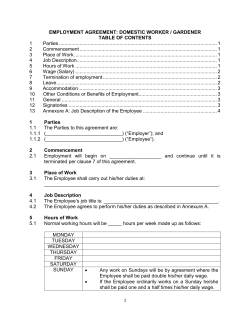

w or k i ng pa p ers