Peak Energy: How to Play the Biggest Global Trend of... Next 100 Years… Ahead of the Coming $289 Billion Windfall

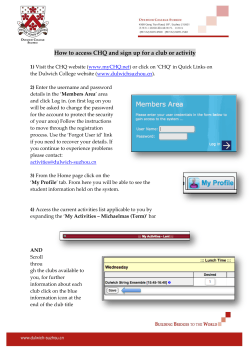

Special Research Report Peak Energy: How to Play the Biggest Global Trend of the Next 100 Years… Ahead of the Coming $289 Billion Windfall TABLE OF CONTENTS Pinpointing Gains With Computer-Like Accuracy ............................1 The Once-in-a-Lifetime Opportunity ..............................................2 The Sad State of Energy and Infrastructure ....................................4 The Great Energy Paradigm Shift....................................................4 How Do We Get From Here to There?..............................................5 Why Natural Gas? ..........................................................................5 Greasing the Skids ........................................................................6 “Fracturing” Old Rocks ..................................................................7 Gathering and Distributing the Transition Fuel ................................9 Energy Infrastructure: Fueling the Shift ........................................11 America the LNG Exporter? ..........................................................11 Venture Capital Shoveling Money into Electric Vehicles......................12 EV Projected Sales Growth: Fasten Your Seatbelt ..........................13 Lithium: The South American Connection ....................................16 Welcome aboard Peak Energy Strategist. Our research team has begun using a powerful concept called an “algorithm” to track where stocks are headed. Since testing began last year, this exciting technology has handed them the chance at more than 1,300% gains. Even more impressive, the "algorithm" has generated a 100% win rate. Until now, it's been kept under lock and key. But the testing phase is over. Now that the technology‘s finally “going public” for the first time, it’s about to hand some serious investors as much as 2,600% gains. This special report contains the first new recommendations from our system. I think you’ll find it interesting, and exciting reading. PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT Introduction We’re sitting in the catbird seat of once-in-a-lifetime opportunities for profits from investing in energy, energy infrastructure and the technology making it possible. To find those opportunities, my research team has been using an amazing tool. We call it the “Peak Energy Indicator” or PEI for short. The PEI is based on a special predictive formula called an “algorithm”. It works the same way as a GPS navigation system. A GPS crunches millions of pieces of data, maps out your route, and tells you where to turn next. The algorithm I’ve developed crunches huge quantities of data and give me the future trajectory of individual stocks, essentially predicting where they’re headed next. Since testing began last year, the team has chalked up more than 1,300% gains. Even more impressive, our proprietary algorithm has generated a 100% win rate for months on end. Until now, we’ve kept the technology under lock and key. But the testing phase is over. We’ve finally decided the time is perfect to “go public” with it for the first time. So how exactly does this technology work? And how could it soon be handing you a steady stream of gains with computer-like accuracy… month after month? Let’s take a look… Pinpointing Gains With Computer-Like Accuracy… As a 30-year veteran of the markets – and the engineering and energy world – I’ve never seen a technology this powerful. And it’s simple, too. We apply our PEI algorithm to the entire energy sector. When all the number-crunching is complete, we end up with an exceptional group of stocks. The algorithm also gives us an easy-to-read roadmap of where these stocks will likely be 24 hours from now… seven days from now… or even seven years now. And it’s time to get started. In this report we’ve detailed the first sectors and stocks we’ve identified with the PEI. They’re the ones we’re initially adding to the Peak Energy Strategist portfolio. We’ll go through each in great detail. But first, let me describe the incredible set of events that’s led us to this fantastic investment opportunity. PAGE 1 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT The Once-in-a-Lifetime Opportunity America is just beginning to claw its way out from under the most serious recession since the Great Depression. With company earnings and markets heading higher, the worst is behind us. But we’re not completely out of the woods yet. There’s no question our return to pre-recession prosperity still lies ahead. But there’s every reason to be optimistic. History has shown that Americans have perhaps the greatest capacity of any country to engineer solutions to life’s biggest problems. I’m convinced that not only is that capacity still very much intact, but that it’s rising to the occasion once again. This time it’s to solve the most dire need we’ve ever had: weaning us off of fossil fuels… permanently. The United States – and the rest of the world – is beginning an exciting journey down the long path to global energy resource sustainability. The socio-economic implications of this journey are unprecedented… and so, too, will be the investment opportunities. It matters little that we’re still in a recession. Among the millions of out-of-work Americans are talented engineers, laborers, and factory workers. New companies will form, and existing ones will expand. The American worker is the “intellectual fuel” that will help us regain our economic strength. All three sectors – energy, energy infrastructure and energy technology – will play