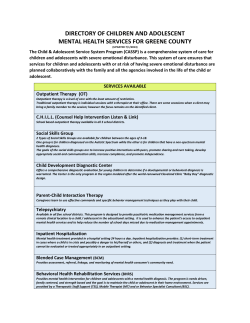

ATTACHMENT C APPLICATION COVER SHEET AND CHECK-OFF LIST Identifying Information: