Document 252341

Virginia State Corporation Commission

eFiling CASE Document Cover Sheet

Case Number (if already assigned)

PUE-2013-00011

Case Name (if known)

Document Type

OTHR

Document Description Summary

Expert Testimony and Report - Short Version .

Total Number of Pages

74

Submission ID

6810

eFiling Date Stamp

4/30/2013 4 :44 :26PM

IMA

W

PA

w

COMMONWEALTH OF VIRGINIA, ex rel.

STATE CORPORATION COMMISSION

CASE NO. PUE-2013-00011

Ex Parte: In the matter of investigating the toll

Rates of Toll Road Investors Partnership 11, L.P .,

Under § 56-542 D of the Code of Virginia

JOINT EXPERT REPORT OF

MR. ROBERT G. VAN HOECKE AND DR. A41CHAEL J. WEBB

April 30, 2013

I-A

W

REPORT CONTENT

1.

Introduction ...... . .. ..... . . . ...... . . .. .... .. . ..... . . . ...... . . ...... . . . . . ..... . . . ...... . . ...... . . ...... . . . ........ . . . ..... . . . ....... . . 2

H.

Purpose and Overview ...... . . ...... . . . ..... . . . ...... . . ...... . . . ..... . . . ...... . . .... ... . . ..... . . . ...... . . ........ . . . ..... . . . ... 3

M.

Appropriate Toll Standards Under §56-542 of the Virginia Code . . ..... . . . ...... . . ... ... .. . . . ..... . ... 4

A.

B.

C.

Relationship of Tolls and User Benefits . . . ..... . . . ....... . ...... . . . ..... .. . ........ ........ . . ...... . . . . 13

Tolls Must Not Materially Discourage Use of the Roadway .. . . . ...... . . ........ . ....... . . .. 16

Tolls Must Provide Operator No More Than a Reasonable Return . . . ...... . . . ..... . . . ... 19

1.

Reasonable Return Must be Determined Based on Costs .... .. ........ . . . ..... . . . . 19

Allowed Components of Return . . . ..... .. . ....... . ...... . . . .. ... .. . ...... . . ...... .. . . ...... . . . . 21

2.

3.

Return of Investment (Depreciation) . . . . ...... . . ...... . . . ..... . . . ...... . . ...... .. . . ..... . . ... 22

4.

Reasonable Return Must be Based on Prudent Investment . . . ........ . ....... . . .. 31

IV.

Preliminary Assessment of TRIP 11's Compliance with Relevant Criteria ... .. ...... . . . ..... . . . . 31

V.

Conclusion and Recommendation .. .. . ...... . . ...... . . . ....... . . . ...... . . ...... . . . ..... . ........ . . ...... .. . ..... . . . ... 39

I

PA

W

I.

INTRODUCTION

1.

We are Mr. Robert G. Van Hoecke and Dr . NEchael J . Webb . Mr. Van Hoecke is

a Principal with the firm of Regulatory Economics Group, LLC-a firm specializing in

economic and financial consulting to regulated entities . Dr. Webb is a Director with the

same firm. Our business address is 2325 Dulles Comer Boulevard, Suite 470, Hemdon,

Virginia 20171-4675.

2.

Mr. Van Hoecke has twenty-nine years of experience working for and providing

consulting services to regulated entities and has testified before state and federal

agencies, state and federal courts, and before domestic and international arbitral tribunals.

A detailed listing of Mr. Van Hoecke's qualifications is provided at Exhibit No. I - Dr.

Webb has sixteen years of experience providing consulting services to regulated entities.

He has filed testimony before state and federal agencies. In addition, Dr. Webb holds a

PhD in economics from George Mason University, and has taught courses in Law and

Economics, the Economics of Regulation, and the Economics of Energy to both graduate

and undergraduate students. Attached as Exhibit No. 2 is Dr. Webb's curriculum vitae.

3.

Upon learning of the investigation' initiated by the State Corporation Commission

("Commission") into the rate structure and rate level charged by Toll Road Investors

Partnership II, L.P. ("TRIP 11") in response to Delegate David I. Ramadan's complaint,

we met with Delegate Ramadan and offered to prepare an expert report based on our

Order Initiating Investigation, Docket No. PUE-2013-00011 (January 30, 2013).

2

I"

W

combined experience and expertise in regulatory matters . We are not being compensated

for our time analyzing these issues or preparing this report. 2

H.

PURPOSE AND OVERVIEW

4.

The Commission's authority to regulate TRIP 11's operation of the Dulles

Greenway was promulgated in the Virginia Highway Corporation Act of 1988 ("Act")

and is codified in §56-535 through §56-552 of the Virginia Code ("Code") . In its Order

Initiating Investigation of the rate structure and rate level charged by TRIP 11, the

Commission cites the statutory requirements of §56-542 D of the Code, which sets forth

three requirements the Commission will apply in this investigation. Specifically, the

Commission must ensure that tolls are set at a level : (1) "Which is reasonable to the user

in relation to the benefit obtained"; (2) "which will not materially discourage use of the

roadway by the public"; and (3) "which will provide the operator no more than a

reasonable return as determined by the Commission ."

3

Having determined that an

investigation was warranted, the Commission requested submissions to "address and

define with specificity the standards that the Commission should apply for each of these

three requirements ."

5.

The purpose of our report is to present relevant standards we believe the

Commission should consider when carrying out its investigation. At this juncture our

analyses have been limited to certain publicly available documents, however using this

information we will explain why, in our opinion, TRIP 11's current rate level and rate

structure are inconsistent with the statutory mandates defined above. We anticipate

In addition, neither of us resides nor works in Loudoun County .

Case No. PUE-2013-0001 1 . Order Initiating Investigation . Page 3

3

~A

W

through TREP 11's concurrent filing and the discovery process that more detailed

information will be forthcoming. For this reason we respectfully reserve the option to

supplement our submission and to respond to TRIP 11's anticipated evidence as relevant

.4

information becomes available in this proceeding

6.

In Section 1H below, we will address standards the Commission should consider

which will ensure that TREP H's tolls and toll structure meet the mandates established by

the Act. In Section IV we will provide comments on how these proposed standards

should be applied and to the extent information is available provide an illustration of their

application.

M.

APPROPRIATE TOLL STANDARDS UNDER §56-542 OF THE

VIRGINIA CODE

7.

Pursuant to the Act the Commission has the power to regulate TRIP H as a public

service corporation.5 The tolls charged by the TRIP H in performing its "public duties"

are governed within a broad framework characterized by three explicit factors.

Specifically, "the Commission, upon application, complaint or its own initiative, and

after investigation, may order substituted for any toll being charged by the operator a toll

which is set at a level:

which is reasonable to the user in relation to the benefit obtained and

ii.

which will not materially discourage use of the roadway by the public and

To the extent it is appropriate we may submit a reply report on July 9, 2013 in accordance

with the current procedural schedule.

§56-542 B

4

1-b

W

iii.

which will provide the operator no more than a reasonable return as

determined by the Commission ."6

8.

In evaluating the appropriate regulatory standards that the Commission should

consider when evaluating TRIP 11's toll levels and structure it is important to consider

how these three independent statutory requirements work together to establish a

comprehensive means of regulatory oversight. The statutory requirement that "[the toll]

will provide the operator no more than a reasonable return as determined by the

Commission"7 call for an examination of the operator's cost of providing the regulated

service when evaluating the tolls. Moreover, other statutory provisions in §56-542

clearly establish cost-based requirements to ensure : (1) that the operator's costs are not

improper or excessive;8 (2) that any contractual relationship with a closely associated or

affiliated entity are no less favorable than the operator than it could obtain in an arm's

length transaction;9 (3) rates shall be neither applied or collected in a discriminatory

fashion; 10 (4) that the price paid in connection with any ownership change does not

contribute to an increase in cost or tolls;" and (5) the use of any proceeds or funding

obtained by the operator from bond indentures or credit agreements are limited to certain

purposes-generally to build and maintain the physical plant or refinance any debt

previously incurred for this limited purpose.

