insurance companies.’’ Regs. §1.14715(e)(1)(iv). Note, in relevant part, Regs. §1.1471-5(e)(1)(v) provides that treasury centers and holding companies also constitute financial institutions, if they are part of an expanded affiliated group that includes an ‘‘insurance company.’’ As such, even if an affiliated insurer is not itself a financial institution, it may trigger the financial institution status for other affiliates. 39 Regs. §1.1471-5(b)(1)(iv) (cash value contracts as financial Tax Management International Journal subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 7 then it must run the gauntlet of active versus passive NFFE status.40 In that case, while insurance premiums themselves are not considered to be ‘‘passive’’ income, all of the likely returns from investing unearned premiums and returns from investing reserves are passive,41 creating a strong possibility that the insurance company would become a passive NFFE. As with the treasury center, the different statuses generate different documentation requirements for the group’s payors to the insurance company. Foreign IP Co in the example, like the insurance company, deals in kinds of income that are normally considered to be passive — royalties. Royaltygenerating activities, however, are not the kind of activities that would make the company a foreign financial institution.42 Thus, its status issues are whether it is an active or passive nonfinancial foreign entity. In this regard, it benefits from two ‘‘active licensing’’ provisions. First, in an analogy to the rules under subpart F, royalties are not considered to be passive if they are earned from an active licensing business conducted at least partly by the IP Co’s own employees.43 Second, in categorizing payments, one looks through royalties received from a related person, and classifies them as active.44 Thus, in determining whether the IP Co would be an active or passive NFFE, its principal income — the royalties from affiliates — might be mostly active, putting it in the active NFFE camp. To reach this conclusion, however, a full analysis of the company, its business, and its income must be done. Aside from the payee status aspects of this affiliate inventory, the exercise should be used secondarily to determine whether the payments made to them are withholdable. Documenting the entity is only one part of the total FATCA exercise. Payees and payments still must be reported. A quick look at the draft future Form 1042-S, which the IRS released on April 2, 2013,45 shows that the group’s payment to the various recipients must be reported with the correct income code (box 1) and a recipient code base on the chapter 4 classification that the inventory exercise determines is correct (box 12). Thus, even though classification of the entities and documentation of exemption from FATCA withholding has correctly been done, the nature of the payment and the exact status of the entity remain important. accounts), (b)(3)(vii) (cash value over $50,000 makes a contract a cash value insurance contract). 40 Regs. §1.1472-1(c)(1)(iv). 41 Regs. §1.1472-1(c)(1)(iv)(A)(11). 42 Regs. §1.1471-5(e)(1). 43 Regs. §1.1472-1(c)(1)(iv)(A)(4). Compare Regs. §1.9542(d). 44 Regs. §1.1471-5(c)(1)(iv)(B)(1). Compare §954(c)(6)(A). 45 http://www.irs.gov/pub/irs-dft/f1042s—dft.pdf. As a side note, the draft form 1042-S also provides a reminder that simply eliminating chapter 4 withholding may not obviate all withholding. The withholdable payments — no matter whether grandfathered or otherwise exempted — may still be subject to withholding under §§1441–1443. (Under the coordination rule for the two withholding provisions, chapter 4 withholding, if it must be done, takes precedence over these withholding provisions. Any amount that should be withheld under §§1441–1443 from the same payment is reduced by the amount that has been withheld under chapter 4.46 Negating withholding under chapter 4 thus simply brings back any subsumed chapter 3 withholding requirement.) PRIORITIZE PAYMENTS AND PAYEES In planning a documentation exercise, it is probably useful to categorize payees and payment streams into those that have a higher or lower urgency. Then, if time runs short to complete the exercise before FATCA’s withholding obligation becomes effective, emphasis can be put on payment streams that most urgently require immediate attention. Some companies may choose to use this step as an avenue to avoid documenting situations that enjoy various exceptions. We do not particularly recommend that approach, as FATCA’s complexity, the strict view of documentation normally taken by withholding auditors, and the changing nature of business could create an exposure, but this is a practical reality. Some payments are exempt from any withholding obligation by nature of the payment. No matter what kind of payee they are made to, no withholding agent’s liability would result from a failure to have documented the payee. Most particularly, this is true of payments for the purchase of goods. Those payments are not FDAP, and are therefore not withholdable payments, and