1. Do the following simple numerical exercises.

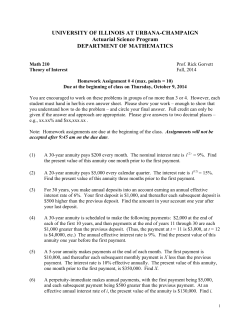

1. Do the following simple numerical exercises. a. What is the six-year discount factor at a discount rate of 12 percent? b. The PV of €139 is €125. What is the discount factor? c. Suppose you invest €100,000 at 6 percent. How much will you have after eight years? d. What is the PV of £37,400 to be received in year 9? The cost of capital is 9 percent. e. What is the PV of nine annual payment of £37,400? The first payment is 2. 3. 4. 5. next year, and the cost of capital is 9 percent. f. What is the NPV of an investment that costs HK$2 million and pays HK$225,000 in perpetuity? The cost of capital is 8.5 percent. A project produces cash flows of A$432,000 in year 1, A$437,000 in year 2, and A$330,000 in year 3. What is the project’s PV? The cost of capital is 15 percent. The interest rate is 10 percent. a. What is the PV of an asset that pays $1 a year in perpetuity? b. The value of an asset that appreciates at 10 percent per annum approximately dou-bles in seven years. What is the approximate PV of an asset that pays $1 a year in perpetuity beginning in year 8? c. What is the approximate PV of an asset that pays $1 a year for each of the next seven years? d. A piece of land produces an income that grows by 5 percent per annum. If the first year’s income is $10,000,what is the value of the land? The continuously compounded interest rate is 12 percent. a. You invest $1,000 at this rate. What is the investment worth after five years? b. What is the PV of $5 million to be received in eight years? c. What is the PV of a continuous stream of cash flows , amounting to $2,000 per year , start-ing immediately and continuing for 15 years? When Samuel Pepys, the British diarist, lent his friend, Lady Sandwich, £100 in 1668,he charged her 6 percent interest. If the loan was due at the end of one year, how much would Lady Sandwich have had to pay if interest was (a) compounded annually,(b) compounded semiannually,(c) compounded continuously? 6. Mike Polanski is 30 years of age and his salary next year will be $40,000. Mike forecasts that his salary will increase at a steady rate of 5 percent per annum until his retirement at age 60. a. If the discount rate is 8 percent, what is the PV of these future salary payments? b. If Mike saves 5 percent of his salary each year and invests these savings at an inter-est rate of 8 percent, how much will he have saved by age 60? c. If Mike plans to spend these savings in even amounts over the subsequent 20 years, how much can he spend each year? 7. Kangaroo Autos is offering free credit on a new $10,000 car. You pay $1,000 down and then $300 a month for the next 30 months. Turtle Motors next door dose not offer free credit but will give you $1,000 off the list price. If the rate of interest is 10 percent a year, ( about 0.83 percent a month ) which company is offering the better deal? 8. What is the value of the following three investments? Each investment generates four annual cash inflows. The interest rate is 7 percent. a. Investment P1 pays €10,000 at the end of each year. b. Investment P2 pays €10,000 at the beginning of each year. c. Investment P3 pays €10,000 spread evenly over each year. 9. Vernal Pool, a self-employed herpetologist, wants to put aside a fixed fraction of her an-nual income as savings for retirement. Ms. Pool is now 40 years old and makes $40,000 a year. She expects her income to increase by 2 percentage points over inflation (e.g., 4 percent inflation means a 6 percent increase in income). She wants to accumulate $500,000 in real terms to retire at age 70. What fraction of her income does she need to set aside? Assume her retirement funds are conservatively invested at an expected real rate of return of 5 percent a year. Ignore taxes. 10. If you deposit $10,000 in a bank account that pays 10 percent interest annually, how much money will be in your account after 5 years? 