**PER DIEM** (Non-Benefitted or Temporary Position) New Hire Processing

Congratulations and Welcome to

University Medical Center of Southern Nevada!

**PER DIEM**

(Non-Benefitted or Temporary Position)

New Hire Processing

New Hire Processing

What to Expect

Your Online New Hire Packet is available for you to complete prior to new hire processing. New

Hire Processing consists of the following:

Completing your Online Background Check through Certiphi (instructions sent to you via

email);

Completing your Drug Screen;

Completing your Employee Health Assessment with Enterprise;

Completing and printing your required online forms;

Returning all required online forms to Human Resources on your scheduled processing date.*

If forms are not completed when you arrive for new hire processing, this will delay your start date.

*You will be scheduled for New Hire Processing as soon as Human Resources obtain confirmation

you have cleared your Drug Test and Background Check. A Human Resources Representative

will contact you and schedule New Hire Processing.

New Hire Processing is held on Tuesday and 7KXUVGD\ (excluding Holidays). Morning and afternoon

sessions are available. New hire processing generally requireV1 hour of your time and is

UNPAID.

New Hire Processing Location:

UMC Human Resources Office

901 Rancho Lane, Ste. 160

Las Vegas, NV 89106

(IIHFWLYHSURFHVVLQJZLOOEH7XHVGD\7KXUVGD\$0±$0DQG30±30

PLEASE NOTE ALL OF THE FOLLOWING:

DRUG TESTING – You have 48 hours from the time of the offer being extended to complete your

drug test.

BACKGROUND CHECK PROCESSING - You have 48 hours from the time of the offer being

extended to complete your online Background Screening Form. Your Background Check may take up

to 10 business days to clear.

EMPLOYEE HEALTH ASSESSMENT - You must contact Enterprise Physicals -Employee Health

IMMEDIATELY to schedule your Pre-Employment Physical at (702) 383-3660. Human Resources will

be notified once you have cleared.

You will not be scheduled for New Employee Orientation until you have cleared your Employee

Health Assessment. New Employee Orientation will be three (3) full days. Some medical positions

require additional time and your Human Resources Representive will provide you with specifics at

time of processing.

New Employee On-Boarding Forms

(PER DIEM NEW HIRES)

You must complete, print and return the following forms to Human

Resources for processing.

(If forms are not completed when you arrive for processing, you may be rescheduled

which could delay your start date.)

Human Resources Information Sheet

Pre-Employment Drug/Alcohol Testing Consent Form

Form I-9, Employment Eligibility Verification (Print and return Page 7)

Form W-4 (Employee Withholding Allowance Certificate)

UMC Beneficiary Designation Form

UMC Direct Deposit Authorization Form - Bring a voided check or preprinted direct

deposit authorization from your bank reflecting the account number and routing number

complete with last name, first name, middle initial and indicate checking or savings

account. Please choose from the banking facility listed. If it’s an out of state account,

mark “other”, write name of bank and write the routing number. Sign and date. (Do not

attach deposit slips)

FICA Alternative and the Deferred Compensation Plan

Basic Facts about FICA Alternative and the Deferred Compensation Plan-OBRA

(For your records only)

Beneficiary Designation/Name & Address Change – 457 and 401(a) Complete

Employee and Beneficiary section including dates of birth, Social Security number(s),

relationship, percentage of benefit and your signature. (total percentage for all

designated beneficiaries must equal 100% and Social Security numbers are

required)

NV PERS Retiree Re-employment Notification Non-PERS Eligible Position

(If applicable)

UMC Parking Permit Form

Remember your “New Hire Packet” must be completed prior to your scheduled new hire processing

date. If you have any questions regarding the new hire processing or required pre-employment

documents, please feel free to contact the HR Analyst at 383-2230.

UNIVERSITY MEDICAL CENTER

HUMAN RESOURCES INFORMATION SHEET

(PLEASE PRINT)

POSITION OFFERED: _________________________________________________ SSN:__________________________________

Are you currently receiving Nevada PERS retirement benefits?

Y

N (If yes, you will be required to complete the Retiree Reemployment Notification Non-PERS Eligible Position

form at time of processing).