furthermore, are not reportable, thus making them the safest payments for which to ignore documentation.47 (The risk in doing so, of course, arises from situations in which part of the pay46 Regs. §1.1474-6(b). FIRPTA (Foreign Investment in Real Property Tax Act) withholding (§1445) in general represents withholding from proceeds of a purchase of property, and not FDAP by virtue of Regs. §1.1441-2(b)(2)(i). (The exclusion for FIRPTA withholding may change in 2017, when gross proceeds become part of withholdable payments, because gross proceeds could include sales of U.S. real property holding corporations that are U.S. real property interests.) Withholding from effectively connected income of partnerships (§1446) is not subject to chapter 4 withholding, since ECI is excluded from withholdable payments. Regs. §§1.1473-1(a)(4)(ii), 1.1474-6(d). 47 Regs. §1.1474-4-1(d)(2). Draft Form 1042-S does not include an income type or exemption code for payments for purchase of goods, thereby indicating that payments of that type are not expected to appear on that form at all. After 2016, however, Tax Management International Journal 8 subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 ment may be treated as a payment for something else as well, such as shipping, insurance, interest or other services that may ultimately accompany a purchase of goods.)48 Two other categories of payment that, despite their nature as U.S.-source FDAP, do not generate a withholding obligation, although they would be reportable, are payments under grandfathered obligations and ‘‘excluded nonfinancial payments.’’ Grandfathered obligations must be monitored to ensure that a material modification has not caused the obligation to lose grandfathered status. If a payor is the issuer of the obligation, that information is at least theoretically available to it by virtue of its being a party to any modification (although the tax department or the department that makes payment on the obligation may not necessarily be advised of all relevant changes that could affect that status). If the payment is made by a transfer agent, or withholding is being handled by an intermediary receiving payment on the owner’s behalf, that information may not be readily available. The chapter 4 regulations finalized what had been proposed as an exception for payments made in the ordinary course of business, as an exception for ‘‘excluded nonfinancial payments.’’49 Excluded nonfinancial payments will cover a large class of active payments for most businesses, and means payments for the following: • services (including wages and other forms of employee compensation such as stock options); • use of property (including office and equipment leases and software licenses not classified as purchases); • transportation, freight; and • interest on outstanding accounts payable arising from the acquisition of goods or services. With regard to interest on accounts payable, one should note that such payments as late fees under rental, lease, or royalty agreements — not atypical in today’s slow-paying environment — are not covered by this or any other FATCA exception. payments for items that generate ‘‘gross proceeds’’ will become withholdable and reportable. 48 There is no specific chapter 4 rule for mixed payments. Common deemed income within payments for purchases include interest on deferred payment, e.g., §§483 and 482, but interest on accounts payable for goods or services is considered to be an excluded nonfinancial payment (addressed below), so probably would not be an exposure. 49 Regs. §1.1473-1(a)(4). Compare Prop. Regs. §1.14731(a)(4)(iii). Although not common payments for most active businesses, excluded nonfinancial payments under the final regulations also include the following: gambling winnings, awards, prizes, and scholarships. Important specific exclusions from this exempted category of payments also require monitoring. Most of these exclusions are payments that one may not normally consider to be ‘‘nonfinancial.’’ Those are: dividends; interest except on the accounts payable mentioned above; forwards, futures, options, or notional principal contracts or similar financial instruments; and amounts paid under cash value insurance or annuity contracts. On the other hand, some payments for services are excluded because they would be made to financial entities (investment advisory fees; custodial fees; and bank or brokerage fees), and premiums for insurance contracts or annuity contracts are excluded, apparently even if not for the restricted kinds of insurance contracts that are considered to be financial accounts in other parts of the chapter 4 regulations. As was earlier noted, excluded nonfinancial payments and payments under grandfathered obligations must be reported. A failure to trace them and report properly would not insulate a withholding agent from penalties for failure to report the payments properly, but this exposure is smaller than the withholding agent’s liability for the underlying withholding is likely to be. Beyond the foregoing payment-specific withholding exceptions, other