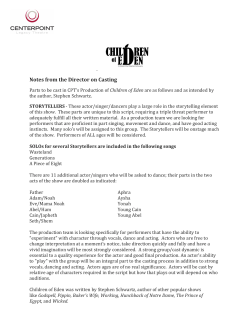

How to integrate the European Energy Markets: a new vision