integral roles in the coming decades to effectively end our dependence on fossil fuels. The recommendations of companies we’ll be sending your way – starting with those contained in this special report – have the very real potential to chalk up gains of historic proportions. We’re going to cover the hottest energy and infrastructure stories making headlines… and the companies behind them making it happen. I’m excited about having the opportunity to provide you with a regular, focused review of all the areas I’m actively following. Electric vehicles, natural gas, oil, geothermal, solar, wind, smart grid initiatives and just about everything in between are on my radar screen. This special report will you give you – as a new Peak Energy Strategist subscriber – the lay of the land. More importantly, it will allow us to set the stage for what lies ahead. PAGE 2 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT Rest assured: There will be plenty of investment opportunities in both conventional fossil fuels and alternatives. In the energy sector, the journey to alternatives must be undertaken. Countries all over the globe need cheap, sustainable sources of energy. It’s a crucial element in order for economies to be able to grow and prosper. Our present energy sources – oil… coal… uranium… all finite resources – are being depleted at alarming rates. That’s not to say there won’t be compelling investment opportunities that present themselves with fossil fuels. There most definitely will be, and our Peak Energy Indicator will flag them for us. But better to be harnessing the heat of the Earth’s depths… the wind blowing across the plains… and the powerful rays of the sun. For these are all free, and readily available for the taking. Regardless of your feelings about global warming, the climate-change argument simply disappears with renewables. They contribute nothing in the way of pollution or global warming. Energy infrastructure is seeing unprecedented investments as well: oil and gas pipelines… electrical transmission lines and substations… water and sewer lines… LNG terminals… the list is endless. And so are the opportunities, if you can sort through the myriad of companies involved. That’s where my proprietary Peak Energy Indicator comes in. It sorts the “wheat from the chaff” in the complex and fast-moving area of energy. Energy technology is the catalyst that brings it all together. New technologies are emerging daily in solar, wind, the smart grid, energy storage and about every other area in the energy sector. You’ll learn about a lot of that new technology right here. More importantly, we’ll track the absolute best investment opportunities for profits. Our goal is to bring you the best ideas that rise to the top of our research pile. So let’s get started. The Sad State of Energy and Infrastructure “May you live in interesting times.” It sounds like a complement. It’s actually an ancient Chinese curse. PAGE 3 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT “May you live in difficult times,” is how a Chinese recipient would take it. And the times we are living in are certainly nothing if not interesting… and extremely difficult for many. Failing banks, soaring healthcare costs and an ineffectual political system. All are serious issues without equal in modern history. Those aren’t the biggest problems we face, however. The largest headaches are aging infrastructure and the lack of energy self-sufficiency. Why are they the biggest? Because if we don’t do something about them – and fast – the United States will cease to be a tier-one economy. Only countries with good sources of low-cost, sustainable energy – combined with modern, efficient infrastructure – can be economic powerhouses. It’s the main reason the United States has been the largest economy in the world for so long. But alas, the opposite is also true. Our infrastructure is crumbling around us, and we’re beholden to rogue nations for much of our oil. That costs roughly $500 billion a year… money flowing out of America… lining the pockets of people who hate us. It gets even worse: At current rates of fossil fuel consumption, we’re pumping nearly 9.1 billion tons of CO2 greenhouse gas annually into the Earth’s atmosphere. That’s costing us untold hundreds of billions more in inefficiencies and wasted energy. China’s bringing a new coal-burning power plant on-line every week. India’s selling $2,000 gasoline cars. If nothing’s done – and done soon – greenhouse gas output is only going to skyrocket. Perhaps with dire consequences. We know fossil fuels are a limited resource. There’s much debate about when oil, natural gas, coal and uranium will peak. Some scientists believe oil already has. One thing is certain… they all eventually will. The Great Energy Paradigm Shift The great economist, Herbert Stein – in what is now known as Stein’s Law – put it quite simply, “If something cannot go on forever, it will stop.” Clearly for the future, we have to look to alternatives… especially to oil and coal. The “great energy paradigm shift” – as I like to call it – has already begun. It’s a PAGE 4 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT transition from a fossil fuel-based existence to one based on renewable, sustainable and clean sources of energy. There’s no question it’s a huge undertaking. It will ultimately cost many trillions of dollars. How long will it take? Decades at a minimum. Perhaps as long as 100 years. But there’s no question that the shift is getting underway. World sentiment increasingly favors green forms of energy. Not transitioning really isn’t an option. That could have grave consequences, resulting in the possible formation of an “energy