exceptions are based on the kind of entity to which the payments are made. As a broad generalization, FATCA withholding does not apply (although FATCA reporting may still apply) to foreign payees that turn over valid documentation certifying ‘‘compliant’’ chapter 4 status. On the FFI side, this includes every documented payee except for those indicating ‘‘nonparticipating FFI’’ status. On the NFFE side, every entity that provides timely and valid documentation (whether disclosing substantial U.S. owners as a passive NFFE, or certifying excepted NFFE status, e.g., as an active or regularly publicly traded NFFE) also avoids withholding. Notably, these payments largely remain subject to FATCA reporting, notwithstanding the availability of withholding tax relief.50 As noted above, a narrow reporting exception applies to payments under preexisting obligations, where made to NFFEs that are neither prima facie FFIs (see discussion below) nor passive NFFEs that have not disclosed at least one U.S. owner. (Payments to those latter entities are subject to FATCA beginning January 1, 2014.) Such payments are excused from both withholding and reporting until January 1, 2015 (possibly January 1, 2016). The result is that documentation for new obligations (including obligations 50 This is similar, for example, to the requirement to report treaty-exempt income for chapter 3 purposes. Tax Management International Journal subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 9 to new vendors, new obligations to existing vendors, and old obligations that are modified after January 1, 2014) becomes immediately relevant at the start of January 2014, but chapter 4 documentation for preexisting obligations could take place after that date without creating withholding or reporting exposure. Payments to a publicly traded corporation (that does not fall into FFI classification) or members of its expanded affiliated group are considered to be made to an ‘‘excepted NFFE,’’ so are not subject to withholding (although remain reportable).51 To qualify for this publicly traded company or affiliate exception, a payee must have a class of stock that is regularly traded on an established securities market, or be a member of the expanded affiliated group of such a company.52 Because the concepts of ‘‘established securities market’’ and ‘‘regularly traded’’ are subject to specific definitions — in the latter case having to do with the percentage of votes in the class of traded stock, and volume of trading during a year — publicly traded status is not likely to be determinable by a withholding agent. Nor would it be possible to determine membership in an expanded affiliated group without documentation provided by it. Finally, payments requiring the most critical attention are those made to entities that are, or appear to be, financial entities. FATCA was aimed at these payments and entities, and it targets them earliest. As we noted above, payments to entities that are considered prima facie FFIs become subject to information reporting as of January 1, 2014. Prima facie FFIs receive a grace period until July 1, 2014, to avoid FATCA withholding and document their chapter 4 status. If still undocumented on that date, a prima facie FFI is deemed to be a nonparticipating FFI and FATCA withholding begins on its payments, to continue until the date the entity documents a different chapter 4 status. Remember that, where there is a threat of withholding, there is a threat of secondary liability. Therefore, identifying payments to entities meeting the definition of prima facie FFI and documenting those entities is as much a priority as documenting payments on new vendor arrangements. The definition of a prima facie FFI is based on objective information that a withholding agent has in ‘‘electronically searchable information,’’53 which is itself defined as information in ‘‘tax reporting files, customer master files, or similar files,’’ in an electronically searchable form (i.e., not in an image retrievable format such as .pdf). The scope of ‘‘similar files’’ is undefined, so an important first step in the documentation exercise will be to ensure that all of a company’s information storage systems are reviewed, to ensure that none which might be ‘‘similar’’ is overlooked. Although locating and documenting other financial entities will be quite important, the transition rules for grandfathered obligations and preexisting obligations of financial entities that are not prima facie FFIs will defer withholding from many other situations of payments to financial entities until January 1, 2016. (Here, too, as with many other payments, reporting is not deferred, with the exposures noted above for inability to do so.) With that, you have taken the necessary inventories and ordered priorities in obtaining payee documentation. The next step in the compliance exercise is to actually gather that documentation. GATHER DOCUMENTATION The heart of the FATCA compliance exercise is to have in hand, before making a withholdable payment, either documentation establishing that the payee is not subject to