NAME: _______________________________________________

First

Middle Initial

Last

PRIMARY CONTACT NO: (

) _____________________

SECONDARY CONTACT NO: (

) _____________________

CURRENT ADDRESS:

STREET ADDRESS

MARITAL STATUS: M

S

Apt. #

CITY, STATE

DATE OF BIRTH: ___________________

ZIP

GENDER: _______

ETHNICITY - Please choose one

(W) White: (Not of Hispanic origin) All persons having origins in any of the original peoples of Europe, North Africa, or the

Middle East.

(B) Black: (Not of Hispanic origin) All persons having origins in any of the Black racial groups of Africa.

(H) Hispanic: All persons of Mexican, Puerto Rican, Cuban, Central or South American or other Spanish culture or origin,

regardless of race.

(A) Asian or Pacific Islander: All persons having origins in any of the original peoples of the Far East, Southeast Asia, the

Indian Sub continent, or the Pacific Islands. This area includes, for example, China, India, Japan, Korea, the Phillippine

Islands and Samoa.

(I) American Indian or Alaskan Native: All persons having origins in any of the original peoples of North America, and

who maintain cultural identification through tribal affiliation or community recognition.

VETERANS STATUS: ______ 1. Special Disabled

(Please indicate by number only) 2. Vietnam Era Veteran

3. Other eligible veteran

4. Non qualifying veteran or no military service

PLEASE CHOOSE FROM ONE OF THE FOLLOWING:

US CITIZEN

RESIDENT ALIEN

ALIEN AUTHORIZED TO WORK

PERSON TO CONTACT IN CASE OF EMERGENCY:

NAME:

RELATIONSHIP:

ADDRESS:

STREET ADDRESS

PHONE NUMBER: (

Apt. #

CITY, STATE

ZIP

) _________________________

EMPLOYEE SIGNATURE:

HR USE

ONLY

Form #08-62 (11/08)

DATE:

Background Check:

Completed

Required

Basic Computer Skills:

Completed

Required

Drug Test:

Completed

Required

Completed

Required

Employee Health Assessment:

PRE-EMPLOYMENT DRUG & ALCOHOL

TESTING CONSENT

NMU00823 (02/06/14)

Page 1 of 1

I understand that pre-employment drug and alcohol testing is a condition of employment with the University Medical

Center of Southern Nevada (UMC).

I hereby consent to submit to a drug and alcohol test and authorize Quest Laboratories or another testing laboratory

designated by UMC to perform the tests deemed necessary to determine the presence or absence of drugs and alcohol in

my urine.

I authorize the designated laboratory to release my test results to UMC and, if necessary, to a Medical Review Officer

selected by UMC to evaluate my test results. I understand that the Medical Review Officer may request proof that I am

taking a controlled substance pursuant to a lawful prescription issued in my name. If requested, I must provide such proof

within 72 hours. I further understand that the Medical Review Officer will release my final test results to UMC.

I understand that a positive result may render me ineligible for hire at UMC.

I agree to hold UMC harmless from any liability arising in whole or part from the collection of specimens, testing, and use

of the information from said testing in connection with UMC’s consideration of my application for employment.

I further understand that a positive result may be reported to governmental agencies and/or boards as mandated by law.

Applicant Name (print):

Date:

Applicant Signature:

ORIGINAL: UMC Human Resources

COPY: Applicant

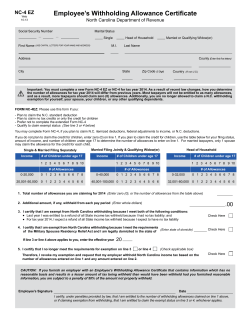

Form W-4 (2014)

Purpose. Complete Form W-4 so that your employer

can withhold the correct federal income tax from your

pay. Consider completing a new Form W-4 each year

and when your personal or financial situation changes.

Exemption from withholding. If you are exempt,

complete only lines 1, 2, 3, 4, and 7 and sign the form

to validate it. Your exemption for 2014 expires

February 17, 2015. See Pub. 505, Tax Withholding

and Estimated Tax.