6

§56-542 D

7

Emphasis added.

8

§56-542 C

9

§56-542 C

10

11

12

12

§56-542 B

§56-542 E

§56-542 G

5

These types of requirements, which in

I-A

W

general address cost reasonableness and prudency, are commonly imposed on public

service or infrastructure entities subject to economic regulation . This cost-based approach

to regulation is typically referred to as cost of service or rate of return regulation .' 3

9.

The cost of service approach to economic regulation is well established and has

been applied by regulatory agencies at the state and federal level for many decades. It is

based on the principle that the regulated entity is granted an opportunity to recover it's

reasonable and prudently incurred cost of providing the service, which would include a

reasonable return on its prudently made investment associated with the assets used to

provide the regulated service. 14 As Dr. Bonbright observed in Principals ofPublic Utility

Rates:

one standard of reasonable rates can fairly be said to outrank all others in

importance attached to it by experts and by public opinions alike--the

standard of cost of service, often qualified by the stipulation that the

relevant cost is necessary cost or cost reasonably or prudently incurred . 15

10.

An extensive body of economic literature and case law has developed to guide

regulatory agencies in established cost-based standards for setting rates that limit the

returns to a reasonable level . This guidance, which we find relevant for interpreting the

provisions of §56-542 D, is summarized as follows. First, the regulated entity should be

given the opportunity to recover prudently incurred operating expenses and investment .

To the extent the entity incurs imprudent costs, or makes imprudent decisions which

13

14

is

For purposes of this report we will refer to this as cost of service regulation.

We address the details of the appropriate cost of service standard below and evaluate

TRIP 11's current rates under this standard using publicly available information .

Bonbright, James C. Principles ofPublic Utility Rates New York: Columbia University

Press, 1961 . p.67 (emphasis in original) Also see, Alfred E. Kahn, "The Economics of

Regulation : Principles and Institutions" . The MIT Press : Cambridge, Massachusetts .

(1988) Volume 1, Chapter 2.

6

P

W

result in additional costs, these should not be included in the rates, nor should they be

reflected in the return. Second, the entity is only given an opportunity to earn a

reasonable return on investment, commensurate with other investments of similar risk

observed in the marketplace . 16 When determining reasonable return on investment (both

debt and equity), the Commission should identify the rate of return that similar entities of

comparable risk must offer both equity and debt investors in order to efficiently attract

17

the capital required to build the regulated assets . The Commission should then apply

the resulting weighted average cost of capital ("WACC") against the prudent level of rate

base (generally based on the depreciated level of investment used to provide the regulated

service) in order to detennine the maximum level of debt and equity return which is

reasonable. Regulated entities are not guaranteed a return nor are they guaranteed that

they will even recover their operating costs and make a profit .

18 Consequently, as a

general matter, regulatory agencies and the courts prohibit regulated entities from

engaging in retroactive ratemaking-taking costs which are properly incurred but not

16

17

Is

Federal Power Commission v. Hope Natural Gas Co., 320 U.S. 591 (1944) There is a

zone of reasonableness where the level of projected return can be neither excessive nor

confiscatory.

Provided the debt is arm's-length and has been provided by a non-affiliated party, most

regulatory bodies will accept a rebuttable presumption that the actual embedded cost of

debt is reasonable, absent a determination that the capital structure is not prudent or

representative of the market or risks. In addition, to the extend another entity, such as a

parent guarantees to provide recourse for the debt, most regulatory authorities look

through the regulated entity to that guarantor when determining the weighted average

cost of capital .

Market Street Ry. v. Railroad Commn., 324 U.S . 548 (1945)

1-4

W

recovered in one period and seeking to adjust rates in future periods to retroactively

recover those costs.' 9

11 .

Apart from being deemed improper by the courts, retroactive ratemaking causes

several problems when setting reasonable rates and evaluating the proper level of return

commensurate with the operator's risk. First, it can cause different generations of users

to bear different levels of cost responsibility for the same asset or regulated service (i.e.,

intergenerational inequity). Absent special circumstances this is inappropriate, just as it

would be inappropriate to unduly discriminate . In addition, setting current maximum

rates on the basis of costs which supported rates in prior periods effectively provides to

the regulated entity an opportunity to recover the same cost more than once. This

provides a form return surety, thereby reducing the operator's risk. If the reduced risk is

not properly reflected in the allowed rate of return-which is applied to the rate basethis can result in excessive rates or returns .

12.

In addition to the traditional cost of service requirements, which are essentially

captured in the requirement that "[the toll] will provide the operator no more than a

reasonable return" the Act does not limit the regulatory oversight of the tolls to a

traditional cost of service review, but went further to establish two additional independent

statutory requirements . These additional requirements work in concert with the

limitations of return to create a more comprehensive regulatory structure. These two

companion provisions require that tolls must be : (1) "reasonable to the user in relation to

the benefit obtained"; and (2) "not materially discourage use of the roadway by the

19

The courts have held that retroactive ratemaking is prohibited in determining cost of

service rates that provide no more than a reasonable return . See, Public Service Company

ofNew Hampshire v. FERC, 600 F.2d. 944 (D.C. Cir . 1970)

'A

P&

W

public" . As we explain below, the overarching statutory framework created by these

three criteria was designed to maximize the public benefit derived from the roadway.

13.

It is appropriate for the Commission to request input regarding "standards that the

Commission should apply for each of these three requirements" and to take this

opportunity to re-evaluate its past regulation of the Dulles Greenway. In recent years,

several community leaders and many local residents have raised numerous concerns that

the Dulles Greenway tolls are excessive and that its toll structure is not sensitive to the

distances users travel on the roadway .20 Despite public assurances from TRIP Il's

financial officer in 1999 that the Dulles Greenway was "on very solid financial ground

( . . . ) [w]e have had positive cash flow for some time, and with the [recent debt] closing we

now have a debt structure which matches our revenue stream" it is clear now that the

course that TRIP 11 envisaged has taken a wrong turn. 21 It is clear conditions have

changed which support a reconsideration of the prior standards used by the Commission .

14.

At the time of the prior assurances in 1999, the average toll was $1 .25, average

daily traffic had recently climbed to around 34, 00022_-due in part to toll reductions a few

1999.23 Annual revenues

years earlier which caused traffic to double between 1996 and

were just over $15 million and cash operating expenses before financing (i.e., total

20

21

22

23

In addition to Delegate Ramadan's complaint filed in this case, see e.g., Representative

Frank Wolf s letter to Loudon Elected Officials at Exhibit No.3, and Leesburg Today

news article regarding Representative Wolf s backing of Loudon Board of Supervisors

formal request for distance-based tolling at Exhibit No. 4.

See a newsletter from tollroadnews.com in May 1999, attached hereto as Exhibit No. 5.

Direct Testimony of Ashley Yelds on behalf of TRIP 11 in Case No. PUE-2006-0008 1 .

See page 55 of the Maunsell report in Exhibit No. 6 attached hereto .

Direct Testimony of E. Thomas Sines on behalf of TRIP 11 in Case No. PUE-200600081 . See Exhibit No. 7 attached hereto at page 6.