chapter 4 withholding,54 or analysis establishing that the payment itself is exempt from withholding. Gathering documentation from payees is a large communications exercise. Foreign payees are being asked to interpret and sign a U.S. tax form of significant complexity. Reactions to that request will be all over the spectrum, from simple compliance, if the payee has enough U.S. business activity already to be familiar with the requirements and what it must do, to an initial belligerent refusal (usually accompanied by threats to cut off business) if this is something new to it. In designing a documentation request program, what are some considerations that will minimize reactions of the latter type? ‘‘Documentation’’ for chapter 4 purposes means primarily one of the new Forms W-8 (or for a U.S. payee when required, the old, familiar Form W-9). There are five Forms W-8 in draft for adoption and use simultaneously under chapters 3 and 4. The addition of chapter 4 status and the kinds of payment relevant to chapter 4 have dramatically increased the length, complexity, and requirement of U.S. tax knowledge to understand and complete at least two of these; the W-8BEN-E (to be used by legal entities that beneficially own the payment being made) and the W-8IMY (to be used by various kinds of intermediary, transparent entity, or other recipient that is not a 51 Regs. §1.1472-1(c)(1)(i). The draft Form 1042-S has a chapter 4 status code 25 (‘‘excepted NFFE — other’’) for these recipients. 52 Regs. §1.1472-1(c)(1)(i), Regs. (c)(1)(ii). 53 Regs. §1.1471-2(a)(4)(ii)(B). 54 Regs. §§1.1471-2(a)(1), 1.1474-1(a)(4). The requirement that documentation be in hand pre-payment is worded a bit more generally than in chapter 3 regulations (compare Regs. §1.14411(b)(2)(vii)(A)), but the intent is there. Tax Management International Journal 10 subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 beneficial owner). At the same time, the chapter 4 regulations increase the importance of receiving the correct form, correctly filled out. They have broadened the standard under which a withholding agent is considered to have reason to know that a Form W-8 is unreliable or incorrect, by specifying various factors that could provide such a reason. Among those factors can be (depending on whether a new or preexisting obligation is being paid) information in accountopening or other customer account systems. Among other matters, you should consider in advance how much advice you will be prepared to give a payee in filling out one of these forms. Under chapter 3, experience showed a high error rate in completing Forms W-8, and the longer more complex versions will not mitigate that. In many cases, your payee’s U.S. activity may not be a major part of its business, so that it might view seeking its own U.S. tax advice as uneconomical. In that case, commonly, the payee comes back and asks, ‘‘What should I say here?’’ On the one hand, helping the payee fill out the form gets it completed and into your files. But on the other hand, doing that increases the possibility that by assisting in completing the form, if there’s anything wrong with it, you have forgone the right to rely on it absent the specific ‘‘reason to know’’ factors in the regulations. In any event, you should anticipate a high initial error rate, and a need to return forms for correction. One way to address foreign vendor confusion may be to design your own substitute form. That would allow you to restrict the information required by the form to points that are relevant for chapter 3 and chapter 4 in the transactions that you do. The chapter 4 regulations specifically provide for the creation of substitute forms, which may be tailored to the withholding agent’s transactions, and set out certain requirements for what must be in one.55 There are many ways in which a substitute form must simply mirror the official form, but it may at least eliminate transactions that are not relevant to your withholdable payments. A substitute form, if it can be simpler than the official form, offers the side benefit of eliminating the official form indicia, which by itself can help to defuse foreign businesses’ generally extreme reluctance to sign U.S. tax forms. The downside, of course, is the cost of creating various tailored substitute forms, plus any cost (and potential risk) of determining which tailored variation applies in any given situation. At this point, it would be natural to start looking for ways to avoid asking payees to sign the current W-8s, and thereby avoid the difficulties just described. The chapter 4 regulations mention other forms of docu55 Regs. §1.1471-3(c)(6)(v)(A). mentation that can be used to determine both U.S. and foreign status, but also status under chapter 4, and this might appear to be an easier route to go down than requesting official forms. While this might work for transactions under certain circumstances, it is unlikely to be widely useful. First, the regulations generally limit alternative documentation to use in transactions that are considered ‘‘offshore obligations.’’56 Offshore obligations