gap.” Most developed countries around the world recognize this and have passed initiatives of their own. Somewhat ironically, it’s been the United States – the world’s most powerful nation and its greatest innovator – that’s been late to the energy shift party. But the United States is doing its best to catch up. In the last 18 months, the amount of legislation and money that’s being directed towards the energy sector has been unprecedented. How Do We Get From Here to There? Clearly, solar, wind – and to a lesser extent, geothermal – have been getting a lot of press in recent months, particularly since there are now Federal – and increasingly, state tax incentives to invest in them. But government bribes aside, there are fundamental reasons to greatly expand alternatives as energy supplies. They’re free, renewable, sustainable and non-polluting. Perhaps most importantly, we have an abundant supply of them right here in the good ol’ USA. But to get from here to there we need a transition plan. More importantly, we need a transition fuel. In the United States, and increasingly around the world, we’re talking about natural gas. Natural gas is the first sector our Peak Energy Indicator flagged for investment. Why Natural Gas? Unlike crude oil, we’re awash in natural gas. Last year, the Potential Gas Committee the nation’s authority on natural gas supplies issued a report that shows a substantial increase in natural gas reserves here in the United States. This was the largest increase in the 44-year history of the committee, and its language PAGE 5 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT was reflective of that: “[The report] shows an exceptionally strong and optimistic gas supply picture for the nation.” Our natural gas windfall couldn’t have come at a more opportune time. The PGC’s findings point to natural gas as the transition fuel as we move from coal and oil to solar, wind, geothermal and other non-carbon sources of power. At 2030 projected U.S. consumption rates of about 25 Tcf (Trillion cubic feet), we have nearly a 100-year supply. That makes U.S. reserves the largest in the world. And you can bet those estimates are going higher: Technological improvements are happening weekly in the oil and gas exploration and production sector. I fully expect the Potential Gas Committee’s estimate will double in the next three to five years. John B. Curtis, a geology professor at the Colorado School of Mines and the report’s principal author, said, “New and advanced exploration, well drilling and completion technologies are allowing us increasingly better access to domestic gas resources especially unconventional gas which, not that long ago, were considered impractical or uneconomical to pursue.” How much gas do we need to get around? One Tcf is enough to run 12 million cars per year. Replace 75% of the fleet (190 million vehicles) and we’re still only talking 15 Tcf per year. Electric cars might be the ultimate alternative to fossil fuels. (We’ll talk about them later in this report.) But switching to natural gas -powered vehicles gets us a long way down the road toward energy independence. More importantly for the long run, it buys us valuable time to replace power generation with alternatives, further reducing our dependence on fossil fuels. The increase in supply is clearly good news. It reinforces the choice of natural gas as our energy transition fuel. Will the federal government finally recognize it as our best alternative and legislate to promote its increased use? We’re starting to see the beginnings of legislation in that direction… Greasing the Skids H.R. 1835, known as the “New Alternative Transportation to Give Americans Solutions Act of 2009,” amends the Internal Revenue Code of 1986 to create jobs and encourage alternative energy investments. Now before I get a dozen e-mails pointing out that natural gas is just a different fossil PAGE 6 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT fuel, let me head them off. There’s no argument there. However, it’s much cleaner burning, produces less carbon emissions and, most importantly, it’s found here in abundance. It’s a walk in the park to produce new cars and trucks that run on it, and convert older ones as well. It will free us of the ”oil grip” of rogue nations around the world in 10 years or less. We’ll all be better off economically. But even better, we’ll have greater piece of mind and increased flexibility when it comes to our choices for energy. We have so much natural gas, it could turn into one of our greatest exports. It would be a terrible paradox, though, if we end up exporting natural gas while still paying to import oil from Middle East oil barons. That could happen if Congress doesn’t pass legislation promoting the significant use of natural gas. In the meantime, a number of LNG import terminals are being reworked with an eye toward exporting natural gas, as well as importing it. With that as a backdrop, our Peak Energy Indicator identified three players all of whom are positioned for strong growth as the natural gas transition fuel strategy builds a head of steam over the next 12 to 24 months. Fracturing Old Rocks In order to use our newfound wealth of natural gas, we first have to get it out of the ground. There’s nobody in the business who’s better at it than Range Resources Corp. (NYSE: RRC). *Important stock update on page 20. Range Resources is one of the largest independent natural gas companies. It’s engaged in the exploration, development and production of natural gas. And it has operations in West Texas, East Texas, mid-continent, the Gulf Coast and the Appalachian regions of the United States. As of December 31, 2009, the