9

1~0

W

operating expenses less depreciation and interest expense) was about $8.5 million

resulting in positive cash flow from operations of $6 .6 million. The roughly $500 million

in debt, although much higher than the cost of the toll road property, had an average

interest rate of 7%, a AAA rating and was set to be repaid by 2036.

15.

Since that time conditions have changed. Ownership of TRIP 11 was transferred

to Macquarie Infrastructure Groups ("MIG") in 2005 . Significant toll increases over the

last six years have pushed the maximum two-axle toll from $2.70 in 2006 to $4. 10

currently- $4.90 during rush hour . Prior to the rate increases, average daily traffic

climbed to 61,185 in 2005. Most recent first quarter 2013 traffic statistics show the daily

traffic has averaged at 44,02 1 .

24

Revenues have increased almost five fold to $72.4

million. Cash operating expenses before financing have increased more than 70 percent

to $14.7 million. Yet due to the significant rate and corresponding revenue increases the

cash flow from operations (before depreciation and debt service) has increased almost

nine-fold to $57.7 million.25 Long-term debt has ballooned, reaching $958 million with

an extended term of 2056-prompting a recent downgraded by Fitch to BB+. 21 TRIP 11

requested and received a twenty-year extension on its toll road concession now through

2056 .

16 .

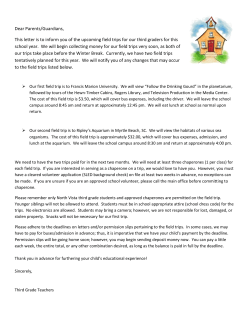

Table I presents the change in TRIP 11's positive cash flow from operations which

it described as "very solid ground" in 1999 as compared to a more recent period .

24

25

26

See Exhibit No. 6 at page 5 and page 56 of the Maunsell report contained therein, Exhibit

No. 8 at page 3 .

Compare TRIP 11's 2005 and 2012 financial statements attached hereto as Exhibit No. 9

and Exhibit No. 10.

See Exhibit No. I I

10

1-b

W

Table I

Toll Road Investors Partnership 111, L.P.

Cash Flow from Operations ($ millions)

Total Revenue

1999

15.1

2012

72.4

Total

1999 to 2012

681 .3

Cash Operating Expenses 1\

Revenue in Excess of Operafing Cost

8.5

6.6

14.7

57.7

213 .7

467.6

Source : Exhibit No . 12

1 1 Excludes Depreciation and Interest Expense

17.

The table above excludes cost associated with return-both the return of capital

(depreciation) and return on capital (debt and equity) which are related to the assets used

to provide the regulated service. In other words, the $467.6 million in cash flow from

operations represents the funds that have been collected over the past fourteen years that

were available to be applied to return . 27 As of the end of 2012, TRIP U's gross project

investment was approximately $435 million . The depreciation expense reported by TRIP

U during this period was $138 million. Consequently, even if one first assigns the

positive cash flow to the return of investment, $329.6 million in revenues were available

to be applied to costs associated with the return on investment (debt and equity) during

this period . However, since 2004 TRIP 11 has increased long-term debt by $442.8

million, from $515 .7 million in 2004 to $958.5 million in 2012 . During the same period

gross project investment only increased approximately $85.7 million, from $349.4

million in 2004 to $435.1 million in 2012 . This leaves almost $700 million dollars of

27

Assuming the Commission finds that all of the cash operating costs were prudent during

this period .

II

~-D

V-3

cash flow and proceeds from incremental debt that was not used to fund the construction

of physical plant or refinancing debt previously incurred for this purpose .

18 .

,J)

A

TRUP H has incurred significant levels of debt, more than three times the net book

value of the assets . TRIP H reports a current interest expense in excess of $64 million,

more than four times the annual operating costs and approximately twenty percent of the

current net value of the assets used to provide the regulated service. Notwithstanding that

the Commission extended its concession an additional twenty years to 2056. The level of

debt and debt service is not reasonable and is resulting in high tolls which appear to be

diverting traffic, causing significant congestion on other roads in the area and

undermining a primary purpose for granting the concession in the first place-to reduce

the need to expend public funds to increase the road capacity along this route. The

graphic below demonstrates that approximately 80 percent of the toll which users pay to

drive on the Dulles Greenway relate to the operator's debt.

28

IPMM

WM WO

t-MM

SAM

am

28

Accessed from the Dulles Greenway's website on April 26, 2013

12

0~

19.

It is appropriate for the Commission to reevaluate the standards that it will apply

when setting tolls. The Commission has the authority to reconsider decisions it has made

more than a decade ago, especially if current evidence suggests that those decisions are

no longer consistent with its statutory requirements established in the Act, or are not well

reasoned today given the current evidence . Conditions may change over an extended

time and ultimately the Commission should establish standards that meet the

requirements of the Act and are well reasoned based on the facts and circumstances of the

current proceeding. Therefore we support the recent Commission order requesting

submissions for standards that should be applied when setting tolls pursuant to the Act.

A.

20.

Relationship of Tolls and User Benefits

Delegate David Ramadan, Representative Frank Wolf and others have previously

requested that the Dulles Greenway tolls be adjusted to reflect travel distance. We

believe that the Commission should give strong consideration to imposing a standard that

requires tolls be established on a distance-basis, absent clear and convincing evidence

that an alternate structure is more efficient and results in greater public benefit .

21 .

Cost-based rates are generally established in the first instance based on the

principal of cost causation. In other words, costs that are caused by a particular class of

traffic or are associated with travel over a specific portion of a regulated entity's assets

should be assigned to those movements, or classes of traffic, for cost recovery purposes.

A motorist traveling westbound for only the short distance between the main toll plaza to

Route 606, less than 2 miles, derives little benefit from the remaining 12 miles of

roadway to Route 7 in Leesburg . Yet under the current toll structure these users are

13

1-b

W

likely regain traffic which TRIP II has diverted over the recent years due to high tolls,

albeit at a lower toll . The incremental traffic generates minimal incremental cost for

TRIP 11 and therefore additional traffic generated by the lower tolls should be profitable

for TRIP 11 on an incremental basis . Moreover, in the not too distant future the Silver

Line Metro extension is projected to be operation in eastern Loudoun County. The

absence of distance based tolls on the Dulles Greenway could lead to greater traffic

congestion on alternate routes .

26.

We anticipate that TRIP H may argue that shorter distance movements might

create congestion on the toll way. Currently the TRIP 11 has congestion based tolls which

the Commission approved in a prior proceeding . As we noted above, a significant level

of traffic has been diverted since the congestion-based toll structure was approved, the

average daily traffic count is down from 61,185 in 2005 to approximately 44,021 in first

quarter 2013 . It is highly likely that under the current traffic conditions, TRIP II cannot

support the need for a congestion surcharge . The Commission should require TRIP 11 to

provide a detailed traffic study to justify if congestion-based tolls are still warranted. If

after distance-based tolls are established significant congestion occurs on the Dulles

Greenway, TRIP 11 should be allowed to submit an application seeking congestion or

peak pricing, but only on those segments and during times when significant congestion

existing .

B.

27.

Tolls Must Not Materially Discourage Use ofthe Roadway

It is notable that in addition to the other criteria, the legislation provides that the

toll charged by the operator must not to "materially discourage use of the roadway by the

public" . This requirement is firmly based on the concept of maximizing the public

16

~A

W

benefit derived from the toll road and preventing an exercise of market power . If this

criteria was not in place, operator might exercise market-power by increasing rates above

a reasonable level a divert traffic and attempt to increase profits with less traffic . 32

28.