are defined as those executed and maintained by the withholding agent’s office or branch only outside the United States.57 Second, alternative documentation is defined to include substantial legal documents, such as certificates of incorporation and certificates of residence from a foreign government, third-party credit reports, letters from government agencies or statements on a government website, and financial statements.58 These may turn out to be harder to collect than an actual W-8, and should probably be left for consideration as ‘‘Plan B’’ for nonU.S. offices. Another issue that has come up, generated by a misunderstanding of a somewhat vague provision in the regulations,59 is whether current Forms W-8BEN that may be on-hand can be used to determine exemption from chapter 4 withholding. The regulation is clear that current W-8s can be relied on to establish a payee’s status as a foreign individual, foreign government or international organization. For other entities, the existing Form W-8 may be relied upon only if supported by two forms of other documentary evidence. One is documentary evidence of the kind described in the preceding paragraph to confirm the chapter 4 status of the entity. The other is any supplementary information for specific transactions, such as documentation of owners of a passive NFFE, and so forth. In the absence of that supporting documentation, you must use presumption rules to determine what the chapter 4 status actually will be. The presumption rules, as noted earlier, are not intended to excuse withholding, but simply direct a withholding agent to one or the other of the withholding and documentation regimes.60 Thus, for example, a person presumed to be an individual in the first instance is presumed to be a U.S. individual in the absence of certain specified indicia that apply only to 56 Regs. §1.1471-3(d). Regs. §1.1471-1(b)(82). 58 Regs. §1.1471-3(c)(5)(ii). 59 Regs. §1.1471-3(d)(1). 60 Regs. §1.1471-3(f). With regard to the individual mentioned in the paragraph, while individuals are not themselves the subject of chapter 4 withholding, so that would not be required if the person were presumed to be a specified U.S. person by a direct obligor, parallel presumption rules under backup withholding would then apply to require backup withholding. 57 Tax Management International Journal subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 11 entities. In the absence of documentation, a U.S. individual is presumed to be a specified U.S. individual, which means that an FFI must treat that person as an account holder subject to reporting (and ultimately withholding from foreign passthru payments). Likewise an NFFE must treat that person as a substantial U.S. owner if the person owns a sufficient interest in the entity. Similarly, an entity that is presumed to be foreign is presumed to be a nonparticipating FFI, and the portion of any payment made to an entity deemed to be an intermediary under the presumption rules is deemed to be made to a nonparticipating FFI account holder of the intermediary. All in all, the presumption rules are intended to be overly cautious in classifying undocumented persons, likely resulting in a more instances of withholding and reporting than might otherwise arise. Consequently, it is wise to avoid reliance on presumption rules, and try to get the necessary forms. As part of the documentation exercise, it is important that the staff who will receive the documentation be trained to know what should be on the forms. The chapter 4 regulations do not permit a ‘‘receive, file, ignore’’ reaction. Rather, they raise the threshold for acceptance of information from foreign vendors, whether on official Forms W-8, substitute forms, or other documentation, by specifically requiring that they be reviewed, evaluated, and accepted. You must, for example, confirm documentation claiming participating or compliant FFI status against registration numbers that will appear on the IRS’s website. With regard to other entities’ documentation, you must check account-opening and other vendor documents to make sure that nothing in them conflicts with what is on the Form W-8. The staff will also need to pay quite a bit of attention to what they should be seeing on the forms the vendors return. Regulations list a number of factors on the face of forms that are specifically characterized as ‘‘reason to know’’ that the form is incorrect.61 The more diverse your vendor records and account payable procedures, the more time you will need to plan for this due diligence on the Forms W-8. Groups within the company who know the facts should be talking to groups who know the law; close coordination between the department managing the document collection process and the tax department will be necessary. Experience under chapter 3 indicates that the high error rate occurs on both sides (foreign vendors filling them out and U.S. companies accepting them). Chapter 4-compliant forms are an order of magnitude more complex than those formerly used just for chapter 3. It is likely that a fair percentage of initial forms will have to be returned to the vendor for correction. 61 Regs. §1.1471-3(e). It is also important to assign some people with authority to work with the staff members who will be interfacing with the foreign vendors. In most companies, the group that goes out asking for withholding documentation is the Accounts Payable department. It is impossible to underestimate the amount of resistance that can arise from this exercise. Much of that can be moderated or eliminated if somebody with an appropriate title and level of authority can communicate with resistant foreign vendors. As important or more is the fact that without knowing that management is standing behind this exercise, and is willing if necessary to require compliance with the withholding obligation at the possible expense of future business with a vendor, the staff doing the document collection may tend to cave in to objections and either not collect W-8s or accede to accepting incorrect ones, before letting payments go out the door. Your company may accept that conclusion, but that is a level of risk assumption that probably should be made with management’s participation, and at least its knowledge. DOCUMENT THE DOCUMENTATION Having and being able to produce documentation of foreign payees’ withholding status with respect to any payment — whether that is a Form W-8, other documentary evidence, or other information — is essential to meeting the ‘‘reliably associate’’ requirement in the regulations.62 At a minimum, this means that any certifications from the payee must be stored and must be retrievable. Withholding records and documentation are also, of course, tax records subject to the general record retention requirements.63 Both chapter 3 and chapter 4 regulations have specific instructions about receipt of Forms W-8 electronically,64 and the IRS has published guidelines for maintenance of records electronically (including imaging what was originally a hard-copy record).65 This means you can receive forms either in hard copy or electronically, and store them electronically, if you don’t want to keep pieces of paper. In an entirely manual environment, a vendor’s record should contain not only the vendor’s certification (Form W-8, etc.), but also any relevant notes or notations made in connection with the review and acceptance of that certification. As we have noted above that this may mean a search through other systems that may have information about this particular ven62 Regs. §§1.1471-2(a)(1), -3(c)(1). Regs. §§1.6001-1(a), -1(e). 64 Regs. §§1.1441-1(e)(4)(iv), 1.1471-3(c)(6)(iv). 65 Rev. Proc. 97-22, 1997-1 C.B. 652; Rev. Proc. 98-25, 1998-1 C.B. 689. 63 Tax Management International Journal 12 subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 dor, an indication that someone made that search and found no information of concern should be part of the retained documentation. Most companies’ payment processes, though — and particularly accounts payable processes — are automated. This means that whatever information is coming through in a documentation exercise must be translated into the payables system in the form of entity codes, income codes, and exemption codes (or a withholding indicator if withholding will be required). The IRS has listed all of these codes on its draft Form 1042-S, at least as it currently proposes to require them.66 (You should be aware that there are now separate chapter 3 and chapter 4 entity, income, and exemption codes. Existing codes that may be in the IT system to manage chapter 3 withholding will not be sufficient for chapter 4 reporting or withholding if that will be required.) Then, to meet the ‘‘reliably associate’’ requirement, the system must either store an image or store the information from the Forms W-8 (or other vendor certifications that have been received) or must provide a ‘‘locator’’ code to another IT or filing system where those forms or that information is stored. No matter whether payee records are manual or automated, they should be designed to act dynamically. Some of the chapter 4 entity statuses, exemptions and income categories are based on facts, which can change over the course of a vendor relationship. The draft Forms W-8BEN and W-8BEN-E, but not the current draft W-8IMY (at least not yet) include a certification that the signatory will submit a new form within 30 days of any relevant change in the facts that have been certified. This improves the chance that company personnel who manage payments will see something that triggers a change in the payee records when necessary. However, the requirement that statements in the form not be contradicted by information in other company records means that other departments of the company should be primed to alert the group managing payments to such things as changes in financial instruments or accounts that might terminate grandfathered status, change relationships with entities, etc. Going forward, the general counsel should develop a standard contractual term — if your business uses contracts — requiring vendors and suppliers to provide information about relevant changes