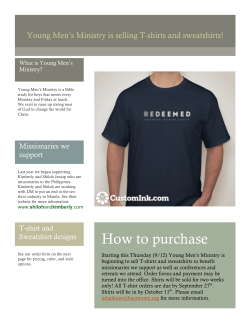

Document 253117