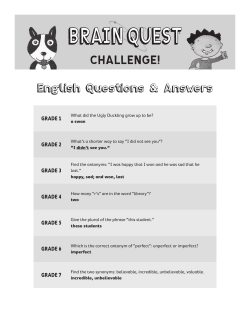

W R&D ?