Note. If another person can claim you as a dependent

on his or her tax return, you cannot claim exemption

from withholding if your income exceeds $1,000 and

includes more than $350 of unearned income (for

example, interest and dividends).

Exceptions. An employee may be able to claim

exemption from withholding even if the employee is a

dependent, if the employee:

• Is age 65 or older,

• Is blind, or

• Will claim adjustments to income; tax credits; or

itemized deductions, on his or her tax return.

The exceptions do not apply to supplemental wages

greater than $1,000,000.

Basic instructions. If you are not exempt, complete

the Personal Allowances Worksheet below. The

worksheets on page 2 further adjust your

withholding allowances based on itemized

deductions, certain credits, adjustments to income,

or two-earners/multiple jobs situations.

Complete all worksheets that apply. However, you

may claim fewer (or zero) allowances. For regular

wages, withholding must be based on allowances

you claimed and may not be a flat amount or

percentage of wages.

Head of household. Generally, you can claim head

of household filing status on your tax return only if

you are unmarried and pay more than 50% of the

costs of keeping up a home for yourself and your

dependent(s) or other qualifying individuals. See

Pub. 501, Exemptions, Standard Deduction, and

Filing Information, for information.

Tax credits. You can take projected tax credits into account

in figuring your allowable number of withholding allowances.

Credits for child or dependent care expenses and the child

tax credit may be claimed using the Personal Allowances

Worksheet below. See Pub. 505 for information on

converting your other credits into withholding allowances.

Nonwage income. If you have a large amount of

nonwage income, such as interest or dividends,

consider making estimated tax payments using Form

1040-ES, Estimated Tax for Individuals. Otherwise, you

may owe additional tax. If you have pension or annuity

iincome, see Pub. 505 to find out if you should adjust

your withholding on Form W-4 or W-4P.

Two earners or multiple jobs. If you have a

working spouse or more than one job, figure the

total number of allowances you are entitled to claim

on all jobs using worksheets from only one Form

W-4. Your withholding usually will be most accurate

when all allowances are claimed on the Form W-4

for the highest paying job and zero allowances are

claimed on the others. See Pub. 505 for details.

Nonresident alien. If you are a nonresident alien,

see Notice 1392, Supplemental Form W-4

Instructions for Nonresident Aliens, before

completing this form.

Check your withholding. After your Form W-4 takes

effect, use Pub. 505 to see how the amount you are

having withheld compares to your projected total tax

for 2014. See Pub. 505, especially if your earnings

exceed $130,000 (Single) or $180,000 (Married).

Future developments. Information about any future

developments affecting Form W-4 (such as legislation

enacted after we release it) will be posted at www.irs.gov/w4.

Personal Allowances Worksheet (Keep for your records.)

A

Enter “1” for yourself if no one else can claim you as a dependent . . . . . . . . . . . . . . . . . .

A

• You are single and have only one job; or

Enter “1” if:

B

• You are married, have only one job, and your spouse does not work; or

. . .

• Your wages from a second job or your spouse’s wages (or the total of both) are $1,500 or less.

Enter “1” for your spouse. But, you may choose to enter “-0-” if you are married and have either a working spouse or more

than one job. (Entering “-0-” may help you avoid having too little tax withheld.) . . . . . . . . . . . . . .

C

Enter number of dependents (other than your spouse or yourself) you will claim on your tax return . . . . . . . .

D

Enter “1” if you will file as head of household on your tax return (see conditions under Head of household above) . .

E

Enter “1” if you have at least $2,000 of child or dependent care expenses for which you plan to claim a credit

. . .

F

(Note. Do not include child support payments. See Pub. 503, Child and Dependent Care Expenses, for details.)

Child Tax Credit (including additional child tax credit). See Pub. 972, Child Tax Credit, for more information.

• If your total income will be less than $65,000 ($95,000 if married), enter “2” for each eligible child; then less “1” if you

have three to six eligible children or less “2” if you have seven or more eligible children.

G

• If your total income will be between $65,000 and $84,000 ($95,000 and $119,000 if married), enter “1” for each eligible child . . .