In fact, TRIP 11's presentations to investors demonstrate that this is exactly the

experience on the Dulles Greenway since 2008. Rates have increased and traffic has

been diverted to other routes, thereby increasing congestion on these roads . 33 However,

TRIP U's revenues have increased every year.

29.

This has contributed to the need for the Commonwealth's Department of

Transportation ("VDOT") to construct expanded capacity on bypass routes at public

expense.34 It is notable that this outlay in part duplicates capacity which already exists on

the Dulles Greenway . Notwithstanding VDOT's efforts to expand these alternate routes,

during the times when TRIP H charges congestion-based pricing these, alternate routes

face significant congestion . Despite the reduced traffic count on the Dulles Greenway,

TRIP H continued to increase its revenue, indicating that it may be charging rates which

reflect an exercise of market power. A century of economic theory and regulatory

precedent suggest that rates reflecting an exercise of market power imply an

unreasonably high return.

30.

Public service companies, like the Dulles Greenway, represent what economists

call a "Natural Monopoly". Specifically, Natural Monopoly is characterized by a firm

32

33

34

Decreasing quantity and increasing price represents the textbook example by which a

firm with market-power exercises this market-power .

See Exhibit No. 20.

See page 35 of Exhibit No. 21 noting capacity upgrades on alternative routes .

17

I-A

W

having substantial fixed costs and low variable costs. Once constructed, the Natural

Monopoly's low variable cost may provide it a significant market advantage over firms

wanting to enter the market.

It is important to recognize, however, that having market

power and being a monopoly are not equivalent. A firm with only one or two

competitors, especially if those competitors are capacity constrained, may possess a

substantial degree of market power and have the ability to charge prices and set quantities

(i.e. traffic on the road, as discussed above) at levels that do not produce optimal social

benefit. For these reasons, absent sufficient market forces to prevent the exercise of

market power, Natural Monopolies which provide a public service are often subject to

economic regulation, typically based on its cost of service 35

31 .

There are several reasons to believe that the Dulles Greenway does possess

market power. In certain investor presentations TRIP 11 indicates that they may have

market power. 36 Operator claims that congestion on alternate routes is increasing every

year and they as "well positioned to take advantage" of the increased congestion in the

future.

32.

One justification for requiring that tolls must not materially discourage use of the

roadway by the public is to maximize the public benefit from the road . Any mechanism

which allows the operator to take costs used to justify prior maximum rates and include

those costs tojustify future higher tolls may undermine this statutory requirement . This

35

36

If a firm with these characteristics were required to charge prices equal to marginal cost it

would become insolvent . As a result investors would not invest in this firm and society

would be worse off. However, the cost of service methodology described below balances

the interests of the users and the investors .

See Exhibit No. 20 at page marked "Exhibit 5"

18

~a

W

is because it removes any financial incentive for the operator to maintain reasonable tolls

that do not divert traffic or otherwise suffer the potential loss. In essence it provides

greater surety that the operator will recover its return despite actions it might take which

diverts traffic .

C

Tolls Must Provide Operator No More Than a Reasonable Return

I.

33 .

Reasonable Return Must be Determined Based on Costs

The Commission is not required to determine that the Dulles Greenway is a public

utility before it can impose a traditional cost of service (rate of return) regulatory

framework in setting its rates. First, the Act specifically envisions that the Commission

will limit the investor returns generated by the Dulles Greenway to a reasonable level .

Second, certificated public service corporations, such as TRIP II, are in effect granted the

opportunity to pursue business within the constructs of their enabling legislation and

governing code . As stated in §56-542 D, the operator is subject to a ceiling rate of return

set forth by the Commission ; it is provided "no more than a reasonable return" . Contrary

to positions that TRIP Il has articulated in the past the fact that it is not a franchised

monopoly, or lacked eminent domain authority when constructing the roadway, or

operates the roadway under a time limited concession does not provide any justification

for departure for traditional cost of service regulation, nor does it change the statutory

obligations of the Commission established in the Act. Other inftastructure-based

companies face similar challenges and are yet regulated on a cost of service approach .

Clearly each of these limitations were known when the Act was passed 37 and yet they still

37

The lack of eminent domain and limited concession period were actually established in

the Act. See §56-54 1, Eminent Domain; and §56-55 1, Termination of certificate;

dedication of assets.

19

~A

W

imposed a duty on the Commission to evaluate the reasonableness and prudency of TRIP

H's costs in order to limit the return to a reasonable level as one of three guiding

ratemaking principals .

34.

Consequently cost of service ratemaking provides a reasonable way to apply the

regulatory and economic concept underlying the provisions in the Act in evaluating the

TREP II's tolls. In this regard, TRIP H should be allowed the opportunity to recover its

prudently incurred cost of service, including a reasonable return on its depreciated

investment relative to the current period of operation. It should not be guaranteed a

return or cost recovery, nor should it be allowed to reflect any debt or financing costs in

its cost of service which was not directly related to construction or expanding of physical

assets used in providing the regulated toll road service. 38

35.

In the following section we provide a broad overview of the cost of service

standard the Commission should apply when examining the reasonableness of TRIP II's

tolls and rate structure. In the subsequent section, we also present an illustrative

calculation of TREP 11's cost of service under this approach based on publicly available

information. 39

36.

The Commission should evaluate the reasonableness of the Dulles Greenway rates

using a depreciated original cost ("DOC") cost of service methodology . This approach is

38

39

See §56-542 G

Given the lack of certain cost and traffic information in the public record we are not able

to verify the appropriateness or prudency of certain costs for inclusion in the operator's

cost of service . Therefore we believe that the attached computation likely overstates the

costs that should be included in setting tolls. To the extent we are able to obtain

additional information we reserve the right to update these calculations in order to

provide the Commission with a more complete record upon which to make its decision .

20

4

I-a

W

widely accepted by most state regulatory agencies that oversee the economic regulation

of public service corporations in the United States . In general, a DOC cost of service is

comprised of four main elements ; (1) prudently incurred operating expenses; (2) an

allowed return of the asset base ; (3) a reasonable allowed return on the deprecated value

of the existing asset base ;40 and (4) a provision of income taxes.

37 .

To the extent a Commission is setting forward looking rates, as opposed to

reviewing past cost recovery, they should examine actual costs over a recent twelve

month period ("base period") and adjust these costs to remove any imprudent costs. In

addition, any non-recurring cost incurred during the historical period may need to be

removed or amortized to the extent the Commission determines that is appropriate. In

addition, because the rates are being set for a future period, the Commission should

consider if there are any "known and measureable" changes anticipated in the cost or

traffic in the near term, e.g., over the next nine months. If so, appropriate adjustments

should be made in order to determine a rate that will provide the operator with an

opportunity to recover its projected cost of service .

2.

38 .

Allowed Components of Return

The reasonable return noted under §56-542 D is to be "determined by the

Commission ." In a regulatory environment the notion of "return" is comprised of two

components. First, a regulated entity may charge rates that include a return of capital,

which is represented by depreciation expense reflected over the useful life of the asset.

Second, a regulated entity may charge rates that include return on capital. The return on

capital is calculated by determining a reasonable capital structure (i.e. debt and equity

40

This is commonly referred to as "rate base".

21

0)

a

PA

W

ratio). Once this is determined the allowed return on investment is determined by

applying a weighted average cost of capital ("WACC") to the net rate base. The WACC

is determined by multiplying a reasonable cost of debt by the debt percentage and a

reasonable cost of equity by the equity percentage .

39.