company had proven reserves totaling 3.1 Trillion cubic feet of natural gas equivalent (Tcfe). This is an increase of 13% over 2008. Its proven reserve life is currently estimated to be nearly 20 years. Range was one of the early players in the Marcellus Shale, and has been increasing its acreage and reserves there every year. The company now owns 1.3 million acres of leasehold in the Marcellus area. Its multiyear drilling inventory consists of over 11,500 drill sites. PAGE 7 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT The company continues to make outstanding, industry-leading progress in its exploration of the Marcellus Shale. John Pinkerton, Range’s Chairman and Chief Executive Officer, had this to say in a press release in early April: “Our technical team continues to do an outstanding job in the Marcellus Shale. The results of our longer lateral wells are very encouraging. We will continue to evaluate longer laterals and more completion stages. “Optimizing our well designs is critical, as it will allow us to continue to drive down our unit cost and increase our returns. Early in the life of the play we developed a significant acreage position in the wet gas area of the southwest portion of the play. “Given that a significant portion of our development over the next several years will be in the southwest, the impact of the high-value liquids component of the product stream will significantly increase our returns. “The high liquids component combined with the favorable gas basis differential due to proximity of the play to the northeast gas market helps make the Marcellus Shale play economics extremely attractive even in a low gas price environment.” In the Southwest portion of the play, Range has about 600,000 acres in the “fairway.” The fairway is the part of the field that has the highest concentrations of natural gas. PAGE 8 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT It’s been the pioneer of longer horizontally drilled lateral wells, drilling them nearly twice as long as its competitors. The result is a more expensive well, with each costing in the neighborhood of $4 million. But it’s well worth the extra expense. Range has been able to increase the amount of recoverable gas it gets from each well, more than offsetting the additional drilling costs. The Colorado School of Mines has estimated that the Marcellus Shale formation contains 489 Tcf of natural gas, making it the second-largest natural gas deposit in the world. In 2009, Range Resources drilled more wells in the Marcellus than any other operator. Each of its wells now averages upwards of 13 Mcf (million cubic feet)/day. It doubled production in 2009 and it plans to do it again in 2010. Its share price has been on a tear: up 200% in the last five years and 2,500% in the last 10. But don’t be fooled: There’s plenty more upside here. Its formidable acreage in the Marcellus is only one of the advantages Range has over its competition. Range’s wells are close to existing gathering lines. This means it has some of the lowest production costs in the industry. One final point: Unlike many of its competitors, Range isn’t diversifying into oil plays. It’s sticking with what it knows: natural gas exploration, drilling and production. That strategy has been and will continue to pay off in spades for the company. With a performance much more compelling than any of its competitors, Range could easily be the first triple-digit winner recorded in the Peak Energy Strategist portfolio. Action to Take: Buy Range Resources, Inc. (NYSE:RRC) at market. Due to the cyclical and sometimes volatile nature of the energy markets, I recommend you use a 35% trailing stop to protect your principal and your profits. Gathering and Distributing the Transition Fuel Once we’ve found the gas, it has to be gathered and distributed to the markets that use it. There are 210 natural gas pipeline systems in the United States. They span 305,000 miles and can deliver gas just about anywhere in the country. Some of the largest systems belong to the Williams Companies, Inc. (NYSE: WMB). Williams finds, produces, gathers, processes and transports natural gas. Williams is the leading natural gas service provider in the United States, delivering 12% of the nation’s daily supply. In addition to transporting gas for other companies, Williams boasts 4.5 Tcf of natural gas reserves of its own. PAGE 9 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT It’s ramping up its drilling activity at its Piceance Basin operations in northwestern Colorado. This is a low-cost, high-return basin for Williams. It plans to spend nearly $1 billion over the next to years to further develop and enhance its production capabilities in the region. Its mid-stream operation includes gathering and processing natural gas. Most natural gas can’t be used as it comes from the well. Heavier hydrocarbon liquids must be separated from the natural gas stream. Natural gas liquids (NGLs) are typically worth more than the natural gas itself. NGLs are used by the plastics industry as refinery feedstock, as well as for home heating. Williams owns more than 15,000 miles of interstate natural gas pipelines. The company operates three of the nation’s largest gas transmission pipeline systems. And it’s expanding its massive network even further. Over the next two years, Williams is spending over $1.2 billion to increase its gathering lines and processing capabilities in the Marcellus shale, the Rockies and in deepwater Gulf of Mexico. Capable of transporting 12 billion cubic feet per day, Williams’ pipelines move enough gas to heat over 30 million homes. With Williams’ massive, natural gas gathering and transmission pipeline