▶

Add lines A through G and enter total here. (Note. This may be different from the number of exemptions you claim on your tax return.)

H

{

B

C

D

E

F

G

H

For accuracy,

complete all

worksheets

that apply.

}

{

• If you plan to itemize or claim adjustments to income and want to reduce your withholding, see the Deductions

and Adjustments Worksheet on page 2.

• If you are single and have more than one job or are married and you and your spouse both work and the combined

earnings from all jobs exceed $50,000 ($20,000 if married), see the Two-Earners/Multiple Jobs Worksheet on page 2 to

avoid having too little tax withheld.

• If neither of the above situations applies, stop here and enter the number from line H on line 5 of Form W-4 below.

Separate here and give Form W-4 to your employer. Keep the top part for your records.

Form

W-4

Department of the Treasury

Internal Revenue Service

1

Employee's Withholding Allowance Certificate

OMB No. 1545-0074

▶ Whether you are entitled to claim a certain number of allowances or exemption from withholding is

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

Your first name and middle initial

2

Last name

Home address (number and street or rural route)

3

Single

Married

2014

Your social security number

Married, but withhold at higher Single rate.

Note. If married, but legally separated, or spouse is a nonresident alien, check the “Single” box.

City or town, state, and ZIP code

4 If your last name differs from that shown on your social security card,

check here. You must call 1-800-772-1213 for a replacement card. ▶

5

6

7

Total number of allowances you are claiming (from line H above or from the applicable worksheet on page 2)

5

Additional amount, if any, you want withheld from each paycheck . . . . . . . . . . . . . .

6 $

I claim exemption from withholding for 2014, and I certify that I meet both of the following conditions for exemption.

• Last year I had a right to a refund of all federal income tax withheld because I had no tax liability, and

• This year I expect a refund of all federal income tax withheld because I expect to have no tax liability.

If you meet both conditions, write “Exempt” here . . . . . . . . . . . . . . . ▶ 7

Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is true, correct, and complete.

Employee’s signature

(This form is not valid unless you sign it.)

8

Date ▶

▶

Employer’s name and address (Employer: Complete lines 8 and 10 only if sending to the IRS.)

For Privacy Act and Paperwork Reduction Act Notice, see page 2.

9 Office code (optional)

Cat. No. 10220Q

10

Employer identification number (EIN)

Form W-4 (2014)

Page 2

Form W-4 (2014)

Deductions and Adjustments Worksheet

Note. Use this worksheet only if you plan to itemize deductions or claim certain credits or adjustments to income.

Enter an estimate of your 2014 itemized deductions. These include qualifying home mortgage interest, charitable contributions, state

1

and local taxes, medical expenses in excess of 10% (7.5% if either you or your spouse was born before January 2, 1950) of your

income, and miscellaneous deductions. For 2014, you may have to reduce your itemized deductions if your income is over $305,050

and you are married filing jointly or are a qualifying widow(er); $279,650 if you are head of household; $254,200 if you are single and not

head of household or a qualifying widow(er); or $152,525 if you are married filing separately. See Pub. 505 for details . . . .

$12,400 if married filing jointly or qualifying widow(er)

2

Enter:

$9,100 if head of household

. . . . . . . . . . .

$6,200 if single or married filing separately

3

Subtract line 2 from line 1. If zero or less, enter “-0-” . . . . . . . . . . . . . . . .

4

Enter an estimate of your 2014 adjustments to income and any additional standard deduction (see Pub. 505)

Add lines 3 and 4 and enter the total. (Include any amount for credits from the Converting Credits to

5

Withholding Allowances for 2014 Form W-4 worksheet in Pub. 505.) . . . . . . . . . . . .

{

6

7

8

9

10

}

Enter an estimate of your 2014 nonwage income (such as dividends or interest) . . . . . . . .

Subtract line 6 from line 5. If zero or less, enter “-0-” . . . . . . . . . . . . . . . .

Divide the amount on line 7 by $3,950 and enter the result here. Drop any fraction . . . . . . .

Enter the number from the Personal Allowances Worksheet, line H, page 1 . . . . . . . . .

