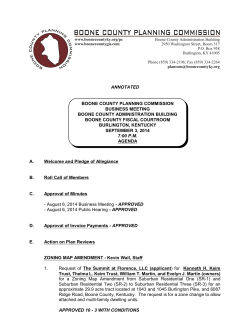

Document 228748