11. What is the present value of a security that promises to pay you $5,000 in 20 years? Assume that you can earn 7 percent if you were to invest in other securities of equal risk. 12. A rookie quarterback is in the process of negotiating his firs contract. The team’s general manager has offered him three possible contracts. Each of the contracts lasts for 4 years. All of the money is guaranteed and is paid at the end of each year. The terms of each of the contracts are listed below: CONTRACT 1 PAYMENTS CONTRACT 2 PAYMENTS CONTRACT 2 PAYMENTS Year 1 $3 million $2 million $7 million Year 2 3 million 3 million 1 million Year 3 3 million 4 million 1 million Year 4 3 million 5 million 1 million The quarterback discounts all cash flows at 10 percent. Which of the three contracts offers him the most value? 13. Your company is planning to borrow $1,000,000 on a 5-year, 15%, annual payment, fully amortized term loan. What fraction of the payment made at the end of the second year will represent repayment of principal? 14. Assume that your father is now 50 years old, that he plans to retire in 10 years, and that he expects to live for 25 years after he retires, that is until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $40,000 has today (he realizes that the real value of his retirement income will decline year by year after he retires). His retirement income will begin the day he retires, 10 years from today, and he will then get 24 additional annual payments. Inflation is expected to be 5 percent per year from today forward; he currently has $100,000 saved up; and he expects to earn a return on his savings of 8 percent per year, annual compounding. To the nearest dollar, how much must he save during each of the next 10 years (with deposits being made at the end of each year) to meet his retirement goal? 15. The price in last week’s Florida lottery was estimated to be worth $35 million. If you were lucky enough to win, the state will pay you $1.75 million per year over the next 20 years. Assume that the first installment is received immediately. a. If interest rates are 8 percent, what is the present value of the prize? b. If interest rates are 8 percent, what is the future value after 20 years? c. How would your answers change if the payments were received at the end of each year? 16. Your client is 40 years old and wants to begin saving for retirement. You advise the client to put $5,000 a year into the stock market. You estimate that the market’s return will be, on average, 12 percent a year. Assume the investment will be made at the end of the year. a. If the client follows your advice, how much money will she have by age 65? b. How much will she have by age 70? 17. You are serving on a jury. A plaintiff is suing the city for injuries sustained after falling down an uncovered manhole. In the trial, doctors testified that it will be 5 years before the plaintiff is able to return to work. The jury has already decided in favor of the plaintiff, and has decided to grant the plaintiff an award to cover the following items: (1) Recovery of 2 years of back-pay ($34,000 in 2001, and $36,000 in 2002). Assume that it is December 31, 2002 ,and that all salary is received at year end. This recovery should include the time value of money. (2) The present value of 5 years of future salsry (2003-2007). Assume that the plaintiff’s salary would increase at a rate of 3 percent a year. (3) $100,000 for pain and suffering. (4) $20,000 for court costs. Assume an interest rate of 7 percent. What should be the size of the settlement? 18. You just started your first job, and you want to buy a house within 3 years. You are currently saving for the down payment. You plan to save $5,000 the first year. You also anticipate that the amount you save each year will rise by 10 percent a year as your salary increases over time. Interest rates are assumed to be 7 percent, and all savings occur at year end. How much money will you have for a down payment in 3 years? 19. A 15-year security has a price of $340.4689. The security pays $50 at the end of the next 5 years, and then it pays a different fixed cash flow amount at the end of each of the following 10 years. Interest rates are 9 percent, What is the annual cash flow amount between Years 6 and 15? 