How to save tax while selling a house

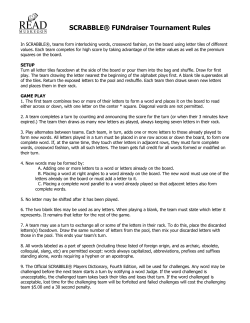

TIMES PERSONAL FINANCE 18 How to save tax while selling a house Avoid the hefty tax outgo on your capital gains by making the sale at the right time and investing the proceeds in suitable avenues T iming is critical in finance, especially if you want to make a profit. Of course, you need to pick a good time to take advantage of the appreciation in value, but it’s equally important to keep an eye on the calendar to avoid paying a hefty amount as tax. It was a lesson learnt well by Mumbai-based Benny Abraham when he sold his house in 2011 within two years of purchasing it. “The property was fetching me nearly 60% in profits on the initial investment, so when I got an offer to sell it, I immediately agreed,” says Abraham, a brand consultant. Unfortunately, the 50-year-old had no clue about the tax implication of his hasty decision. Not only did he have to pay a substantial amount as tax on the profit, he also had to shell out the tax exemptions that he was availing of on the home loan. This is because under the Income Tax Act, if you sell a house within three years of buying it, the tax benefits on the principal repayment and interest paid on the home loan are reversed. These are then included in your income when you file your tax return. Also, if a house is sold within five years of the end of the financial year in which it was purchased, all the deductions claimed under Section 80C with respect to the property are added to the taxable income in the year of sale. Capital gain and indexation Real estate is regarded as an asset, so the profit from its sale is assessed under the head ‘capital gains’. According to Manish Thakkar, director of Mumbai-based Thakkar Consultants, if a property is sold within three years of buying it, it is treated as a short-term capital gain. This is added to the total income and taxed according to the slab rate. However, if you sell a property after three years from the date of purchase, the profit is treated as a long-term capital gain and is taxed at 20% after indexation. While you can avail of various tax exemptions in case of long-term capital gains, no such benefit is provided for short-term ones. One of the advantages associated with long-term capital gains is the inclusion of indexation while determining the profit. Indexation is a method through which the seller is able to inflate the value of his assets. Since inflation reduces the value of an asset over time, it is essential to increase the initial cost of the house to calculate its current value. This is done by multiplying the original cost price with a factor that is issued by the Central Board of Direct Taxes. This factor tracks the increase in the general price level, or inflation, and is known as the cost inflation index (CII). It is notified by the central government for every financial year. The Income Tax Act considers 1981-82 as the base year with a cost inflation index of 100. So, the CII for 1982-83 is 109, and so on. The indexed purchase price can be calculated as—purchase price x (CII for year of sale / CII for year of purchase). The indexation of purchase price helps to reduce the net capital gain, thereby slashing the tax burden for the seller. Reduce your tax burden You can claim tax exemption under Section 54 on the long-term capital gain on the sale of a house. “To avail of this exemption, you must use the entire profit to either buy another house within two years or construct one in three years. If you had already bought a second house within a year before selling the first one, you could still avail of the tax exemption,” says Pankaj Ghadiali, tax expert at PC Ghadiali & Co Chartered Accountants. “Such capital gain exemption is reversed and the amount taxed as capital gain if the new property is sold within three years of the date of purchase/construction. This profit will be considered a short-term gain and taxed at the normal slab rates, not the 20% beneficial rate,” says Sonu Iyer, tax partner, Ernst & Young. You can also utilise Section 54 (F) to avail of exemption on the longterm capital gain made from the sale of any asset other than a house. Again, the sale proceeds should be invested only in a residential property, not a commercial property or a vacant plot of land. However, to avail of this benefit, you should not own How to compute capital gains tax with indexation more than one house. The long-term capital gain tax can also be saved under Section 54 (EC) if the capital gain is invested for three years in bonds of the National Highways Authority of India and Rural Electrification Corporation Limited within six months of selling the house. However, you can invest only up to `50 lakh in a financial year. The sale proceeds will be calculated on the basis of the valuation adopted by the state’s Stamp Duty and Registration Authority and will not be the amount mentioned in the deed of conveyance. This is intended to cover the cases where a portion of the sale price is received by the seller as unaccounted for cash. The effective tax is 20% on long-term capital gains. Cost of house Year of purchase Sale price Year of sale No of years Purchase CII Sale CII Indexed purchase price* Capital gain** Tax with indexation*** If you miss the due date It’s possible that you are not able to make the required investment to avail of the exemption on capital gains before the due date for filing your tax return. In such a situation, the amount of capital gain or net consideration, as the case may be, has to be deposited in a separate account in a nationalised bank under the Capital Gains Account Scheme (CGAS) before the last date of filing your return for the relevant year. There are two types of such accounts—type A is a savings deposit and type B is a term deposit. The interest rates for these are the same as those for regular savings and term bank deposits. The proof of the deposit can be attached along with the tax return in order to claim exemption. 