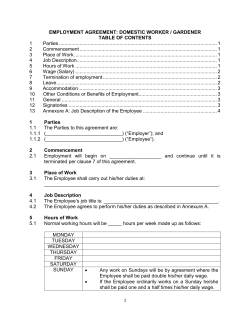

Document 242885