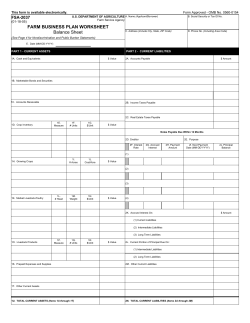

COVER SHEET 1 0 0 4 4