The net rate base represents the depreciated cost of the assets used to provide the

regulated service. Under cost of service the interest expense from the operator's income

statement is replaced with an allowed debt and equity return on investment when

determining the reasonable level of costs . Standards for determining a reasonable rate of

return should be guided by the principle that firms and even projects within firms must

compete for capital . Within the regulatory context, this means that a reasonable rate of

return will provide the regulated firm with a return on capital equivalent to the return it

would have earned on projects of similar risk

. 41

Return of Investment (Depreciation)

40.

Depreciation represents the return of the cost incurred in the construction of

physical assets used in regulated service. The depreciation expense represents the

opportunity for the regulated entity to recover this return based on the allocation of this

cost to specific periods in which the assets are used. Regulators typically require

depreciation of regulatory assets to be performed on a straight-line basis over their useful

lives. However, to the extent the regulated entity can demonstrate that an alternate form

of depreciation is more appropriate, or that a significant difference exists between the

economic life and physical life of an asset, they may seek approval to adjust the method

of depreciation . If the projected economic or physical lives of the assets materially

41

Federal Power Commission v . Hope Natural Gas Co., 320 U.S . 591 (1944)

22

change while in regulated service, regulators should require the regulated entity to

perform a depreciation study and seek approval to prospectively adjust the depreciation

factors based on the new information .

41 .

TRIP 11's depreciation expense used to establish tolls should only reflect prudent

investment associated with assets that provide regulated service to the users. To the

extent TRIP H has invested in capital that is not providing regulated service or has made

imprudent investment in capital, even if it is providing regulated service, any depreciation

cost above the level of prudent investment reasonably required to provide the regulated

service should be excluded from the tolls.

42.

TRIP 11's depreciation expense should be computed on a straight-line basis using

the lesser of the physical life of the asset or its economic life. The maximum economic

life for TRIP H must consider the number of years remaining in its concession period .

Based on TRIP U's current net investment of approximately $270 million and its current

depreciation expense of $9.65 million per year, the existing assets are projected to be

fully depreciated in approximately 28 years (i.e., 2040), which is well before the end of

the new concession period .

43.

The Commission has recently extended TRIP H's concession period through 2056 .

As such any current assets which will continue to provide service beyond the original

concession termination date may need to have their depreciation factors adjusted to

reflect the extension of their economic life.

a.

Reasonable Return on Capital Funded by Debt

23

W

W

44.

The interest expense found in TRIP H income statement is not appropriate for cost

of service purposes. As the shown graphic above demonstrates approximately 80 percent

of the tolls users pay is related to the operator's debt . The amount of existing debt is

more than three times TRIP H's net assets, resulting in excessive interest expense. Under

a cost of service standard the Commission computes a reasonable debt return based on

the debt costs and the percentage of rate base that is reasonably funded by debt .

45 .

Excessive interest expense should not be included in the toll rates charged to users

pursuant to §56-542 C, which states :

[Tlhe Commission shall review the [annual] report and other such

materials as it deems necessary for the purpose of determining improper or

excessive costs, and shall exclude from the operator's costs any amounts

which it finds are improper or excessive .

46.

In addition, §56-542 E indicates that if there is a change in ownership, as occurred

when MIG acquired TRIP II in 2005,

[T)he Commission, in any subsequent proceeding to set the level of a toll

charged by the operator, shall ensure that the price paid in connection with

the change in ownership or control, and any costs and other factors

attributable to or resulting from the change in ownership or control, if they

would contribute to an increase in the level of the toll, are excluded from

the Commission's determination of the operator's reasonable return, in

order to ensure that a change in ownership or control does not increase the

level of the toll above the level that would otherwise had been required

under subsection D or subdivision 1 3 if the change in ownership or

control had not occurred .

47.

The dramatic increase in debt since 2004 has lead to an increase in the interest

expense TRIP Il asserts should be considered when setting tolls. TRIP 11's interest

expense was just over $33 million in 1999 . This increased to $43.9 million in 2004 prior

to MIG's acquisition. In 201 1 and 2012, TRIP 11 reported interest expenses of $66.2

24

W

million and $64.8 million, respectively . The Commission should investigate the extent to

which this change in control may have resulted in the increase in costs TRIP 11 is

reporting .

48.

In addition, the Commission should investigate any evidence that might indicate if

TRIP 11 has an affiliated or closely associated relationship with any debt holder . The

legislation explicitly states that; during the course of its annual review of the operator's

costs Commission shall;

Included in [the course of the annual review] shall be consideration of

contractual relationships between the operator and individuals or entities

that are closely associated or affiliated with the operator to assure that the

terms of such contractual relationships are no less favorable or

unfavorable to the operator than what it could obtain in an arm's length

transaction . §56-542 C

Absent a cost of service standard, allowing debt beyond that needed to build or expand

capital assets opens the door for TRIP 11 to circumvent regulatory oversight by over

levering the assets and potentially paying their affiliate an unreasonable rate of interest.

49.

The cost of service requirement to set the debt return based on the portion of rate

base funded by debt is consistent with §56-542 G which would limit any debt service

included in tolls to that debt which funded capital ;

The proceeds and funding provided to the operator from any future bond

indenture or similar credit agreement must be used for the purpose of

refinancing existing debt, acquiring, designing, permitting, building,

constructing,

improving,

equipping,

modifying,

maintaining,

reconstructing, restoring, rehabilitating, or renewing the roadway

property, and for the purpose of paying reasonable arm's-length fees,

development costs, and expenses incurred by the operator or a related

individual or entity in executing such financial transaction, unless

otherwise authorized by the Commission .

25

W

IA

W

If TREP H is able to include in its rates amounts of debt that was not used to build toll

road assets, or refinancing at a lower rate existing debt previously issued to build toll road

assets~ TRIP 11 has unlimited ability to increase rates by simply securing more debt. This

ability is only capped by the coverage ratios imposed by third parties-a result that

reflects bond holders' perceived risk that such abuse may lead to loss on their notes. In

other words, the ability to include in its rates unlimited amounts of debt would effectively

allow TREP 11 to set tolls that would be otherwise unreasonable, thereby evading

regulation . A cost of service standard avoids this problem.

50.

A new regulatory provision effective January 2013 through January 2020 which

instructs the Commission under certain conditions to increase the inflation index applied

to existing tolls if the future tolls are not sufficient to permit the operator to maintain

coverage ratio set forth in the rate covenant provisions of its bond indenture or similar

credit agreement.42 First, the extent to which this provision applies should be limited by

the other existing provisions of the Act. The Commission should only adjust tolls under

this provision to the extent required to meet reasonable debt ratios related to debt

proceeds that were actually used to construct the assets used to provide the regulated

service. In addition, the Commission must also determine that: the level of debt, and its

covenants, are prudent; that any increase in the debt or coverage requirements are not the

result of the prior change in ownership or control ; and any debt held by related parties

reflect terms that are no less favorable than those that could be obtained from unrelated

parties . Absent these standards, or toll set strictly on a cost of service basis, TRIP 11 has

42

§56-542 1 (3)

26

11-A

the potential to unreasonably increase or maintain excessive tolls by issuing excessive

and imprudent debt or by agreeing to overly restrictive coverage ratios .

51 .

Under a cost of service approach the level of debt return permitted in setting

maximum rates is based on the size of the net rate base, the percentage of the rate base

funded by debt, and the reasonable level of debt cost required to attract sufficient debt

investors to provide a level of funds consistent with the debt portion of the rate base . In

this regard, cost of service does not include interest expense that is reflected on the

operator's income statement, but instead reflects a reasonable cost of debt for the portion

of the rate base presumed to be funded by debt.

52.