systems, it’s in the perfect position to take advantage of the coming increase in natural gas use. The company expects its 2011 earnings per share performance to be double that of 2009. PAGE 10 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT It’s why we’re making Williams Companies, Inc. the second core holding of our Peak Energy Strategist portfolio. Action to Take: Buy Williams Companies, Inc. (NYSE: WMB) at market. Due to the cyclical and sometimes volatile nature of the energy markets, I recommend you use a 35% trailing stop to protect your principal and your profits. Energy Infrastructure: Fueling the Shift The gas is out of the ground; it’s processed and on its way. But to where? One place will be the transportation sector. When Congress finally passes HR 1835 – or something like it – natural gas will see a huge increase in use as a transportation fuel. After all, it’s the fastest way to reduce our dependence on foreign oil. (Recall we have over 2,100 trillion cubic feet of natural gas reserves.) It would only take about 15 Tcf annually to run all of our cars and trucks. We are tracking several companies involved in the natural gas transportation sector. (None have tripped our Peak Energy Indicator yet.) Congressional action will be an important catalyst. America the LNG Exporter? We’ve talked at length about the glut of natural gas in this country: 2,100 Tcf and counting. By 2020, that estimate stands a good chance of increasing by an order of magnitude. That’s right. With new technologies for finding it – as well as extracting it from formations previously thought impermeable – a decade from now, our natural gas supply could be 10 times what it is today. As a result, an amazing transformation is about to take place in the energy infrastructure sector here in the United States. And it has to do with Liquid Natural Gas (LNG). Why is LNG so attractive? In its liquid state, natural gas takes up 1/600 of the volume it does in a gaseous state. It’s odorless, non-corrosive and non-toxic. The huge reduction in volume results in a cost-effective way to transport natural gas where there aren’t any pipelines. Currently, there are nine LNG import facilities in the United States. Eight in the lower 48 and one in Puerto Rico. There are eight more on the drawing boards. PAGE 11 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT The reason is that up until a few years ago, it was estimated that the natural gas supply in the United States was in decline, just like crude oil. Now, with reserve estimates 10 times what they were a decade ago, many LNG importers are rethinking their business models. Increasingly, they are thinking about exporting LNG. As demand from emerging economies like China and India remains all but insatiable, the need for LNG is on the rise. The United States has the potential to be a big LNG export player. It has some of the lowest natural gas production costs of any country, along with one of the best pipeline delivery systems. We’re tracking several potential LNG infrastructure companies and will cover the sector in more detail in future Peak Energy Strategist issues. Venture Capital Shoveling Money into Electric Vehicles Green Technology or “Green-Tech,” as it’s more commonly referred to, is going to be the place to be for the next several decades. And one of the hottest Green-Tech sectors out there is Electric Vehicles. If you think electric vehicles will only carve out a small “niche” of the $653 billion worldwide automotive market, think again. Electric Vehicles (EVs) and Plug-in Hybrid Electric Vehicles (PHEVs) are no longer a novelty. They’re on the verge of mass introduction both here and around the world. Venture capital funds are literally flooding into the sector. In 2009, there were 65 VC deals totaling over $1 billion in electric vehicle and related companies. Only solar garnered more venture capital money than the electric vehicle sector. Just look at some of the money VCs are throwing at electric vehicle companies: • Tesla Motors – makers of a high-end electric sports car – received $82.5 million from Fjord Capital and Daimler Motors. It’s also raising another $100 million in the equity markets. • Fisker Automotive – a California startup designing a $48,000 family hybrid electric – snagged $85 million from Kleiner Perkins. But what is, perhaps, the biggest vote of confidence in the nascent electric vehicle industry? A group of investors led by HSBC anted up $350 million for Better Place. PAGE 12 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT That investment, combined with previous funding, values Better Place at $1.25 billion. It also leaves HSBC with a 10% ownership stake in the company. Coulomb Technologies, a provider of electric charging stations for plug-in vehicles, just bagged $14 million in a second round of financing. The list goes on and on. The EV boom is largely being driven by concerns over dwindling oil reserves and corresponding increase in oil prices. Forty-eight car manufacturers are introducing PHEVs or full EVs in the next year or two. Some are slated to hit dealer showrooms in early 2011. The stakes are high… but the opportunities are just immense. EV Projected Sales Growth: Fasten Your Seatbelt As you can see from the chart, EV sales are poised to triple in the next five years. But depending on government incentives, the geo-political uncertainty regarding oil supplies and customer acceptance, this forecast could turn out to be very conservative. There’s an excellent chance it’s off by a factor of two or even three. Mainstream acceptance will spur even greater sales. But it all hinges on one gating item... and it’s a really, really big one. Building a reliable