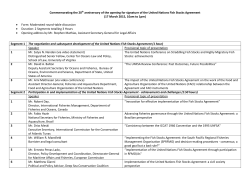

Are You Ready For $150 Oil? Here's How To Invest Now

Are You Ready For $150 Oil? Here's How To Invest Now By Nathan Slaughter, Scarcity & Real Wealth May 1, 2013 In case you couldn't tell from the gasoline prices in your area, oil prices have been on the move. The chart below pretty much says it all. The Absolute Best Dividend Stocks In America Carla Pasternak, High-Yield Investing I've uncovered the little-known "sister" of the famous S&P Dividend Aristocrats Index. Its collection of reliable, high-yield stocks could lead you to some of the most attractive yields on the market. The 5 Most Shorted Stocks In The S&P 500 Ben Gersten, Money Morning As you can see, benchmark West Texas Intermediate Crude has been bubbling higher lately, and prices have now ascended into near triple-digit territory. For the record, that's an impressive 120% bounce off the lows from January 2009. Sponsor Triple The Power of Ordinary Dividend Strategies... Former IBM engineer and accomplished poker player from Austin, TX has perfected a unique multi-layer dividend strategy. If you need or want more income, then you really should consider checking this out. Click here for the full story... There are compelling reasons to believe these elevated prices might stick around for a while. In fact, further upside to $150 is a distinct possibility. That could act as an economic drag, siphoning money from consumers and sparking inflationary price hikes for goods and services. Right now, the most shorted stocks include a struggling retailer, a for-profit college, an alternative energy company, and one stock that's up 131% in the last five months. But don't be misled into going against the grain... these stocks are not "buys." How To Profit From 'The Death Of Cash' Andy Obermueller, Game-Changing Stocks I've been telling readers about this game-changing trend for months. Now, the herd is finally catching on -- yet there's still time to profit. Sponsor One analyst is predicting a stock rise of 1,566%. Another stock has already jumped over 1,000% and is expected to keep going. To learn more about what's causing these stocks to rocket higher, click here. The United States alone consumes 18.9 million barrels of oil every day, rain or shine. And China's appetite grows more ravenous by the minute, with daily consumption doubling from 5.5 million barrels in 2003 to nearly 9.8 million in 2011. Aside from a brief downturn during the recession, global oil consumption is moving inexorably higher. Wish You Could Invest Like John Paulson? Here's Your And $150 per barrel oil would be a gale-force tailwind for energy investors. As you can see, worldwide oil consumption passed its pre-recession 2007 peak in 2010 and continues to rise. It is projected to reach 90.2 million barrels per day this year. Meanwhile, the world's oil companies will only produce 90 million barrels per day. In other words, demand will outstrip supply by 200,000 barrels per day, or about 73 million barrels for the year. We can barely feed our appetite today. And we're getting hungrier. Per-capita consumption in China and India is still less than one-tenth that of the United States. But they're catching up fast. In fact, 18 million new cars hit the road in China last year, compared with 14.5 million in the United States. That's stretching supplies even thinner. Meanwhile, most production grounds have been in a steady decline for decades. Future oil exploration activity will be focused in deep offshore basins, which are expensive to tap (meaning drilling and production will halt if prices retreat and recovery becomes uneconomical). And if all that weren't enough, the Federal Reserve's quantitative easing and other dollar debasement policies have given a huge boost to oil and other dollar-denominated assets. In short, there are plenty of factors underpinning high crude prices. And I think they are headed even higher. But even if oil stabilizes at this level, we could still see blowout profits for many companies -- enough to buy back shares, raise dividends, and plow surplus cash into expansion projects to support future growth. There will be many beneficiaries: offshore drillers, equipment and service providers, even the alternative energy sector (which always attracts interest when high oil prices become oppressive). But most of the wealth will go to the companies pulling the stuff out of the ground. Still, you can't just invest blindly. Some companies may have already locked in most of their production at lower prices through hedging. Those companies won't feel the full impact of the tailwind. And integrated giants like Exxon Mobil (NYSE: XOM) won't yield the greatest returns either, because high oil prices typically crimp refining profits. Instead, look for smaller companies with no distractions and a nimble earnings needle. Small energy producers are by far the easiest way to make money on energy stocks. If oil eventually shoots to $150, as I think it will, you'll be glad you did. Chance The hedge-fund manager who bagged a $15 billion profit has made his next big bet. Here's why the time may be right to follow his lead... Read more The Most Dangerous Man In The World This Nobel Prize winning economist "won" the vicious argument between those who want to increase government spending, and those who want to cut spending and reduce deficits. But could this man just be setting us up for catastrophic failure? Read more The Next Country To Collapse Isn't In Europe A collapse in this country's currency and the stock market is all but certain -- the only question is when. Read more Is Now The Time To Target Smith & Wesson? With gun sales going through the roof, let's take a look at whether this company should be part of your portfolio. Read more A 20% Rally For This Energy Company Is Just The Beginning What separates this energy company from the field is that it produces electricity from both natural gas and nuclear power. That's a fairly potent combination, and it should result in better margins and higher profits. Read more Nathan Slaughter Scarcity & Real Wealth P.S. -- I've uncovered three investments that are spearheading "The New Oil Boom of 2013." Even better, these companies are just a small part of the overall boom taking over the market today. But it's not too late to get in on this opportunity. Click here to get all the details. PDF Version Web Version Whitelist Us Home | About Us | Archives | Reports | Terms of Use | Privacy Policy To ensure that you receive these emails, please add [email protected] to your address book. Disclosure: TopStockAnalysts does not own shares of securities mentioned in this article. TopStockAnalysts is a publisher of financial news and opinions. TopStockAnalysts is not a securities broker/dealer or an investment advisor and we do not recommend or endorse any brokers, dealers or investment advisors. This work is based on SEC filings, current events, interviews, corporate press releases and publicly available information which may contain errors. All information contained in our newsletters and/or on our website(s) should be independently verified with the companies or sources mentioned. You are responsible for your own investment decisions and should always conduct your own research and due diligence and consider obtaining professional advice before making any investment decision. TopStockAnalysts welcomes your comments, feedback or suggestions. You may contact our customer service department by visiting this link. To unsubscribe from this publication please click here. Published by: TopStockAnalysts, 4601 Spicewood Springs Road, Austin, TX 78759. Copyright (c) 2013 TopStockAnalysts. All rights reserved. Any reproduction or redistribution in whole or in part without TopStockAnalysts approval is prohibited.

© Copyright 2026