TRIP 11's debt is more than three time net investment . Consequently, its interest

expense appears excessive given the level of investment in assets used to provide the

regulated service. In addition, its balance sheet suggests that the operation is funded

entirely by debt. There is no indication that MIG contributed any equity to TRIP H

during the 2005 acquisition. On the contrary there appear to have been approximately

$90 million in debt proceeds distributed as a return of capital in 2005 . If a regulator

determines that the actual capital structure of an entity is not reasonable or is not

consistent with market-driven capital structures of similar enterprises it will often impute

a capital structure and cost of debt which it believes is reasonable for purposes of

computing a cost of service.

53 .

In Section IV below we apply a cost of service to TRIP II's 2012 financial results

and we impute a capital structure which is 50% debt and equity. In doing so we have

accepted for the sake of the presentation the actual debt cost associated with TRIP Il's

27

I-A

W

existing long-term debt, roughly 6.36 percent, although we note the Commission may

want to consider if TRIP 11's leveraging effects the level of this cost. This assumption

regarding the capital structure actually increases the overall weighted average cost of

capital we apply in our calculation for two reasons . First, the cost of equity is estimated

to be higher than the cost of debt. Second, we provide TRIP II an allowed income tax

allowance on the equity return based on the maximum statutory federal and state tax

rates.

b.

54.

Reasonable Return on Capital Funded by Equity

In the past the Commission has allowed TRIP II to set its current maximum tolls

based in part on its allowed return . It also appears that in its prior examinations the

Commission has considered past earnings when evaluating the current maximum rates

under a mechanism known as the Reinvested Earnings Account ("REA"). It appears that

the operator has asserted that it should be allowed to not only carry-forward costs that

were used to justify prior rates, but is also allowed to compound additional return in the

form of "interest" when computing the past unrecovered allowed return . The REA

approach in combination with an unreasonably high allowed return on equity results in

excessive levels of proposed allowed equity returns

. 43

As we discussed above, allowing a

regulated entity to use the same cost to justify maximum rates and return in two different

periods is considered retroactive ratemaking and has been prohibited by regulatory

agencies and ruled improper by the Courts . It is inconsistent with the basic tenets of costbased regulation and may create certain intergenerational equity concerns that future tolls

43

See the revised REA exhibit attached to the testimony of Mr. McKean, submitted on

behalf of TREP 11 in Case No. PLJE-2006-0008 1, attached hereto as Exhibit No. 22.

28

P

W

might violate the non-discrimination provision of the Act. We do not believe this

approach is reasonable and have concerns that it will result in excessive tolls.

55 .

In the initial rate proceeding the Commission allowed TREP 11 to set tolls based on

surprisingly high 30 percent return on equ

ity.44

At no point in our extensive regulatory

backgrounds, have either of us heard of a regulatory body granting an allowed return on

equity this high . As a point of reference, comparable allowed returns for natural gas and

oil pipelines, two regulated infrastructure industries that face much greater risk than TRIP

H, will generally average betwetri nine and thirteen percent depending on market

conditions . Moreover, the allowed returns in these industries are not guaranteed . The

operator is not allowed to carry-forward return that the regulatory agency determines is

allowed and permitted to be recovered in one period into a subsequent period .

56.

TRIP H's original investment in the Dulles Greenway appears to have been

funded with approximately I I% equity-$40 million in equity and $3 10 million in debt .

By the end of 2005, TRIP H asserts that it net equity investment was roughly $55 million.

At the same time its balance sheet indicates that the partner's equity was a negative

$333 .5 million. Despite the relative low percentage of project investment funded with

equity, TREP II claims that in 2005 it has $1 .18 billion in retained equity which must be

considered when evaluating the reasonableness of its requested toll increase. 45 This is in

44

45

As a point of reference, this level of return is roughly equivalent to the average annual

return Microsoft has earned since 1987. Given that the Dulles Greenway is a regulated

enterprise and does not involve innovative technology, it is difficult to reconcile the

notion of a reasonable return with allowing TREP Il to earn a 30% return per annurn .

See Exhibit No. 22.

29

addition to the interest expense TRIP 11 computes on roughly $855 .6 million of long-term

debt.

57.

This approach allows TREP 11 to claim a REA and interest expense associated

with long-term debt which is more than three times the net project investment. We

believe such an approach fails to provide any meaningful oversight to ensure that the tolls

are reasonable and that return is not excessive .

58.

TRIP H has had an opportunity for seventeen years to recover any return that it

may reasonably been entitled to during its early operation. In addition, the Commission

has recently extended the TRIP 11's concession until 2056, in essence granting the

operator a remaining concession period which was longer than the original concession

term . There does not appear to have been any substantial investment in the project

investment or improvement in the quality of service that would support the need for an

extended period to recover the actual investment . This action appears to provide TRIP H

additional assurances and opportunities to recover its return and potentially imposes more

imprudent costs on the users. The combination of high allowed returns in prior decisions,

potential retroactive ratemaking through the use of the REA concept, inclusion of interest

expenses from debt not used to fund project investment and the extended concession

period are all inconsistent with the requirement that the tolls and return be limited to a

reasonable level. Conditions have changed and the Commission should establish new

standards addressing those changes in order to meet the requirements of the Act.

59.

Under a cost of service approach an operator is allowed an opportunity to earn a

reasonable equity return based on the size of the net rate base, the percentage of the rate

30

base funded by equity, and the reasonable level of equity cost . The last factor is based on

comparable investments of similar risk so the entity is able to attract sufficient equity

investors to provide a level of funds consistent with the equity portion of the rate base .

60.

As we noted above, the existing TRIP 11 capital structure appears to contain too

much debt therefore for cost of service purposes we have assumed a market-based capital

structure of 50% equity . We have also assumed that an appropriate equity rate of return

should be not greater that the equity returns currently being earned by publicly traded

hazardous liquid pipelines . These companies provide a common carrier infrastructure

service and face much greater risks than TPJP 11.46

4.

61 .

Reasonable Return Must be Based on Prudent Investment

The proper interpretation of "reasonable return" should be based only on prudent

investment . In addition, the requirement of §56-542 C that the operator's cost must not

be improper or excessive would suggest that any cost caused by debt issuance and

affiliate relationships must also be found reasonable before it could be included in the

tolls .

IV.

PRELIAHNARY ASSESSMENT OF TRIEP U'S COMPLIANCE WITH

RELEVANT CRITERIA

62.

In the following section we present an illustrative calculation of a cost of service

for the Dulles Greenway under the DOC cost of service approach based on publicly

available information. For purposes of this illustration we are using information reported

in TRIP U's 2012 financial reports. As we noted above, these costs should be adjusted to

46

These proxy companies are listed in Exhibit No. 23 at page 3

31

1-h

W

remove any imprudent or non-recurring costs. In addition, the impact of any known and

measurable changes in costs should also be considered in setting a forward looking rate .

We anticipate TRIP II will identify any ftiture changes in costs in its direct case.

63 .

For proposes of our analysis we using the actual cash operating expenses that

TRIP H reported in its 2012 income statement (i.e., this excludes depreciation and interest

expense-debt return, which is addressed below) .

64.

The next step is to estimate the net value of the assets used to provide regulated

service. We generally refer to this as rate base . The rate base can consists of several

elements: (1) Property in Service; (2) Allowance for Funds Used during Construction

("AFUDC"); (3) Accumulated Depreciation ; (4) Amortization of AFUDC ; (5) Working

Capital ; (6) Accumulated Deferred Income Taxes ("ADIT").

65 .

Property in Service is a key component of the DOC rate base . It represents the

actual gross cost to construct or acquire the capital facilities (i .e., the physical long-lived

fixed assets) used to provide the regulated service. Most state regulatory bodies require

that the property in service be based on the original cost to construct the assets .