Add lines 8 and 9 and enter the total here. If you plan to use the Two-Earners/Multiple Jobs Worksheet,

also enter this total on line 1 below. Otherwise, stop here and enter this total on Form W-4, line 5, page 1

1

$

2

$

3

4

$

$

5

6

7

8

9

$

$

$

10

Two-Earners/Multiple Jobs Worksheet (See Two earners or multiple jobs on page 1.)

Note. Use this worksheet only if the instructions under line H on page 1 direct you here.

Enter the number from line H, page 1 (or from line 10 above if you used the Deductions and Adjustments Worksheet)

1

2

Find the number in Table 1 below that applies to the LOWEST paying job and enter it here. However, if

you are married filing jointly and wages from the highest paying job are $65,000 or less, do not enter more

than “3” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

If line 1 is more than or equal to line 2, subtract line 2 from line 1. Enter the result here (if zero, enter

“-0-”) and on Form W-4, line 5, page 1. Do not use the rest of this worksheet . . . . . . . . .

1

2

3

Note. If line 1 is less than line 2, enter “-0-” on Form W-4, line 5, page 1. Complete lines 4 through 9 below to

figure the additional withholding amount necessary to avoid a year-end tax bill.

4

5

6

7

8

9

Enter the number from line 2 of this worksheet . . . . . . . . . .

4

Enter the number from line 1 of this worksheet . . . . . . . . . .

5

Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . .

Find the amount in Table 2 below that applies to the HIGHEST paying job and enter it here . . . .

Multiply line 7 by line 6 and enter the result here. This is the additional annual withholding needed . .

Divide line 8 by the number of pay periods remaining in 2014. For example, divide by 25 if you are paid every two

weeks and you complete this form on a date in January when there are 25 pay periods remaining in 2014. Enter

the result here and on Form W-4, line 6, page 1. This is the additional amount to be withheld from each paycheck

Table 1

Married Filing Jointly

If wages from LOWEST

paying job are—

Enter on

line 2 above

6

7

8

$

$

9

$

Table 2

All Others

If wages from LOWEST

paying job are—

Married Filing Jointly

Enter on

line 2 above

$0 - $6,000

0

$0 - $6,000

0

1

6,001 - 13,000

6,001 - 16,000

1

2

13,001 - 24,000

16,001 - 25,000

2

3

24,001 - 26,000

25,001 - 34,000

3

4

26,001 - 33,000

34,001 - 43,000

4

5

33,001 - 43,000

43,001 - 70,000

5

6

43,001 - 49,000

70,001 - 85,000

6

7

49,001 - 60,000

85,001 - 110,000

7

8

60,001 - 75,000

110,001 - 125,000

8

9

75,001 - 80,000

125,001 - 140,000

9

10

80,001 - 100,000

140,001 and over

10

100,001 - 115,000

11

12

115,001 - 130,000

13

130,001 - 140,000

14

140,001 - 150,000

15

150,001 and over

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this

form to carry out the Internal Revenue laws of the United States. Internal Revenue Code

sections 3402(f)(2) and 6109 and their regulations require you to provide this information; your

employer uses it to determine your federal income tax withholding. Failure to provide a

properly completed form will result in your being treated as a single person who claims no

withholding allowances; providing fraudulent information may subject you to penalties. Routine

uses of this information include giving it to the Department of Justice for civil and criminal

litigation; to cities, states, the District of Columbia, and U.S. commonwealths and possessions

for use in administering their tax laws; and to the Department of Health and Human Services

for use in the National Directory of New Hires. We may also disclose this information to other

countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal

laws, or to federal law enforcement and intelligence agencies to combat terrorism.

If wages from HIGHEST

paying job are—

$0

74,001

130,001

200,001

355,001

400,001

- $74,000

- 130,000

- 200,000

- 355,000

- 400,000

and over

Enter on

line 7 above

$590

990

1,110

1,300

1,380

1,560

All Others

If wages from HIGHEST

paying job are—

$0 - $37,000

37,001 - 80,000

80,001 - 175,000

175,001 - 385,000

385,001 and over

Enter on

line 7 above

$590

990

1,110

1,300

1,560

You are not required to provide the information requested on a form that is subject to the

Paperwork Reduction Act unless the form displays a valid OMB control number. Books or

records relating to a form or its instructions must be retained as long as their contents may

become material in the administration of any Internal Revenue law. Generally, tax returns and

return information are confidential, as required by Code section 6103.

