WHAT IS XPAX?

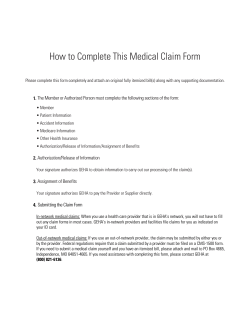

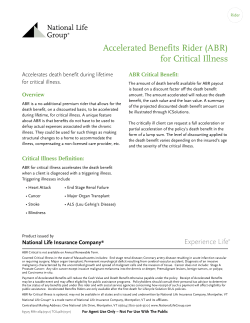

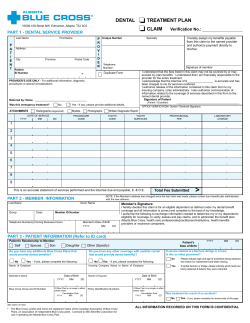

WHAT IS XPAX? XPAX is a suite of insurance covers provided in one policy specifically designed for ex members of HM Armed Forces. In theatre, on leave or enjoying life after military service, you are likely to be the person who gets a little more out of life. This is where XPAX can help. Whether on manoeuvres, at work or out enjoying life, XPAX can give you the confidence to do the things you want to do knowing you’ve got something to fall back on. And XPAX can be extended to include financial protection for your partner and children too, so don’t hold back. LIVE LIFE FULL ON. CUS TO M ER S ERV ICE H EL PL INE 020 8662 8102 (UK) +44 20 8662 8102 (OVERSEAS) BECAUSE FORMER SERVICE PERSONNEL SHOW GREAT FORM PAX– 24/7 WORLDWIDE COVER In this brochure you’ll find all you need to know about how XPAX can provide money to help you as a former member of HM Armed Forces. The insurance is split into 4 parts: Part 1 – Personal Accident • cover if you are injured in an accident, or • you die as a result of an accident whilst on or off duty, and • cover is 24 hours a day, 365 days a year and whilst you are anywhere in the world. Part 2 – Personal Liability • if you injure someone else or damage their property in an accident and you are legally liable, the amount you are required to pay them in compensation and any legal defence costs. Part 3 – An Optional part – Life & Critical Illness Insurance • if you die of natural causes or are diagnosed as terminally ill, or you are diagnosed with cancer - excluding less advanced cases, or suffer a heart attack - of specified severity, or stroke - resulting in permanent symptoms. Part 4 – Legal Protection (for former members of HM Armed Forces only) • if you are injured by someone else and you need to take legal action against them for compensation. We also include a telephone helpline service, where you can obtain a second opinion on any medical diagnosis or a proposed course of treatment. Of course the insurance cover has limits on how much we will pay and what we will pay for and you should read the rest of this brochure and the enclosed Policy booklet for details of the cover provided. XPAX COVER IS QUICK AND EASY TO ARRANGE AND CHANGE YOU SELECT THE AMOUNT OF COVER YOU NEED The cover provided under the Personal Accident section is broken down into units. You can choose from 1 to 15 units depending on your own needs or your budget. The more units you have the higher the cash benefits available to you.† You can also add the XPAX Optional Life & Critical Illness Insurance cover; however the number of units will be the same as that selected for the Personal Accident insurance and the plan type - i.e. individual or family. XPAX Optional Life & Critical Illness Insurance is not available without purchasing the Personal Accident insurance and is subject to medical acceptance. YOU CHOOSE WHO YOU WANT TO INSURE Insure yourself only or include your partner and children, it’s up to you. • Individual Plan covers you and, if you are a single parent, covers your children as well for no additional charge • Family Plan covers you, your partner and your children including legally adopted and step-children. Your children are covered until their 18th birthday, or their 23rd birthday if they are in full-time education There are some limitations to the amount we will pay for Injuries to your children, dependent on their age. Please refer to the enclosed Policy booklet for details. PAYMENT OF PREMIUMS C US TO M E R SE RV IC E HE LP LI NE 020 8662 8102 (UK) +44 20 8662 8102 (OVERSEAS) The premium is payable monthly, the amount is dependent on the number of units you choose, if you also include XPAX Optional Life Insurance cover and if you include your family. The premium will be deducted from your bank account via Direct Debits on the first day of each month. The premium is the same for whatever job you do, even if you return for a short spell of active duty, you won’t pay more. Check out the Pricing Table in the Policy booklet enclosed to see just how affordable XPAX can be, but remember if you do not select the Optional Life & Critical Illness Insurance cover, death by natural causes, diagnosis of a terminal illness or the specified critical illnesses will not be covered. YOU CONTROL YOUR COVER To buy XPAX, complete the Application Form enclosed (including the DD mandate) with the cover you have chosen and send it to us in the envelope provided. You can change the amount of cover you require, add or remove