10 lakh 1995 25 lakh 2008 13 281 582 20,71,174 4,28,826 85,765 * Indexed purchase price = purchase price X (Cost inflation index for the year of sale / cost inflation index for the year of purchase) `10, 00,000 X (582/281) = `20,71,174 ** Capital gain= Sale price –Indexed purchase price `25,00,000 - `20,71,174 = `4,28,826 *** Tax with indexation = Capital gain x 20% `4,28,826 x 20% = `85,765 THE TIMES OF INDIA, NEW DELHI MONDAY, MAY 7, 2012 Don’t blame the financial players. Educate yourself Instead of wallowing on being victimised, investors should make informed decisions I notice two disturbing trends in public debates about financial products and advice—sensationalism and righteousness. What are the issues that rile everyone? Banks are defrauding customers, insurance companies are bringing out dubious products, advisers are ripping off customers, mutual funds are inefficient, micro-finance is bad for the poor, and brokers are encouraging gambling. The recommendations and remedies are righteous about who should do what and how. Can we have a balanced debate instead? Let us not assume that products on sale, including financial products, are expected to meet only basic, defined, necessary and ‘good’ needs. Marketing is about creating and growing demand for products and services beyond the basics. Otherwise, all of us would be holding the simplest press button mobile phone, and paying a low and affordable price. Those that produce diamond-crusted handsets would surely be sinners. We can argue about the wasteful consumption of societies and the harmful effects of advertising, but we have come quite a distance to now return to the basics. False claims are made about what shampoos do to hair, ready-to-eat cereals to nutrition, and so on. Product choices are a reality and producers, including those offering financial products, will release into markets what they believe appeals to greed, aspiration, or status. Consider loans. We should ideally live within our means and spend what we have and taking a loan is downright harmful. Why then do we have banks at all selling us loans? The truth is that without the benefit of borrowing, it would be a small, shrunken world of limited assets, jobs, wealth and opportunities. We may paint loans as the demon, but countless entrepreneurs and households have expanded their horizons with this product. Millions would not own homes if banks did not agree to lend against the asset they liked to own. By the same reasoning, we can rubbish credit cards as harmful spend-inducing loans, at usurious rates; stock trading as mindless speculative activity; and derivatives as useless tools to disaster. The problem, perhaps, is not in the product, but in its misuse. We need fair and informed exchange between the buyer and seller without being righteous and patronising. Every financial product, in its basic form, engages two different entities and their balance sheets. A micro-finance loan is a useful product for a self-help group of poor women entrepreneurs trying to get a regular income. The lender likes to price it based on his balance sheet, primarily driven by his cost of funds and operations. The borrower takes the loan on her balance sheet hoping to generate income that helps repay the loan in instalments. Regulatory and governance structures should protect this premise and ensure that the exchange happens on fair terms for both parties. The problems in this market primarily arose with lenders expanding their balance sheets at the cost of quality, and borrowers using multiple lenders to fund expenses rather than assets. Ill-informed regulatory action targeted pricing, recovery and more micro issues and killed this market. The responses to the problem came from a position of misplaced righteousness. Responsible financial decision-making is the strategic choice that both businesses and households have to make. As consumers, we have learnt to distrust the fancy sale of pure silk garments at a 90% discount, but easily buy into 24% assured returns. It is in our interest to understand what financial products do to our finances, our own balance sheets driven by our income, risks, plans and problems. If we are able to strategise and implement key life decisions with financial implications, such as how many children we will have and when, whether both spouses will work, and where we will live and earn, we need to make money choices with the same level of strategic seriousness. If it requires us to learn and educate ourselves, that is how it should be. At a macro level, to create a more healthy market for financial products, we need two core ingredients. The first is the presence of long-term players, who are well-capitalised, and set industry benchmarks as they grow. The regulatory environment should focus on nurturing such growth and development, and provide a competitive environment that encourages fair play. Mistaken activism has all but killed the business in at least two cases—micro finance and mutual funds. One cannot legislate for integrity, a lesson lost in both these cases. The second is the presence of a legal system that ensures prompt and punitive action for fraudsters. It is under the inefficient criminal justice system that fly-by-night operators dupe investors. Misrepresentation of product features, masking risk in fine print, misleading ads are criminal activities that need to be dealt with as such. Financial product mis-selling is one manifestation of this deficient justice system. Financial products and their sales happen in the larger context of a poorly regulated and less developed market. Passing