EV is relatively easy. The real challenge is getting EV driving ranges to approach those of its gasoline-powered cousin. Most gasoline vehicles have gas tanks sized to the engine, which allows drivers to travel anywhere from 200-400 miles between fill-ups. In an EV, the stored energy in the battery replaces the gasoline in the tank. So the more energy you can fit in, the farther you can go before you need to recharge. This is called the “power density” of the battery. It’s measured in watt-hours per kilogram of battery weight. Plenty of EV-capable battery technologies exist today, as seen in the chart above. It shows their power densities today and their future potentials based on ongoing research. Lithium-ion packs nearly twice the energy per kilogram as Nickel-Metal Hydride (NiMH). It’s nearly four times more powerful than Lead-Acid or Nickel-Cadmium technologies. For an HEV, the battery technology of choice has been NiMH technology. It has a PAGE 13 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT Electrified Vehicles: Global Market Growth 2010 2011 2012 2013 2014 2015 0 0.75 1.5 2.25 Electrified Vehicles (millions/year) Battery Technology: It’s About “Power Density” Now Lead/Acid Potential NiCd NiMH Lithium/ion 0 75 150 225 300 W-h/kg) reasonably good power density. Many portable power tool manufacturers utilize NiMH technology for their batteries. But weight (or the lack thereof) and power are only part of the story when it comes to EV batteries. PAGE 14 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT Both must be achieved at a cost that enables EVs to be sold in a price range similar to current gasoline automobiles. Only then will EVs become part of the mass automobile market. Battery Technology: It’s Also About “Cost” Now Lead/Acid Potential NiCd NiMH Lithium/ion 0 250 500 750 1000 $/kW-h One look at the graph to the right tells us that right now, lithium-ion is twice as expensive as any other technology. But like everything else, mass production brings cost reduction. When that happens – in the not too distant future – widespread adoption of EVs will become a reality. Who’s going to buy all these EVs and where do they live? There’s no question that EV sales will be brisk in the United States. Nissan has already received 85,000 pre-orders for its EV entry, the LEAF. But the real volumes will be in Asia. Sales in Japan and China are projected to be twice as big as those in the United States. The best way to invest in the EV battery sector is to invest in a company that produces something all the battery makers need. Lithium: The South American Connection To make a lithium-ion battery, you start with lithium carbonate. It’s the form of the PAGE 15 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT Lithium-ion Batteries Projected Worldwide Sales 2010-2015 Africa/Middle East Asia Pacific Eastern Europe Western Europe Latin America North America 2010 2011 2012 2013 2014 2015 0 2.5 5 7.5 10 KW-h(Millions) metal that’s used in lithium EV batteries. Half of all the known lithium in the world is located in Bolivia but there’s just one problem: The Bolivian government is fairly hostile to foreign investment. The leftist government is building a pilot plant, but it’s questionable that it will ever get off the ground. Much of the current lithium carbonate production is centered in Argentina, Chile, the United States and Australia. (Today, Chile is the leading lithium producer, followed by Australia and Argentina.) Deposits of lithium are found all over the world, but some of the largest are located in South America, in the Andes Mountains. High in the mountains of Chile, Argentina and Bolivia are dry lakebeds known as Salars. A few dozen feet below the surface of the Salars are brine pools containing lithium carbonate and a number of other dissolved chemicals. The brine is pumped into large shallow pools where the water is allowed to evaporate. PAGE 16 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT The lithium carbonate is then separated from the other chemicals, purified and packaged for shipment. Half of the world’s proven reserves are in Bolivia’s Uyuni Desert. It is estimated to contain about 5.4 million tons. As shown in the chart below, Argentina’s proven reserves are the world’s largest. This estimate hasn’t been verified by USGS, so it remains suspect. The Bolivian government is negotiating with Japanese, French and Korean companies to build extraction plants to exploit its valuable resource. In the not-to-distant future, China may become an important supplier of brine-source lithium carbonate. China has plans for manufacturing facilities that would produce as much as 55,000 tons of lithium per year. Estimates of total recoverable lithium from known and unknown world reserves are roughly 35 million tons. Currently, there are about 10 million tons of proven reserves. The world’s largest producer of lithium carbonate is Sociedad Quimica y Minera de Chile SA (NYSE: SQM). But it’s only a small part of SQM’s revenue stream. SQM is a Chilean producer of specialty plant nutrients and chemicals. Historically, most of its revenue and profit has come from its fertilizer business. The company is the largest producer of iodine in the world. Iodine is used in numerous Lithium Mine Production and Reserves Country Production Proven Reserves Probable Reserves Argentina 3,200 6,000,000 6,000,000 Australia 6,900 170,000 220,000 Bolivia 0 0 5,400,000 Brazil 180 190,000 910,000 Canada 710 180,000 360,000 Chile 12,000 3,000,000 3,000,000 China 3,500 540,000 1,100,000 Portugal 570 Not Available Not Available United States Withheld 38,000 410,000 Zimbabwe 300 23,000 27,000 World Totals 27,400 10,141,000 17,427,000 All