your partner, or cancel at any time. There is no minimum contract period and no administration charge. Please see the What Next section at the end of this booklet for further details. † The benefit in the event of death is paid tax-free to the deceased person’s estate, which then may be subject to inheritance tax. OUR BEST COVER – SUPPORTING THE ARMED FORCES FOR OVER 20 YEARS Important kit for everyone who understands the risks they face as a former member of HM Armed Forces. XPAX Personal Accident Insurance provides financial support if you are killed, injured or permanently disabled. Full details are included in the Policy booklet. ALL ROUND PROTECTION XPAX Personal Accident Insurance provides you with tax-free† cash payments for a range of injuries dependent on their severity including payments for catastrophic and paralysing injuries, permanent disabilities**, fractures, burns, or flesh wounds. And, just so you are sure, you’re covered for war and terrorist injuries – on or off duty, plus injuries caused by nuclear, chemical biological and radiological attacks - giving you our best ever cover. XPAX also pays cash if you are hospitalised following an injury and a lump sum payment to your estate† if you suffer a fatal accident. The table opposite gives some examples of the amounts payable dependent on the number of units selected. For a full description of all the covered injuries and amounts payable, please refer to the Table of Benefits under Part One - Personal Accident in the enclosed Policy booklet. XPAX Personal Accident Insurance doesn’t just cover you whilst you are on duty, it also covers you when you are off duty whether on leave, playing sports, on the road and in and around your home or anywhere else in the world. WHAT’S NOT COVERED • Death by suicide • Intentional self inflicted injury, suicide or attempted suicide • Fractures resulting from osteoporosis you knew about before the injury happened • Certain criminal injuries • War, whether declared or not, between the USA, France, the UK and any member State of the Russian Federation For a full description of what’s covered and what isn’t please read Part One (Personal Accident) of the Terms & Conditions section in the enclosed Policy booklet. EXAMPLES OF PERSONAL ACCIDENT INSURANCE COVER UNITS PERMANENT DISABILITY** FATALITY† 1 £20,000 max benefit £10,000 max benefit 5 £100,000 max benefit £50,000 max benefit 10 £200,000 max benefit £100,000 max benefit 15 £300,000 max benefit £150,000 max benefit ** Not all permanent disabilities are listed in the policy booklet but are included under item 15; the amount payable is dependent on the degree of disability as a percentage of the whole body. † The death benefit is paid tax-free to the deceased person’s estate, which then may be subject to inheritance tax. XPAX PERSONAL ACCIDENT INSURANCE EXTRA BENEFITS As well as providing cover for accidental bodily injury, XPAX Personal Accident Insurance comes with a number of additional benefits to help protect and assist you. And they all come as standard, regardless of how many units of cover you choose. Full details are included in the Policy booklet. LEGAL PROTECTION INSURANCE XPAX includes a Legal Advice Helpline, giving you advice including your rights, your prospects of receiving compensation and ways of paying for any action needed to claim for compensation within the laws of England, Wales, Scotland and Northern Ireland. Simply call the XPAX Customer Service Helpline and ask for the Legal Advice Helpline number. You’re also covered for legal fees and expenses up to £100,000 to help make CUS TO M E R S E RV IC E HE LP LI NE 020 8662 8102 (UK) +44 20 8662 8102 (OVERSEAS) a claim against someone who has injured you, no matter how many units have been bought. XPAX does not include this cover for your family. If you have selected the family cover option and your partner or spouse is also employed by HM Armed Forces, they can also benefit. WHAT’S NOT COVERED The cover is subject to some limitations and exclusions, the main ones are that there is no cover for • fines or other penalties, • Medical negligence or drug related claims. You can find full cover details including what’s covered and what isn’t in Part Four (Legal Protection) of the Terms & Conditions section in the enclosed Policy booklet PERSONAL LIABILITY INSURANCE If you’re off duty and you are found legally liable for accidentally injuring another person, or losing or damaging their property, XPAX Personal Liability Insurance will pay up to £500,000 for each claim for damages you have to pay, irrespective of the number of units purchased. We’ll