20. Crissie has just won the state lottery and has three award options to choose from. She can elect to receive a lump sum payment today of $61 million, 10 annual end-of-year payments of $9.5 million, or 30 annual end-of-year payments of #5.5 million. a. If she expects to earn a 7 percent annual return on her investments, which option should she choose? b. If she expects to earn an 8 percent annual return on her investments, which option should she choose? If she expects to earn a 9 percent annual return on her investments, which option should she choose? 21. Find the future value of the following annuities. The first payment in these annuities is made at the end of Year 1 ; that is, they are ordinary annuities. (Note: Seethe hint to Problem 6-34. Also, note that you can leave values in the TVM register, switch to “BEG,” press FV, and find the FV of the annuity due.) Assume that compounding occurs once a year. a. $400 per year for 10 years at 10 percent. b. $200 per year for 5 years at 5 percent. c. $400 per year for 5 years at 0 percent. d. Now rework parts a, b, and c assuming that payments are made at the beginning of each year; that is, they are annuities due. 22. Find the present value of the following ordinary annuities (see note to Problem 6-37). Assume that discounting occurs once a year. a. $400 per year for 10 years at 10 percent. b. $200 per year for 5 years at 5 percent. c. $400 per year for 5 years at 0 percent. d. Now rework parts a, b, and c assuming that payments are made at the beginning of each year; that is, they are annuities due. 23. a. Find the present valued of the following cash flow streams. The appropriate interest rate is 8 percent, compounded annually.(Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that if you do work with the cash flow register, you must enter CF 0 = 0.) YEAR CASH STREAM A CASH STREAM B 1 $100 $300 2 400 400 3 400 400 4 400 400 5 300 100 b. What is the value of each flow stream at a 0 percent interest rate, compounded annually? 24. a. Set up an amortization schedule for a $25,000 loan to be repaid in equal installments at the end of each of the next 5 years. The interest rate is 10 percent, compounded annually. b. How large must each annual payment be if the loan is for $50,000? Assume that the interest rate remains at 10 percent, compounded annually, and that the loan is paid off over 5 years. c. How large must each payment be if the loan is for $50,000, the interest rate is 10 percent, compounded annually, and the loan is paid off in equal installments at the end of each of the next 10 years? This loan is for the same amount as the loan in part b, but the payments are spread out over twice as many periods. Why are these payments not half as large as the payments on the loan in part b? 25. The Jackson family is interested in buying a home. The family is applying for a $125,000, 30-year mortgage. Under the terms of the mortgage, they will receive $125,000 today to help purchase their home. The loan will be fully amortized over the next 30 years. Current mortgage rates are 8 percent. Interest is compounded monthly and all payments are due at the end of the month. a. What is the monthly mortgage payment? b. What portion of the mortgage payments made during the first year will go toward interest? c. What will be the remaining balance on the mortgage after 5 years? d. How much could the Jacksons borrow today if they were willing to have a $1,200 monthly mortgage payment? (Assume that the interest rate and the length of the loan remain the same) 26. A father is planning a savings program to put his daughter though college. His daughter is now 13 years old. She plans to enroll at the university in 5 years, and it should take her 4 years to complete her education. Currently, the cost per year (for everything-food, clothing, tuition, books, transportation, and so forth) is $12,500, but a 5 percent annual inflation rate in these costs is forecasted. The daughter recently received $7,500 from her grandfather’s estate; this money, which is invested in a bank account paying 8 percent interest, compounded annually, will be used to help meet the costs of the daughter’s education. The remaining costs will be met by money the father will deposit in the savings account. He will make 6 equal deposits to the account, one deposit in each year from now until his daughter starts college. These deposits will begin today and will also earn 8 percent interest, compounded annually. a. What will be the present value of the cost of 4 years of