The average time and expenses required to complete and file this form will vary depending

on individual circumstances. For estimated averages, see the instructions for your income tax

return.

If you have suggestions for making this form simpler, we would be happy to hear from you.

See the instructions for your income tax return.

BENEFICIARY DESIGNATION

Under NRS 281.155

NRS 281.155 allows you to designate a beneficiary to receive your final paycheck in the event you expire

while employed at University Medical Center. The final payment will be available to your beneficiary

rather than tying the funds up in the probate of your estate.

This law is intended to make the amount of your last paycheck immediately available to your beneficiary.

If you wish to designate a beneficiary for this purpose, complete this form and submit it to Human

Resources. All information will be kept confidential.

PRNR

Employee Name

(First Name, MI, Last Name)

I hereby designate

(First Name, MI, Last Name)

as beneficiary under the provisions of NRS 281.155

SSN:

(required)

Address:

City/State/Zip Code:

Telephone 1:

Telephone 2:

Relationship:

Name of Contingent:

(if above predeceases the employee)

SSN:

(First Name, MI, Last Name)

(required)

Address:

City/State/Zip Code:

Telephone 1:

Telephone 2:

Relationship:

Signature

Date:

MAIN BANK PAYROLL DIRECT

DEPOSIT AUTHORIZATION

Name:

Last

First

MI

PRNR (new hires, use SSN):

Bank Account Number:

DIRECT DEPOSIT

TYPE OF ACCOUNT: (Please check one)

Checking Account- Attach a voided check or pre-printed direct deposit authorization from bank.

Savings Account- Attach pre-printed documentation reflecting account number (please do not attach

deposit slips)

MAIN BANKING FACILITY FOR ABOVE ACCOUNT: (Please check one)

Routing Number

(for Human Resources’ use only)

Bank of America

Chase Bank

CitiBank West

Clark County Credit Union

Greater Nevada Credit Union

Nevada State Bank

One Nevada Credit Union

Silver State Schools Federal Credit Union

US Bank

Wells Fargo Bank

WestStar Credit Union

Other:

122400724

322271627

321070007

322484113

321280143

122400779

322484401

322484265

121201694

321270742

322484634

I authorize UMC to deposit my entire payroll check directly to the above selected main banking

facility.

I understand that credit to my account is not guaranteed on payroll Friday. I fully understand that I am

responsible for verifying the credit to my account and that UMC is not responsible for any transfer

delays or related overdraft fees/charges by the bank.

Final checks (termination/separation) will be issued as a negotiable check and not automatically

deposited to your bank account by UMC.

Signature

Date

***DIRECT DEPOSIT STARTS IMMEDIATELY***

BASIC FACTS ABOUT FICA ALTERNATIVE AND THE DEFERRED

COMPENSATION PLAN

As a per diem or temporary employee of the University Medical Center of Southern Nevada, you are required to

participate in UMC’s FICA Alternative Deferred Compensation Plan (“Plan”). The Plan is an alternative to

Social Security coverage as permitted by the federal Omnibus Budget Reconciliation Act of 1990 (“OBRA”). As

a FICA alternative employee, you are not subject to tax on compensation under the Old Age, Survivors and

Disability Income portion of FICA. You will be subject to the Medicare portion of FICA.

MANDATORY CONTRIBUTIONS: As a FICA alternative employee, 7.5% of your gross compensation per pay

period must be contributed to the Plan. Your contributions are made on a tax deferred basis, and are not subject to

federal or state income tax. You will be taxed on the value of your contributions (including any earnings) when

you receive a distribution of your benefits from the Plan. Unless your status as a FICA alternative employee

changes, you may not stop or reduce mandatory contributions to the Plan. No additional contributions are

permitted under the Plan.