in activity; various other departments should similarly develop processes to make the group that manages payments aware of relevant changes that they encounter. Then finally, an important ‘‘documentation document’’ is a process manual that describes the proce66 The Apr. 2, 2013 draft can be found at http://www.irs.gov/ pub/irs-dft/f1042s—dft.pdf. dure the company established for obtaining vendor or other payee certifications, reviewing and determining the acceptability of those certifications, and recording the information received in setting up a new account, as well as similarly dealing with changes. Putting down in one place what your processes are has multiple benefits. First, it gives you a description against which you can check what is actually being done to ensure that no material gaps in the process are creating an exposure. Second, it gives you a document that can be used as a reference by the staff that manages the process. Finally, if you should be audited for withholding compliance, you will need it; the IRS will ask about it as an initial part of its audit process,67 and you probably won’t have time to prepare a manual within the time you will be given to respond to the information document request. Just demonstrating that you developed a formal process and documented it is valuable in showing that you are trying to comply with the rules. PAYEES IN YOUR GROUP Your inventory of your group’s foreign entities may have located some that currently are being asked to provide a Form W-8BEN or that receive Forms 1042-S from you or from unrelated payors. These will be an indicator of an entity that will need to provide W-8BEN-Es to avoid FATCA withholding, because FATCA withholdable payments are in general congruent with §1441 withholdable payments. You may need to triage the analysis of these entities, in order to focus on those with greatest exposure to withholding. The most exposed companies are those involved in financial activities, especially if they should happen to operate a business that could be encompassed by one of the prima facie FFI SIC codes.68 Payors are going to ask whether their payees are financial institutions. The analysis of whether any of your affiliated entities are or are not FFIs should be considered a hot-button issue, because if you cannot conclude that they are not, so that they can sign NFFE certifications, they will need to be registered or otherwise become compliant before July 1, 2014, or they will be considered nonparticipating FFIs, and will be subjected to withholding by their payors. Entities that make things, provide services, or otherwise seem to operate a ‘‘real’’ nonfinancial business are more likely to be both nonfinancial and active NFFEs. In that arena, though, the issue to plan for is the time needed to secure information to make the necessary calculations, particularly if any of the enti67 IRM 4.10.21.9.5 (07-29-2008). Note the suggestion subjects of IDRs nos. 2 and 3. 68 Regs. §1.1471-2(a)(4)(ii)(B). Tax Management International Journal subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 13 ties are noncontrolled joint venture entities. Noncontrolled entities generally are not in your expanded affiliated group, because that status requires ‘‘more than 50%’’ ownership of vote and value by group members.69 But if your company has responsibility for the operations, is the tax matters partner, or will be viewed as responsible for managing this U.S.-based withholding issue, this may still be your concern. It can take a bit longer to get necessary information from a noncontrolled foreign entity (and the controlling investors), and this must be taken into account. If you are a publicly traded company that is not in a financial business, you may be considering the publicly traded affiliate exception for your foreign affiliates (that is, ones your group controls). In principle, this exception is easy to establish and rely upon, because it tends to be relatively ‘‘set and forget.’’ Under it, any corporation that is a member of the same expanded affiliated group as a publicly traded NFFE is also an ‘‘excepted NFFE.’’70 A problem with that position is that, even though it reflects the literal language of the regulation, we understand that informally the IRS believes that controlled foreign corporation subsidiaries of U.S. publicly traded corporations should not be able to take advantage of that particular exception, that it should be available solely to foreign affiliates of foreign publicly traded companies. It does not seem possible to sustain that interpretation with a change in the regulation or some other kind of pronouncement, but if this exception is one your U.S.owned group plans to rely upon, it might be wise to consider a backup active NFFE position. Finally, it may be easiest for your foreign affiliates simply to forgo certifying excepted NFFE status, and instead provide a substantial U.S. ownership disclosure. The second draft Form W-8BEN-E, released by the IRS in May 2013, permits the disclosure statement if the foreign entity is ‘‘not certifying its status’’ as an excepted