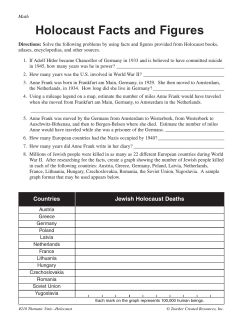

H U N G A R Y