ENROLLMENT: As a per diem or temporary employee, you are automatically enrolled in the plan and there is

nothing you need to do, except complete the beneficiary form, and ensure that you have designated a beneficiary.

Retain a copy for your personal files, and then forward the completed original form to Human Resources

Trauma 5th Floor, for delivery to The Hartford.

FUNDING OPTION: The Plan must limit its investment options to one that provides a fixed rate of return. Your

contributions are automatically invested in the General (declared rate) account with Hartford that provides

stability of principle.

DISTRIBUTIONS

Distribution of your Plan benefits can only be made upon your:

• Severance from employment

• Death

• Attainment of age 70 ½, regardless of employment status

A severance from employment occurs when you are no longer employed at UMC, either voluntarily or

involuntarily. A leave of absence is not a severance of employment. If your employment status changes from per

diem or temporary to full-time or part-time employment, you may be eligible to transfer your benefits under the

FICA Alternative Plan to the UMC Deferred Compensation Plan. Otherwise, the Plan does not provide for

withdrawals while you are still employed at UMC.

When you sever employment, or upon your death, your benefits will be payable to you, or your beneficiary, in

accordance with the payment options provided under the Plan. You may elect to receive your distribution upon

severance of employment or defer payment to a later date. Your benefits will become taxable when received.

If you have any further questions, please call The Hartford customer service line at 1.800.255.2464.

PLEASE COMPLETE AND RETURN THE BENEFICIARY FORM

IMMEDIATELY.

Enrollment Record- Part-time 457 Deferred Compensation

Fax No. : 816-701-8005

SECTION I. Group Number:

Employer:

61236-5-1

SECTION II. Social Security Number:

UMC OBRA Plan

Date of Birth:

Sex (M or F):

Employee Name: Last, First, M.I.

Mailing Address:

City:

State:

Zip:

Home Phone:

Work Phone:

Ext:

SECTION III.

Deferral %

Deferral Frequency

Bi-weekly

Allocation

100% General Account

7.5 %

SECTION IV. BENEFICIARY DESIGNATION

I designate the following person(s) as my beneficiary(ies) under the Plan . Please see page 2 for examples.

Primary Beneficiary(ies)

Relationship

%

Contingent Beneficiary(ies)

Relationship

%

SECTION V. NOTIFICATION OF ACCEPTANCE

I understand and agree to the provisions contained in my Employer’s Deferred Compensation Plan. Together with my heirs, successors, and assigns, I

will hold harmless my Employer from any liability hereunder for all acts performed in good faith, including those related to the investment of deferred

amounts and/or my Employer’s investment preference(s) under my Employer’s Deferred Compensation Plan. I understand that 100% of my deferrals

will be deposited in the General Account.

Signed in the State of

on

Date

Participant Signature

Authorized Plan Sponsor Signature

Registered Representative Signature

Printed Name of Registered Representative

Registered Representative Tax ID/Producer Code

Rev. 8.14

Date

Beneficiary Designation

Please complete the Beneficiary Designation including name, Social Security number, relationship, and percentage of death benefit (totaling 100%).

Married residents of community property states may want to seek legal advice if naming a non-spouse Primary Beneficiary.

Type of Beneficiary:

Examples of Designations:

One Beneficiary

Jane Doe, wife, 100%

Two or more Primary Beneficiaries,

equally among the survivors

John Doe, son, 33%

Carol Smith, daughter, 33%

Mark Doe, son 34%

or equally among the survivors

Two or more Primary Beneficiaries,

with their share to their children

John Doe, son, 33%

Carol Smith, daughter, 33%

Mark Doe, son 34%

per stirpes

Primary and Contingent Beneficiaries

Jane Doe, wife, 100% if living;

otherwise children

equally among the survivors

per stirpes

either

or

Participant’s Estate

Participant’s Estate

Trustee

Jane Doe, trustee under trust

agreement* dated...

* Date of the execution of the trust agreement or a copy of the trust agreement must be provided.

Full Disclosure Statement

Arkansas

“Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an

application for insurance is guilty of a crime and may be subject to fines and confinement in prison.”