education at the time the aughter becomes 18? [Hint: Calculate the future value of the cost (at 5%) for each year of her education, then discount 3 of these costs back (at 8%) to the year in which she turns 18,then sum the 4 costs. b. What will be the value of the $7,500 that the daughter received from her grandfather’s estate when she starts college at age 18? (Hint: Compound for 5 years at an 8 percent annual rate.) c. If the father is planning to make the first of 6 deposits today, how large must each deposit be for him to be able to put his daughter through college? (Hint: An annuity due assumes interest is earned on all deposits; however, the 6th deposit earns no interest-therefore, the deposits are an ordinary annuity.) 27. Juna Garza invested $200,000 10 year ago at 12 percent, compounded quarterly. How much has he accumulated? 28. Your rich godfather has offered you a choice of one of the three following alternatives: $10,000 now; $2,000 a year for eight years; or $24,000 at the end of eight years. Assuming you could earn 11 percent annually, which alternative should you choose ? If you could earn 12 percent annually, would you still choose the same alternative? 29. You need $28,974 at the end of 10 years, and your only investment outlet is an 8 percent long-term certificate of deposit (compounded annually). With the certificate of deposit, you make an initial investment at the beginning of the first year. 30. Del Monty will receive the following payments at the end of the next three years: $2,000,$3,500,and $4,500. Then from the end of the fourth through the end of the tenth year, he will receive an annuity of $5,000 per year. At a discount rate of 9 percent, what is the percent value of all three future benefits? 31. Bridget Jones has a contract in which she will receive the following payments for the next five years: $1,000,$2,000,$3,000,$4,000,and $5,000. She will then receive an annuity of $8,500 a year from the end of the 6th through the end of the 15th year. The appropriate discount rate is 14 percent. If she is offered $30,000 to cancel the contract, should she do it? 32. Mark Ventura has just purchased an annuity to begin payment at the end of 2007(that is the date of the first payment). Assume it is now the beginning of the year 2005. The annuity is for $8,000 per year and is designed to last 10 years. If the interest rate for this problem calculation is 13 percent, what is the most he should have paid for the annuity? 33. If you borrow $15,618 and are required to pay back the loan in seven equal annual installments of $3,000, what is the interest rate associated with the loan? 34. Cal Lury owes $10,000 now. A lender will carry the debt for five more years at 10 percent interest. That is, in this particular case, the amount owed will go up by 10 percent per year for five years. The lender then will require that Cal pay off the loan over the next 12 years at 11 percent interest. What will his annual payment be? 35. If your uncle borrows $60,000 from the bank at 10 percent interest over the seven-year life of the loan, what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest (round to the nearest dollar)?How much of his first payment will be applied to interest? To principal? How much of his second payment will be applied to each? 36. Larry Davis borrows $80,000 at 14 percent interest toward the purchase of a home. His mortgage is for 25 years. a. How much will his annual payments be? (Although home payments are usually on a monthly basis, we shall do our analysis on an annual basis for ease of computation. We will get a reasonably accurate answer.) b. How much interest will he pay over the life of the loan? c. How much should he be willing to pay to get out of a 14 percent mortgage and into a 10 percent mortgage with 25 years remaining on the mortgage? Assume current interest rates are 10 percent. Carefully consider the time value of money. Disregard taxes. 37. You are chairperson of the investment fund for the Eastern Football League. You are asked to set up a fund of semiannual payments to be compounded semiannually to accumulate a sum of $100,000 after 10 years at an 8 percent annual rate(20 payments).The first payment into the fund is to occur six months from today, and the last payment is to take place at the end of the 10th year. a. Determine how much the semiannual payment should be.