also pay your costs and expenses relating to the claim if they have been previously agreed in writing by us. XPAX includes this cover for your family if you have selected the family cover option. WHAT’S NOT COVERED The Personal Liability cover is subject to some limitations and exclusions, the main ones are that there is no cover for: • War, rebellion or revolution, riot or civil commotion, • Any deliberate act by you, • Injury arising out of you using or owning firearms or mechanically powered vehicles, aircraft or watercraft, • Loss, injury or damage for which you must have insurance under Road Traffic legislation • Injury, damage or loss you maliciously, recklessly or intentionally caused, or resulting from a crime in which you have taken part • You carrying out your duties with HM Regular Armed Forces or another occupation. See the full cover details and what’s not included in Part Two (Personal Liability) of the Terms & Conditions section in the enclosed Policy booklet. SECOND OPINION MEDICAL SERVICE (for former members of HM Armed Forces only) If you’re concerned about the diagnosis or course of treatment recommended by your doctor or medical consultant, we’ll provide free access to some of the world’s top medical specialists who can discuss the diagnosis and treatment, and may suggest alternatives. The Second Opinion Medical Service is available for any medical condition, not just those covered by XPAX. You can access this service through the XPAX Customer Service Helpline. XPAX OPTIONAL LIFE & CRITICAL ILLNESS INSURANCE – VALUABLE COVER You know better than most that some things just can’t be avoided - however well prepared you may be. That’s why many service men and women choose to extend their cover to include the XPAX Optional Life & Critical Illness Insurance. Full details are included in the Policy booklet. This cover is only available if you take out XPAX Personal Accident Insurance The Optional Life & Critical Illness Insurance cover allows you to extend XPAX to include death by natural causes, the diagnosis of a terminal illness or a covered critical illness - heart attack - of specified severity, cancer - excluding less advanced cases or stroke - resulting in permanent symptoms. The amount payable is dependent on the number of Personal Accident Units purchased. The table opposite gives some examples of the amounts payable dependent on the number of units selected. For a full description of the cover, please refer to Part Three - Optional Life & Critical Illness Insurance in the enclosed Policy booklet. NO MEDICAL REQUIRED No medical examination is necessary. If you choose this option you just need to be able to truthfully answer ‘no’ to the two health questions detailed on the enrolment certificate and sign the health declaration - your cover is then automatic. If you can’t answer ‘no’ or you’ve got any questions, just give the XPAX Customer Service Helpline a call on 0208 662 8102 for help and advice on what cover can be given. Please see the What Next section at the end of this booklet for further application details. COVER FOR YOU AND YOUR FAMILY Your level of XPAX Optional Life & Critical Illness Insurance cover will be the same as the number of XPAX Personal Accident Insurance units you’ve chosen. If you’ve chosen the Family plan, your partner and children will also be insured (your children will be insured under the Individual plan if you’re a single parent). XPAX OPTIONAL LIFE & CRITICAL ILLNESS INSURANCE COVER XPAX OPTIONAL LIFE & CRITICAL ILLNESS INSURANCE OFFERS COVER FOR: Death by Natural Causes Death which is not caused by an accident. Terminal Illness cover In the event of terminal illness diagnosis of an advanced or rapidly progressing illness where, in the opinion of an attending consultant and our Chief Medical Officer, life expectancy is no greater than 12 months, we will pay the full death benefit. Critical Illness cover £4,000 will be paid for each unit of cover if you are diagnosed with: • cancer – excluding less advanced cases • a heart attack – of specified severity • a stroke – resulting in permanent symptoms (Please refer to the Policy definitions applicable to the Optional Life & Critical Illness C US TO M E R SE RV ICE HE LP LI NE 020 8662 8102 (UK) +44 20 8662 8102 (OVERSEAS) insurance for a full description of what is covered for these conditions.) Limitations There are some limitations to the cover, dependent on the circumstances, the key ones are as follows: The maximum we will pay for children aged over 28 days to 16 years old is £7,500 for death and £3,000 for a specified covered critical illness, no