Operators are generally not allowed to write-up the cost of assets acquired from others

which were already in regulated service. As such, the change in ownership of regulated

assets between two parties would not lead to an increase in cost or rates as the result of

the acquisition price the buyer paid for the assets . Virginia Code §56-542 E indicates that

the Commission :

[S]hall ensure that : the price paid in connection with the change in ownership or

control, and any costs and other factors attributable to or resulting from the

change in ownership or control, if they would contribute to an increase in the

32

I-A

W

level of the toll, are excluded from the Commission's determination of the

operator's reasonable return, in order to ensure that a change in ownership or

control does not increase the level of the toll . . .

66.

In preparing the 2012 cost of service for TRIP H attached hereto as Exhibit No.

23, we estimated a gross project investment of approximately $435 million of project

investment based on Note 3 to the TRIP Il's 2012 financials .47 In addition we add to the

project investment the gross amount of fixed assets, approximately $1 .6 million,

associated certain furniture, fixtures, office equipment and vehicles on the assumption all

of these are used to provide regulated service and should be included in the rate base.

67.

We were not able to verify at this point if this figure includes any write-up of the

assets due to the 2005 change of control. To the extent they do, the write-up should be

removed . 48 In addition, we assume that the assets listed on the financial statements

represent facilities that only provide regulated service. If this is not the case, then an

adjustment would need to be made to remove any assets not used in providing the

regulated service on the Dulles Greenway .

68.

The notes to the financial statements indicate that the project investment costs

reflect all direct and indirect costs related to the acquisition, development and

construction of the project. Because the project investment cost includes all direct and

indirect costs related to the acquisition, development and construction of the project, we

have assumed any cost of capital incurred during the construction of the roadway was

capitalized in the project investment figures discussed above and therefore we have not

attempted to break out any AFUDC .

47

48

See Exhibit No. 10

Pursuant to §56-542 E

33

4

.0

A

PA

W

69.

The accumulated depreciation for the project investment as of year-end 2012 is

reported to be approximately $165 million" and $1 .3 million for fixed assets.50 Since the

cost of capital during construction is capitalized in the project investment, we assume that

the amortizations of these amounts are reflected in the accumulated depreciation balances

that the operator has provided .

70.

A regulated entity is typically allowed to include certain items relating to working

capital in its rate base ; primarily prepayments and certain inventory costs related to

operations. The year-end 2012 balance sheet provided in the financial records submitted

to the Commission indicates that the operator incurred approximately $542 thousand in

prepaid expenses related to operations . We include this amount in the cost of service

calculation. We have not included any prepaid bond insurance or deferred bond issue

cost. These reflect costs associated with long-term debts which are amortized to interest

expense over the term of the financing agreements . These costs represent the cost of debt

financing and not working capital associated with operating the toll road .

71 .

Generally regulated entities are required to compute any tax timing differences

that are created between applying an accelerated tax depreciation factor as compared to a

straight-line book depreciation factor. This timing difference, the accumulated deferred

income tax ("ADIT") is typically determined by applying the maximum statutory state

and federal income tax to the depreciation timing difference generates by applying the

accelerated tax and straight-line book depreciation factors . Under a cost of service

approach the operator is required to recognize the value of any tax timing difference as an

49

50

See Exhibit No. I O at note 3

See Balance Sheets at Exhibit No. 10

34

A

W

offset (i .e., reduction) to the net value of the rate base . TRIP 11 is a pass-through entity

and as such these timing differences accrue to the benefit of its owners. Even in a period

when TRIP 11 reports a net tax loss to the individual investor, these tax deductions can

still serve to further reduce the investors' tax obligation . We advocate that when dealing

with pass-through entities the appropriate method for determining ADIT is to consider

the potential tax obligation of the investor (i.e., determine a weighted average tax rate for

computing ADIT based on the income assignment to each investor and that investor's

expected maximum statutory tax rate) .51 Because TRIP 11 is a pass through entity its

financials do not provide an ADIT balance or enough information to compute such a

balance. Consequently, we have not reduced the rate base in the attached schedule to

account for any ADIT and therefore believe our rate base is over-stated by this amount.

72.

We computed the 2012 end of year rate base by taking the gross project

investment and fixed assets less the associated accumulated depreciation plus working

capital. If additional information becomes available we would also propose to reduce this

balance by the accumulated deferred income tax balance. As presented in Exhibit No. 23

we estimate based on publicly available data that TRIP 11's rate base is no greater than

$273.8 million.

73 .

Once we have determine the appropriate rate base, the allowed return on rate base

can be computed by identif~ing a reasonable after-tax cost of equity and debt and

computing an allowed weighted average cost of capital ("WACC") as follows :

51

This is consistent with our position that part of the operator's cost of service should

reflect a tax allowance. Since TRIP 11 is a pass-through entity, and does not directly pay

any taxes itself, we would compute the tax allowance abased on the maximum allowed

after-tax equity return and the weighted average tax rate for TRIP 11's investors, the

parties that ultimately face the tax obligation .

35

A

~A

W

a

(After-tax Cost of Equity x % of Rate Base funded by Equity)

+ (Cost of Debt x % of Rate Base funded by Debt)

74.

The WACC is applied to the rate base to determine the maximum allowed overall

return - both debt and equity which the Commission will use to determine the maximum

tolls . In determining the WACC it is important that the cost of debt and after-tax cost of

equity represent the risks inherent in the operation of the regulated entity .

75 .

The debt cost used in the WACC must represent a reasonable cost of debt

associated with debt used to construct the assets in the rate base . For purposes of our

calculations we have accepted TRIP U's embedded cost of debt of 6.34% for the current

debt instruments. 52 The Commission should determine if TRIP 11's cost of debt would be

less if it had not issued debt more than three times its net book value. Macquarie

Infrastructure Groups' presentation to its investors indicates that other toll roads in its

portfolio may have a lower cost of debt. 53

76.

Based on our review, it appears that the initial investment in the Dulles Greenway

was funded with only $40 million in equity and $310 million in debt. By 2004, the year

prior to MIG's acquisition, the net book value for the project investment was

approximately $258 .5 million, total assets of roughly $384 million, long-term debt was

approximately $515 .7 million and investor equity was negative, ($202.9) million . 54 In

52

53

54

See Exhibit No. 23 at page 2

See Exhibit No. 21 at slide 29

Financial statements for these periods are not publicly available. A review may be

needed to determine the extent and sources of any equity partner distributions or

contributions that may have occurred during this period.

36

1-a

W

September 2005, MIG acquired 100% interest in the TRIP H, reportedly agreeing to pay

$617.5 million, an amount value that is greater than the total asset value.55 MIG assumed

the existing debt and issued additional debt to bring the total long-term debt at year-end

to more than $855 million . 56 There is no indication on the 2005 cash flow statement that

any investors made an additional equity contribution as part of the acquisition . On the

contrary, during 2005 TRIP H received proceeds from debt in excess of $390 million and

despite reflecting a net income loss in excess of $41 million on the income statement and

only generating $22 .4 million in positive operating cash flow, TRIP 11 distributed almost

$90 million as return of partner capital .57 Consequently, it seems highly likely that the

proceeds for the 2005 bonds were used to fund capital distributions to the investors . In

addition, certain partners were paid $11 million out of the loan proceeds relating to work

they performed in connection with extending the Certificate of Authority and issuing the

2005 Senior Bonds . 58

77 .