(Round to whole numbers.) On the day after the fourth payment is made (the beginning of the third year) the interest rate will go up to a 10 percent annual rate, and you can earn a 10 percent annual rate on funds that have been accumulated as well as all future payments into the fund. Interest is to be compounded semiannually on all funds. b. Determine how much the revised semiannual payments should be after this rate change ( there are 16 payments and compounding dates). The next payment will be in the middle of the third year.(Round all values to whole numbers.) 38. Your younger sister, Linda, will start college in five years. She has just informed your parents that she wants to go to Hampton University, which will cost $17,000 per year for four years (cost assumed to come at the end of each year). Anticipating Linda’s ambitions, your parents started investing $2,000 per year five years ago and will continue to do so for five more years. How much more will your parents have to invest each year for the next five years to have the necessary funds for Linda’s education? Use 10 percent as the appropriate interest rate throughout this problem (for discounting or compounding). 39. Dr. Harold Wolf of Medical Research Corporation (MRC) was thrilled with the re-sponse he had received from drug companies for his latest discovery, a unique elec-tronic stimulator that reduces the pain from arthritis. The process had yet to pass rigorous Federal Drug Administration (FDA) testing and was still in the early stages of development, but the interest was intense. He received the three offers described below this paragraph.( A 10 percent interest rate should be used throughout this analysis un-less otherwise specified.) Offer I $100 million in cumulative sales by the end of year 15, he would receive an ad-ditional $3,000,000. Dr. Wolf thought there was a 70 percent probability this would happen. Offer II Thirty percent of the buyer’s gross profit on the product for the next four years. Zbay Pharmaceutical. Zbay’s gross profit margin was 60 percent. Sales in year one were projected to be $2 million and then expected to grow by 40 percent per year. Offer III A trust fund would be set up for the next 8 years. At the end of that period, Dr. Wolf would receive the proceeds (and discount them back to the present at 10 per-cent). The trust fund called for semiannual payments for the next 8 years of $200,000(a total of $400,000 per year). The payments would start immediately. Since the payments are coming at the begin-ning of each period instead of the end, this is an annuity due. To look up the future value of an annuity due in the tables, add 1 to n (16+1) and subtract 1 from the value in the table. Assume the annual interest rate on this annuity is 10 percent annually ( 5 percent semiannually). Determine the present value of the trust fund’s final value. 40. 當瑪莉 Corens 是田納西大學的一個學生時,她以一個 9%的年利率借 12,000 美元的學生貸款。如果瑪莉每年還 1,500 美元,要多久她才能付清債款? 41. 假如你繼承一些錢。你的一位朋友正在一家本地經濟商行實習,而且她的老 闆正出售一些證券要求 4 筆現金流量,在今後 3 年每年末的 50 美元,以及 在 4 年度末 1,050 美元的現金流量。你朋友說他能以 900 美元賣你這些証券。 你知道銀行利率 8%但是用季度複利。你認為證券與你的銀行存款有相同變 現性與風險。你必須計算證券的現值以決定它們是否是一筆好投資。他們的 現職是什麼? 42. a.現在 1 月 1 日。你計畫每 6 個月存 100 美元,共存 5 筆,今天存第一筆。 如果銀行的名目利率是 12%,但是使用半年的複利,在 10 年之後你的帳戶 裡將有多少? b.10 年後你必需有一筆 1,432.02 美元的款項。為準備這筆現金流量,你將存 5 筆相等的存款,今天開始和下四個季度,12%名目利率,季度複利。每筆 存款必須是多大? 43. 威致 40 歲,最近開始規劃他的退休計劃,他預計 55 歲退休,活到 75 歲,他 與太太現在生活水準是一個月 5 萬元,希望退休生活水準也保持一樣,假設 他的理財顧問提供他一個保證有每年 6%報酬(月複利)的投資帳戶,請替威致 回答下列問題: 1.他退休時必須準備多少資金才能如願退休? 2.如果他計畫現在起開始每月存一筆錢準備該筆退休基金,每月該存多 少? 3.假設他退休時可以領到一筆勞保退休金約 200 萬,那他每月又該存多 少錢? 4.承上題,如果威致每月能存 20,000 元,請問他能於幾歲時存足退休基 金? 44. 詹君現有生息資產 300 萬元,預計二十年後購置 4,000 萬元房屋乙幢,假設 實質報酬率 3%,則每年平均儲蓄最少應達幾萬元才足夠購屋? (A)128.7 萬元(B)137.3 萬元(C)232.4 萬元(D)248.7 萬元 45. 假設年投資報酬率為6%,預計工作二十五年後累積 500 萬元退休金,則每 月應儲蓄之金額為多少(取近似值,以最近百元計)? (A)6,400 元(B)7,200 元(C)8,000 元(D)8,800 元 46. 小陳年薪扣除開銷後每年餘額為 80 萬;今小陳向銀行辦理房屋貸款 500 萬 元,利率 7%,期間二十年,按年定期還款。倘小陳年薪餘額扣除房貸後逐 年持續定存(定存利率 3%) ,試問二十年後定存總額為何(取最近金額)? (A)850 萬元(B)880 萬元(C)910 萬元(D)940 萬元 47. 小王現年 40 歲,以儲存 500 萬元,計畫供其 60 歲退休後生活之用;假設投 資報酬率 6%,在不考慮通貨膨脹之情形下,試問二十年後退休時,小王總 共累積多少退休金準備(取近似值,以最近萬元)? (A)1,150 萬元(B)1,348 萬元(C)1,513 萬元(D)1,604 萬元

© Copyright 2026