figures in Metric Tons PAGE 17 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT medical applications, LCD displays and other products. But all those busineses will pale in comparison to what’s about to happen to SQM’s lithium business. It’s SQM’s lithium business that will ultimately be the crown jewel of the company. The EV industry’s demand for lithium batteries is about to skyrocket, shooting up hundreds of percentage points by the end of this year and into 2011. Why? The EVs are coming. Customers have pre-ordered 85,000 Nissan LEAFs. They all need lots and lots of lithium batteries. Right now, only 25% of the all the lithium produced is used for batteries, mostly for portable tools, cell phones and computers. That percentage stands to increase dramatically once the demand for EVs is factored into the demand forecasts. Fact: The automobile industry buys several years in advance of any given model year. It has to. In order to produce enough cars in a timely fashion, parts have to be specified, designed, manufactured and stocked. That includes huge numbers of lithium batteries for all of those Chevy Volts, Nissan LEAFs and other all-electric vehicles that manufacturers are bringing to market in 2012. Those batteries are being ordered now and will be in production in the second half of 2010. It’s all great news for SQM. The company produces lithium carbonate at its Salar del Carmen facilities in Chile. The process is relatively simple: It evaporates lithium-containing brines from salt flats it owns. The lithium carbonate is then separated from other chemicals (some of which become fertilizers), purified and packaged for shipment. While there are literally dozens of companies jumping into lithium mining, SQM has a huge advantage. Its cost structure is the lowest in the specialty chemical business. As lithium production ramps up to meet increasing demand from the battery makers, SQM is well positioned to gain the largest share of the worldwide lithium production. The good news for investors is that SQM has historically been considered a fertilizer stock. After all, as we mentioned previously, that’s still where most of its revenue comes from. That sector is certainly still in the doldrums, having been passed over in the most recent stock rally. That makes SQM not only undervalued from a fertilizer sector standpoint, but also extremely undervalued as a lithium supplier. PAGE 18 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT Once analysts connect the future growth of the all-electric vehicle with what will be a nearly endless demand for lithium carbonate, shares of SQM will soar into the stratosphere. That makes it the perfect time to add a few shares of SQM to the Peak Energy Strategist portfolio – well ahead of the big jump in demand, which could start as soon as the end of 2010. Action to Take: Buy Sociedad Quimica y Minera de Chile SA (NYSE: SQM) at market. I recommend you use a 25% trailing stop to protect your principal and your profits. About the Author: David Fessler is the energy and infrastructure expert for The Oxford Club, one of the world’s most exclusive and prestigious networks of private investors. A prolific writer, David writes Hot Stacked, a focused overview of the energy and infrastructure markets appearing monthly in The Communiqué. He’s also the managing editor of Peak Energy Strategist, The Oxford Club’s premium energy research service. In addition, he’s a weekly contributor to Investment U, the Club’s free investment education division with more than 355,000 active subscribers. His articles are syndicated widely. Seeking Alpha has listed Dave in the group of the top 100 fastest growing authors by readership. David has appeared on the Glenn Beck Show on the Fox News Channel. He was one of the first journalists to break the story on the commercial real estate crash. Before retiring at the age of 47, David served as Vice-President for Strategic Business at LTX Corporation. He was also Vice-President of Operations, Sales & Marketing for Quality Telecommunications, Inc. His success as an investor spans 35 years in the technology and energy sector. He owns and operates two successful businesses. He’s a degreed Electrical Engineer, and is a renowned specialist in the semiconductor, telecommunications, energy and infrastructure sectors. David, his wife Anne and their two sons, Jared and Noah, live in a 200-year-old stone farmhouse in northeastern Pennsylvania. An avid cyclist, David also enjoys fly-fishing with his sons, gardening with Anne and woodworking. PAGE 19 PEAK ENERGY STRATEGIST • SPECIAL RESEARCH REPORT *IMPORTANT STOCK UPDATE: since this report was printed/written, Range Resources Corp. hit our trailing stop and we were stopped out of the position. As a result, we are no longer officially tracking it in the Peak Energy Portfolio. However, I am still a big believer in the Natural Gas Sector and the future prospect of Range Resources. If and when market conditions warrant I will consider re-entering a position in Range Resources or a similiar company. From time to time, The Oxford Club will recommend stock investments that will not be included in the VIP Trading Circle or in the Communiqué’s Portfolios. There are certain situations where we feel a company may be an extraordinary value but may not necessarily fit within the selection guidelines of these existing portfolios. In these cases, the recommendations are to be considered as speculative and should not be considered as part of the Club’s more conservative Communiqué portfolio. Also, by the time you receive this report, there is a chance that we may have exited a recommendation previously included in a VIP or Communiqué