Due to the significant leveraging the balance sheet reflects negative equity and it

appears that TRIP H's capital structure is 100% debt.59 In certain situations when a

regulator deten-nines that the capital structure is imprudent and does not reflect

reasonable conditions, it can impute a capital structure for purposes of determining a

reasonable level of return . We believe that is appropriate in this instance.

55

56

57

58

59

Exhibit No. 24

Exhibit No. 9 at note 7

See Exhibit No. 10

This is reflected as an expense on the income statement and contributes to the net loss

that year. Exhibit No. 10 at note 9

Base on our review of Macquarie's report to investors it appears that TREP Il's debt is not

guaranteed by, or has recourse back to, its parent company . See Exhibit No. 21 at slide 9.

37

1-4

W

78.

Based on the average market dfiven capital structures and rates of return observed

for publicly traded oil pipeline companies, we have estimated that a reasonable capital

structure is approximately 50/50 debt/equity and a reasonable return on the imputed

equity is currently 10 .97% '0

79.

Based on these assumption the WACC of 8 .65% is derived by taking the 50%

debt capital structure times TRIP 11's 6.34% cost of debt and summing it with the product

of the imputed 50% equity capital structure and the estimate market-driven after-tax

return on equity of 10.97%.

80.

Multiplying the WACC against the $270.9 million rate base results in an allowed

after-tax return of $23 .4 million.

81 .

We estimated a tax allowance required on the equity portion of the return

assuming that the investors all pay the maximum statutory tax rates of 35% federal and

5 .75% for Virginia state income taxes. The results in an effective tax rate of 38.7% and a

tax allowance on the imputed equity return of $9 .4 million.

82.

The following table aggregating the individual elements for the cost of service

together to determine the maximum revenue requirement that should be allowed when

computing tolls for TREP 11.

60

We believe that these companies actually face greater operating risks that those

encountered by TRIP 11 and therefore these proxy estimates most likely overstate the

level of return TRIP II should receive .

38

)-A

W

0

Ok

A

Table 2

Toll Road Investors Partnership H, L.P.

Operating Expenses (Excl. Interest & Depreciation)

Return of Capital (Depreciation)

Return on Capital

Tax Allowance

Total Cost of Service

($000s)

14,652

9,652

23,443

9,396

57,142

Source : Exhibit No. 23, Page I

83 .

This maximum revenue requirement should be allocated over the vehicle road

miles traveled on the Dulles Greenway to determine distance-based tolls that are

reasonable . We currently do not have detailed usage data for the Dulles Greenway to

illustrate this calculation. We believe the Commission should require TRIP 11 to produce

such information and that absent its production the Commission should impose distancebased tolls based on the length of the movements in proportion to the $4 . 10 toll for a 14

mile movement, or the maximum toll the Commission determines is reasonable-

whichever is less .

84.

Total revenues in 2012 were more than $72 million, which indicates that the rates

are providing revenues in excess of the cost of service. This suggests that the current

level of returns is not reasonable .

V.

CONCLUSION AND RECOMAMNDATION

85 .

Per the Commission's request for submissions, the foregoing addresses and

defines with specificity the standards we believe the Commission should apply to an

investigation under §56-542 D of the Code of Virginia .

39

~A

W

86.

The criteria that the toll "will provide the operator no more than a reasonable

return" and "will not materially discourage the use of the roadway by the public" support

a cost of service approach . We have explained the cost of service standard and provided

an analysis of TREP H's financial results under the cost of service approach. Based on

publically available information, the preliminary results demonstrate that the current level

of return is not reasonable . In addition, the criterion that the toll should be "reasonable to

the user in relation to the benefit obtained" supports the application of a distance-based

rate design standard .

87.

In summary, we conclude that the three concurrent criteria in §56-542 D are

properly interpreted as cost of service regulation and distance-based rate design . Should

in the course of this proceeding further relevant information become available, we

respectfully reserve the option to supplement, modify or extend the content of this report .

40

A

COMMONWEALTH OF VIRGINIA, ex reL

STATE CORPORATION COMMISSION

CASE NO. PUE-2013-00011

Ex Parte: In the matter of investigating the toll

Rates of Toll Road Investors Partnership II, L.P.,

Under § 56-542 D of the Code of Virginia

STATE OF VIRGINIA

TOWN OF HERNDON

Before me, a Notary Public in and for the aforesaid jurisdiction, personally

appeared Robert G. Van Hoecke who, being by me first duly sworn, did depose and say

that he is the individual who prepared with Michael J. Webb the Joint Report of Mr.

Robert G. Van Hoecke and Dr. Michael J. Webb to be submitted to the above captioned

docket, and that the facts stated therein are true to the best of his professional knowledge

and belief .

Robert G. Van

Subscribed and sworn to me on thisac&day of

2013.

§46tary Put4ic-

I-A

W

COMMONWEALTH OF VIRGINIA, ex reL

STATE CORPORATION COMMISSION

CASE NO. PUE-2013-00011

Ex Parte: In the matter of investigating the toll

Rates of Toll Road Investors Partnership H, L.P.,

Under § 56-542 D of the Code of Virginia

STATE OF CALIFORNIA

CITY OF SAN FRANCISCO

Before me, a Notary Public in and for the aforesaid jurisdiction, personally

appeared Michael J. Webb who, being by me first duly sworn, did depose and say that he

is the individual who prepared with Robert G. Van Hoecke the Joint Report of Mr.

Robert G . Van Hoecke and Dr. Michael J. Webb to be submitted to the above captioned

docket, and that the facts stated therein are true to the best of his professional knowledge

and belief.

A%N~41F VeWM1 D,---I

,~~ael

SAN FRANCISCO, CA

Subscribed and sworn to me on this

MARLYN ANO

comm. 0 20OM9

NOTARY PUBW - GUgM

SM FRANC= CoLan

MyC0M-Wfe9Ahft21,2017

Le=LM

day of

A

2013 .

Notary Public

EXHIBIT NO. 1

I-A

W

ROBERT G. VAN HOECKE

Regulatory Economics Group, LLC .

Principal

Mr. Van Hoecke has twenty-nine years of experience in the oil pipeline business . For over twelve years

he held various positions with Williams Pipe Line Company (WPL), including Operations Supervisor,

Health and Safety Supervisor, Strategic Planning and Tariffs Manager, and Tariff and Regulatory Affairs

Manager . Since leaving WPL, Mr. Van Hoecke has provided consulting services to the industry,

primarily relating to cost of service, market studies and business planning . Mr. Van Hoecke has provided

expert testimony in numerous matters relating to pipeline tariffs, cost of service and business practices .

Relevant Experience

Pipeline Operation

*

Directed and Managed WPL's Phase II defense in a rate case before the U.S. Federal Energy

Regulatory Commission (FERC) in Docket No. IS90-21-000 et al.

#

Managed and supervised preparation of monthly, annual and long-range forecasts of volumes,

revenues and related variance comments.

*

Established and supervised system-wide health and safety programs for approximately 700

employees in 10 states .

*

Directed and supervised all day-to-day operational activities of pipeline terminals and pump

stations for a three terminal complex transporting and delivering refined petroleum, fertilizer,

asphalt and LPG .

*

Carried out various aspects of pipeline operations and administration at terminal, pump station

and regional field office levels.

Rates and Regulation

For WPL, directed company's Phase II defense in a rate case before the FERC in Docket No.

IS90-21-000 et al. Responsible for developing the course of defense and selecting appropriate

expert witnesses to testify on the company's behalf. Supervised development of various stages of

discovery, direct testimony, rebuttal testimony and case preparation. Served as chief company

witness and performed short-run marginal cost analysis of integrated pipeline network containing

more than 40,000 distinct routes .

*