matter how many units have been bought. There is no cover for children under 28 days old. Once a critical illness benefit has been paid for an insured person, no further critical illness benefit is payable in respect of the same insured person. If you cancel the cover there is no return premium or amount payable as a surrender value. WHAT’S NOT COVERED Under the Optional Life & Critical Illness Insurance there are some things not covered. The key exclusions are: • Death by suicide within 12 months of the policy starting • Accidental death (as this is covered under Part One Personal Accident) • Children under 28 days old • A critical illness which is not a heart attack - of specified severity, cancer - excluding less advanced cases or a stroke - resulting in permanent symptoms. See the full cover details and what’s not included in Part Three (Optional Life & Critical Illness Insurance) of the Terms & Conditions section in the enclosed Policy booklet. WHO WE PAY In the event of a claim for death, we will pay the legal personal representative or executor acting on behalf of the deceased person. Otherwise we will pay the benefit to the insured person unless they are a child under 18 years of age when we will pay one of the parents insured by XPAX or we will pay their legal guardian. EXAMPLES OF OPTIONAL LIFE & CRITICAL ILLNESS INSURANCE COVER UNITS DEATH/TERMINAL ILLNESS CRITICAL ILLNESS 1 £10,000 max benefit £4,000 max benefit 5 £50,000 max benefit £20,000 max benefit 10 £100,000 max benefit £40,000 max benefit 15 £150,000 max benefit £60,000 max benefit WHAT NEXT? To get you and your family protected and living life full on with confidence, follow these simple instructions. Please make sure that you have read and understood the Policy terms and conditions prior to completing the Application Form. GETTING COVERED For XPAX Personal Accident Insurance • Select the number of units you want Call the XPAX Customer Services Helpline on 0208 662 8102 if you answer `yes’ to one or both of the declaration questions. You may be asked to complete a Health Questionnaire to help us decide whether we can offer Life cover. This will not affect the decision regarding Personal Accident cover. • Read, sign and date the Application Form and complete the Direct Debit mandate Premium payments will be taken on the 1st day each month until you tell us to stop your cover. TO INCLUDE XPAX OPTIONAL LIFE INSURANCE CHANGING AND STOPPING YOUR COVER Fill in Personal Accident and Life Insurance section (instead of the Personal Accident only section) With XPAX, you’re always in control. So, you can apply to change your cover at any time to suit your needs. Simply call the Customer Services Helpline to apply to reduce, stop or, within limits, increase your cover. • Fill in the Application Form Personal Accident Insurance only section • Choose either the Individual or Family plan • Choose either the Individual or Family plan and select the number of unit’s worth of cover that you want • Read, sign and date the Life Insurance Declaration if you can answer `no’ to the declaration questions. Use the envelope provided to send in the completed application form and DD mandate. Direct Debits can only be taken from UK based bank accounts. Keep your copy of the form together with the Policy booklet as evidence of your cover. C US TO M E R SE RV ICE HE LP LI NE 020 8662 8102 (UK) +44 20 8662 8102 (OVERSEAS) MAKING A CLAIM As soon as you think you may have a claim, contact the XPAX Customer Service Helpline on 0208 662 8102 (from the UK or +44 20 8662 8102 (from overseas) and request a claim form. WHAT ARE THE DOCUMENTS IN THE BACK? 1. Application Form You’ll need to fill this short form out to buy XPAX Personal Accident Insurance (and Optional Life Insurance). 2. Policy booklet This document contains the following items. • Pricing Table A full list of the XPAX Personal Accident Insurance and Optional Life Insurance premiums (monthly prices). • Policy Summary An overview of the key features of our insurance. Remember, these are NOT part of the Terms & Conditions, they are to give you an overview of the key features and limitations of the cover. • Terms & Conditions This sets out exactly what you can expect from the insurance you’re buying. You must agree to these Terms & Conditions before buying XPAX Personal Accident and Optional Life Insurance, so it’s important you read these through carefully. 3. Key facts Information about our insurance services. If any of these documents are missing, please call the XPAX Customer Service Helpline on 0208 662 8102 (UK) +44 20 8662 8102 (OVERSEAS).

© Copyright 2026