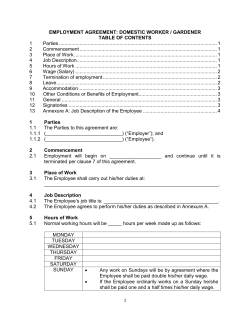

What Is New-Keynesian Economics? Robert J. Gordon Journal of Economic Literature