portfolio. Occasionally, this happens because we use a disciplined “trailing stop” philosophy with our investments, meaning that any time a company’s share price falls 25% from its high, we sell the stock. NOTE: The Oxford Club is not a broker, dealer or licensed investment advisor. No person listed here should be considered as permitted to engage in rendering personalized investment, legal or other professional advice as an agent of The Oxford Club. The Oxford Club does not receive any compensation for these services. Additionally, any individual services rendered to Oxford Club members by those mentioned are considered completely separate from and outside the scope of services offered by The Oxford Club. Therefore if you choose to contact anyone listed here, such contact, as well as, any resulting relationship, is strictly between you and the Pillar One service. Copyright 2010, The Oxford Club, LLC, 105 W. Monument Street, Baltimore, MD 21201 Phone: 410.223.2643 All rights reserved. No part of this report may be reproduced or placed on any electronic medium without written permission from the publisher. Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The Oxford Club provides its members with unique opportunities to build and protect wealth, globally, under all market conditions. The executive staff, research department and editors who contribute to the Club’s recommendations are proud of the reputation The Oxford Club has built since its inception in 1984. We believe the advice presented to its members in our published resources and at our meetings and seminars is the best and most useful available to global investors today. The recommendations and analysis presented to members is for the exclusive use of members. Copying or disseminating any information published by The Oxford Club, electronic or otherwise, is strictly prohibited. Members should be aware that investment markets have inherent risks and there can be no guarantee of future profits. Likewise, past performance does not assure future results. Recommendations are subject to change at any time, so members are encouraged to make regular use of The Oxford Insight and the members-only website, and pay special attention to “The Oxford Portfolio Review” section of the Communiqué to get the most value from our investment analysis. The publishers, editors, employees or agents are not responsible for errors and/or omissions. PRIVACY NOTICE You and your family are entitled to review and act on any recommendations made in this document. All Oxford Club publications are protected by copyright. No part of this report may be reproduced by any means (including facsimile) without written permission from the publisher. Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The Oxford Club expressly forbids its writers from having a financial interest in any security recommended to its readers. All Oxford Club employees and agents must wait 24 hours after an Internet publication and 72 hours after a print publication is mailed prior to following an initial recommendation. The Oxford Club does not act as a personal investment advisor, nor does it advocate the purchase or sale of any security or investment for any specific individual. Investments recommended in this publication should be made only after consulting with your investment advisor, and only after reviewing the prospectus or financial statements of the company. PAGE 20 Special Research Report Peak Energy: How to Play the Biggest Global Trend of the Next 100 Years… Ahead of the Coming $289 Billion Windfall The year 1856 marked the beginning of the “Age of Oil.” For the last 154 years, it has provided mankind with the cheapest form of energy in history. But only a finite supply exists. In other words, the end of the Age of Oil is on the horizon. Which puts us in the midst of an unprecedented profit opportunity. Some believe the peak for oil has already passed. And, of course, there are concerns about the potential effects fossil fuels are having on the Earth’s climate. After oil’s recent peak of $147 a barrel, renewables like geothermal, solar, wind and others burst onto the energy stage and quickly gained traction. But the reality is that the transition won’t happen overnight. Challenges and concerns litter the path to global energy resource-sustainability. The socio-economic implications are unprecedented… Fortunately for us, so are the profit opportunities. The research contained inside this Peak Energy TrendWatch report has the very real potential of logging gains of historic proportions. Each quarter, Peak Energy TrendWatch will highlight the world’s hottest energy trends. And provide precise recommendations for playing them for double- and triple-digit gains. Every blockbuster report will feature institutional-quality research. You’ll hear about the latest news and exciting advances in alternative energy, fossil fuels, energy infrastructure and the energy technology companies that pull it all together. But while my research team and I dig deep, we’ll always keep it simple, which means you’ll know exactly what you’re investing in and why. You’ll also get Peak Energy Weekly, where I’ll give you sneak peeks into what I’m researching or the next report. The weekly will also contain updates on all our current positions. And hot new recommendations that just can’t wait for the next quarterly report. We’re at the beginning of what I trust will be an exciting, fascinating and most importantly – extremely profitable adventure. Welcome to Peak Energy Strategist. 300R014970 The master portfolio – The Peak Energy Portfolio – contains all our current picks. And provides simple buy/sell/hold recommendations for all of them.

© Copyright 2026