on the blame, expecting protection, and wallowing in helplessness is not going to help anyone. Investors can begin by making the effort to see financial transactions as a deal between equals on terms both parties understand and agree upon. There is no short-cut to informed decision-making. —The author is Managing Director, Centre for Investment Education and Learning, and can be reached at uma.shashikant@ ciel.co.in How to bring down your auto insurance cost Despite a hike in the third-party motor insurance premium, you can keep the total premium on your motor policy under control Opt for a higher deductible You can also opt for a higher deductible amount in the policy. This means that you will pay the initial `5,000-10,000 of the repair bill and the insurance company will pay the balance. The higher the deductible, the lower is the premium. However, don’t opt for too high a deductible just to bring down the cost of insurance. You might end up paying more than the amount you stand to save. Let go of smaller claims Share more information You are entitled to a no-claim bonus (NCB) for every claim-free year. If you don’t make any claim for a few years, the NCB can reduce your premium cost by as much as 50%. So, don’t rush to make a claim for fixing every small dent on your car. Sometimes, what you spend on repairs could be less than the amount you stand to lose as no-claim bonus. Many insurers offer better rates these days to customers who are willing to share personal information, such as age, gender, marital status, occupation, claim history and driving track record. For instance, Berkshire Insurance, which distributes Bajaj Allianz’s motor insurance policies, offers a discount of 5% to those who provide details about themselves by answering the questions in the forms. “The premium for a young male who smokes will be higher than that for the same amount of cover for a young, nonsmoking female,” says Arun Balakrishnan, chief executive officer, Berkshireinsurance.com. “The details help in the correct calculation of premiums and also in getting discounts of Annual premium rates for third-party motor covers PRIVATE CARS Up to 1,000 cc 1,000 cc to 1,500 cc More than 1,500 cc 2011-12 2012-13 740 880 2,750 784 925 2,853 330 330 330 680 350 357 355 680 The Economic Times Wealth is India’s only personal finance paper exclusively devoted to multiplying your wealth week after week. It comes to you every Monday in a form that is engaging, enlightening and enriching. Sign up with auto associations Becoming a member of the Automobile Association of India (AAI) or its affiliates gives you a discount on the premium rates from some insurers; the discount could be lower of 5% or `200 on the own damage premium for private cars. Similarly, if you install an anti-theft device approved by the Automotive Research Association of India, you could claim a discount of 2.5%, subject to a maximum of `500. Be careful about add-on covers TWO-WHEELERS Up to 45 cc 75 cc to 150 cc 150 cc to 350 cc More than 350 cc sure that your premium is not inflated for options you may never use. 10-25%,” adds Niraj Jain, CEO, Insurancemall.in. All figures in ` T he insurance regulator has hiked the third-party motor insurance premiums in line with its decision last year to review the rates annually. Some insurers are also planning to revise their ‘own damage’ rates. Put these two pieces of news together and it is a fair guess that your overall premium will go up when you buy or renew your motor insurance. Don’t lose hope though. There are many ways to keep the total premium on the comprehensive motor policy under control. Weigh whether the damage is worth filing a claim for or is it smarter to wait for another claim-free year. The add-on features like depreciation cover, roadside assistance, emergency expenses, and hospital cash, may have immense utility value, but some agents try to push unnecessary covers as well. Tally the policy features with your needs before buying the add-ons. This will en- Stick to the mandated part of cover As per the prevailing law, you have to buy a minimum cover of `6,000 to compensate third parties for any property damage. Sure, you have the option to buy a higher cover, which may come in handy if there is a huge payout, but remember that your premium will also rise. If you want to keep the premium low, opt only for the mandatory cover. Transfer no-claim bonus while selling a car If you are planning to upgrade your car, you can bring down the insurance cost by transferring the no-claim bonus of your old car. If you have been a careful driver and have a 40-50% no-claim bonus, get it transferred when you sell your car. The insurer will issue a noclaim certificate, which will get you the discount on the new car’s insurance. If the insurance of the new car works out to `15,000, a 50% no-claim bonus will reduce it to `7,500. This no-claim certificate is valid for three years from the date of issue. Termination of the insurance means your old car is without a cover. Since a buyer typically assumes the car comes with insurance, make things clear while striking the deal. In most cases, buying new insurance for the old car may still be cheaper. HIGHLIGHTS OF THIS WEEK’S ISSUE High returns do not come with higher risk Getting good returns from your investments does not mean taking undue risks. Here’s how to create the right balance to earn above average returns. ● Scan your health policy ● Rights of a mutual fund investor ● Get your bank to lower the loan rate ● Accessories that improve your tablet The Economic Times Wealth is available at an invitation price of `7/issue. To book your copy*, contact your newspaper vendor or call 011 - 39898090; Email: crm.delhi@ timesgroup.com; SMS ETWS to 58888 *Available in city and NCR areas only

© Copyright 2026