NFFE. Thus, it appears that a foreign payee may disclose U.S. owners without prejudice to any future arguments that an NFFE exception in fact applied. This may be the easiest way to proceed, particularly for members of controlled multinational groups. CONCLUSIONS In conclusion, you can take away four very simple points from this discussion about FATCA compliance. First, this is not something that can be ignored in the hope that it will go away or not apply to you. Although the degree of difficulty in compliance varies considerably with the number of foreign payees your 69 70 §1504(a)(2); Regs. §1.1471-5(i). Regs. §1.1471-2(c)(1)(ii). company or group deals with, most companies today have some form of cross-border dealings, and so have some amount of compliance to do. Many groups will find (some to their surprise) that they have payee issues as well as payor issues to manage. Second, while nonfinancial businesses do not have the same magnitude of issues that financial institutions have, they are not overly endowed with time, particularly those that have a decentralized payment system or many independent payment points, and thus have significant IT systems work to do. Unfortunately, the fact that aspects of the system are still being developed does not provide a stable analytical base for designing a compliance program, but the integration of chapter 4 and chapter 3 and the fact that the new chapter 4 rules apply only to payments that in principle are already being managed under chapter 3 does give you a head start. Third, as the discussion above indicates, designing a compliance program that takes account of the ‘‘KISS’’ principle (‘‘keep it simple,. . .’’) will provide the best certainty that you are compliant. You are probably best served by insisting upon a Form W-9 or Form W-8 (or a substitute form if you design one) from all of your payees, and simply establishing that as a payment policy, setting up a process to collect those forms, and using that inflexible policy as a way to deal with objections. Going forward, it would be best to incorporate both your procurement group and your general counsel (or contracting group) in the document collection process because they will address suppliers, vendors, and contractors at a time when they are being most cooperative. Finally, in the initial stages of collecting payee documentation, you should expect initial adverse reactions from foreign payees, as they begin to encounter these requirements and what they mean for them. The advice for dealing with that is just to grin and bear it; it will eventually get better. That occurred when the chapter 3 regulations took effect in 2001, and as foreign payees encountered more requests from more customers, they calmed down and realized that it was just one more requirement they had to contend with in order to do business with the United States. Although these requirements are materially more complicated, there is no reason to expect the reaction to be different over time. Tax Management International Journal 14 subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 subsidiary of The Bureau of National Affairs, Inc. 姝 2013 Tax Management Inc., aISSN 0090-4600 Tax Management International Journal 15 • Begin withholding on all US FDAP income payments under new (post-‐ 2013) obliga#ons • Begin withholding on US FDAP payments on preexis#ng obliga#ons to passive NFFEs documen#ng at least one substan#al US owner and documented nonpar#cipa#ng FFIs. January 1 But, delayed withholding on US FDAP payments under preexis#ng obliga#ons to prima facie FFIs (treated as non-‐ par#cipa#ng FFIs from this date to the date documenta#on is provided establishing FATCA status). March 15 March 15 M 2016 2 Begin withholding on preexis#ng obliga#ons of any remaining transi#on rule preexis#ng obliga#ons. NB: This may be the date on which Treasury intended to start withholding from preexisng obligaons to NFFEs. Watch that space. January 1 Reports due for 2015 payments: • Post 2013 obliga#ons • Preexis#ng obliga#ons of: • Documented nonpar#cipa#ng FFIs • Undocumented prima facie FFIs • NFFEs • Begin full withholding from US FDAP income payments under preexis#ng obliga#ons to remaining NFFEs. NB: May be a draing error as to preexisng obligaons to NFFEs: watch this space. 2015 January 1 Reports due for 2014 payments: • On post-‐2013 obliga#ons • On pre-‐2014 payments to “undocumented” prima facie FFIs and to passive NFFEs with at least one substan#al US owner July 1 2014 • Begin tracking payments for future repor#ng (filing due in 2015), including: • Grandfathered • Preexis#ng (except to certain NFFEs) • Payments to prima facie FFIs March 15 Reports due for 2015 payments: • Post 2013 obliga#ons • Preexis#ng obliga#ons of: • Documented nonpar#cipa#ng FFIs • Undocumented prima facie FFIs • NFFEs January 1 2017 • Tracking of “gross proceeds” payments and withholding appropriately may begin. • Tracking of “foreign pass-‐ thru” payments and withholding appropriately may begin. FATCA COMPLIANCE TIME-LINE: NONFINANCIAL BUSINESSES

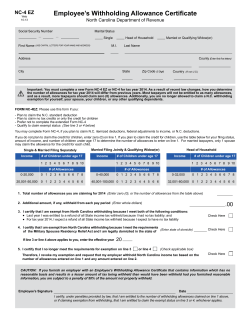

© Copyright 2026