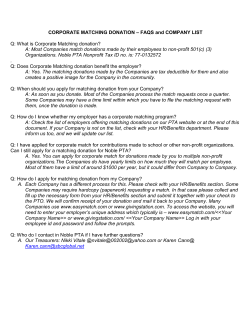

COVER SHEET C 1 9