Colorado

“It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or

attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or

agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the

purpose of defrauding or attempting to defraud the policyholder or claimant with regard to settlement or award payable from insurance proceeds shall

be reported to the Colorado Division of Insurance within the Department of Regulatory Services.”

District of Columbia

“WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person.

Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was

provided by the applicant.”

Florida

“Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false,

incomplete, or misleading information is guilty of a felony of the third degree.”

Kentucky

“Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any

materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance

act, which is a crime.”

Louisiana

“Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an

application for insurance is guilty of a crime and may be subject to fines and confinement in prison.”

Maine

“It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company.

Penalties may include imprisonment, fines or a denial of insurance benefits.”

New Jersey

“Any person who includes any false or misleading information on an application for an insurance policy, is subject to criminal and civil penalties.”

New Mexico

“Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an

application for insurance is guilty of a crime and may be subject to civil fines and criminal penalties.”

Ohio

“Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a

false or deceptive statement, is guilty of insurance fraud.”

Oklahoma

“WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance

policy containing any false, incomplete or misleading information is guilty of a felony.”

Oregon

“Any person who knowingly, and with INTENT TO DEFRAUD or solicit another to defraud an insurer (1) by submitting an application, or (2) by filing a

claim containing a false statement as to any MATERIAL FACT, MAY BE violating state law.”

Pennsylvania

“Any person who knowingly and with intent to defraud any insurer files an application or claim containing any false, incomplete or misleading

information shall, upon conviction be subject to imprisonment for up to seven years and payment of a fine of up to $15,000.”

Tennessee

“It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company.

Penalties include imprisonment, fines, and denial of insurance benefits.”

Rev. 8.14

page 2 of 2

Public Employees’ Retirement System of Nevada

693 W. Nye Lane, Carson City, NV 89703 - (775) 687-4200 - Fax (775) 687-5131

5820 S. Eastern Avenue, Suite 220, Las Vegas, NV 89119 - (702) 486-3900 – Fax (702) 678-6934

7455 W. Washington Avenue, Suite 150, Las Vegas, NV 89128 – (702) 486-3900 – Fax (702) 304-0697

Toll Free Number 1-866-473-7768

www.nvpers.org

Retiree Reemployment Notification

Non-PERS Eligible Position

PERS retirees are prohibited from reemployment with a Nevada public employer except as provided by

NRS 286.520. This provision allows a retiree to receive a monthly PERS benefit while reemployed with a

Nevada public employer if the retiree has been retired for a minimum of 90 days and the position does not

require reenrollment back into PERS.

Eligibility for PERS enrollment is based on the type of position in which the retiree has been hired. In

some cases, the retiree is limited on the amount of hours he or she may work in either a fiscal or school

year in order to avoid the suspension of the monthly benefit and reenrollment into the system. In all

cases, retirees reemployed with a Nevada public employer are limited in the amount they can earn in a

fiscal year. Contact the PERS office for the earnings limitation currently in effect.

Employer Notification

We have hired the below PERS retiree into a position that does not require their reenrollment back into PERS.

We agree to monitor the earnings and hours worked by this retiree in order to avoid a violation of PERS’

reemployment rules. We agree to notify PERS within 10 days in the event the retiree exceeds the fiscal year

earnings limitation or is in a position in which the work hours require reenrollment into the system.

Retiree Name:___________________________________________________________

Social Security Number:___________________________________________________

Position Title:_________________________________Hire Date:__________________

_____________________________

Liaison Officer/Signature Authority

____________________________

Date

_____________________________

_____________________________

Agency Name

Agency Number

*****************************************************************************************

Retiree Notification

I have accepted a position with a Nevada public employer that does not require my reenrollment back into

PERS. I agree to monitor my work hours and earnings in this position in order to avoid a violation of PERS’

reemployment rules. I agree to notify PERS within 10 days if I exceed the fiscal year earnings limitation or if

my work hours require that I be reenrolled back into the system.

________________________________________________________________________

Retiree Signature

Date

PERS Use Only

Date received

Rev. 03/11

1800 W. Charleston Blvd.

NV

Las Vegas

702-383-2000

(Optional):

89102

© Copyright 2026